Answered step by step

Verified Expert Solution

Question

1 Approved Answer

1. Over the past month, TSLA made 14% and GOOG made 12%. The risk free rate was 1% (EMR). How much would you have today

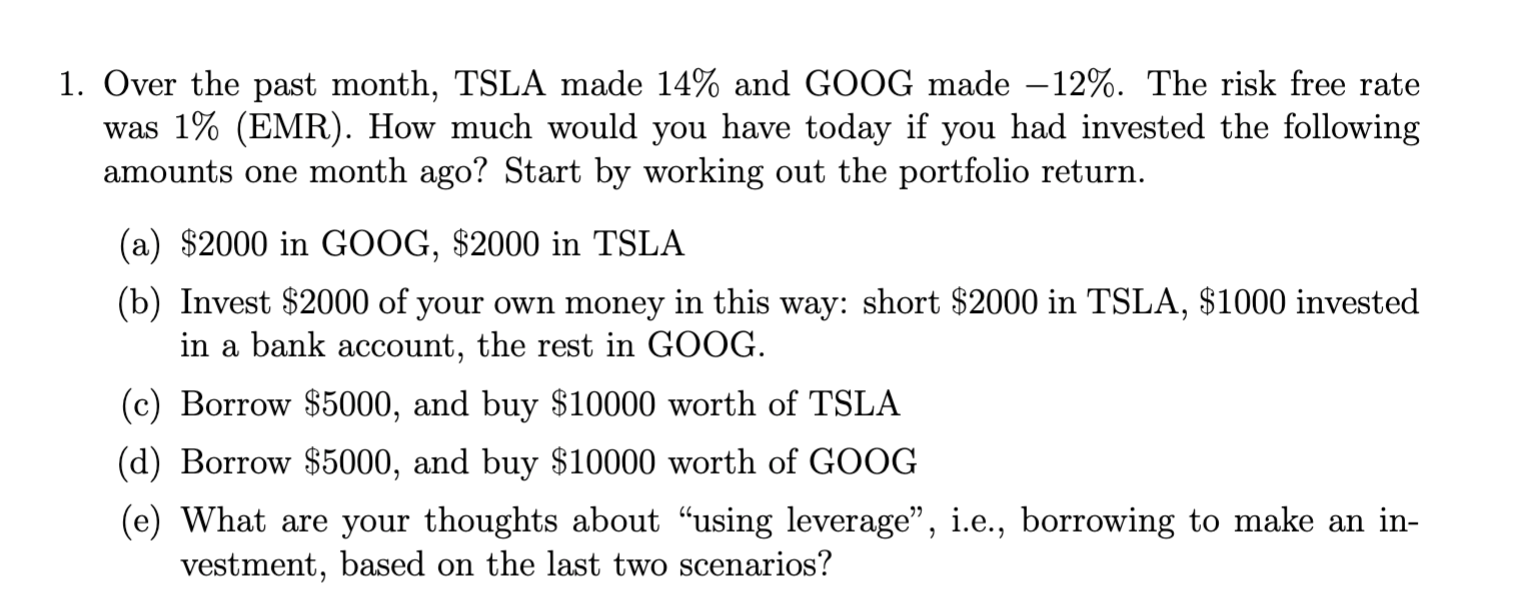

1. Over the past month, TSLA made 14% and GOOG made 12%. The risk free rate was 1% (EMR). How much would you have today if you had invested the following amounts one month ago? Start by working out the portfolio return. (a) $2000 in GOOG, $2000 in TSLA (b) Invest $2000 of your own money in this way: short $2000 in TSLA, $1000 invested in a bank account, the rest in GOOG. (c) Borrow $5000, and buy $10000 worth of TSLA (d) Borrow $5000, and buy $10000 worth of GOOG (e) What are your thoughts about "using leverage", i.e., borrowing to make an investment, based on the last two scenarios

1. Over the past month, TSLA made 14% and GOOG made 12%. The risk free rate was 1% (EMR). How much would you have today if you had invested the following amounts one month ago? Start by working out the portfolio return. (a) $2000 in GOOG, $2000 in TSLA (b) Invest $2000 of your own money in this way: short $2000 in TSLA, $1000 invested in a bank account, the rest in GOOG. (c) Borrow $5000, and buy $10000 worth of TSLA (d) Borrow $5000, and buy $10000 worth of GOOG (e) What are your thoughts about "using leverage", i.e., borrowing to make an investment, based on the last two scenarios Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started