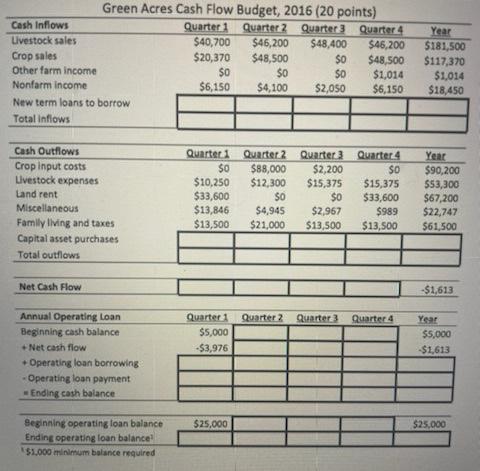

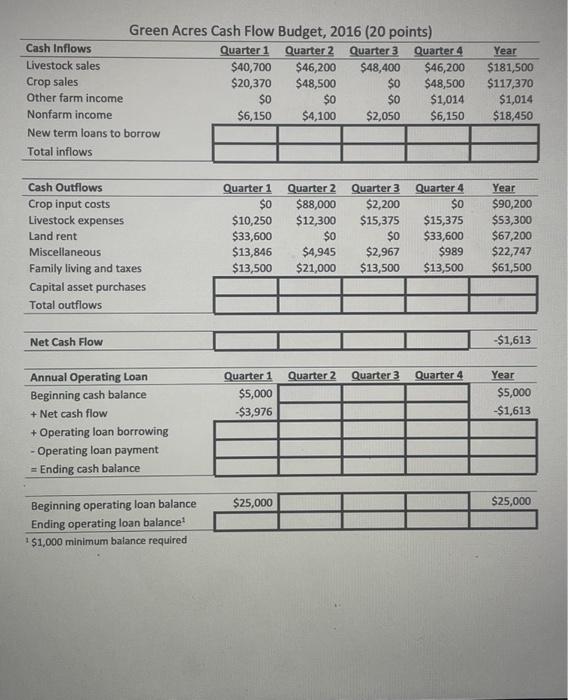

1. Overview-Green Acres needs to find out how much operating capital they will need to borrow this coming year. As the new farm manager, you are tasked with completing the cash flow budget for 2016. Green Acres Farm organizes their cash flow budget by quarter. They have a good handle on projections for cash coming into and going out of the business (cash inflows and outflows). However, they have yet to complete a budget and need your help. 2. Net Cash Flow- Using the cash inflows and outflows data in the Green Acres cash flow budget, calculate and fill in the four (4) quarterly values for Net Cash Flow and the annual (1) value. All annual values in the table can be found by summing the estimates for the four (4) quarters. 3. Ending Cash Balance-The farm owners instruct you to ensure that there is always an ending cash balance of $1,000 each quarter. When you calculate the required borrowing needs for each quarter, make sure you remember that you will need to borrow enough funds to have $1,000 minimum in the account (if borrowing is in fact needed). 4. Operating Loan-Calculate how much Green Acres will need to borrow each quarter (if borrowing is needed) and how much they can repay each quarter (if borrowing is needed). Do not worry about interest payments on the operating loan. If you estimate that the farm can repay a portion of the loan during one or more of the quarters, simply apply the payment as if it were going towards principal alone. Don't forget to budget for an ending cash balance of $1,000 each quarter. 5. Beginning and Ending Loan Balances- On the bottom two lines of the cash flow budget, estimate the total amount of operating loan funds the farm will have borrowed at the end of each quarter. Note: The Annual Beginning Operating Loan Balance is equal to the Quarter 1 Beginning Operating Loan Balance and the Annual Ending Operating Loan Balance is equal to the Quarter 4 Ending Operating Loan Balance. The Beginning Operating Loan Balance is provided for you at $25,000. Additional Information Sunnybrook Farms plans to purchase replacement heifers from a long-time business partner for the cow herd in April for a negotiated price of $20,000. Assume they are planning to also be approved for a loan equaling the same amount in April. Sunnybrook Farms plans to apply for a loan worth $50,000 (new tractor cost after trade-in value is deducted) to purchase a tractor in July after their loan officer reviews their first and second quarter financial statements. The farm has already received confirmation that the trade-in value for their current tractor is $25,000 and plan to purchase the new tractor the first week of August. Green Acres Cash Flow Budget, 2016 ( 20 points) \begin{tabular}{lrrrrr|r|} \hline Cash Inflows & Quarter 1 & Quarter 2 & Quarter 3 & Quarter 4 & \multicolumn{1}{c}{ Year } \\ \hline Uvestock sales & $40,700 & $46,200 & $48,400 & $46,200 & $181,500 \\ Crop sales & $20,370 & $48,500 & $0 & $48,500 & $117,370 \\ Other farm income & $5 & $50 & $0 & $1,014 & $1,014 \\ Nonfarm income & $6,150 & $4,100 & $2,050 & $6,150 & $18,450 \\ \hline New term loans to borrow & & & & & \\ \hline Total inflows & & & & & \\ \hline \end{tabular} Net Cash Flow 1. Overview-Green Acres needs to find our how much operating capital they will need to borrow this coming year. As the new farm manager, you are tasked with completing the cash flow budget for 2016. Green Acres Farm organizes their cash flow budget by quarter. They have a good handle on projections for cash coming into and going out of the business (cash inflows and outflows). However, they have yet to complete a budget and need your help. 2. Net Cash Flow- Using the cash inflows and outflows data in the Green Acres cash flow budget, calculate and fill in the four (4) quarterly values for Net Cash Flow and the annual (1) value. All annual values in the table can be found by summing the estimates for the four (4) quarters. 3. Ending Cash Balance-The farm owners instruct you to ensure that there is always an ending cash balance of $1,000 each quarter. When you calculate the required borrowing needs for each quarter, make sure you remember that you will need to borrow enough funds to have $1,000 minimum in the account (if borrowing is in fact needed). 4. Operating Loan-Calculate how much Green Acres will need to borrow each quarter (if borrowing is needed) and how much they can repay each quarter (if borrowing is needed). Do not worry about interest payments on the operating loan. If you estimate that the farm can repay a portion of the loan during one or more of the quarters, simply apply the payment as if it were going towards principal alone. Don't forget to budget for an ending cash balance of $1,000 each quarter. 5. Beginning and Ending Loan Balances- On the bottom two lines of the cash flow budget, estimate the total amount of operating loan funds the farm will have borrowed at the end of each quarter. Note: The Annual Beginning Operating Loan Balance is equal to the Quarter 1 Beginning Operating Loan Balance and the Annual Ending Operating Loan Balance is equal to the Quarter 4 Ending Operating Loan Balance. The Beginning Operating Loan Balance is provided for you at $25,000. Additional Information Sunnybrook Farms plans to purchase replacement heifers from a long-time business partner for the cow herd in April for a negotiated price of $20,000. Assume they are planning to also be approved for a loan equaling the same amount in April. Sunnybrook Farms plans to apply for a loan worth $50,000 (new tractor cost after trade-in value is deducted) to purchase a tractor in July after their loan officer reviews their first and second quarter financial statements. The farm has already received confirmation that the trade-in value for their current tractor is $25,000 and plan to purchase the new tractor the first week of August. Green Acres Cash Flow Budget, 2016 (20 points) Beginning operating loan balance Ending operating loan balance 1 1$1,000 minimum balance required 1. Overview-Green Acres needs to find out how much operating capital they will need to borrow this coming year. As the new farm manager, you are tasked with completing the cash flow budget for 2016. Green Acres Farm organizes their cash flow budget by quarter. They have a good handle on projections for cash coming into and going out of the business (cash inflows and outflows). However, they have yet to complete a budget and need your help. 2. Net Cash Flow- Using the cash inflows and outflows data in the Green Acres cash flow budget, calculate and fill in the four (4) quarterly values for Net Cash Flow and the annual (1) value. All annual values in the table can be found by summing the estimates for the four (4) quarters. 3. Ending Cash Balance-The farm owners instruct you to ensure that there is always an ending cash balance of $1,000 each quarter. When you calculate the required borrowing needs for each quarter, make sure you remember that you will need to borrow enough funds to have $1,000 minimum in the account (if borrowing is in fact needed). 4. Operating Loan-Calculate how much Green Acres will need to borrow each quarter (if borrowing is needed) and how much they can repay each quarter (if borrowing is needed). Do not worry about interest payments on the operating loan. If you estimate that the farm can repay a portion of the loan during one or more of the quarters, simply apply the payment as if it were going towards principal alone. Don't forget to budget for an ending cash balance of $1,000 each quarter. 5. Beginning and Ending Loan Balances- On the bottom two lines of the cash flow budget, estimate the total amount of operating loan funds the farm will have borrowed at the end of each quarter. Note: The Annual Beginning Operating Loan Balance is equal to the Quarter 1 Beginning Operating Loan Balance and the Annual Ending Operating Loan Balance is equal to the Quarter 4 Ending Operating Loan Balance. The Beginning Operating Loan Balance is provided for you at $25,000. Additional Information Sunnybrook Farms plans to purchase replacement heifers from a long-time business partner for the cow herd in April for a negotiated price of $20,000. Assume they are planning to also be approved for a loan equaling the same amount in April. Sunnybrook Farms plans to apply for a loan worth $50,000 (new tractor cost after trade-in value is deducted) to purchase a tractor in July after their loan officer reviews their first and second quarter financial statements. The farm has already received confirmation that the trade-in value for their current tractor is $25,000 and plan to purchase the new tractor the first week of August. Green Acres Cash Flow Budget, 2016 ( 20 points) \begin{tabular}{lrrrrr|r|} \hline Cash Inflows & Quarter 1 & Quarter 2 & Quarter 3 & Quarter 4 & \multicolumn{1}{c}{ Year } \\ \hline Uvestock sales & $40,700 & $46,200 & $48,400 & $46,200 & $181,500 \\ Crop sales & $20,370 & $48,500 & $0 & $48,500 & $117,370 \\ Other farm income & $5 & $50 & $0 & $1,014 & $1,014 \\ Nonfarm income & $6,150 & $4,100 & $2,050 & $6,150 & $18,450 \\ \hline New term loans to borrow & & & & & \\ \hline Total inflows & & & & & \\ \hline \end{tabular} Net Cash Flow 1. Overview-Green Acres needs to find our how much operating capital they will need to borrow this coming year. As the new farm manager, you are tasked with completing the cash flow budget for 2016. Green Acres Farm organizes their cash flow budget by quarter. They have a good handle on projections for cash coming into and going out of the business (cash inflows and outflows). However, they have yet to complete a budget and need your help. 2. Net Cash Flow- Using the cash inflows and outflows data in the Green Acres cash flow budget, calculate and fill in the four (4) quarterly values for Net Cash Flow and the annual (1) value. All annual values in the table can be found by summing the estimates for the four (4) quarters. 3. Ending Cash Balance-The farm owners instruct you to ensure that there is always an ending cash balance of $1,000 each quarter. When you calculate the required borrowing needs for each quarter, make sure you remember that you will need to borrow enough funds to have $1,000 minimum in the account (if borrowing is in fact needed). 4. Operating Loan-Calculate how much Green Acres will need to borrow each quarter (if borrowing is needed) and how much they can repay each quarter (if borrowing is needed). Do not worry about interest payments on the operating loan. If you estimate that the farm can repay a portion of the loan during one or more of the quarters, simply apply the payment as if it were going towards principal alone. Don't forget to budget for an ending cash balance of $1,000 each quarter. 5. Beginning and Ending Loan Balances- On the bottom two lines of the cash flow budget, estimate the total amount of operating loan funds the farm will have borrowed at the end of each quarter. Note: The Annual Beginning Operating Loan Balance is equal to the Quarter 1 Beginning Operating Loan Balance and the Annual Ending Operating Loan Balance is equal to the Quarter 4 Ending Operating Loan Balance. The Beginning Operating Loan Balance is provided for you at $25,000. Additional Information Sunnybrook Farms plans to purchase replacement heifers from a long-time business partner for the cow herd in April for a negotiated price of $20,000. Assume they are planning to also be approved for a loan equaling the same amount in April. Sunnybrook Farms plans to apply for a loan worth $50,000 (new tractor cost after trade-in value is deducted) to purchase a tractor in July after their loan officer reviews their first and second quarter financial statements. The farm has already received confirmation that the trade-in value for their current tractor is $25,000 and plan to purchase the new tractor the first week of August. Green Acres Cash Flow Budget, 2016 (20 points) Beginning operating loan balance Ending operating loan balance 1 1$1,000 minimum balance required