Answered step by step

Verified Expert Solution

Question

1 Approved Answer

1. On 1/1, purchased a $15,000 piece of equipment paying $10,000 in cash and obtaining a $5,000 loan (assume it is a note issued at

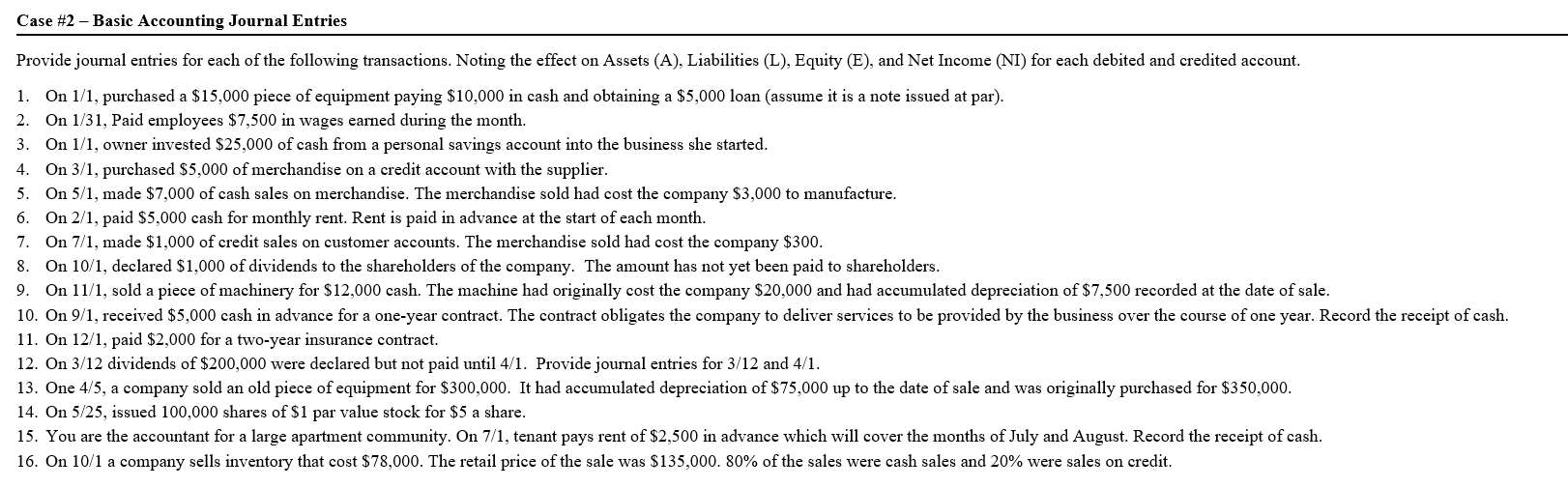

1. On 1/1, purchased a $15,000 piece of equipment paying $10,000 in cash and obtaining a $5,000 loan (assume it is a note issued at par). 2. On 1/31, Paid employees $7,500 in wages earned during the month. 3. On 1/1, owner invested $25,000 of cash from a personal savings account into the business she started. 4. On 3/1, purchased $5,000 of merchandise on a credit account with the supplier. 5. On 5/1, made $7,000 of cash sales on merchandise. The merchandise sold had cost the company $3,000 to manufacture. 6. On 2/1, paid $5,000 cash for monthly rent. Rent is paid in advance at the start of each month. 7. On 7/1, made $1,000 of credit sales on customer accounts. The merchandise sold had cost the company $300. 8. On 10/1, declared $1,000 of dividends to the shareholders of the company. The amount has not yet been paid to shareholders. 11. On 12/1, paid $2,000 for a two-year insurance contract. 12. On 3/12 dividends of $200,000 were declared but not paid until 4/1. Provide journal entries for 3/12 and 4/1. 14. On 5/25, issued 100,000 shares of $1 par value stock for $5 a share. 16. On 10/1 a company sells inventory that cost $78,000. The retail price of the sale was $135,000.80% of the sales were cash sales and 20% were sales on credit

1. On 1/1, purchased a $15,000 piece of equipment paying $10,000 in cash and obtaining a $5,000 loan (assume it is a note issued at par). 2. On 1/31, Paid employees $7,500 in wages earned during the month. 3. On 1/1, owner invested $25,000 of cash from a personal savings account into the business she started. 4. On 3/1, purchased $5,000 of merchandise on a credit account with the supplier. 5. On 5/1, made $7,000 of cash sales on merchandise. The merchandise sold had cost the company $3,000 to manufacture. 6. On 2/1, paid $5,000 cash for monthly rent. Rent is paid in advance at the start of each month. 7. On 7/1, made $1,000 of credit sales on customer accounts. The merchandise sold had cost the company $300. 8. On 10/1, declared $1,000 of dividends to the shareholders of the company. The amount has not yet been paid to shareholders. 11. On 12/1, paid $2,000 for a two-year insurance contract. 12. On 3/12 dividends of $200,000 were declared but not paid until 4/1. Provide journal entries for 3/12 and 4/1. 14. On 5/25, issued 100,000 shares of $1 par value stock for $5 a share. 16. On 10/1 a company sells inventory that cost $78,000. The retail price of the sale was $135,000.80% of the sales were cash sales and 20% were sales on credit Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started