Answered step by step

Verified Expert Solution

Question

1 Approved Answer

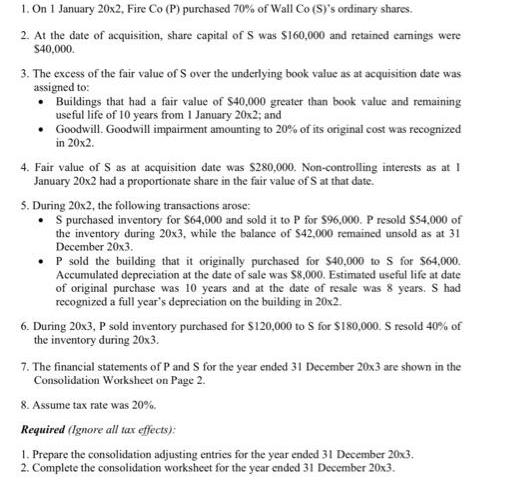

1. On 1 January 20x2, Fire Co (P) purchased 70% of Wall Co (S)'s ordinary shares. 2. At the date of acquisition, share capital

1. On 1 January 20x2, Fire Co (P) purchased 70% of Wall Co (S)'s ordinary shares. 2. At the date of acquisition, share capital of S was S160,000 and retained camings were $40,000. 3. The excess of the fair value of S over the underlying book value as at acquisition date was assigned to: Buildings that had a fair value of S40,000 greater than book value and remaining useful life of 10 years from 1 January 20x2; and Goodwill. Goodwill impairment amounting to 20% of its original cost was recognized in 20x2. 4. Fair value of S as at acquisition date was $280,000. Non-controlling interests as at 1 January 20x2 had a proportionate share in the fair value of S at that date. 5. During 20x2, the following transactions arose: S purchased inventory for $64,000 and sold it to P for $96,000. P resold S54,000 of the inventory during 20x3, while the balance of $42,000 remained unsold as at 31 December 20x3. P sold the building that it originally purchased for $40,000 to s for $64,000. Accumulated depreciation at the date of sale was $8,000. Estimated useful life at date of original purchase was 10 years and at the date of resale was 8 years. S had recognized a full year's depreciation on the building in 20x2. 6. During 20x3, P sold inventory purchased for $120,000 to S for $180,000. S resold 40% of the inventory during 20x3. 7. The financial statements of P and S for the year ended 31 December 20x3 are shown in the Consolidation Worksheet on Page 2. 8. Assume tax rate was 20%. Required (Ignore all tar effects): 1. Prepare the consolidation adjusting entries for the year ended 31 December 20x3. 2. Complete the consolidation worksheet for the year ended 31 December 20x3. Income Statement and Statement of Changes in Equity (Partial) for the year ended 31 Dec 20x3 S(Wall) S250,000 (159.600) P(Fire) Dr Cr Consol. Sales S520,000 Cost of goods sold (372,000) Gross profit Other income Dividend income 148,000 79,250 21,000 (40,000) (32,000) (12.000) 90,400 50,000 Depreciation Interest expense Other expenses Profit before tax 20% Net profit after tax (30,000) (10,400) (40,000) 164,250 60,000 (32,850) (12,000) 131,400 48,000 Retained eamings, I Jan 241,600 100,000 Dividends declared (60.000) $313.000 (30.000) SI18,000 Retained eamings, 31 Dec Statement of Financial Position as at 31 Dec 20x3 P(Fire) $19,800 S(Wall) $3,200 Dr Cr Consol Cash 32,000 330,000 38,000 170,000 Accounts receivable Inventory Land 160,000 80,000 Buildings and equipment Less accumulated depreciation 680,000 520,000 (160,000) (280,000) Investment in Wall, at cost 196.000 Total assets SI.137,800 S651,200 Share capital Retained eamings S240,000 S160,000 313,000 118,000 Bonds payable Bond premium Accounts payable Total equity and liabilities 400,000 300,000 3,200 184,800 SL.137,800 70.000 $651.200 614,600 614,600

Step by Step Solution

★★★★★

3.57 Rating (154 Votes )

There are 3 Steps involved in it

Step: 1

Income Statement and Statement of changes in equity for the year ended 31st December 20X3 Date P Fir...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started