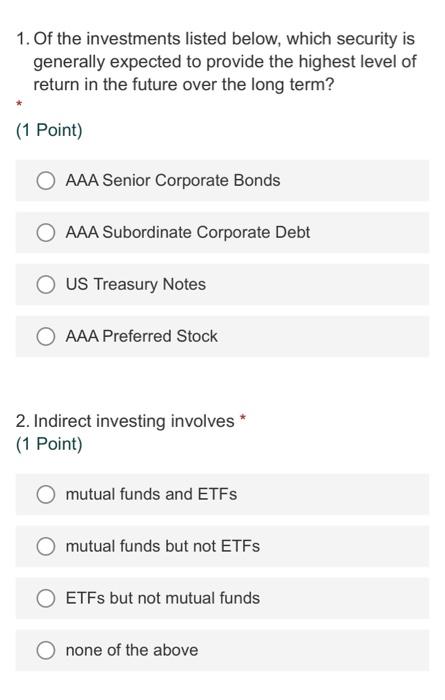

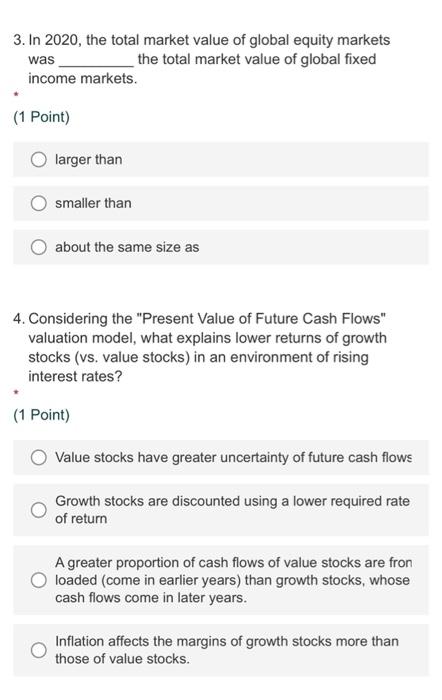

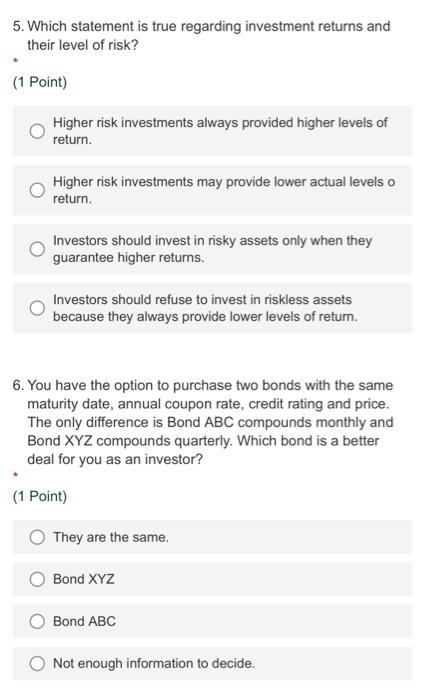

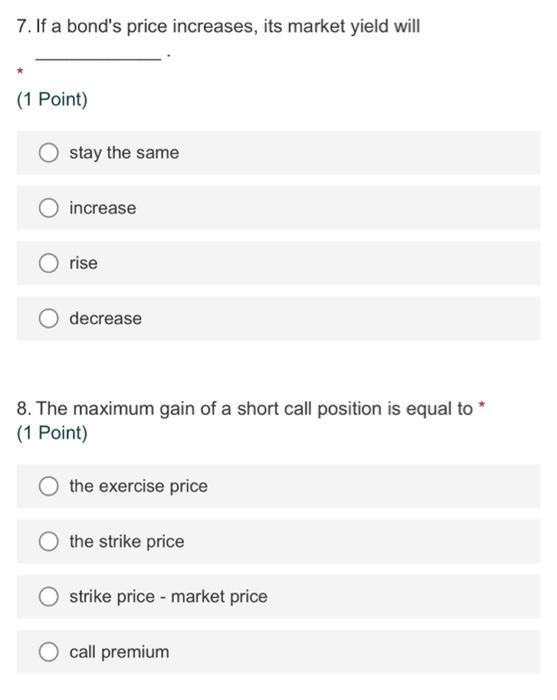

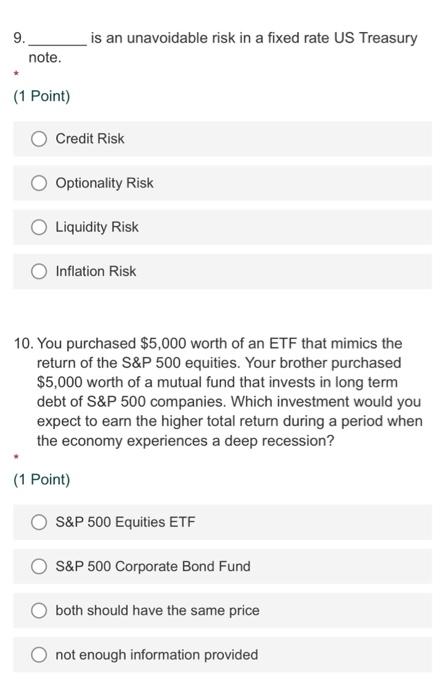

1. Of the investments listed below, which security is generally expected to provide the highest level of return in the future over the long term? (1 Point) AAA Senior Corporate Bonds AAA Subordinate Corporate Debt US Treasury Notes AAA Preferred Stock 2. Indirect investing involves * (1 Point) mutual funds and ETFs mutual funds but not ETFs ETFs but not mutual funds none of the above 3. In 2020, the total market value of global equity markets was the total market value of global fixed income markets. (1 Point) larger than smaller than about the same size as 4. Considering the "Present Value of Future Cash Flows" valuation model, what explains lower returns of growth stocks (vs. value stocks) in an environment of rising interest rates? (1 Point) Value stocks have greater uncertainty of future cash flows Growth stocks are discounted using a lower required rate of return A greater proportion of cash flows of value stocks are fron loaded (come in earlier years) than growth stocks, whose cash flows come in later years. Inflation affects the margins of growth stocks more than those of value stocks. 5. Which statement is true regarding investment returns and their level of risk? (1 Point) Higher risk investments always provided higher levels of return. Higher risk investments may provide lower actual levels o return. Investors should invest in risky assets only when they guarantee higher returns. Investors should refuse to invest in riskless assets because they always provide lower levels of retum. 6. You have the option to purchase two bonds with the same maturity date, annual coupon rate, credit rating and price. The only difference is Bond ABC compounds monthly and Bond XYZ compounds quarterly. Which bond is a better deal for you as an investor? (1 Point) They are the same Bond XYZ Bond ABC O Not enough information to decide. 7. If a bond's price increases, its market yield will (1 Point) stay the same increase rise decrease 8. The maximum gain of a short call position is equal to * (1 Point) the exercise price the strike price strike price - market price call premium 9. note. is an unavoidable risk in a fixed rate US Treasury (1 Point) Credit Risk Optionality Risk Liquidity Risk Inflation Risk 10. You purchased $5,000 worth of an ETF that mimics the return of the S&P 500 equities. Your brother purchased $5,000 worth of a mutual fund that invests in long term debt of S&P 500 companies. Which investment would you expect to earn the higher total return during a period when the economy experiences a deep recession? (1 Point) S&P 500 Equities ETF S&P 500 Corporate Bond Fund both should have the same price not enough information provided