Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Blake is a successful self-employed music producer operating as a sole proprietorship. He materially and actively participated in the business. The business is operated

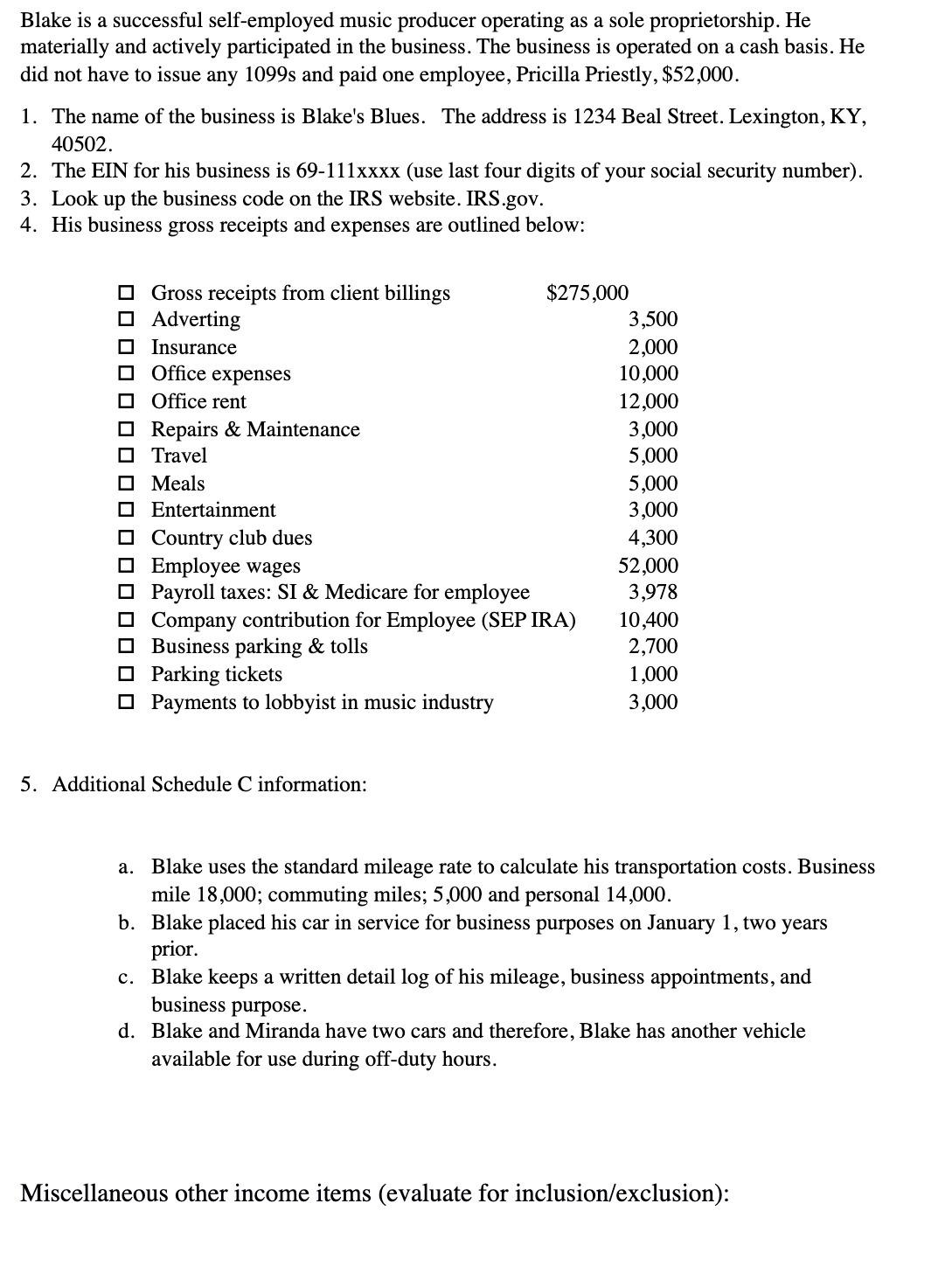

Blake is a successful self-employed music producer operating as a sole proprietorship. He materially and actively participated in the business. The business is operated on a cash basis. He did not have to issue any 1099s and paid one employee, Pricilla Priestly, $52,000. 1. The name of the business is Blake's Blues. The address is 1234 Beal Street. Lexington, KY, 40502. 2. The EIN for his business is 69-111xxxx (use last four digits of your social security number). 3. Look up the business code on the IRS website. IRS.gov. 4. His business gross receipts and expenses are outlined below: Gross receipts from client billings Adverting Insurance Office expenses Office rent Repairs & Maintenance Travel Meals Entertainment $275,000 Country club dues Employee wages Payroll taxes: SI & Medicare for employee Company contribution for Employee (SEP IRA) Business parking & tolls Parking tickets Payments to lobbyist in music industry 5. Additional Schedule C information: 3,500 2,000 10,000 12,000 3,000 5,000 5,000 3,000 4,300 52,000 3,978 10,400 2,700 1,000 3,000 a. Blake uses the standard mileage rate to calculate his transportation costs. Business mile 18,000; commuting miles; 5,000 and personal 14,000. b. Blake placed his car in service for business purposes on January 1, two years prior. c. Blake keeps a written detail log of his mileage, business appointments, and business purpose. d. Blake and Miranda have two cars and therefore, Blake has another vehicle available for use during off-duty hours. Miscellaneous other income items (evaluate for inclusion/exclusion):

Step by Step Solution

★★★★★

3.32 Rating (155 Votes )

There are 3 Steps involved in it

Step: 1

Based on the information provided here are the key details for Blakes selfemployed music production ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started