Answered step by step

Verified Expert Solution

Question

1 Approved Answer

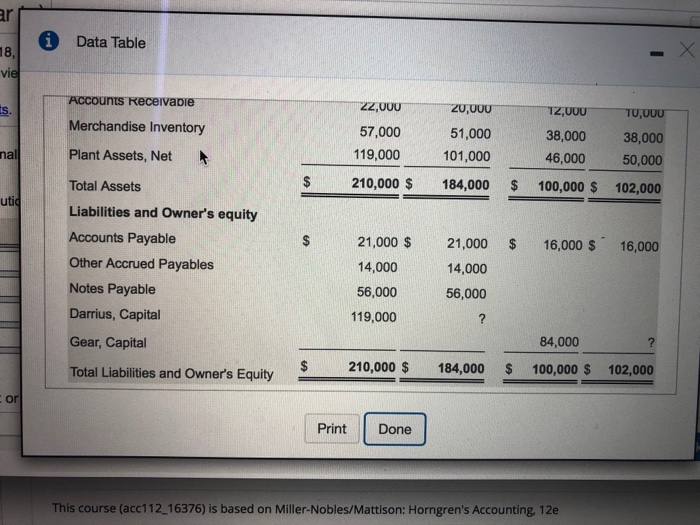

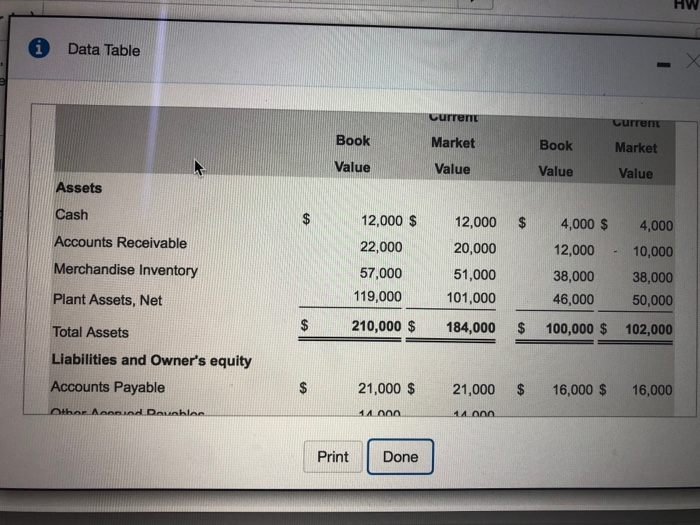

1. On December 31, 2018, Darrius and Gear agree to combine their sole proprietorships into a partnership. Their balance sheets on December 31 are shown

1. On December 31, 2018, Darrius and Gear agree to combine their sole proprietorships into a partnership. Their balance sheets on December 31 are shown as following:

1.journalize the contribution of Darrius and Gearnto the partnership

2. prepare the partnership balance sheet at dec.31,2018

Requirement 1. Journalize the contributions of Darrius and Gear to the partnership. (Record debits first, then, credits. Select explanations on the last line of the journal entry table.)

Journalize the contribution of Darrius.

2. Which characteristic identifies a limited liability company?

A.

The LLC can elect not to pay business income tax.

B.

Members can actively participate in the management of the business

C.

Members have limited personal liability.

D.

All of the above

3. Which characteristic identifies a general partnership?

A.

Limited personal liability

B.

No business income tax

C.

Unlimited life

D.

All of the above

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started