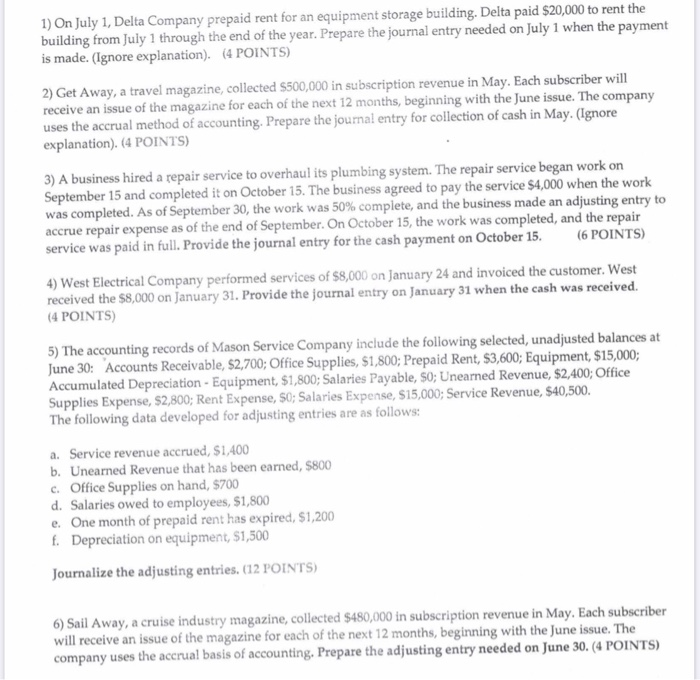

1) On July 1, Delta Company prepaid rent for an equipment storage building. Delta paid $20,000 to rent the building from July 1 through the end of the year. Prepare the journal entry needed on July 1 when the payment is made. (Ignore explanation). (4 POINTS) 2) Get Away, a travel magazine, collected $500,000 in subscription revenue in May. Each subscriber will receive an issue of the magazine for each of the next 12 months, beginning with the June issue. The company uses the accrual method of accounting. Prepare the journal entry for collection of cash in May. (Ignore explanation). (4 POINTS) 3) A business hired a repair service to overhaul its plumbing system. The repair service began work on September 15 and completed it on October 15. The business agreed to pay the service $4,000 when the work was completed. As of September 30, the work was 50% complete, and the business made an adjusting entry to accrue repair expense as of the end of September. On October 15, the work was completed, and the repair service was paid in full. Provide the journal entry for the cash payment on October 15. (6 POINTS) 4) West Electrical Company performed services of $8,000 on January 24 and invoiced the customer. West received the $8,000 on January 31. Provide the journal entry on January 31 when the cash was received. (4 POINTS) 5) The accounting records of Mason Service Company include the following selected, unadjusted balances at June 30: Accounts Receivable, 2,700; Office Supplies, $1,800; Prepaid Rent, $3,600; Equipment, $15,000; Accumulated Depreciation - Equipment, $1,800; Salaries Payable, S0; Unearned Revenue, $2,400; Office Supplies Expense, $2,800; Rent Expense, S0; Salaries Expense, $15,000; Service Revenue, $40,500. The following data developed for adjusting entries are as follows: a. Service revenue accrued, $1,400 b. Unearned Revenue that has been earned, $800 c. Office Supplies on hand, $700 d. Salaries owed to employees, $1,800 e. One month of prepaid rent has expired, S1,200 f. Depreciation on equipment, $1,500 Journalize the adjusting entries. (12 POINTS) 6) Sail Away, a cruise industry magazine, collected $480,000 in subscription revenue in May. Each subscriber will receive an issue of the magazine for each of the next 12 months, beginning with the June issue. The company uses the accrual basis of accounting. Prepare the adjusting entry needed on June 30. (4 POINTS)