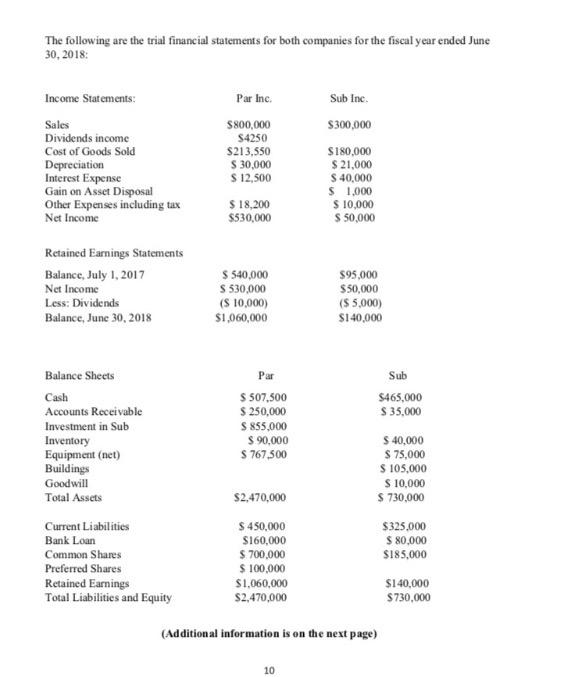

The following are the trial financial statements for both companies for the fiscal year ended June 30, 2018: Income Statements: Par Inc. Sub Inc.

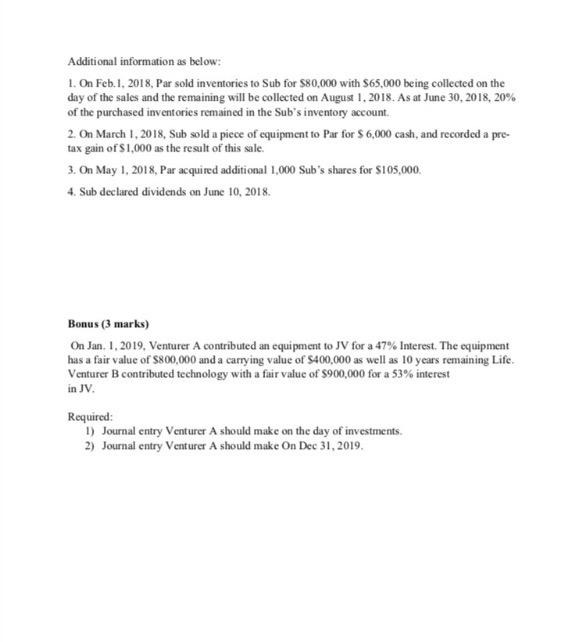

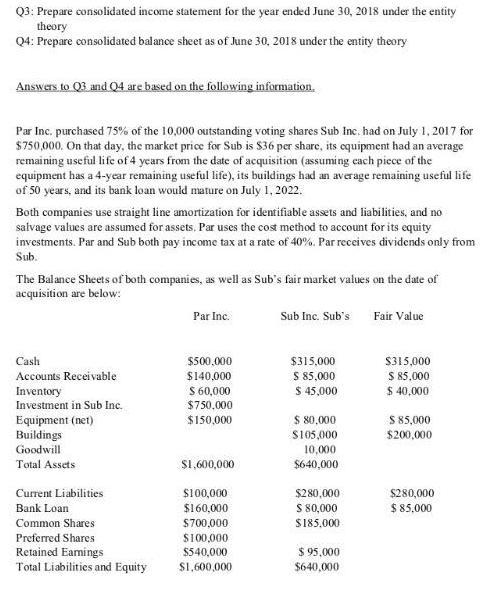

The following are the trial financial statements for both companies for the fiscal year ended June 30, 2018: Income Statements: Par Inc. Sub Inc. Sales Dividends income S800,000 $300,000 $4250 $213,550 S 30,000 S 12,500 Cost of Goods Sold Depreciation Interest Expense Gain on Asset Disposal Other Expenses including tax Net Income S180,000 $ 21,000 $ 40,000 S 1,000 S 10,000 S 50,000 $ 18,200 $530,000 Retained Earnings Statements S 540,000 S 530,000 (S 10,000) $1,060,000 Balance, July 1, 2017 Net Income $95,000 Less: Dividends Balance, June 30, 2018 $50,000 (S 5,000) S140,000 Balance Sheets Par Sub $ 507,500 $ 250,000 S 85,000 $ 90,000 S 767,500 Cash $465,000 Accounts Receivable $ 35,000 Investment in Sub Inventory Equipment (net) Buildings $ 40,000 S 75,000 S 105,000 S 10,000 $ 730,000 Goodwill Total Assets $2,470,000 Current Liabilities $ 450,000 $325,000 S 80,000 SI85,000 Bank Loan S160,000 S 700,000 S 100,000 $1,060,000 S2,470,000 Common Shares Preferred Shares Retained Earnings Total Liabilities and Equity $140,000 S730,000 (Addition al information is on the next page) 10 Additional information as below: 1. On Feb.1, 2018, Par sold inventories to Sub for $80,000 with S65,000 being collected on the day of the sales and the remaining will be collected on August 1, 2018. As at June 30, 20118, 20% of the purchased invent ories remained in the Sub's inventory account. 2. On March 1, 2018, Sub sold a piece of equipment to Par for $ 6,000 cash, and recorded a pre- tax gain of $1,000 as the result of this sale. 3. On May 1, 2018, Par acquired additional 1,000 Sub's shares for $105,000. 4. Sub declared dividends on June 10, 2018. Bonus (3 marks) On Jan. 1, 2019, Venturer A contributed an equi pment to JV for a 47% Interest. The equipment has a fair value of S800,000 and a carrying value of $400,000 as well as 10 years remaining Life. Venturer B contributed technology with a fair value of $900,000 for a 53% interest in JV. Required: 1) Journal entry Venturer A should make on the day of investments. 2) Journal entry Venturer A should make On Dec 31, 2019. Q3: Prepare consolidated income statement for the year ended June 30, 2018 under the entity theory Q4: Prepare consolidated balance sheet as of June 30, 2018 under the entity theory Answers, to Q3 and Q4 are based on the following information. Par Inc. purchased 75% of the 10,000 outstanding voting shares Sub Inc. had on July 1, 2017 for $750,000. On that day, the market price for Sub is $36 per share, its equipment had an average remaining useful life of 4 years from the date of acquisition (assuming cach piece of the equipment has a 4-year remaining useful life), its buildings had an average remaining useful life of 50 years, and its bank loan would mature on July 1, 2022. Both companies use straight line amortization for identifiable assets and liabilities, and no salvage values are assumed for assets, Par uses the cost method to account for its equity investments. Par and Sub both pay income tax at a rate of 40%. Par receives dividends only from Sub. The Balance Sheets of both companies, as well as Sub's fair market values on the date of acquisition are below: Sub Inc. Sub's Par Inc. Fair Value Cash $500,000 $315,000 S315,000 S 85,000 $ 45,000 S 85,000 $ 40,000 Accounts Receivable Inventory Investment in Sub Inc. $140,000 S60,000 $750.000 $150,000 $ 80,000 S 85,000 Equipment (net) Buildings Goodwill S105,000 $200,000 10,000 Total Assets S1,600,000 $640,000 Current Liabilities $100,000 $280,000 $280,000 S 8000 S185,000 $ 85,000 Bank Loan $160,000 Common Shares S700,000 Preferred Shares S100,000 $ 95,000 Retained Eamings Total Liabilities and Equity $540,000 S1,600,000 $640,000

Step by Step Solution

3.36 Rating (165 Votes )

There are 3 Steps involved in it

Step: 1

ANSWER A BONUS 1 JOINT ENTRY VENTURE A SHOULD MAKE ON THE DAY OF INVESTMENTS INVESTMENT DR 800000 TO EQUIPMENT 400000 TO GAIN ON DISPOSAL 800000400000 ...

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started