Answered step by step

Verified Expert Solution

Question

1 Approved Answer

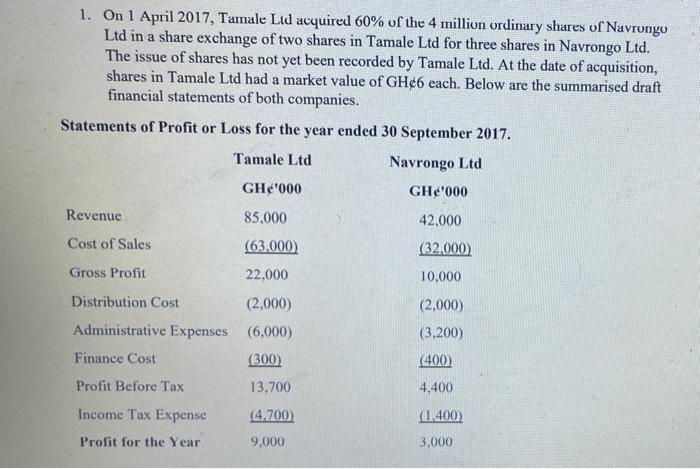

1. On 1 April 2017, Tamale Ltd acquired 60% of the 4 million ordinary shares of Navrongo Ltd in a share exchange of two

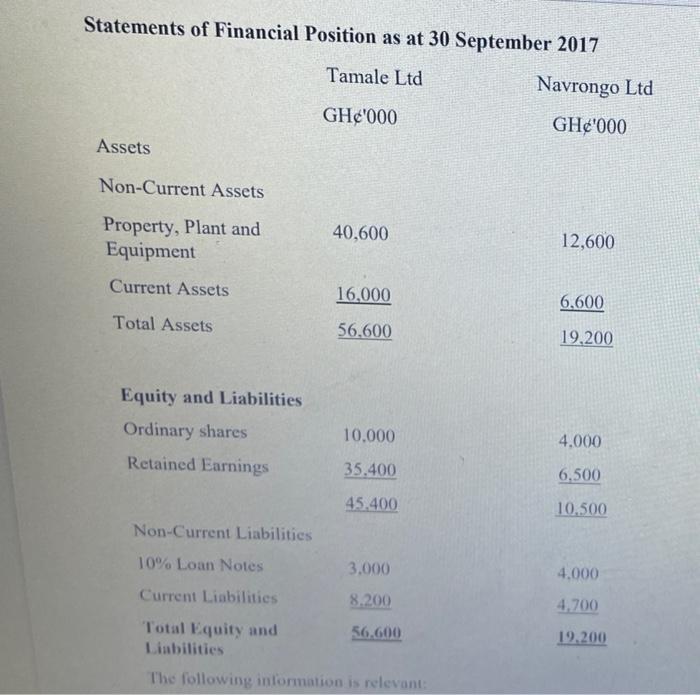

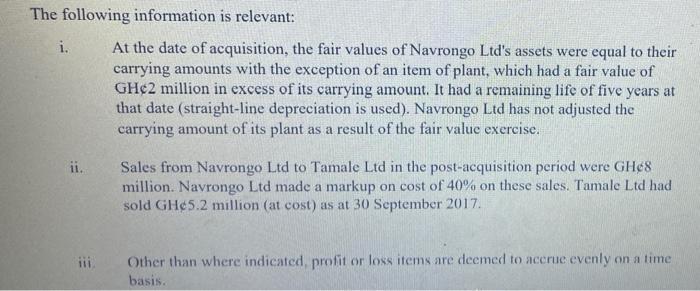

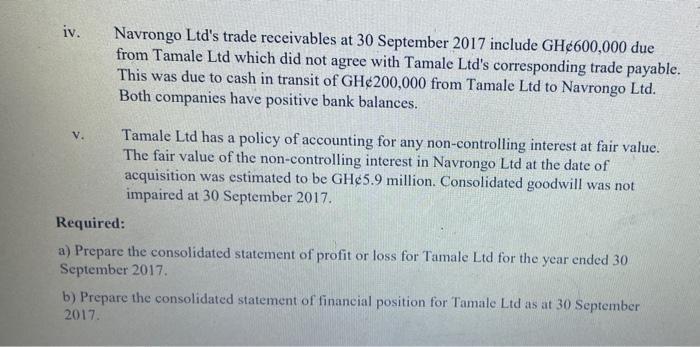

1. On 1 April 2017, Tamale Ltd acquired 60% of the 4 million ordinary shares of Navrongo Ltd in a share exchange of two shares in Tamale Ltd for three shares in Navrongo Ltd. The issue of shares has not yet been recorded by Tamale Ltd. At the date of acquisition, shares in Tamale Ltd had a market value of GH6 each. Below are the summarised draft financial statements of both companies. Statements of Profit or Loss for the year ended 30 September 2017. Tamale Ltd Navrongo Ltd GH'000 42,000 (32,000) 10,000 (2,000) (3,200) (400) 4,400 Revenue Cost of Sales Gross Profit Distribution Cost Administrative Expenses Finance Cost Profit Before Tax Income Tax Expense Profit for the Year GHe'000 85,000 (63,000) 22,000 (2,000) (6,000) (300) 13,700 (4.700) 9,000 (1.400) 3,000 Statements of Financial Position as at 30 September 2017 Tamale Ltd GH'000 Assets Non-Current Assets Property, Plant and Equipment Current Assets Total Assets Equity and Liabilities Ordinary shares Retained Earnings Non-Current Liabilities 10% Loan Notes Current Liabilities Total Equity and Liabilities 40,600 16,000 56.600 10,000 35.400 45.400 3.000 8.200 56.600 The following information is relevant: Navrongo Ltd GH '000 12,600 6.600 19.200 4.000 6,500 10,500 4.000 4,700 19.200 The following information is relevant: i. ii. 111. At the date of acquisition, the fair values of Navrongo Ltd's assets were equal to their carrying amounts with the exception of an item of plant, which had a fair value of GH2 million in excess of its carrying amount. It had a remaining life of five years at that date (straight-line depreciation is used). Navrongo Ltd has not adjusted the carrying amount of its plant as a result of the fair value exercise. Sales from Navrongo Ltd to Tamale Ltd in the post-acquisition period were GHe8 million. Navrongo Ltd made a markup on cost of 40% on these sales. Tamale Ltd had sold GH5.2 million (at cost) as at 30 September 2017. Other than where indicated, profit or loss items are deemed to accrue evenly on a time basis. iv. Navrongo Ltd's trade receivables at 30 September 2017 include GH 600,000 due from Tamale Ltd which did not agree with Tamale Ltd's corresponding trade payable. This was due to cash in transit of GH 200,000 from Tamale Ltd to Navrongo Ltd. Both companies have positive bank balances. Tamale Ltd has a policy of accounting for any non-controlling interest at fair value. The fair value of the non-controlling interest in Navrongo Ltd at the date of acquisition was estimated to be GH5.9 million. Consolidated goodwill was not impaired at 30 September 2017. Required: a) Prepare the consolidated statement of profit or loss for Tamale Ltd for the year ended 30 September 2017. b) Prepare the consolidated statement of financial position for Tamale Ltd as at 30 September 2017.

Step by Step Solution

★★★★★

3.40 Rating (147 Votes )

There are 3 Steps involved in it

Step: 1

Consolidated statement of profit or loss for Tamale Ltd For the year ended 30 September 2017 GHc000 Revenue 98000 Cost of sales 71206 Gross profit 26794 Distribution cost 3000 Administrative Expenses ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started