Answered step by step

Verified Expert Solution

Question

1 Approved Answer

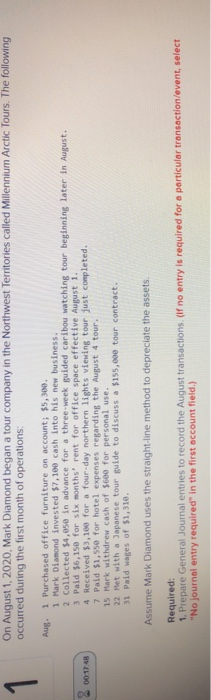

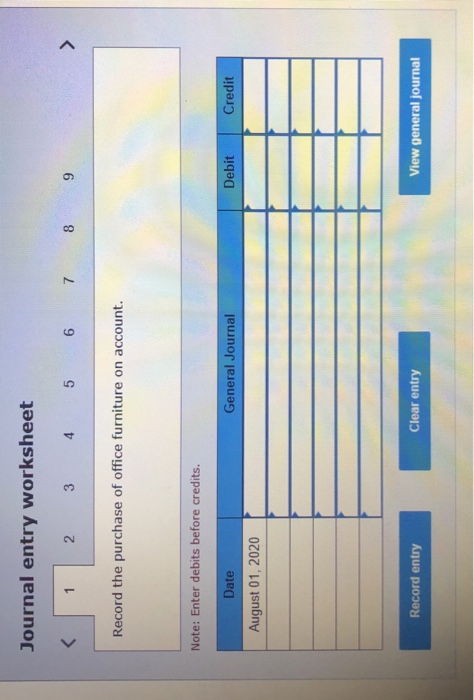

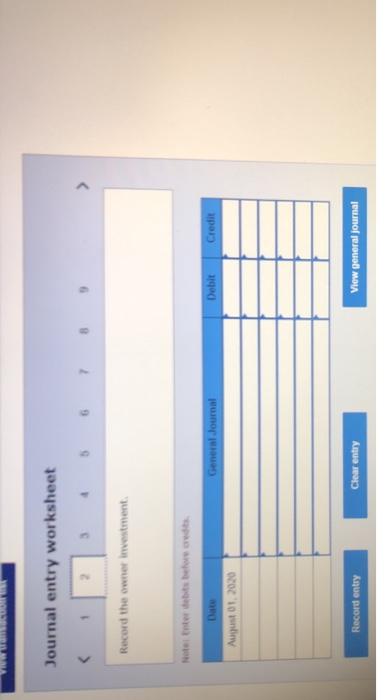

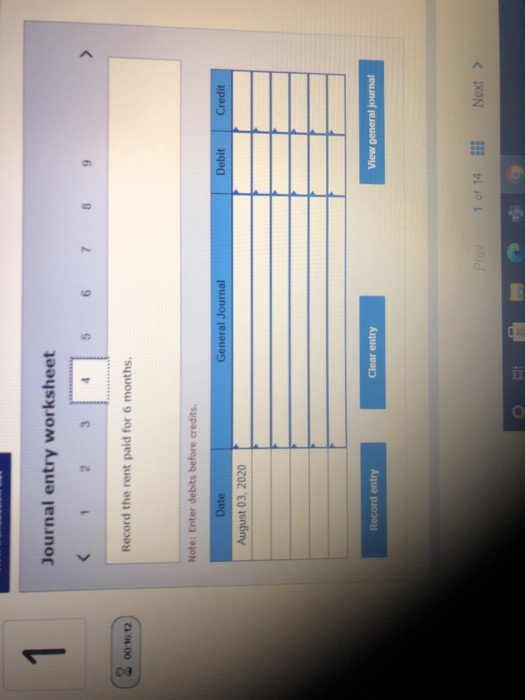

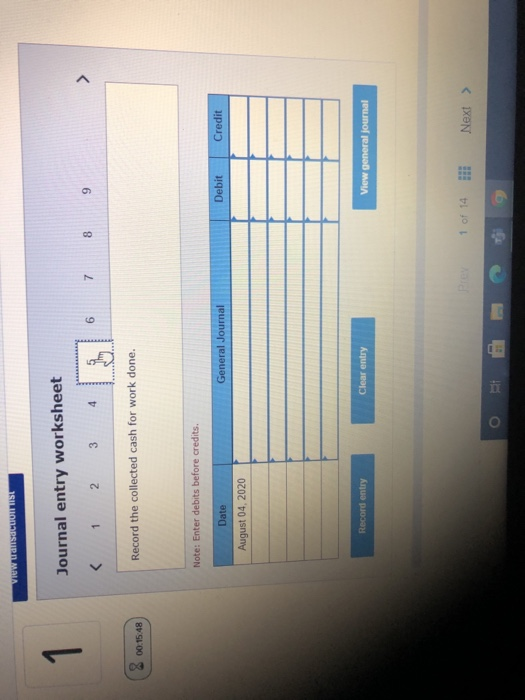

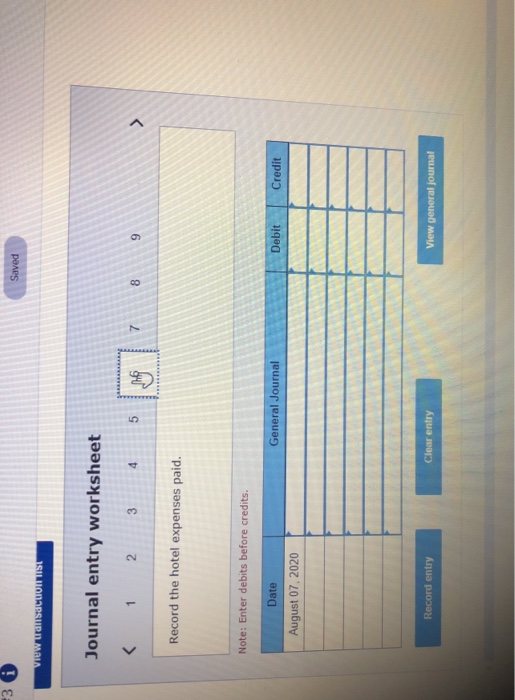

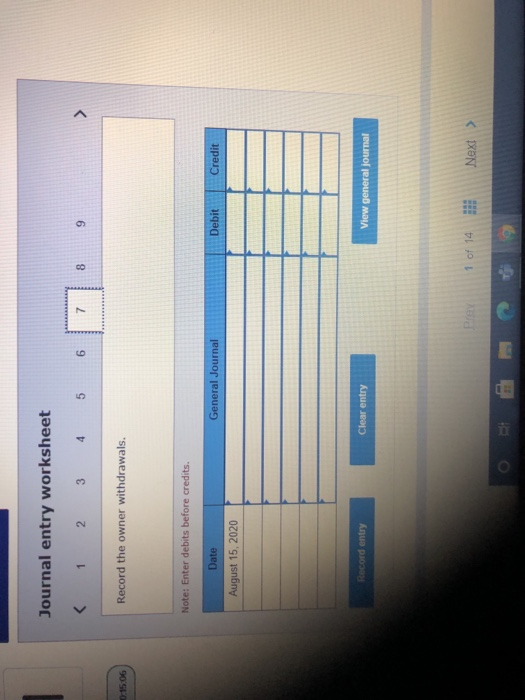

1 On August 1, 2020, Mark Diamond began a tour company in the Northwest Territories called Millennium Arctic Tours. The following occurred during the first

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started