Answered step by step

Verified Expert Solution

Question

1 Approved Answer

1) On January 1, 2018, Allgood Company purchased equipment and signed a six-year mortgage note for $194,000 at 15%. The note will be paid in

1) On January 1, 2018, Allgood Company purchased equipment and signed a six-year mortgage note for $194,000 at 15%. The note will be paid in equal annual installments of $51,262, beginning January 1, 2019. Calculate the portion of interest expense paid on the third installment. (Round your answer to the nearest whole number.)

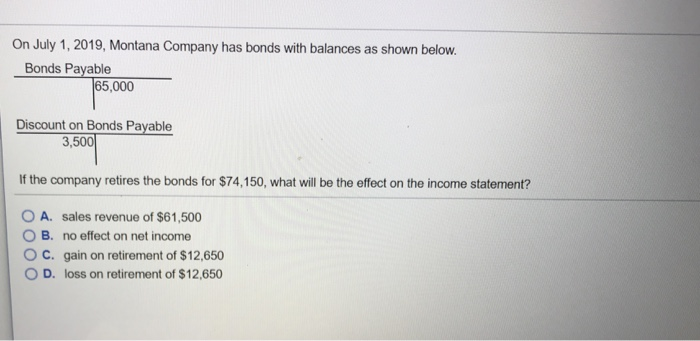

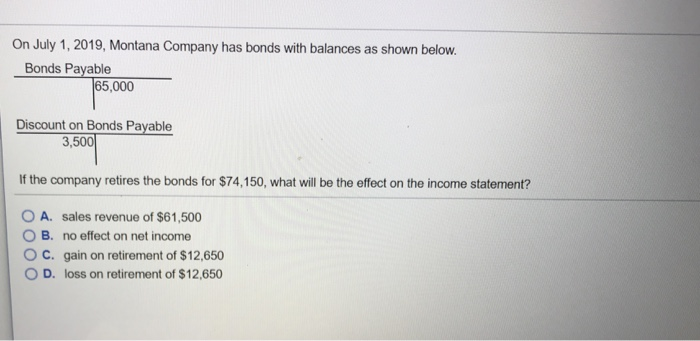

On July 1, 2019, Montana Company has bonds with balances as shown below. 65,000 Discount on Bonds Payable If the company retires the bonds for $74,150, what will be the effect on the income statement? O A. O B. sales revenue of $61,500 no effect on net income C. gain on retirement of $12,650 D. loss on retirement of $12,650 A. $51,262

B. $171,838

C. $21,953

D. $29,100

2) the second question is photographed! please help on 1&2!!

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started