Question

1. P Co., a construction company, uses the percentage of completion method. In 7077. Excel began work on a contract to construct an office building

1. P Co., a construction company, uses the percentage of completion method. In 7077. Excel began work on a contract to construct an office building for P1,100,000 an it was completed in 2023. Data on the cost are

| 2022 | 2023 | |

| Cast incurred | 390000 | 280000 |

| Estimated cost to complete | 260000 |

For the vear 2022 and 2023, Excel should recognize gross profit of

2. B and W are partners who snare income in the ratio of 1:3 and have a capital balnces P100,000 and 140.000 at the time they decide to terminate the partnership. After all noncash assets are sold and all liabilities are paid, there is a cash balance cf P130,000. What amour of loss an realization should be allocated to B & W?

3. P Co., which began operations on January 1, 2020, appropriately uses the installment-sales method of accounting. The following information pertains to Pencil's operations for the year 2020:

Installment sales P1,200,000 Regular sales 480,000 Cost of installment sales 720,000 Cost of regular sales 288,000 General and administrative expenses 96,000 Collections on installment sales 288,000

The deferred gross profit account in P's December 31, 2020 statement of financial position should be?

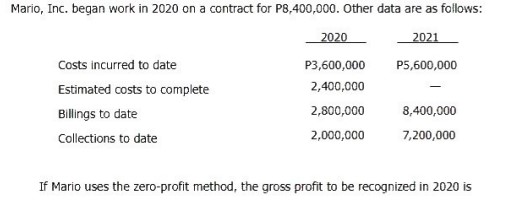

4.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started