Answered step by step

Verified Expert Solution

Question

1 Approved Answer

1. On September 30, they sell for $13,000 stock in Old Opry Corporation purchased as an investment on March 1, of the current year

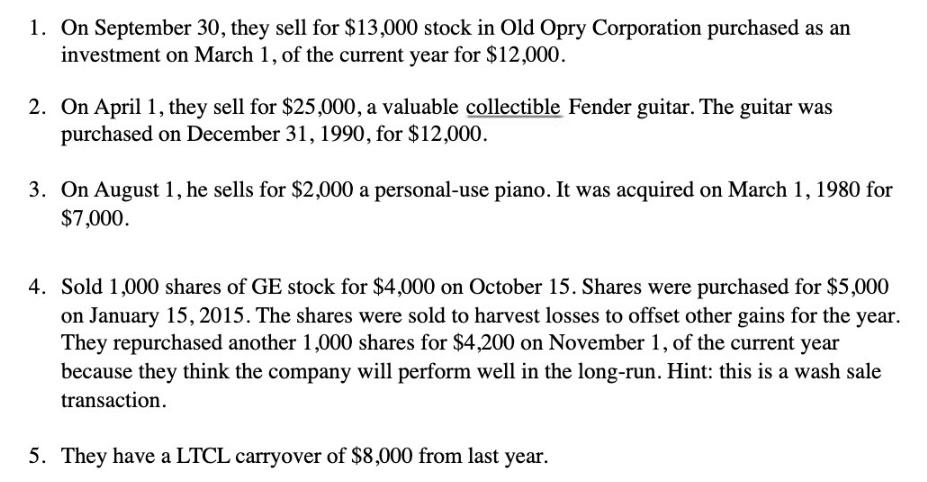

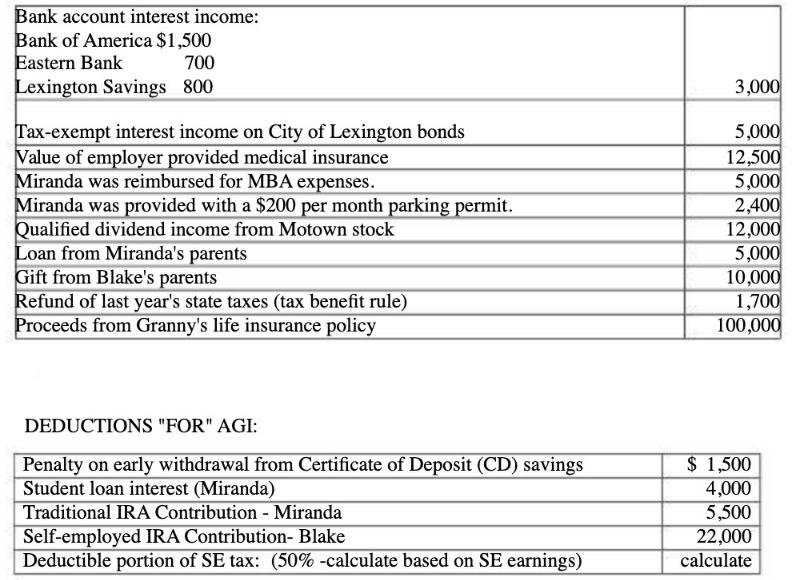

1. On September 30, they sell for $13,000 stock in Old Opry Corporation purchased as an investment on March 1, of the current year for $12,000. 2. On April 1, they sell for $25,000, a valuable collectible Fender guitar. The guitar was purchased on December 31, 1990, for $12,000. 3. On August 1, he sells for $2,000 a personal-use piano. It was acquired on March 1, 1980 for $7,000. 4. Sold 1,000 shares of GE stock for $4,000 on October 15. Shares were purchased for $5,000 on January 15, 2015. The shares were sold to harvest losses to offset other gains for the year. They repurchased another 1,000 shares for $4,200 on November 1, of the current year because they think the company will perform well in the long-run. Hint: this is a wash sale transaction. 5. They have a LTCL carryover of $8,000 from last year. Bank account interest income: Bank of America $1,500 Eastern Bank 700 Lexington Savings 800 Tax-exempt interest income on City of Lexington bonds Value of employer provided medical insurance Miranda was reimbursed for MBA expenses. Miranda was provided with a $200 per month parking permit. Qualified dividend income from Motown stock Loan from Miranda's parents Gift from Blake's parents Refund of last year's state taxes (tax benefit rule) Proceeds from Granny's life insurance policy DEDUCTIONS "FOR" AGI: Penalty on early withdrawal from Certificate of Deposit (CD) savings Student loan interest (Miranda) Traditional IRA Contribution - Miranda Self-employed IRA Contribution- Blake Deductible portion of SE tax: (50% -calculate based on SE earnings) 3,000 5,000 12,500 5,000 2,400 12,000 5,000 10,000 1,700 100,000 $ 1,500 4,000 5,500 22,000 calculate

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Based on the information you provided and the image you sent it appears youre looking to calculate t...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started