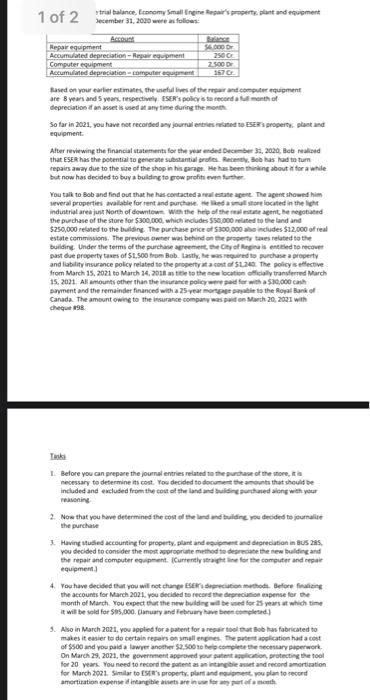

1 of 2 trial balance.com Small roine Roger's pretplant and equipment Jecember 31, 2020 were as follows: Repar equipment Accumulated depreciation - Repair equpment Computer equipment Accumulated depreciation computer gament 54. ODD 250 CE 2500D Based on your earlier estimates the lives of the rear and computer equipment are 8 years and 5 years, respectively. ESER's polos second month of depreciation of an asset is used at any time during the month So far in 2021, you have not recorded a journal artiested to ESET proper plant and equipment After reviewing the financial statements for the year ended December 3, 2020. obrated that ESER has the potential to generate substantial grees Recently, Bob has had totum repairs away due to the size of the shop in his garage. He has been thing about for a while but now has decided to buy a building to grow profit even further You talk to Bob and find out that he has contacted areal estate agent. The agent showed him several properties available for rent and purchased a small store located in the light industrial area just north of downtown. We the heather the negotiated the purchase of the store for $300,000, which includes $50,000 related to the land and $250,000 related to the building. The purchase price of $100.000 hendudes $12.000 of real estate commissions. The previous owner was behind on the property taxes related to the building Under the terms of the purchase agreement, ce ty of Regels ented to recover past due property taxes of $1.500 from Bob. Lastly, he was required to purchase a property and liability insurance policy related to the property at a cost of $20 The policy is efective from March 15, 2021 to March 24, 2018 aste to the new location officially transferred March 15.2021. Al amounts other than the policy for with a $30.000 cach payment and the remainder financed with a 25-year more to the Royal Bank of Canada. The amount owing to the insurance company was paid on March 20,2021 with che 9 1. Before you can prepare the journal entries related to the purchase of the store.it necessary to determine its cost. You decided to document the amounts that should be included and excluded from the cost of the land and Superchased along with your reasoning 2. Now that you have determined the con of the land and building you decided to journal the purchase 3. Having studied accounting for property, plant and equipment and depreciation in Bus 28. you decided to consider the most pronte method to deathe new building and the repair and computer equipment Currently right for the computer and repat equipment 4. You have decided that you will not change in the Before finding the accounts for March 2021. you decided to record the deprecio expense for the month of March. You expect that the new building will be set for years at which time it will be sold for $5.000. Canary and February have bee.com) Also in March 2021, you applied for a patent for a regata Bob has fabricated to makes it easier to do certain repairs on mallenges the potentication hat a cost of $500 and you paid a lawyer another 52,5000 complete secary paperwork On March 29, 2021, the government approved you to protecting the tool for 20 years. You need to record the patient as an intangible and record amortization for March 2021. Similar to Ett's property, plant and went you plan to record amortization expense intangibles informe 1 of 2 trial balance.com Small roine Roger's pretplant and equipment Jecember 31, 2020 were as follows: Repar equipment Accumulated depreciation - Repair equpment Computer equipment Accumulated depreciation computer gament 54. ODD 250 CE 2500D Based on your earlier estimates the lives of the rear and computer equipment are 8 years and 5 years, respectively. ESER's polos second month of depreciation of an asset is used at any time during the month So far in 2021, you have not recorded a journal artiested to ESET proper plant and equipment After reviewing the financial statements for the year ended December 3, 2020. obrated that ESER has the potential to generate substantial grees Recently, Bob has had totum repairs away due to the size of the shop in his garage. He has been thing about for a while but now has decided to buy a building to grow profit even further You talk to Bob and find out that he has contacted areal estate agent. The agent showed him several properties available for rent and purchased a small store located in the light industrial area just north of downtown. We the heather the negotiated the purchase of the store for $300,000, which includes $50,000 related to the land and $250,000 related to the building. The purchase price of $100.000 hendudes $12.000 of real estate commissions. The previous owner was behind on the property taxes related to the building Under the terms of the purchase agreement, ce ty of Regels ented to recover past due property taxes of $1.500 from Bob. Lastly, he was required to purchase a property and liability insurance policy related to the property at a cost of $20 The policy is efective from March 15, 2021 to March 24, 2018 aste to the new location officially transferred March 15.2021. Al amounts other than the policy for with a $30.000 cach payment and the remainder financed with a 25-year more to the Royal Bank of Canada. The amount owing to the insurance company was paid on March 20,2021 with che 9 1. Before you can prepare the journal entries related to the purchase of the store.it necessary to determine its cost. You decided to document the amounts that should be included and excluded from the cost of the land and Superchased along with your reasoning 2. Now that you have determined the con of the land and building you decided to journal the purchase 3. Having studied accounting for property, plant and equipment and depreciation in Bus 28. you decided to consider the most pronte method to deathe new building and the repair and computer equipment Currently right for the computer and repat equipment 4. You have decided that you will not change in the Before finding the accounts for March 2021. you decided to record the deprecio expense for the month of March. You expect that the new building will be set for years at which time it will be sold for $5.000. Canary and February have bee.com) Also in March 2021, you applied for a patent for a regata Bob has fabricated to makes it easier to do certain repairs on mallenges the potentication hat a cost of $500 and you paid a lawyer another 52,5000 complete secary paperwork On March 29, 2021, the government approved you to protecting the tool for 20 years. You need to record the patient as an intangible and record amortization for March 2021. Similar to Ett's property, plant and went you plan to record amortization expense intangibles informe