Question

1. On December 31, 2020, Helena Company, a California real estate firm, received two $20,000 notes from customers in exchange for services rendered. The 8%

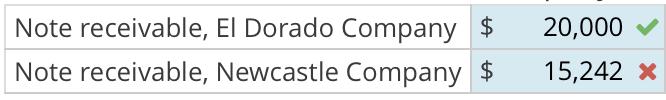

1. On December 31, 2020, Helena Company, a California real estate firm, received two $20,000 notes from customers in exchange for services rendered. The 8% note from El Dorado Company is due in nine months, and the 3% note from Newcastle Company is due in five years. The market interest rate for similar notes on December 31, 2020, was 8%. At what amounts should the two notes be reported in Helena’s December 31, 2020, balance sheet?

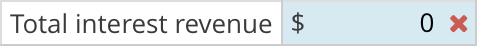

2. EPPA, an environmental management firm, issued to Dara, a $10,000, 8%, five-year installment note that required five equal annual year-end payments. This note was discounted to yield a 9% rate to Dara. What is the total amount of interest revenue to be recognized by Dara on this note?

3. On July 1, 2020, Lezix Company, a maker of denim clothing, sold goods in exchange for a $100,000, one-year, noninterest-bearing note. At the time of the sale, the market rate of interest was 12% on similar notes. At what amount should Lezix record the note receivable on July 1, 2020?

![]()

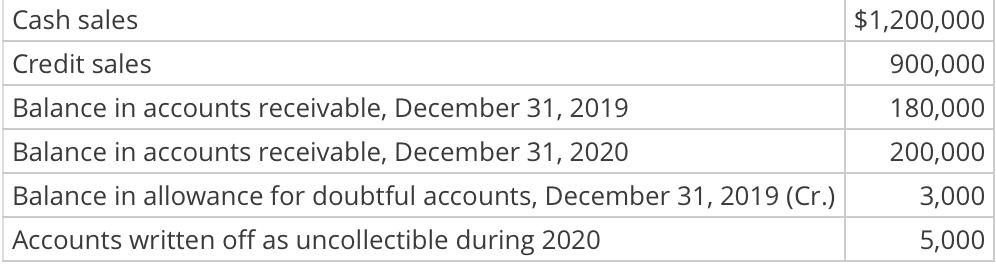

4. The records of Quest Company included the following accounts (with normal balances)

The company estimates bad debts as 2% of receivables at year-end to be uncollectible.

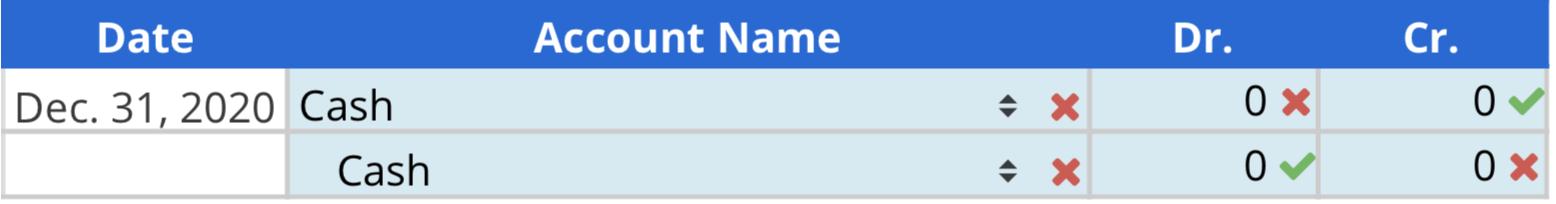

Prepare the adjusting entry at December 31, 2020, to adjust the allowance for doubtful accounts.

Note receivable, El Dorado Company $ Note receivable, Newcastle Company $ 20,000 15,242 x

Step by Step Solution

3.41 Rating (148 Votes )

There are 3 Steps involved in it

Step: 1

ANSWER PV of EL dorado Notes receivable 20000 PVIF 8 12 mon...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started