Answered step by step

Verified Expert Solution

Question

1 Approved Answer

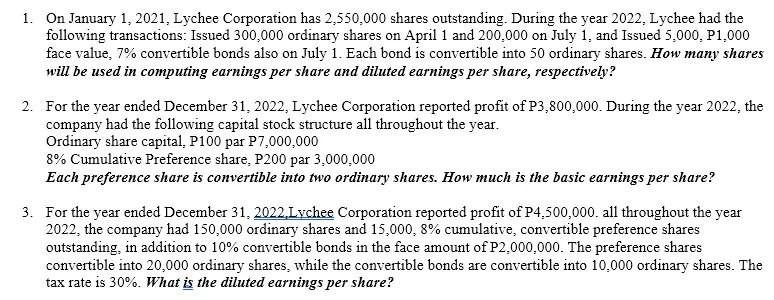

1. On January 1, 2021, Lychee Corporation has 2,550,000 shares outstanding. During the year 2022 , Lychee had the following transactions: Issued 300,000 ordinary shares

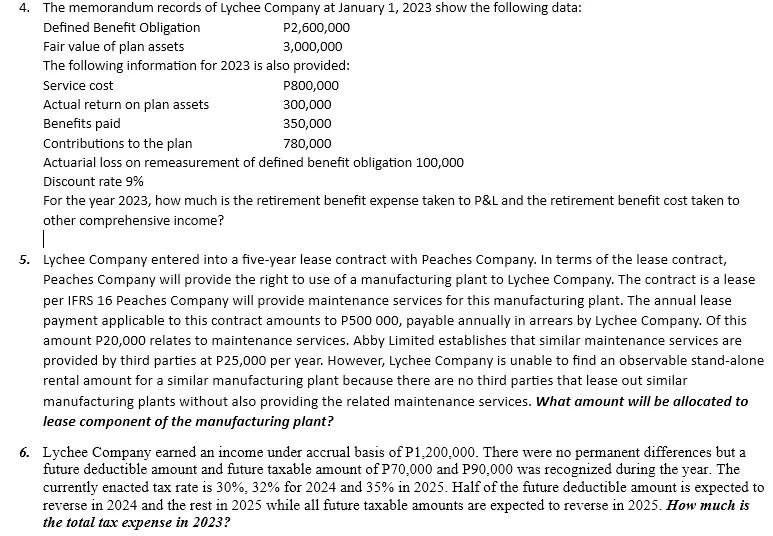

1. On January 1, 2021, Lychee Corporation has 2,550,000 shares outstanding. During the year 2022 , Lychee had the following transactions: Issued 300,000 ordinary shares on April 1 and 200,000 on July 1, and Issued 5,000, P1,000 face value, 7% convertible bonds also on July 1 . Each bond is convertible into 50 ordinary shares. How many shares will be used in computing earnings per share and diluted earnings per share, respectively? 2. For the year ended December 31,2022 , Lychee Corporation reported profit of P3,800,000. During the year 2022 , the company had the following capital stock structure all throughout the year. Ordinary share capital, P100 par P7,000,000 8% Cumulative Preference share, P200 par 3,000,000 Each preference share is convertible into two ordinary shares. How much is the basic earnings per share? 3. For the year ended December 31,2022 , Lvchee Corporation reported profit of P4,500,000. all throughout the year 2022 , the company had 150,000 ordinary shares and 15,000,8% cumulative, convertible preference shares outstanding, in addition to 10% convertible bonds in the face amount of P2,000,000. The preference shares convertible into 20,000 ordinary shares, while the convertible bonds are convertible into 10,000 ordinary shares. The tax rate is 30%. What is the diluted earnings per share? Actuarial loss on remeasurement of defined benefit obligation 100,000 Discount rate 9% For the year 2023, how much is the retirement benefit expense taken to P&L and the retirement benefit cost taken to other comprehensive income? 5. Lychee Company entered into a five-year lease contract with Peaches Company. In terms of the lease contract, Peaches Company will provide the right to use of a manufacturing plant to Lychee Company. The contract is a lease per IFRS 16 Peaches Company will provide maintenance services for this manufacturing plant. The annual lease payment applicable to this contract amounts to P500000, payable annually in arrears by Lychee Company. Of this amount P20,000 relates to maintenance services. Abby Limited establishes that similar maintenance services are provided by third parties at P25,000 per year. However, Lychee Company is unable to find an observable stand-alone rental amount for a similar manufacturing plant because there are no third parties that lease out similar manufacturing plants without also providing the related maintenance services. What amount will be allocated to lease component of the manufacturing plant? 6. Lychee Company earned an income under accrual basis of P1,200,000. There were no permanent differences but a future deductible amount and future taxable amount of P70,000 and P90,000 was recognized during the year. The currently enacted tax rate is 30%,32% for 2024 and 35% in 2025 . Half of the future deductible amount is expected to reverse in 2024 and the rest in 2025 while all future taxable amounts are expected to reverse in 2025 . How much is the total tax expense in 2023

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started