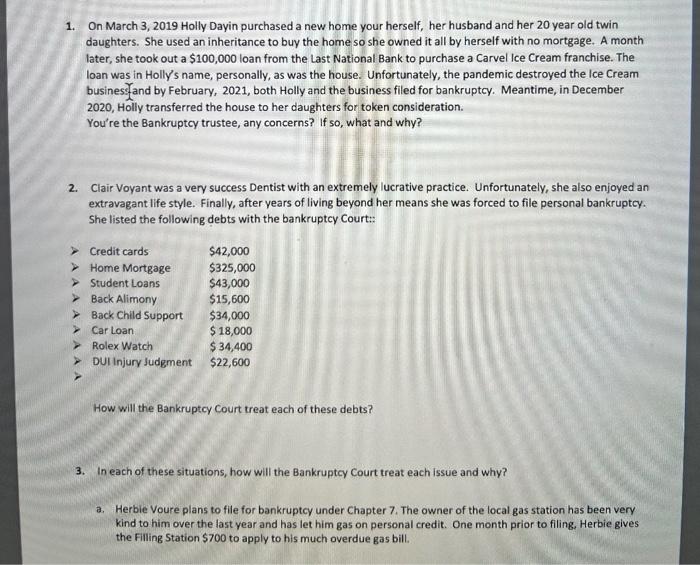

1. On March 3, 2019 Holly Dayin purchased a new home your herself, her husband and her 20 year old twin daughters. She used an inheritance to buy the home so she owned it all by herself with no mortgage. A month later, she took out a $100,000 loan from the Last National Bank to purchase a Carvel Ice Cream franchise. The loan was in Holly's name, personally, as was the house. Unfortunately, the pandemic destroyed the Ice Cream busines.S.Tand by February, 2021, both Holly and the business filed for bankruptcy. Meantime, in December 2020 , Holly transferred the house to her daughters for token consideration. You're the Bankruptcy trustee, any concerns? If so, what and why? 2. Clair Voyant was a very success Dentist with an extremely lucrative practice. Unfortunately, she also enjoyed an extravagant life style. Finally, after years of living beyond her means she was forced to file personal bankruptcy. She listed the following debts with the bankruptcy Court:: How will the Bankruptcy Court treat each of these debts? 3. In each of these situations, how will the Bankruptcy Court treat each issue and why? a. Herbie Voure plans to file for bankruptcy under Chapter 7. The owner of the local gas station has been very kind to him over the last year and has let him gas on personal credit. One month prior to filing. Herbie gives the Filling Station $700 to apply to his much overdue gas bill. 1. On March 3, 2019 Holly Dayin purchased a new home your herself, her husband and her 20 year old twin daughters. She used an inheritance to buy the home so she owned it all by herself with no mortgage. A month later, she took out a $100,000 loan from the Last National Bank to purchase a Carvel Ice Cream franchise. The loan was in Holly's name, personally, as was the house. Unfortunately, the pandemic destroyed the Ice Cream busines.S.Tand by February, 2021, both Holly and the business filed for bankruptcy. Meantime, in December 2020 , Holly transferred the house to her daughters for token consideration. You're the Bankruptcy trustee, any concerns? If so, what and why? 2. Clair Voyant was a very success Dentist with an extremely lucrative practice. Unfortunately, she also enjoyed an extravagant life style. Finally, after years of living beyond her means she was forced to file personal bankruptcy. She listed the following debts with the bankruptcy Court:: How will the Bankruptcy Court treat each of these debts? 3. In each of these situations, how will the Bankruptcy Court treat each issue and why? a. Herbie Voure plans to file for bankruptcy under Chapter 7. The owner of the local gas station has been very kind to him over the last year and has let him gas on personal credit. One month prior to filing. Herbie gives the Filling Station $700 to apply to his much overdue gas bill