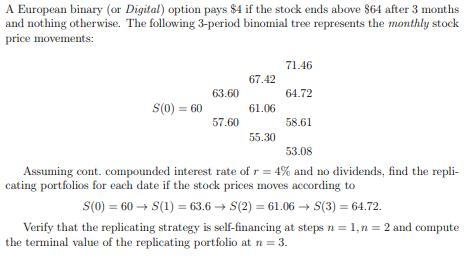

A European binary (or Digital) option pays $4 if the stock ends above $64 after 3 months and nothing otherwise. The following 3-period binomial

A European binary (or Digital) option pays $4 if the stock ends above $64 after 3 months and nothing otherwise. The following 3-period binomial tree represents the monthly stock price movements: S(0) = 60 63.60 57.60 67.42 61.06 55.30 71.46 64.72 58.61 53.08 Assuming cont. compounded interest rate of r = 4% and no dividends, find the repli- cating portfolios for each date if the stock prices moves according to S(0) = 60 S(1) = 63.6 S(2) = 61.06 S(3) = 64.72. Verify that the replicating strategy is self-financing at steps n = 1, n = 2 and compute the terminal value of the replicating portfolio at n = 3.

Step by Step Solution

3.42 Rating (155 Votes )

There are 3 Steps involved in it

Step: 1

Calculate the replicating portfoli...

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started