Answered step by step

Verified Expert Solution

Question

1 Approved Answer

1. On July 15, Piper Company sold $12,000 of merchandise (costing $6,000) for cash. The sales tax rate is 4%. On August 1, Piper

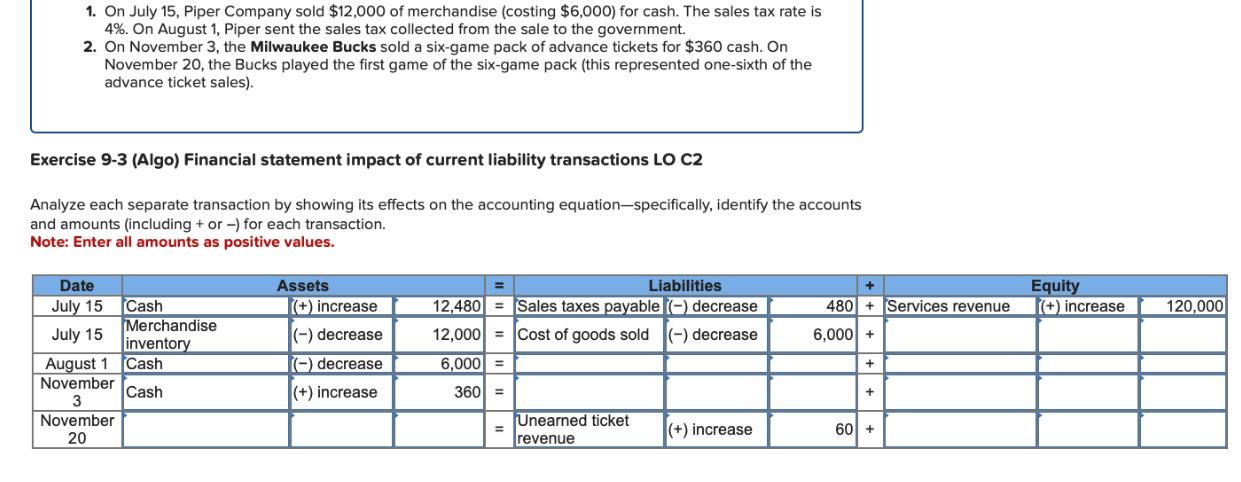

1. On July 15, Piper Company sold $12,000 of merchandise (costing $6,000) for cash. The sales tax rate is 4%. On August 1, Piper sent the sales tax collected from the sale to the government. 2. On November 3, the Milwaukee Bucks sold a six-game pack of advance tickets for $360 cash. On November 20, the Bucks played the first game of the six-game pack (this represented one-sixth of the advance ticket sales). Exercise 9-3 (Algo) Financial statement impact of current liability transactions LO C2 Analyze each separate transaction by showing its effects on the accounting equation-specifically, identify the accounts and amounts (including + or -) for each transaction. Note: Enter all amounts as positive values. Date July 15 Cash Merchandise July 15 inventory August 1 Cash Assets (+) increase (-) decrease (-) decrease Liabilities Equity 12,480 12,000 6,000 = Sales taxes payable (-) decrease Cost of goods sold (-) decrease 480 +Services revenue 6,000+ (+) increase 120,000 November Cash (+) increase 360 = + 3 November 20 Unearned ticket revenue (+) increase 60+

Step by Step Solution

★★★★★

3.42 Rating (155 Votes )

There are 3 Steps involved in it

Step: 1

Your analysis is absolutely correctLets break down each transaction Transaction 1 July 15th Sale Cas...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started