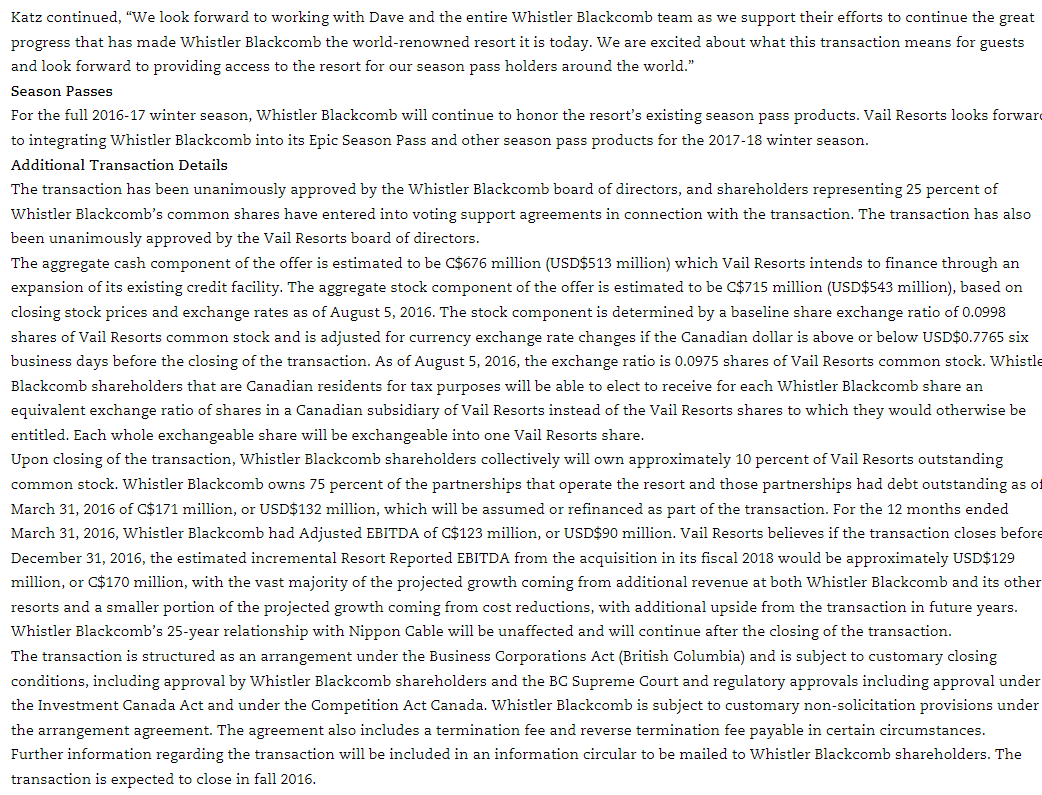

1. On August 7th, 2016 (the day before the announcement of the acquisition deal), Whistler Blackcomb was worth $25.14 per share. Based on this market price, if you were a shareholder in Vail resorts, would you recommend that the board pay $1.4 Billion for the entire equity stake of Whistler Blackcomb? (3 marks; 2-3 sentences + calculations) You are an analyst for Vail Resorts in July of 2016. Your manager at Vail Resorts has asked you to conduct a valuation of Whistler Blackcomb (WB), as Vail is currently interested in acquiring the company. One research group has recommended that the Board of Directors offer WB $1.4 Billion in a mixed-offer of $17.50 in cash and 0.0975 Vail common stock for each share of WB. Your goal is to provide a fair price-per-share valuation of WB. Hours Lifts & TrailsWebcam= Back to Press Releases Share VAIL RESORTS AND WHISTLER BLACKCOMB AGREE TO STRATEGIC COMBINATION VAIL RESORTS IS COMMITTED TO THE GROWTH, EXPANSION AND DEVELOPMENT OF THE WHISTLER BLACKCOMB EXPERIENCE AND CONTINUED INVESTMENT IN THE COMMUNITY WHISTLER BLACKCOMB WILL MAINTAIN ITS UNIQUE BRAND AND CHARACTER WITH STRONG LOCAL CANADIAN LEADERSHIP WHISTLER, BC Aug 8, 2016 Vail Resorts, Inc. (NYSE: MTN) (Vail Resorts") and Whistler Blackcomb Holdings, Inc. (TSX: WB) (Whistler Blackcomb") today announced that they have entered into a strategic business combination joining Whistler Blackcomb with Vail Resorts. Under the transaction, Vail Resorts would acquire 100 percent of the stock of Whistler Blackcomb, whose shareholders would receive C$17.50 per share in cash and 0.0975 shares of Vail Resorts common stock, for consideration having a total value of $36.00 per share. The share exchange ratio is based upon closing stock prices and currency exchange rates as of August 5, 2016 and is subject to a currency exchange rate adjustment, as described below. "Combining Whistler Blackcomb with Vail Resorts' portfolio of outstanding resorts provides Whistler Blackcomb with increased financial strength, marketing exposure, guest relationships and broadens the geographic diversity of our company with resorts across the United States, as well as in Australia and Canada. This relationship will bring greater resources to support our current operations and our ambitious growth plans, including the Renaissance project, the most exciting and transformative investment in Whistler Blackcomb's history," said Dave Brownlie, Whistler Blackcomb's chief executive officer. "Whistler Blackcomb is one of the most iconic mountain resorts in the world with an incredible history, passionate employees and a strong community. With our combined experience and expertise, together we will build upon the guest experience at Whistler Blackcomb while preserving the unique brand and character of the resort as an iconic Canadian destination for guests around the world. We are delighted to add such a renowned resort to Vail Resorts and look forward to expanding our relationships in the Sea-to-Sky community, British Columbia and Canada," said Rob Katz, chairman and chief executive officer of Vail Resorts. Mr. Brownlie added, As the number one ranked and most visited resort in North America, Whistler Blackcomb has enjoyed tremendous success by delivering an exceptional mountain experience for our passionate and loyal guests both locally and from around the world. That's going to continue as we work with our new colleagues at Vail Resorts as well as our employees, local businesses, community and government stakeholders to make Whistler Blackcomb better than ever. We will also continue our discussions with the Squamish and Lil'wat First Nations, on whose traditional lands we operate, regarding a business partnership that will benefit our communities, our province and our company for decades to come. Our board of directors has also been monitoring the unique challenges facing the broader ski industry due to the unpredictability of year-to- year regional weather patterns. Whistler Blackcomb, with its unprecedented acreage of high alpine terrain and Glacier bowls, is well positioned, but by no means immune to these challenges. Partnering with the geographically diversified Vail Resorts and extending its successful Epic Pass products to Whistler Blackcomb are customer-focused ways of securing the long-term future of our resort, our industry and our community." Whistler Blackcomb will nominate one member of its board to the Vail Resorts board of directors, and Dave Brownlie will continue leading Whistler Blackcomb as the resort's chief operating officer and will become a member of the senior leadership team of Vail Resorts' mountain division. Supporting the Whistler Blackcomb Experience Upon completion of this transaction, Vail Resorts is committed to continuing Whistler Blackcomb's success and building on its strengths, including further investment in the resort and the community: Support for Master Development Agreements with local First Nations. Vail Resorts recognizes that Whistler Blackcomb is in the Squamish and Lilwat First Nations' traditional territories and will support and continue the ongoing efforts to negotiate the renewal of Whistler Blackcomb's Master Development Agreements with significant long-term benefits to the Squamish and Lil'wat First Nations, the Province of British Columbia and the Resort Municipality of Whistler. Local leadership. Whistler Blackcomb will continue to have principally local Canadian leadership, with critical day-to-day mountain operations residing at the resort, including ongoing primary responsibility for relationships with the local community, governments and First Nations. Maintain local employment. Vail Resorts intends to retain the vast majority of Whistler Blackcomb employees, while only impacting a few select areas where there may be duplication in corporate functions. This transaction will not change the day-to-day operations at the resort, community engagement or the input of local management in shaping Whistler Blackcomb's future. Investment in the resort experience. Vail Resorts will invest substantially in Whistler Blackcomb's mountain infrastructure and growth plans, including continuing to build community and stakeholder support for the recently announcedRenaissance project, a transformational investment which will diversify the local tourism economy; provide new four-season, weather-independent activities; and elevate Whistler Blackcomb's core skiing, mountain biking and sightseeing experiences for decades to come. Common values on community and environmental sustainability. Consistent with Vail Resorts' core values, Whistler Blackcomb will continue its community involvement through the Whistler Blackcomb Foundation as well as its significant environmental and sustainability commitments. Vail Resorts also will support Whistler Blackcomb's continued engagement with organizations such as Tourism Whistler, Destination BC, Canada West Ski Areas Association, and the Whistler Chamber of Commerce. Katz continued, We look forward to working with Dave and the entire Whistler Blackcomb team as we support their efforts to continue the great progress that has made Whistler Blackcomb the world-renowned resort it is today. We are excited about what this transaction means for guests and look forward to providing access to the resort for our season pass holders around the world." Season Passes For the full 2016-17 winter season, Whistler Blackcomb will continue to honor the resort's existing season pass products. Vail Resorts looks forwar to integrating Whistler Blackcomb into its Epic Season Pass and other season pass products for the 2017-18 winter season. Additional Transaction Details The transaction has been unanimously approved by the Whistler Blackcomb board of directors, and shareholders representing 25 percent of Whistler Blackcomb's common shares have entered into voting support agreements in connection with the transaction. The transaction has also been unanimously approved by the Vail Resorts board of directors. The aggregate cash component of the offer is estimated to be C$676 million (USD$513 million) which Vail Resorts intends to finance through an expansion of its existing credit facility. The aggregate stock component of the offer is estimated to be c$715 million (USD$543 million), based on closing stock prices and exchange rates as of August 5, 2016. The stock component is determined by a baseline share exchange ratio of 0.0998 shares of Vail Resorts common stock and is adjusted for currency exchange rate changes if the Canadian dollar is above or below USD$0.7765 six business days before the closing of the transaction. As of August 5, 2016, the exchange ratio is 0.0975 shares of Vail Resorts common stock. Whistle Blackcomb shareholders that are Canadian residents for tax purposes will be able to elect to receive for each Whistler Blackcomb share an equivalent exchange ratio of shares in a Canadian subsidiary of Vail Resorts instead of the Vail Resorts shares to which they would otherwise be entitled. Each whole exchangeable share will be exchangeable into one Vail Resorts share. Upon closing of the transaction, Whistler Blackcomb shareholders collectively will own approximately 10 percent of Vail Resorts outstanding common stock. Whistler Blackcomb owns 75 percent of the partnerships that operate the resort and those partnerships had debt outstanding as of March 31, 2016 of C$171 million, or USD$132 million, which will be assumed or refinanced as part of the transaction. For the 12 months ended March 31, 2016, Whistler Blackcomb had Adjusted EBITDA of C$123 million, or USD$90 million. Vail Resorts believes if the transaction closes before December 31, 2016, the estimated incremental Resort Reported EBITDA from the acquisition in its fiscal 2018 would be approximately USD$129 million, or $170 million, with the vast majority of the projected growth coming from additional revenue at both Whistler Blackcomb and its other resorts and a smaller portion of the projected growth coming from cost reductions, with additional upside from the transaction in future years. Whistler Blackcomb's 25-year relationship with Nippon Cable will be unaffected and will continue after the closing of the transaction. The transaction is structured as an arrangement under the Business Corporations Act (British Columbia) and is subject to customary closing conditions, including approval by Whistler Blackcomb shareholders and the BC Supreme Court and regulatory approvals including approval under the Investment Canada Act and under the Competition Act Canada. Whistler Blackcomb is subject to customary non-solicitation provisions under the arrangement agreement. The agreement also includes a termination fee and reverse termination fee payable in certain circumstances. Further information regarding the transaction will be included in an information circular to be mailed to Whistler Blackcomb shareholders. The transaction is expected to close in fall 2016. 1. On August 7th, 2016 (the day before the announcement of the acquisition deal), Whistler Blackcomb was worth $25.14 per share. Based on this market price, if you were a shareholder in Vail resorts, would you recommend that the board pay $1.4 Billion for the entire equity stake of Whistler Blackcomb? (3 marks; 2-3 sentences + calculations) You are an analyst for Vail Resorts in July of 2016. Your manager at Vail Resorts has asked you to conduct a valuation of Whistler Blackcomb (WB), as Vail is currently interested in acquiring the company. One research group has recommended that the Board of Directors offer WB $1.4 Billion in a mixed-offer of $17.50 in cash and 0.0975 Vail common stock for each share of WB. Your goal is to provide a fair price-per-share valuation of WB. Hours Lifts & TrailsWebcam= Back to Press Releases Share VAIL RESORTS AND WHISTLER BLACKCOMB AGREE TO STRATEGIC COMBINATION VAIL RESORTS IS COMMITTED TO THE GROWTH, EXPANSION AND DEVELOPMENT OF THE WHISTLER BLACKCOMB EXPERIENCE AND CONTINUED INVESTMENT IN THE COMMUNITY WHISTLER BLACKCOMB WILL MAINTAIN ITS UNIQUE BRAND AND CHARACTER WITH STRONG LOCAL CANADIAN LEADERSHIP WHISTLER, BC Aug 8, 2016 Vail Resorts, Inc. (NYSE: MTN) (Vail Resorts") and Whistler Blackcomb Holdings, Inc. (TSX: WB) (Whistler Blackcomb") today announced that they have entered into a strategic business combination joining Whistler Blackcomb with Vail Resorts. Under the transaction, Vail Resorts would acquire 100 percent of the stock of Whistler Blackcomb, whose shareholders would receive C$17.50 per share in cash and 0.0975 shares of Vail Resorts common stock, for consideration having a total value of $36.00 per share. The share exchange ratio is based upon closing stock prices and currency exchange rates as of August 5, 2016 and is subject to a currency exchange rate adjustment, as described below. "Combining Whistler Blackcomb with Vail Resorts' portfolio of outstanding resorts provides Whistler Blackcomb with increased financial strength, marketing exposure, guest relationships and broadens the geographic diversity of our company with resorts across the United States, as well as in Australia and Canada. This relationship will bring greater resources to support our current operations and our ambitious growth plans, including the Renaissance project, the most exciting and transformative investment in Whistler Blackcomb's history," said Dave Brownlie, Whistler Blackcomb's chief executive officer. "Whistler Blackcomb is one of the most iconic mountain resorts in the world with an incredible history, passionate employees and a strong community. With our combined experience and expertise, together we will build upon the guest experience at Whistler Blackcomb while preserving the unique brand and character of the resort as an iconic Canadian destination for guests around the world. We are delighted to add such a renowned resort to Vail Resorts and look forward to expanding our relationships in the Sea-to-Sky community, British Columbia and Canada," said Rob Katz, chairman and chief executive officer of Vail Resorts. Mr. Brownlie added, As the number one ranked and most visited resort in North America, Whistler Blackcomb has enjoyed tremendous success by delivering an exceptional mountain experience for our passionate and loyal guests both locally and from around the world. That's going to continue as we work with our new colleagues at Vail Resorts as well as our employees, local businesses, community and government stakeholders to make Whistler Blackcomb better than ever. We will also continue our discussions with the Squamish and Lil'wat First Nations, on whose traditional lands we operate, regarding a business partnership that will benefit our communities, our province and our company for decades to come. Our board of directors has also been monitoring the unique challenges facing the broader ski industry due to the unpredictability of year-to- year regional weather patterns. Whistler Blackcomb, with its unprecedented acreage of high alpine terrain and Glacier bowls, is well positioned, but by no means immune to these challenges. Partnering with the geographically diversified Vail Resorts and extending its successful Epic Pass products to Whistler Blackcomb are customer-focused ways of securing the long-term future of our resort, our industry and our community." Whistler Blackcomb will nominate one member of its board to the Vail Resorts board of directors, and Dave Brownlie will continue leading Whistler Blackcomb as the resort's chief operating officer and will become a member of the senior leadership team of Vail Resorts' mountain division. Supporting the Whistler Blackcomb Experience Upon completion of this transaction, Vail Resorts is committed to continuing Whistler Blackcomb's success and building on its strengths, including further investment in the resort and the community: Support for Master Development Agreements with local First Nations. Vail Resorts recognizes that Whistler Blackcomb is in the Squamish and Lilwat First Nations' traditional territories and will support and continue the ongoing efforts to negotiate the renewal of Whistler Blackcomb's Master Development Agreements with significant long-term benefits to the Squamish and Lil'wat First Nations, the Province of British Columbia and the Resort Municipality of Whistler. Local leadership. Whistler Blackcomb will continue to have principally local Canadian leadership, with critical day-to-day mountain operations residing at the resort, including ongoing primary responsibility for relationships with the local community, governments and First Nations. Maintain local employment. Vail Resorts intends to retain the vast majority of Whistler Blackcomb employees, while only impacting a few select areas where there may be duplication in corporate functions. This transaction will not change the day-to-day operations at the resort, community engagement or the input of local management in shaping Whistler Blackcomb's future. Investment in the resort experience. Vail Resorts will invest substantially in Whistler Blackcomb's mountain infrastructure and growth plans, including continuing to build community and stakeholder support for the recently announcedRenaissance project, a transformational investment which will diversify the local tourism economy; provide new four-season, weather-independent activities; and elevate Whistler Blackcomb's core skiing, mountain biking and sightseeing experiences for decades to come. Common values on community and environmental sustainability. Consistent with Vail Resorts' core values, Whistler Blackcomb will continue its community involvement through the Whistler Blackcomb Foundation as well as its significant environmental and sustainability commitments. Vail Resorts also will support Whistler Blackcomb's continued engagement with organizations such as Tourism Whistler, Destination BC, Canada West Ski Areas Association, and the Whistler Chamber of Commerce. Katz continued, We look forward to working with Dave and the entire Whistler Blackcomb team as we support their efforts to continue the great progress that has made Whistler Blackcomb the world-renowned resort it is today. We are excited about what this transaction means for guests and look forward to providing access to the resort for our season pass holders around the world." Season Passes For the full 2016-17 winter season, Whistler Blackcomb will continue to honor the resort's existing season pass products. Vail Resorts looks forwar to integrating Whistler Blackcomb into its Epic Season Pass and other season pass products for the 2017-18 winter season. Additional Transaction Details The transaction has been unanimously approved by the Whistler Blackcomb board of directors, and shareholders representing 25 percent of Whistler Blackcomb's common shares have entered into voting support agreements in connection with the transaction. The transaction has also been unanimously approved by the Vail Resorts board of directors. The aggregate cash component of the offer is estimated to be C$676 million (USD$513 million) which Vail Resorts intends to finance through an expansion of its existing credit facility. The aggregate stock component of the offer is estimated to be c$715 million (USD$543 million), based on closing stock prices and exchange rates as of August 5, 2016. The stock component is determined by a baseline share exchange ratio of 0.0998 shares of Vail Resorts common stock and is adjusted for currency exchange rate changes if the Canadian dollar is above or below USD$0.7765 six business days before the closing of the transaction. As of August 5, 2016, the exchange ratio is 0.0975 shares of Vail Resorts common stock. Whistle Blackcomb shareholders that are Canadian residents for tax purposes will be able to elect to receive for each Whistler Blackcomb share an equivalent exchange ratio of shares in a Canadian subsidiary of Vail Resorts instead of the Vail Resorts shares to which they would otherwise be entitled. Each whole exchangeable share will be exchangeable into one Vail Resorts share. Upon closing of the transaction, Whistler Blackcomb shareholders collectively will own approximately 10 percent of Vail Resorts outstanding common stock. Whistler Blackcomb owns 75 percent of the partnerships that operate the resort and those partnerships had debt outstanding as of March 31, 2016 of C$171 million, or USD$132 million, which will be assumed or refinanced as part of the transaction. For the 12 months ended March 31, 2016, Whistler Blackcomb had Adjusted EBITDA of C$123 million, or USD$90 million. Vail Resorts believes if the transaction closes before December 31, 2016, the estimated incremental Resort Reported EBITDA from the acquisition in its fiscal 2018 would be approximately USD$129 million, or $170 million, with the vast majority of the projected growth coming from additional revenue at both Whistler Blackcomb and its other resorts and a smaller portion of the projected growth coming from cost reductions, with additional upside from the transaction in future years. Whistler Blackcomb's 25-year relationship with Nippon Cable will be unaffected and will continue after the closing of the transaction. The transaction is structured as an arrangement under the Business Corporations Act (British Columbia) and is subject to customary closing conditions, including approval by Whistler Blackcomb shareholders and the BC Supreme Court and regulatory approvals including approval under the Investment Canada Act and under the Competition Act Canada. Whistler Blackcomb is subject to customary non-solicitation provisions under the arrangement agreement. The agreement also includes a termination fee and reverse termination fee payable in certain circumstances. Further information regarding the transaction will be included in an information circular to be mailed to Whistler Blackcomb shareholders. The transaction is expected to close in fall 2016