Answered step by step

Verified Expert Solution

Question

1 Approved Answer

1. On July. 1, 2017, Wales acquired 1,800 shares in Cardiff. Over the last year to Dec 31 , 2017, Cardiff has reported profits of

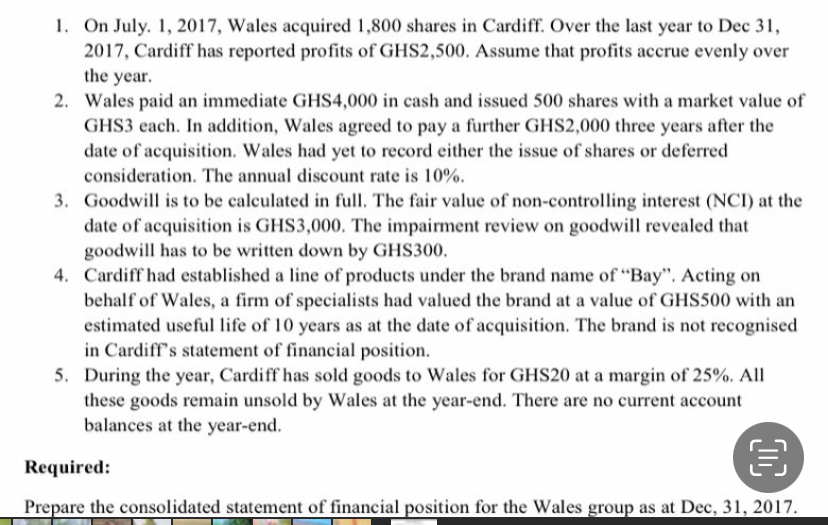

1. On July. 1, 2017, Wales acquired 1,800 shares in Cardiff. Over the last year to Dec 31 , 2017, Cardiff has reported profits of GHS2,500. Assume that profits accrue evenly over the year. 2. Wales paid an immediate GHS4,000 in cash and issued 500 shares with a market value of GHS3 each. In addition, Wales agreed to pay a further GHS2,000 three years after the date of acquisition. Wales had yet to record either the issue of shares or deferred consideration. The annual discount rate is 10%. 3. Goodwill is to be calculated in full. The fair value of non-controlling interest (NCI) at the date of acquisition is GHS3,000. The impairment review on goodwill revealed that goodwill has to be written down by GHS300. 4. Cardiff had established a line of products under the brand name of "Bay". Acting on behalf of Wales, a firm of specialists had valued the brand at a value of GHS500 with an estimated useful life of 10 years as at the date of acquisition. The brand is not recognised in Cardiff's statement of financial position. 5. During the year, Cardiff has sold goods to Wales for GHS 20 at a margin of 25%. All these goods remain unsold by Wales at the year-end. There are no current account balances at the year-end. Required: Prepare the consolidated statement of financial position for the Wales group as at Dec, 31, 2017

1. On July. 1, 2017, Wales acquired 1,800 shares in Cardiff. Over the last year to Dec 31 , 2017, Cardiff has reported profits of GHS2,500. Assume that profits accrue evenly over the year. 2. Wales paid an immediate GHS4,000 in cash and issued 500 shares with a market value of GHS3 each. In addition, Wales agreed to pay a further GHS2,000 three years after the date of acquisition. Wales had yet to record either the issue of shares or deferred consideration. The annual discount rate is 10%. 3. Goodwill is to be calculated in full. The fair value of non-controlling interest (NCI) at the date of acquisition is GHS3,000. The impairment review on goodwill revealed that goodwill has to be written down by GHS300. 4. Cardiff had established a line of products under the brand name of "Bay". Acting on behalf of Wales, a firm of specialists had valued the brand at a value of GHS500 with an estimated useful life of 10 years as at the date of acquisition. The brand is not recognised in Cardiff's statement of financial position. 5. During the year, Cardiff has sold goods to Wales for GHS 20 at a margin of 25%. All these goods remain unsold by Wales at the year-end. There are no current account balances at the year-end. Required: Prepare the consolidated statement of financial position for the Wales group as at Dec, 31, 2017 Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started