Answered step by step

Verified Expert Solution

Question

1 Approved Answer

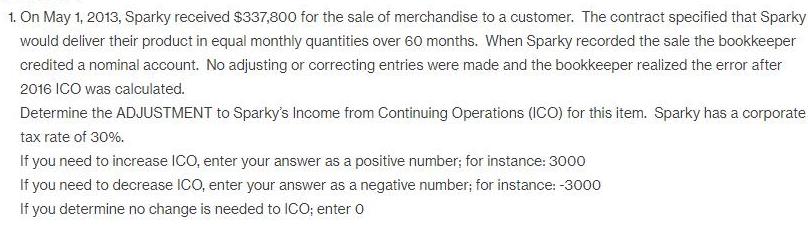

1. On May 1, 2013, Sparky received $337,800 for the sale of merchandise to a customer. The contract specified that Sparky would deliver their

1. On May 1, 2013, Sparky received $337,800 for the sale of merchandise to a customer. The contract specified that Sparky would deliver their product in equal monthly quantities over 60 months. When Sparky recorded the sale the bookkeeper credited a nominal account. No adjusting or correcting entries were made and the bookkeeper realized the error after 2016 ICO was calculated. Determine the ADJUSTMENT to Sparky's Income from Continuing Operations (ICO) for this item. Sparky has a corporate tax rate of 30%. If you need to increase ICO, enter your answer as a positive number; for instance: 3000 If you need to decrease ICO, enter your answer as a negative number; for instance: -3000 If you determine no change is needed to ICO; enter o

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Assuming the fiscal yearend to be December Aftertax Sales income to be recognised ea...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started