Answered step by step

Verified Expert Solution

Question

1 Approved Answer

1. On January 1, 2023 ISU issued 6%, 5 year bonds with a face amount of 100 million dollars to fund the renovation of a

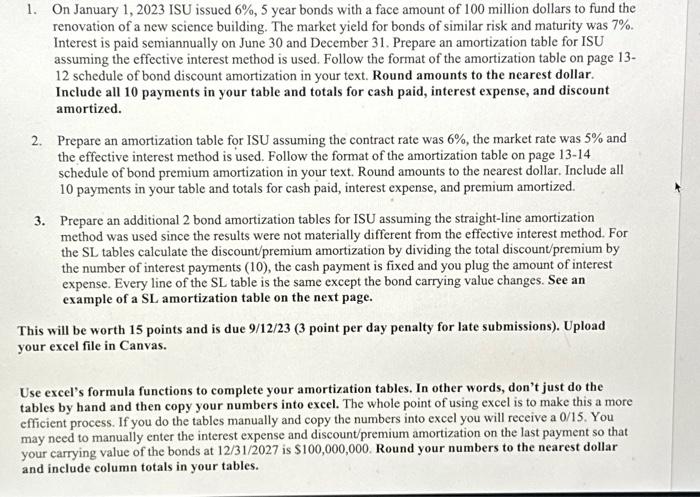

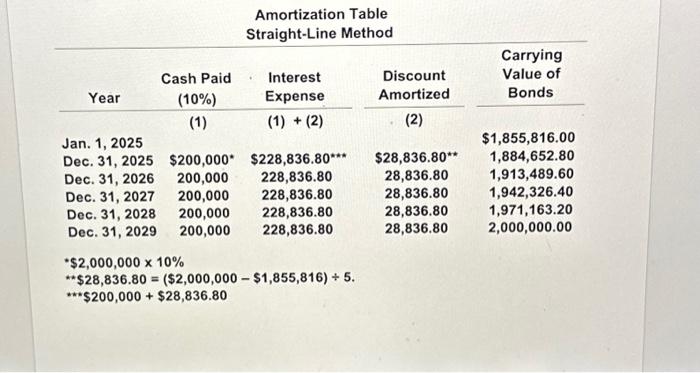

1. On January 1, 2023 ISU issued 6%, 5 year bonds with a face amount of 100 million dollars to fund the renovation of a new science building. The market yield for bonds of similar risk and maturity was 7%. Interest is paid semiannually on June 30 and December 31. Prepare an amortization table for ISU assuming the effective interest method is used. Follow the format of the amortization table on page 13- 12 schedule of bond discount amortization in your text. Round amounts to the nearest dollar. Include all 10 payments in your table and totals for cash paid, interest expense, and discount amortized. 2. Prepare an amortization table for ISU assuming the contract rate was 6%, the market rate was 5% and the effective interest method is used. Follow the format of the amortization table on page 13-14 schedule of bond premium amortization in your text. Round amounts to the nearest dollar. Include all 10 payments in your table and totals for cash paid, interest expense, and premium amortized. 3. Prepare an additional 2 bond amortization tables for ISU assuming the straight-line amortization method was used since the results were not materially different from the effective interest method. For the SL tables calculate the discount/premium amortization by dividing the total discount/premium by the number of interest payments (10), the cash payment is fixed and you plug the amount of interest expense. Every line of the SL table is the same except the bond carrying value changes. See an example of a SL amortization table on the next page. This will be worth 15 points and is due 9/12/23 (3 point per day penalty for late submissions). Upload your excel file in Canvas. Use excel's formula functions to complete your amortization tables. In other words, don't just do the tables by hand and then copy your numbers into excel. The whole point of using excel is to make this a more efficient process. If you do the tables manually and copy the numbers into excel you will receive a 0/15. You may need to manually enter the interest expense and discount/premium amortization on the last payment so that your carrying value of the bonds at 12/31/2027 is $100,000,000. Round your numbers to the nearest dollar and include column totals in your tables.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started