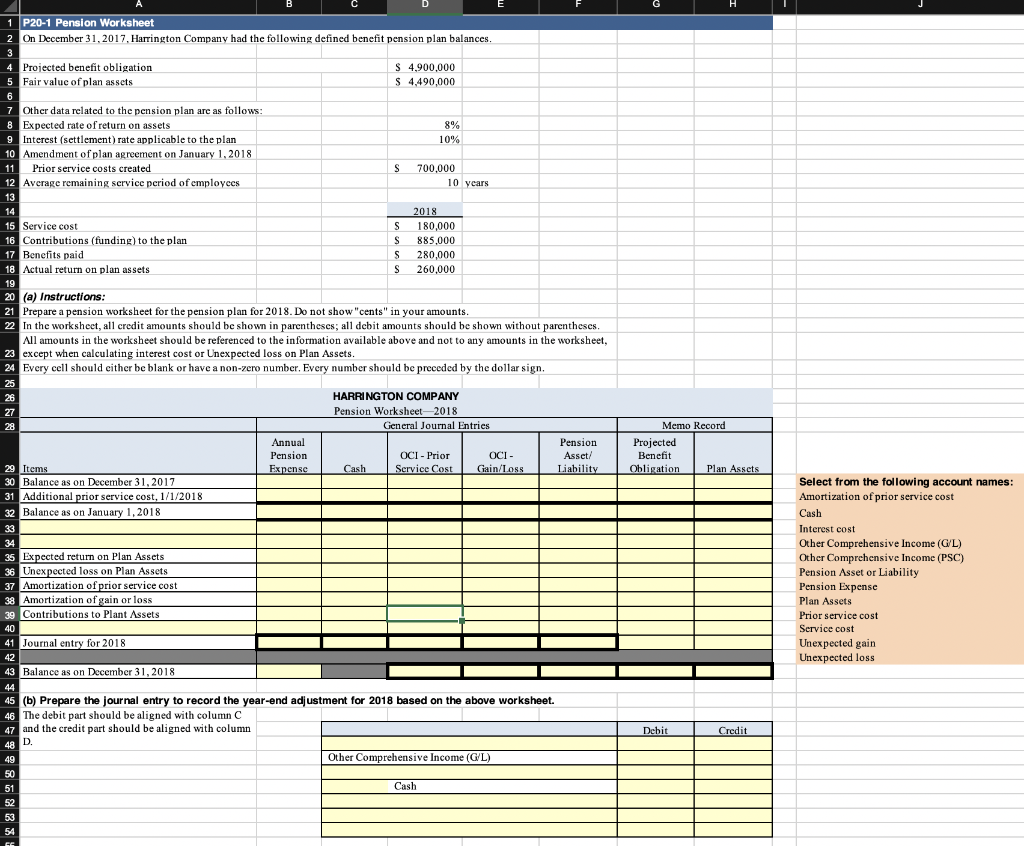

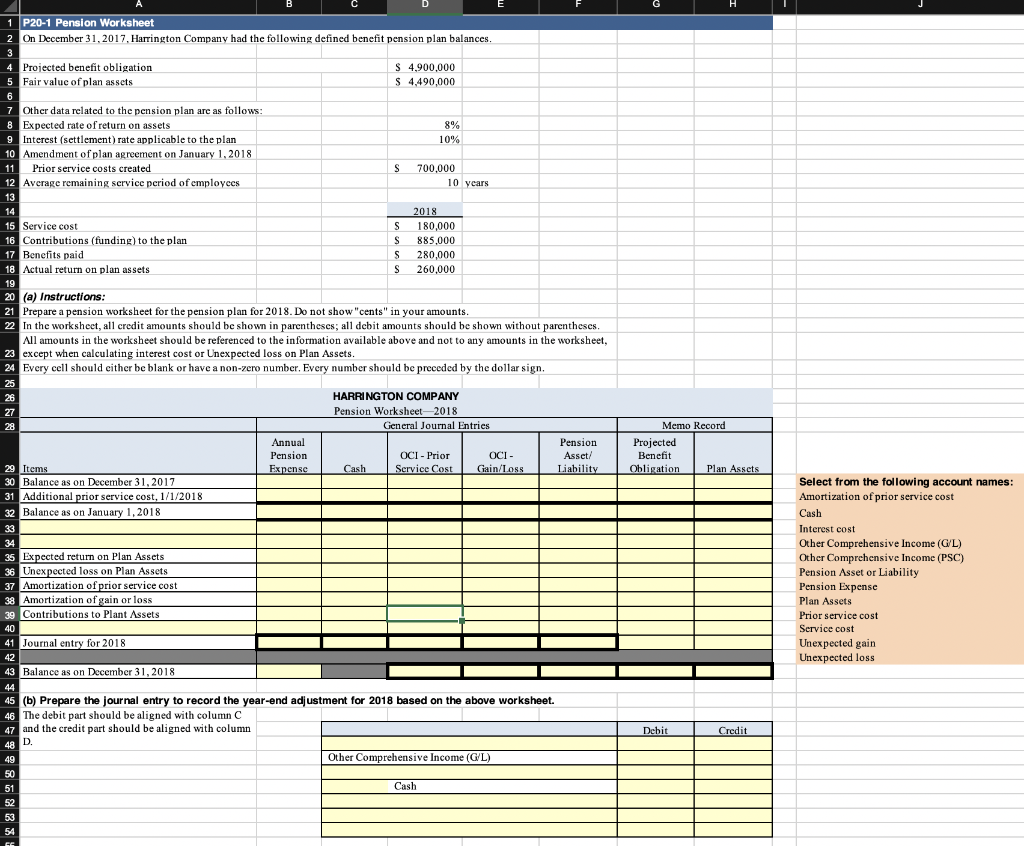

1 P20-1 Pension Worksheet On December 31,2017, Harrington Company had the following defined benefit pension plan balances Projected benefit obligation Fair valuc of plan assets 4,900,000 S 4,490,000 Other data related to the pension plan are as follows Expected rate ofreturn on assets Interest (settlement) rate applicable to the plan Amendment ofplan agreement on January 1,2018 890 10% 1Prior service costs created S 700,000 Average remaining service period of employces 10 years 13 14 15 16 S 180,000 S 885,000 S 280,000 S 260,000 Service cost Contributions (funding) to the plan Benefits paid Actual return on plan assets (a) Instructions: Prepare a pension worksheet for the pension plan for 2018. Do not show "cents" in your amounts In the worksheet, all credit amounts should be shown in parentheses al dcbit amounts should be shown without parentheses All amounts in the worksheet should be referenced to the information available above and not to any amounts in the worksheet except when calculating interest cost or Unexpected loss on Plan Assets Every cell should cither be blank or have a non-zero number. Every number should be preceded by the dollar sign. 21 25 HARRINGTON COMPANY Pension Worksheet-2018 General Journal Entries Memo Record Annual Pension Asset Liabilit Projected Benefit OCI- Prior Gain/Loss OblisationPlan Assct Balance as on December 31,2017 Additional prior service cost, 1/1/2018 Balance as on January 1,2018 Select from the following account names Amortization of prior service cost Cash Interest cost Other Comprehensive Income (G/L) Other Comprehensive Income (PSC) Pension Asset or Liability Pension Expense Plan Assets Prior service cost Service cost Unexpected gain Unexpected loss 32 Expected return on Plan Assets Unexpected loss on Plan Assets Amortization of prior service cost Amortization ofgain or loss Contributions to Plant Assets 35 39 40 ournal entry for 2018 Balance as on Dccember 31,2018 (b) Prepare the journal entry to record the year-end adjustment for 2018 based on the above worksheet. The debit part should be aligned with column C and the credit part should be aligned with column D. Other Comprehensive Income (GL) 52 1 P20-1 Pension Worksheet On December 31,2017, Harrington Company had the following defined benefit pension plan balances Projected benefit obligation Fair valuc of plan assets 4,900,000 S 4,490,000 Other data related to the pension plan are as follows Expected rate ofreturn on assets Interest (settlement) rate applicable to the plan Amendment ofplan agreement on January 1,2018 890 10% 1Prior service costs created S 700,000 Average remaining service period of employces 10 years 13 14 15 16 S 180,000 S 885,000 S 280,000 S 260,000 Service cost Contributions (funding) to the plan Benefits paid Actual return on plan assets (a) Instructions: Prepare a pension worksheet for the pension plan for 2018. Do not show "cents" in your amounts In the worksheet, all credit amounts should be shown in parentheses al dcbit amounts should be shown without parentheses All amounts in the worksheet should be referenced to the information available above and not to any amounts in the worksheet except when calculating interest cost or Unexpected loss on Plan Assets Every cell should cither be blank or have a non-zero number. Every number should be preceded by the dollar sign. 21 25 HARRINGTON COMPANY Pension Worksheet-2018 General Journal Entries Memo Record Annual Pension Asset Liabilit Projected Benefit OCI- Prior Gain/Loss OblisationPlan Assct Balance as on December 31,2017 Additional prior service cost, 1/1/2018 Balance as on January 1,2018 Select from the following account names Amortization of prior service cost Cash Interest cost Other Comprehensive Income (G/L) Other Comprehensive Income (PSC) Pension Asset or Liability Pension Expense Plan Assets Prior service cost Service cost Unexpected gain Unexpected loss 32 Expected return on Plan Assets Unexpected loss on Plan Assets Amortization of prior service cost Amortization ofgain or loss Contributions to Plant Assets 35 39 40 ournal entry for 2018 Balance as on Dccember 31,2018 (b) Prepare the journal entry to record the year-end adjustment for 2018 based on the above worksheet. The debit part should be aligned with column C and the credit part should be aligned with column D. Other Comprehensive Income (GL) 52