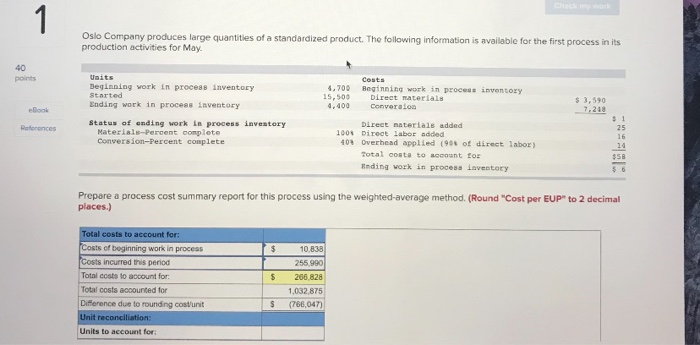

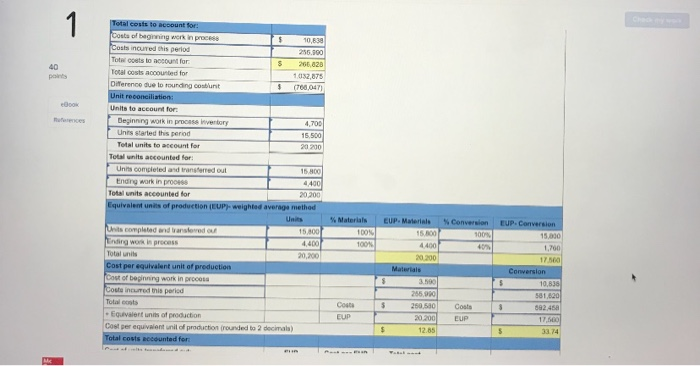

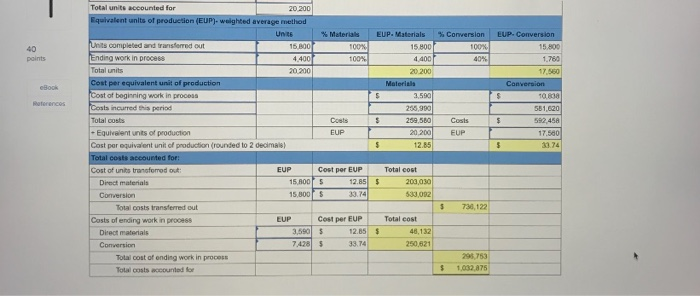

1 Oslo Company produces large quantities of a standardized product. The following information is available for the first process in its production activities for May. 40 points Costs 1,700 Reginning work in process inventory 15,500 Direct materials 4.400 Conversion $ 3,590 Units Beginning work in process inventory Started Ending work in process inventory Status of ending work in process inventory Materials-Percent complete Conversion-Percent complete Book References Direct materials added 1004 Direct labor added 40% Overhead applied (90% of direct labor) Total costs to account for Ending work in process inventory $1 25 16 14 $50 56 Prepare a process cost summary report for this process using the weighted average method (Round "Cost per EUP" to 2 decimal places.) $ $ Total costs to account for: Costs of beginning work in process Costs incurred this period Total costs to account for: Total costs accounted for Difference due to rounding costunit Unit reconciliation: Units to account for 10,838 255.990 266,828 1,032,875 (766,047) $ 40 pois Box Total costs to account for: Costs of beginning werk in process $ 10,838 Costs incurred this period 256.900 Tot costs to account for $ 266,828 Total costs accounted for 1.032,875 Difference due to rounding count $ (700,047) Unit reconciliation Units to account for: Beginning work in process inventory 4.700 Uns started this period 15,500 Total units to account for 20 200 Total units accounted for Units completed and transferred out 15.800 Ending work in process 4400 Total units accounted for 20.200 Equivalent units of production (UP)-weighted average method Units units completed and transfered out 15 800 Ending work in process 4,400 Total units 20,200 Cost per equivalent unit of production Cost of beginning work in pross Costa neurred this period Total costs - Equivalent units of production Cost per equivalent unit of production rounded to 2 decimals) Total costs accounted for Materials 1 DON 1001 Conversion 100% EUP. Material 15.000 4.400 20.200 Materiais $ 3.590 255.900 $ 250.500 20.200 $ 12.85 EUP. Conversion 15.000 1,700 17.500 Conversion $ 10,838 581.620 8 892.458 17.500 5 33.74 Costa EUP Costs EUP --- 40 points % Conversion 100% 40% Boch EUP. Conversion 15.800 1.780 17.560 Conversion $ 10. 838 551.620 $ 592.458 17.580 $ 33.74 Motorences Total units accounted for 20.200 Equivalent units of production (EUP)-weighted average method Un % Materials EUP. Materials Units completed and transferred out 15.300 100% 15 800 Ending work in process 4.400 100% 4400 Total units 20.200 20.200 Cost per equivalent unit of production Materials Cost of beginning work in process $ 3.590 Costs incurred this period 256,990 Total costs Cools $ 259,580 - Equivalent units of production EUP 20.200 Cost per equivalent unit of production (rounded to 2 decimals) $ 12.85 Total costs accounted for: Cost of units transforrod out: EUP Cost per EUP Total cost Direct materials 15.2005 12.85$ 203,030 Conversion 15.800 33.14 533,092 Total costs transferred out Costs of ending work in pro. 68 EUP Cost per EUP Total cost Direct materials 3,5905 $ 18,132 Conversion 7,4285 33.74 250,621 Total cost of ending work in process Total costs accounted for Costs FUP 5 730,122 296.753 1,032,875 $