Question: Reflection:1 What would be another way to calculate total interest rather than merely using sum(? Reflection 2: When was the original principal invested and when

Reflection:1 What would be another way to calculate total interest rather than merely using sum(?

Reflection 2: When was the original principal invested and when was the payment invested (end or beginning of the period)? In the finance world, what type of investment is this called?

Reflection 3: What are some of the pros and cons of each of the three methods you have used?

Reflection 4: Which of the three methods is your favorite way to calculate the balance and why?

Reflection 5: What impressions or insights have you gained from this exercise?

All the reflection questions should be for the topic: "Regular payment savings plan"

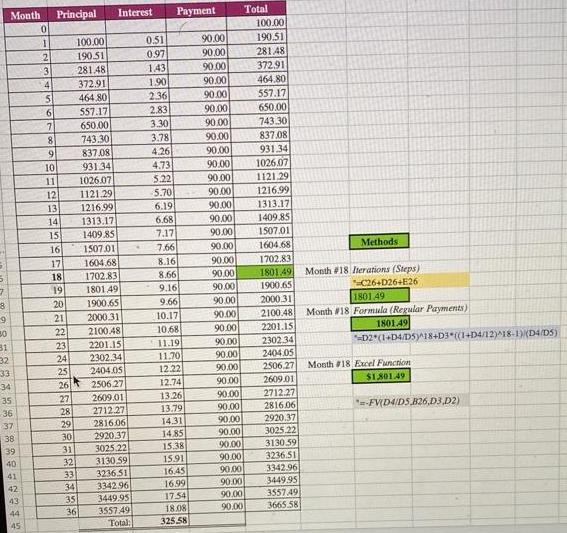

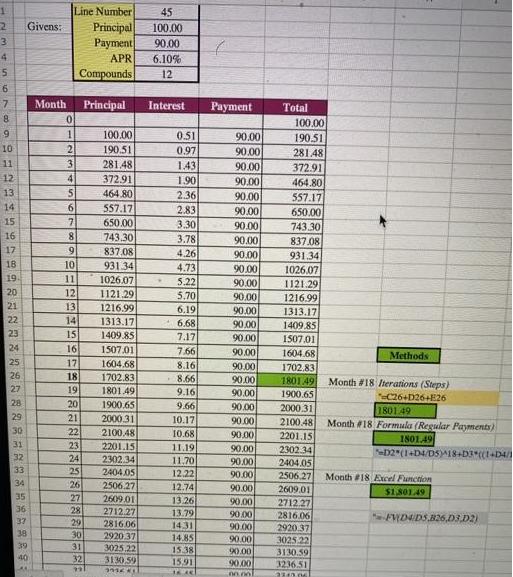

Total 100.00 190.51 Month Principal Interest ment 0. 100.00 190.51 90.00 90,00 0.51 0.97 281 48 372.91 464.80 557.17 3. 281.48 143 90.00 90.00 90.00 372.91 1.90 464.80 2.36 557.17 650.00 2.83 90.00 650.00 3.30 3.78 90.00 90.00 743.30 837.08 743.30 837.08 8. 4.26 931.34 1026.07 1121.29 90.00 90.00 90.00 90.00 10 93134 4.73 11 1026.07 5.22 12 1121.29 5.70 1216.99 1313.17 1409.85 1507.01 13 1216.99 6.19 90.00 14 1313.17 6.68 90.00 90.00 90.00 15 1409.85 7.17 16 1507.01 7.66 1604.68 Methods 1702.83 1801.49 17 1604.68 8.16 90.00 Month 18 Iterations (Steps) C26+D26+E26 1801.49 Month #18 Formula (Regular Payments) 1801.49 18 8.66 9.16 9.66 1702.83 90.00 1801.49 1900.65 19 90.00 1900.65 2000.31 2100.48 20 90.00 90.00 90.00 21 2000.31 10.17 2100.48 2201.15 2302.34 2404.05 10.68 11.19 11.70 12.22 12.74 13.26 22 2201.15 2302.34 D2 (1+D4/D5)yA18+D3 ((1+D4/12)18-1)(D4/D5) 31 32 33 23 24 90.00 90.00 90.00 2404.05 25 2506.27 Month #18 Excel Function 34 26 2506 27 90.00 2609.01 $1 S01.49 2712.27 27 28 29 30 2609.01 2712.27 2816 06 2920.37 3025.22 3130.59 90.00 90.00 35 36 13.79 2816.06 "-FVD4/DS B26,D3,D2) 37 14.31 90.00 2920.37 90.00 90.00 90.00 38 14.85 3025.22 15.38 15.91 39 31 3130.59 3236.51 3342.96 3449.95 3557.49 3665.58 40 32 3236.51 3342.96 3449.95 3557 49 16.45 16.99 90.00 90.00 90.00 41 33 42 34 35 1754 18.08 43 36 90.00 44 45 Total: 325 58

Step by Step Solution

3.34 Rating (154 Votes )

There are 3 Steps involved in it

Reflection1 What would be another way to calculate total interest rather than merely using sum Its P ... View full answer

Get step-by-step solutions from verified subject matter experts