Question

1. On July 1, 2012, Sparky purchased a machine for $200,000 with a salvage value of $8,000 and useful life of 20 years which

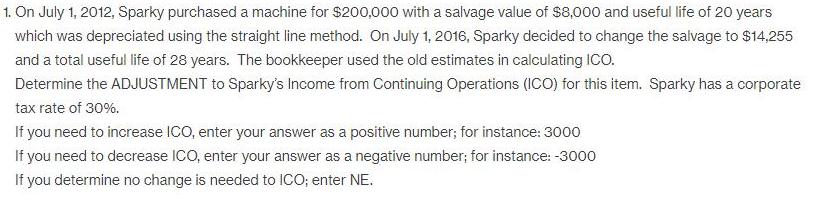

1. On July 1, 2012, Sparky purchased a machine for $200,000 with a salvage value of $8,000 and useful life of 20 years which was depreciated using the straight line method. On July 1, 2016, Sparky decided to change the salvage to $14,255 and a total useful life of 28 years. The bookkeeper used the old estimates in calculating ICO. Determine the ADJUSTMENT to Sparky's Income from Continuing Operations (ICO) for this item. Sparky has a corporate tax rate of 30%. If you need to increase ICO, enter your answer as a positive number; for instance: 3000 If you need to decrease ICO, enter your answer as a negative number; for instance: -3000 If you determine no change is needed to ICO; enter NE.

Step by Step Solution

3.40 Rating (150 Votes )

There are 3 Steps involved in it

Step: 1

Old Estimates Purchase price 200000 Salvage value 8000 Useful life ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Financial and Managerial Accounting

Authors: Jonathan E. Duchac, James M. Reeve, Carl S. Warren

11th Edition

9780538480901, 9781111525774, 538480890, 538480904, 1111525773, 978-0538480895

Students also viewed these Finance questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App