Answered step by step

Verified Expert Solution

Question

1 Approved Answer

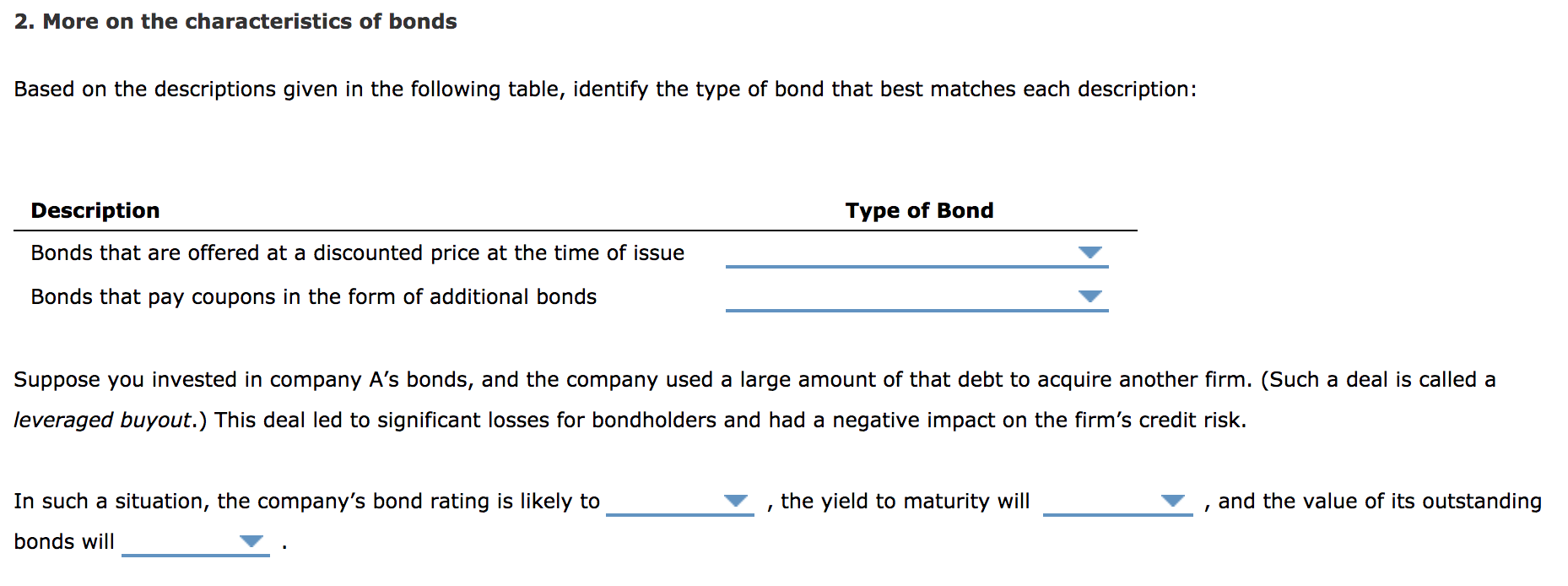

1. Options: a. Original Issued Discount Bonds; b. Fallen Angels; c. Par Value Bonds; d. Payment-in-kind-bonds 2. Options: a. Step-up Provision in Bonds; b. Payment-in-kind-bonds;

1. Options: a. Original Issued Discount Bonds; b. Fallen Angels; c. Par Value Bonds; d. Payment-in-kind-bonds

2. Options: a. Step-up Provision in Bonds; b. Payment-in-kind-bonds; c. Zero Coupon Bonds; d. Originial Issue Discount Bonds

3. a. Increase; b. Decrease

4. a. Increase; b. Decrease

5. a Increase; b. Decrease

2. More on the characteristics of bonds Based on the descriptions given in the following table, identify the type of bond that best matches each description: Description Type of Bond Bonds that are offered at a discounted price at the time of issue Bonds that pay coupons in the form of additional bonds Suppose you invested in company A's bonds, and the company used a large amount of that debt to acquire another firm. (Such a deal is called a leveraged buyout.) This deal led to significant losses for bondholders and had a negative impact on the firm's credit risk. In such a situation, the company's bond rating is likely to , the yield to maturity will , and the value of its outstanding bonds willStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started