Question

Jane spends all of her $200 weekly income on two goods, X and Y. Her utility function is given by U(X, Y)= 4XY, If

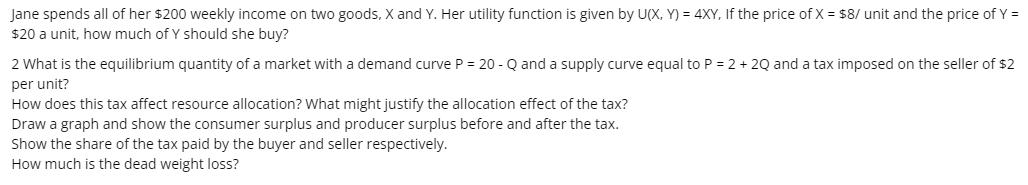

Jane spends all of her $200 weekly income on two goods, X and Y. Her utility function is given by U(X, Y)= 4XY, If the price of X = $8/ unit and the price of Y = $20 a unit, how much of Y should she buy? 2 What is the equilibrium quantity of a market with a demand curve P = 20-Q and a supply curve equal to P = 2 + 2Q and a tax imposed on the seller of $2 per unit? How does this tax affect resource allocation? What might justify the allocation effect of the tax? Draw a graph and show the consumer surplus and producer surplus before and after the tax. Show the share of the tax paid by the buyer and seller respectively. How much is the dead weight loss?

Step by Step Solution

3.36 Rating (159 Votes )

There are 3 Steps involved in it

Step: 1

1 Janes optimal consumption of Y is given by the equation 20 8Y 0 Y 25 2a The equilibrium quantity i...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Principles Of Managerial Finance

Authors: Lawrence J. Gitman, Chad J. Zutter

13th Edition

9780132738729, 136119468, 132738724, 978-0136119463

Students also viewed these Accounting questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App