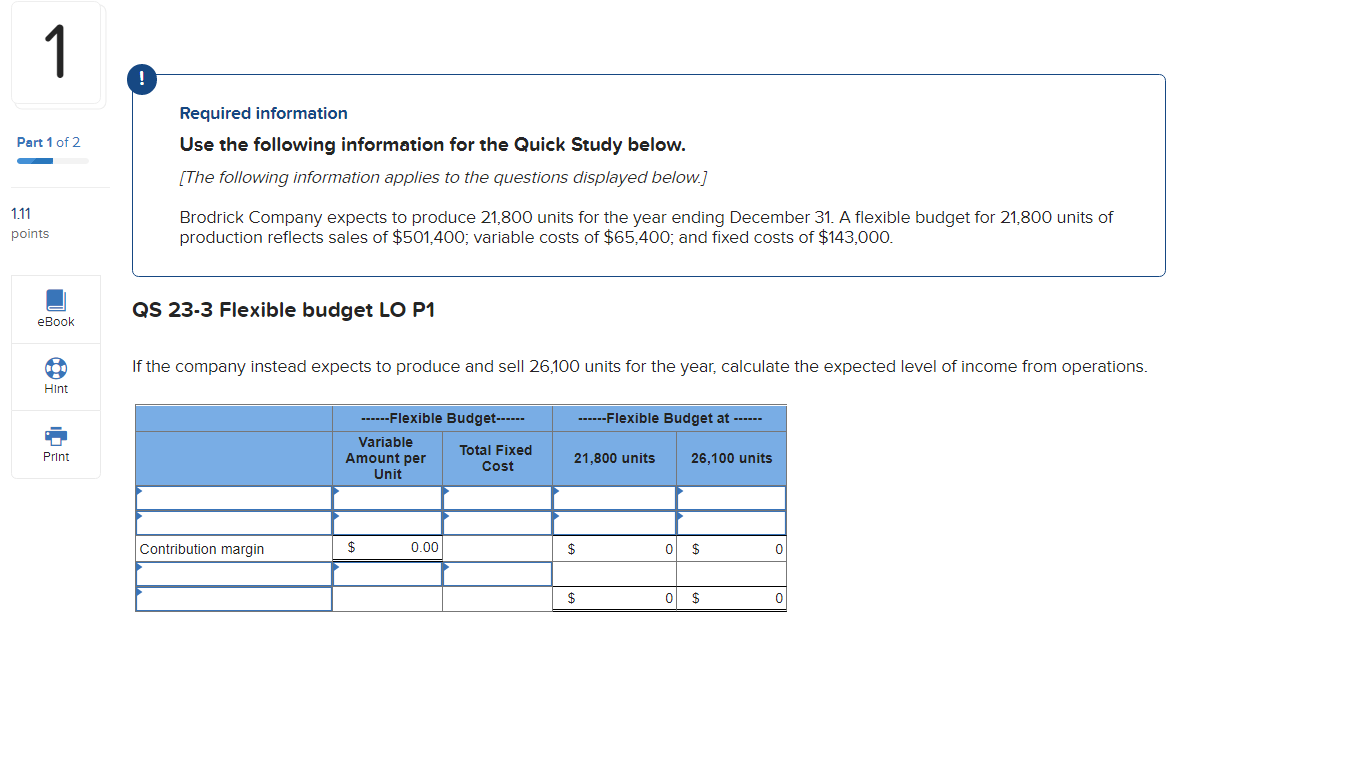

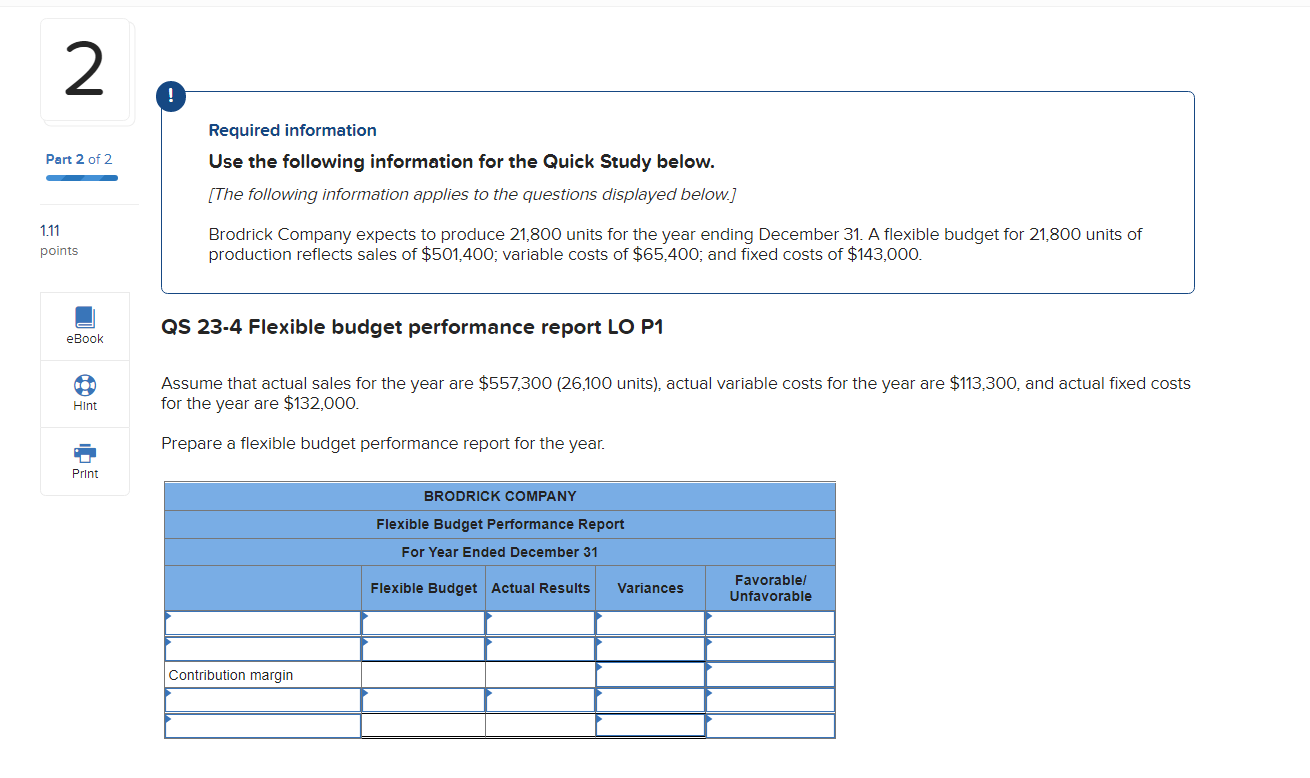

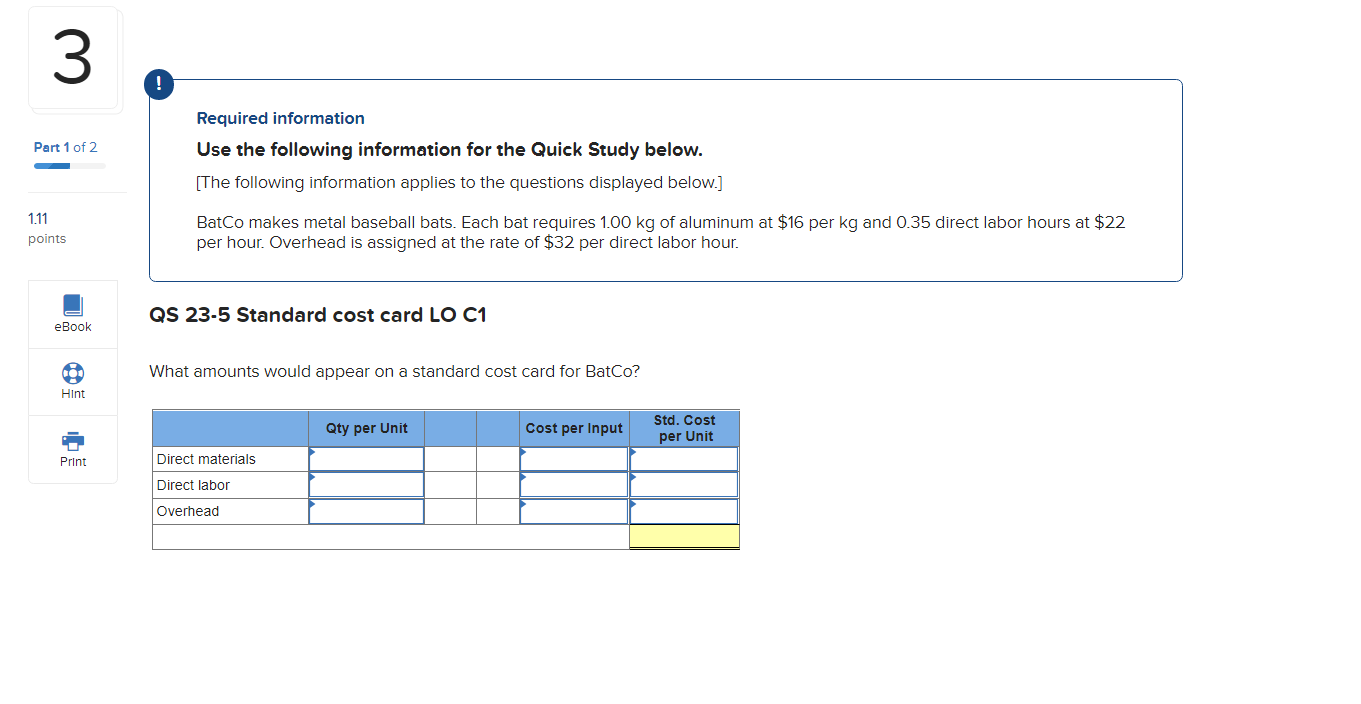

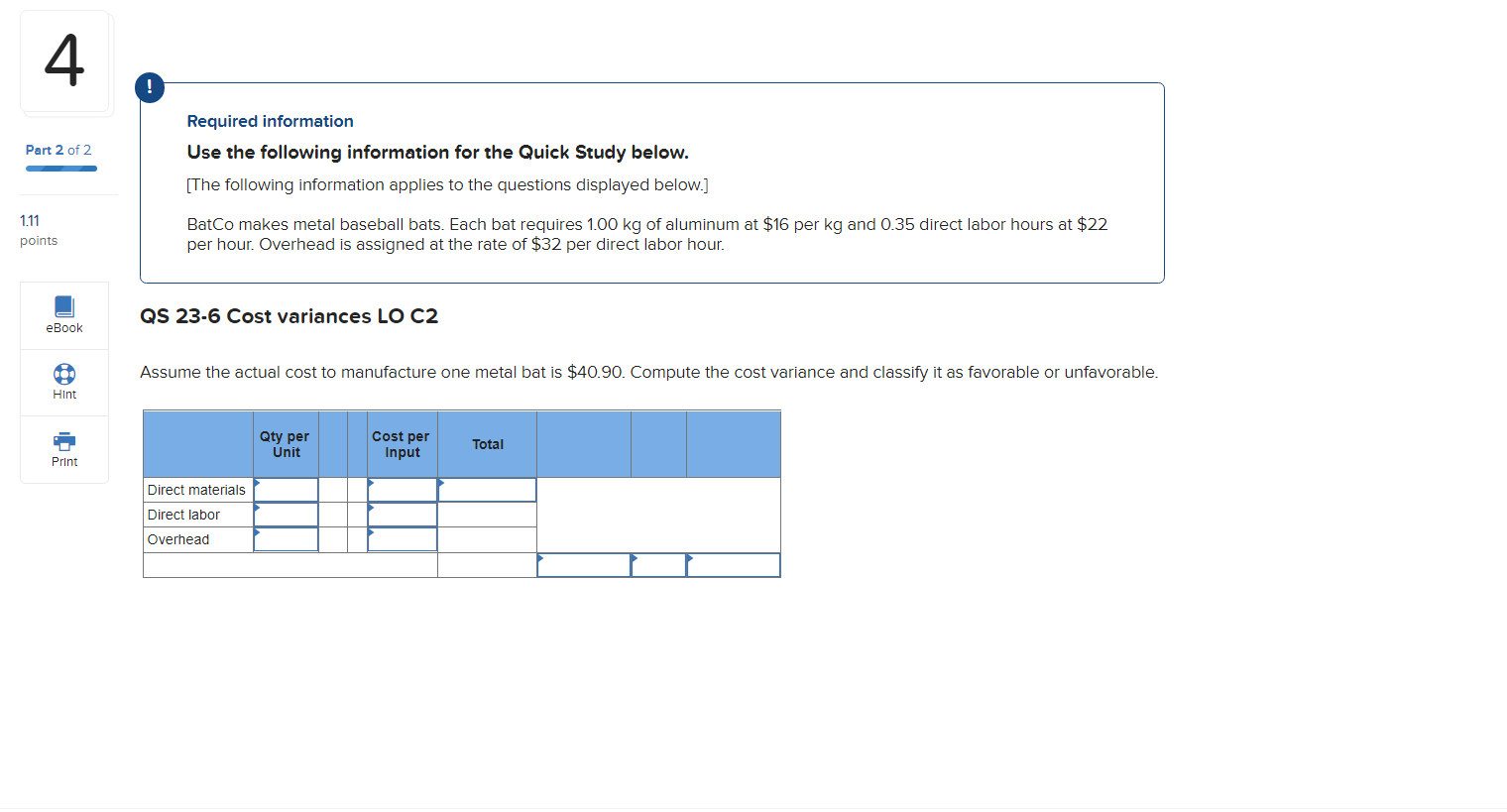

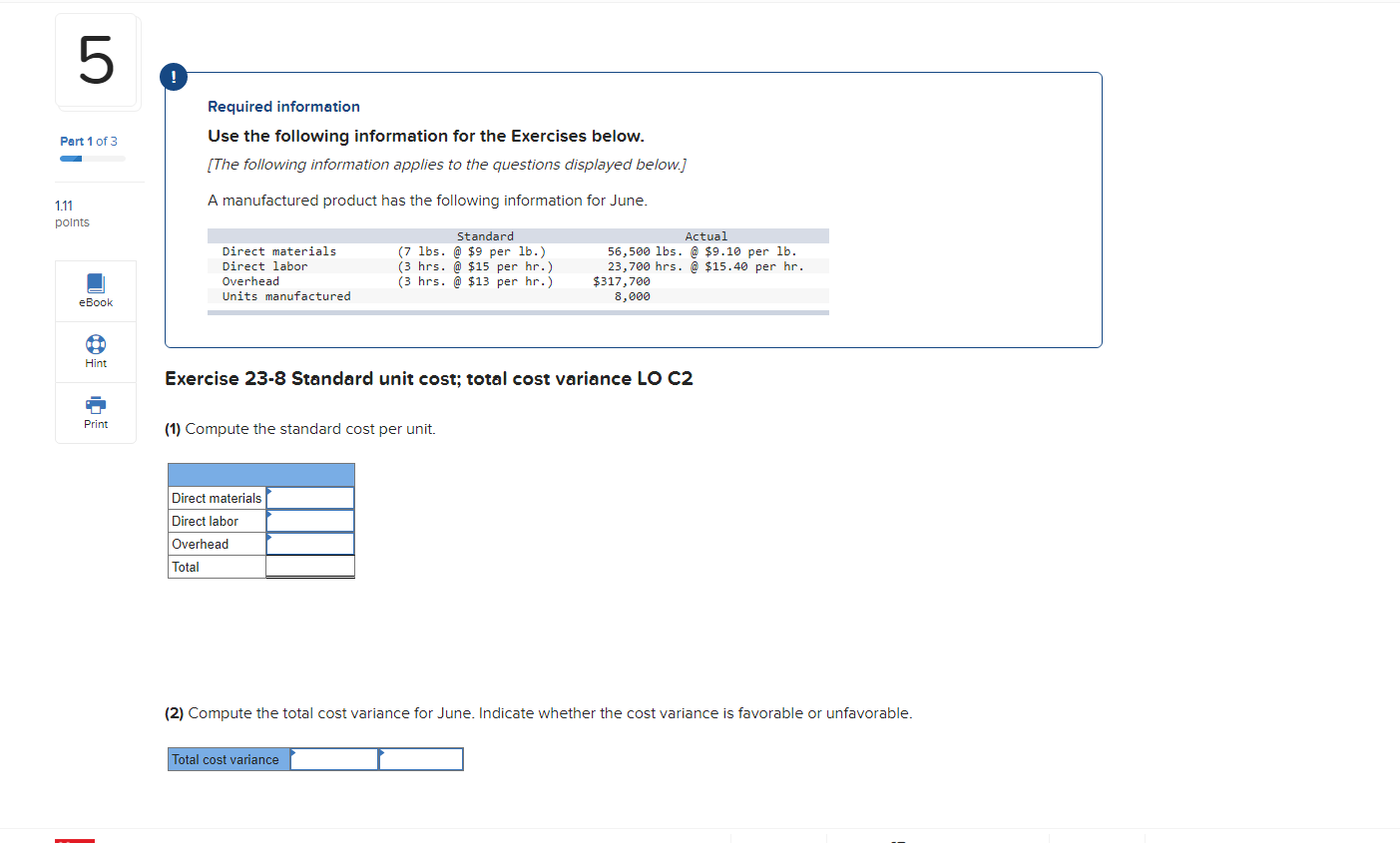

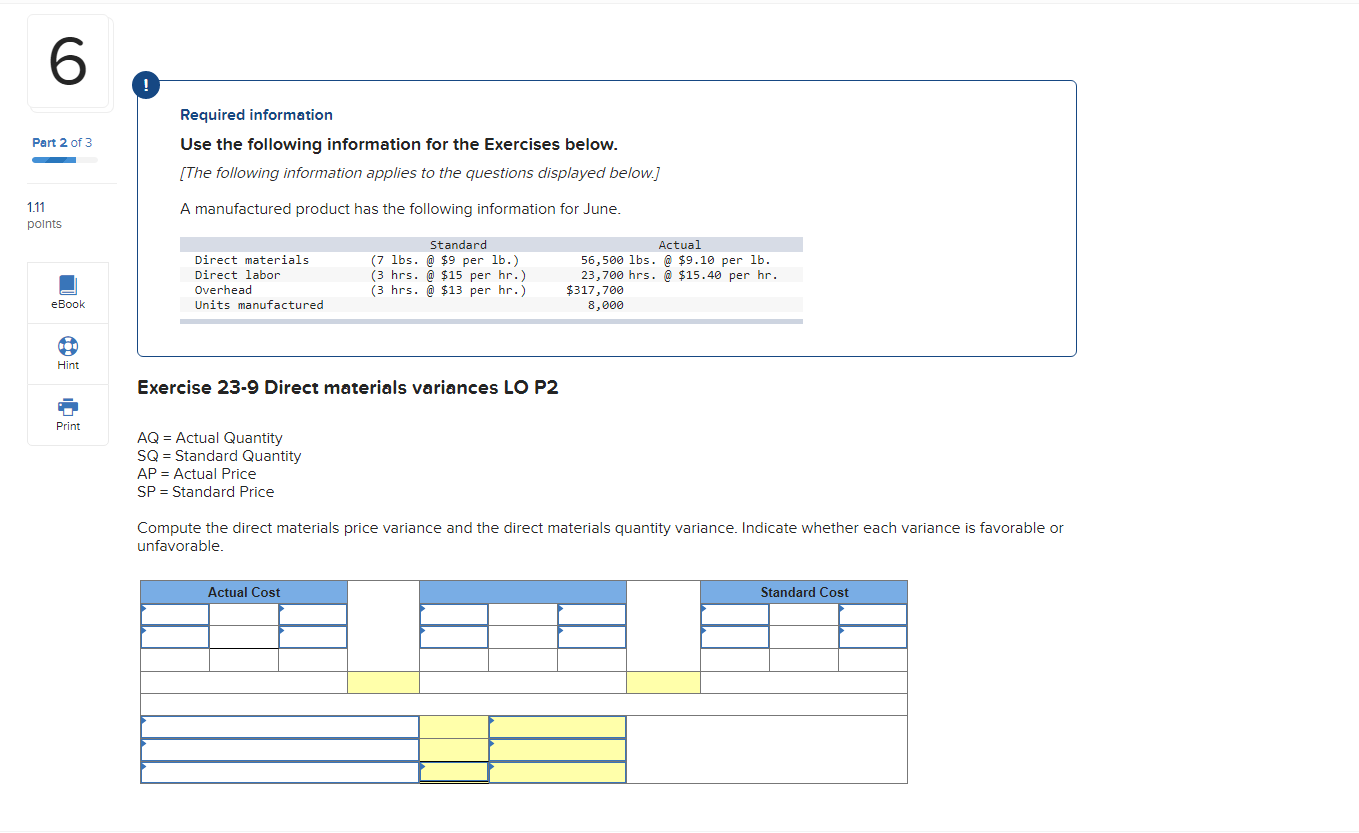

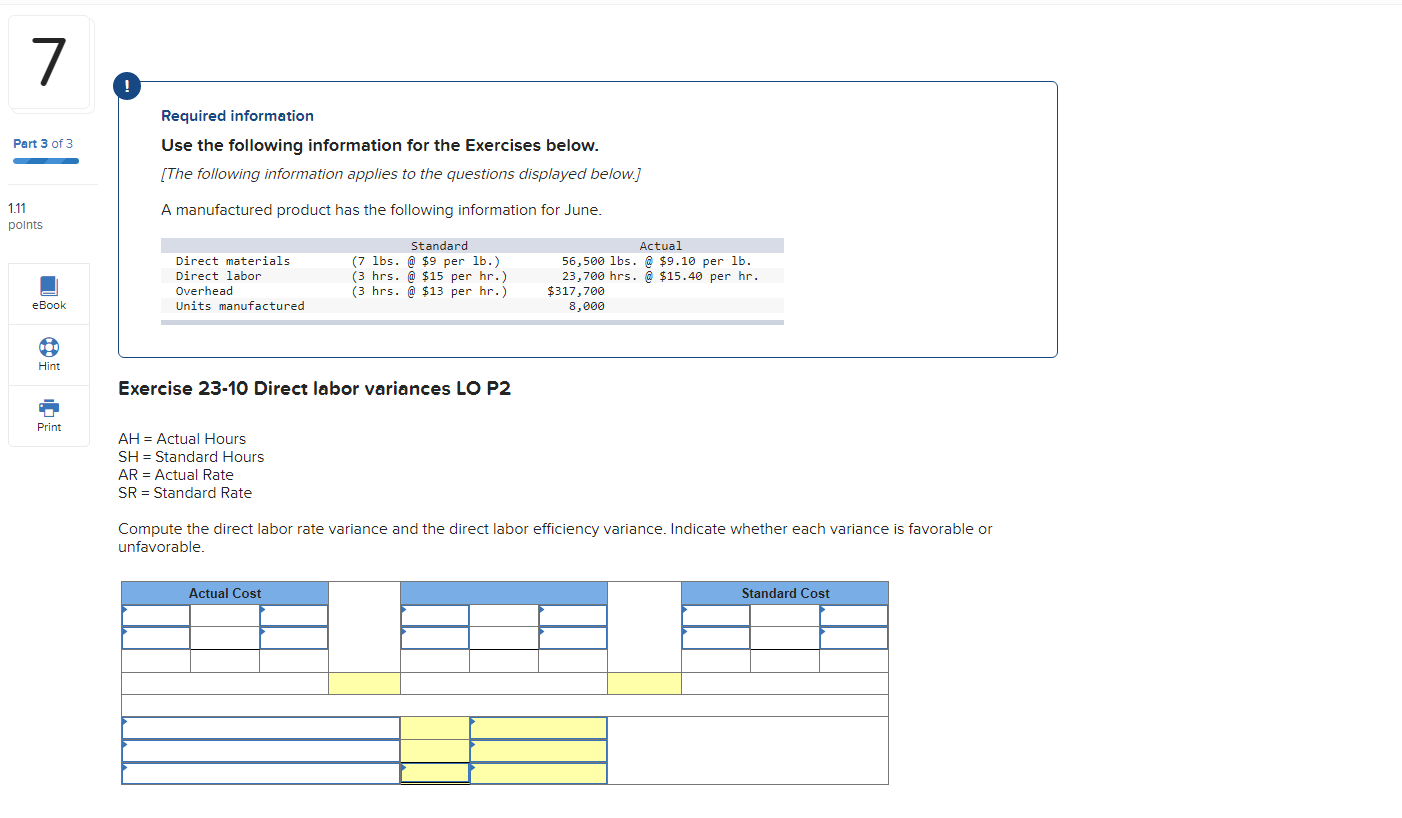

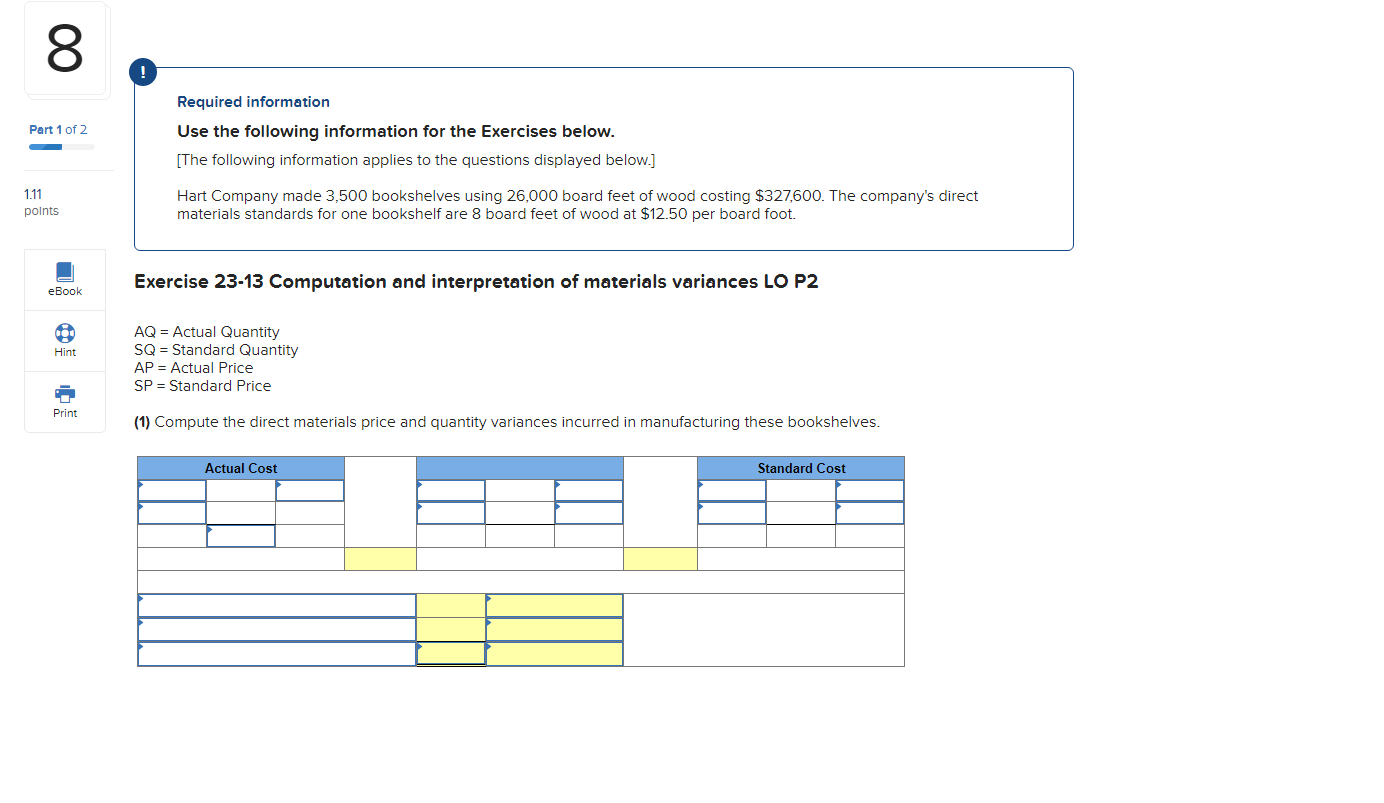

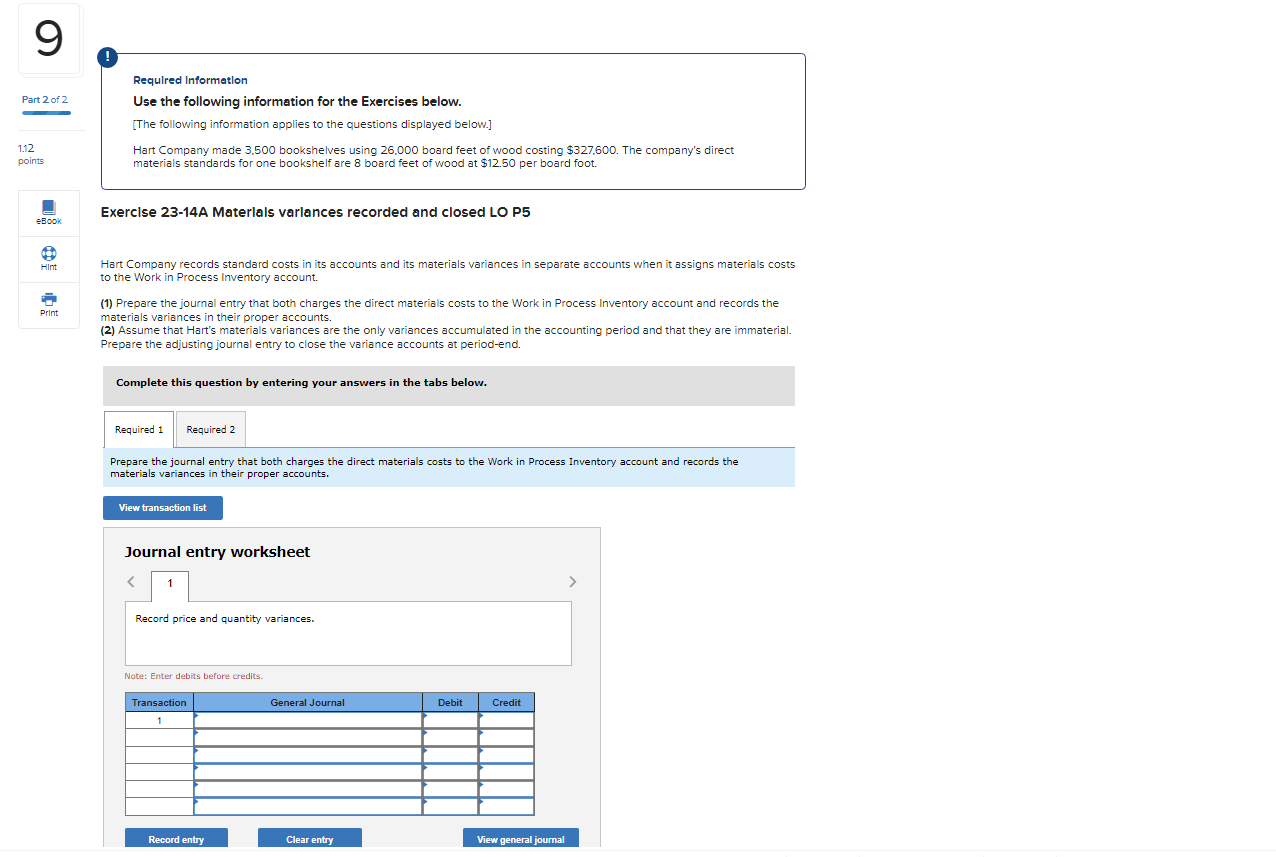

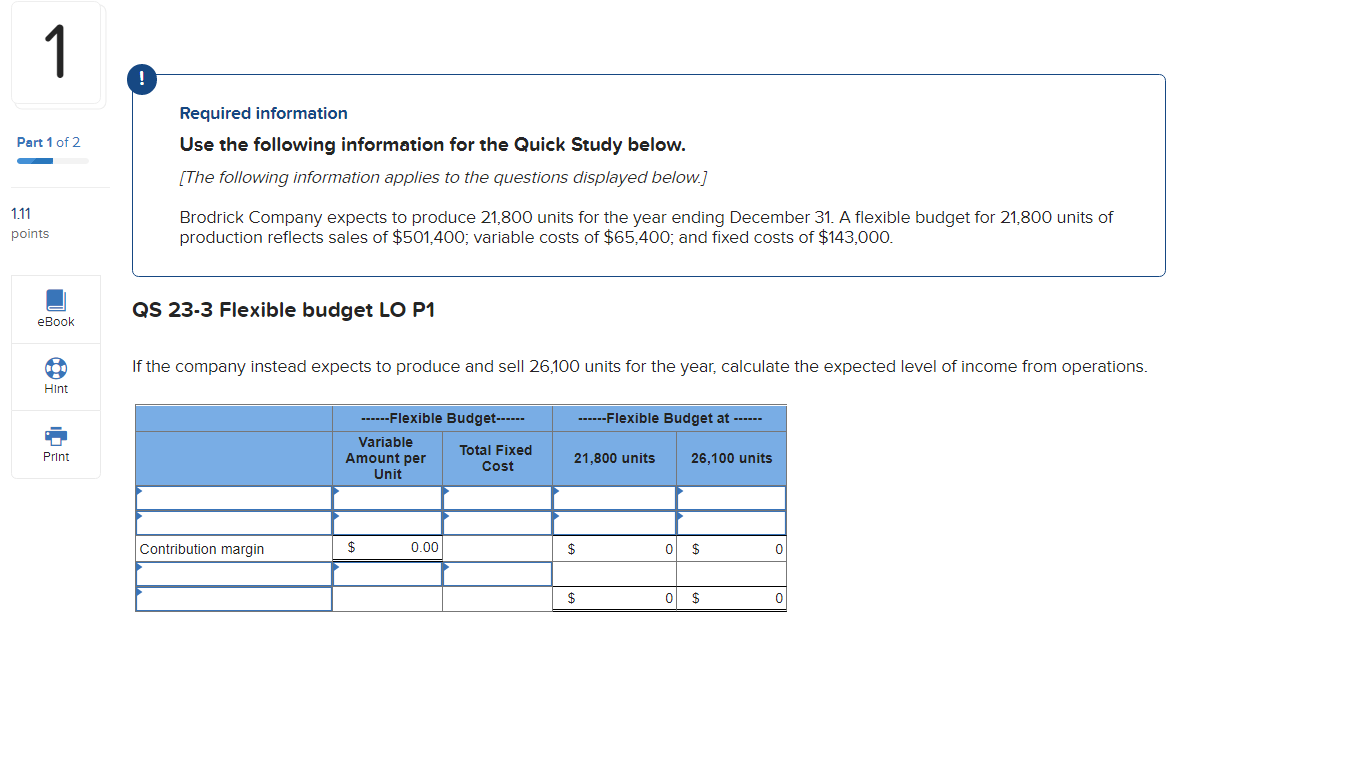

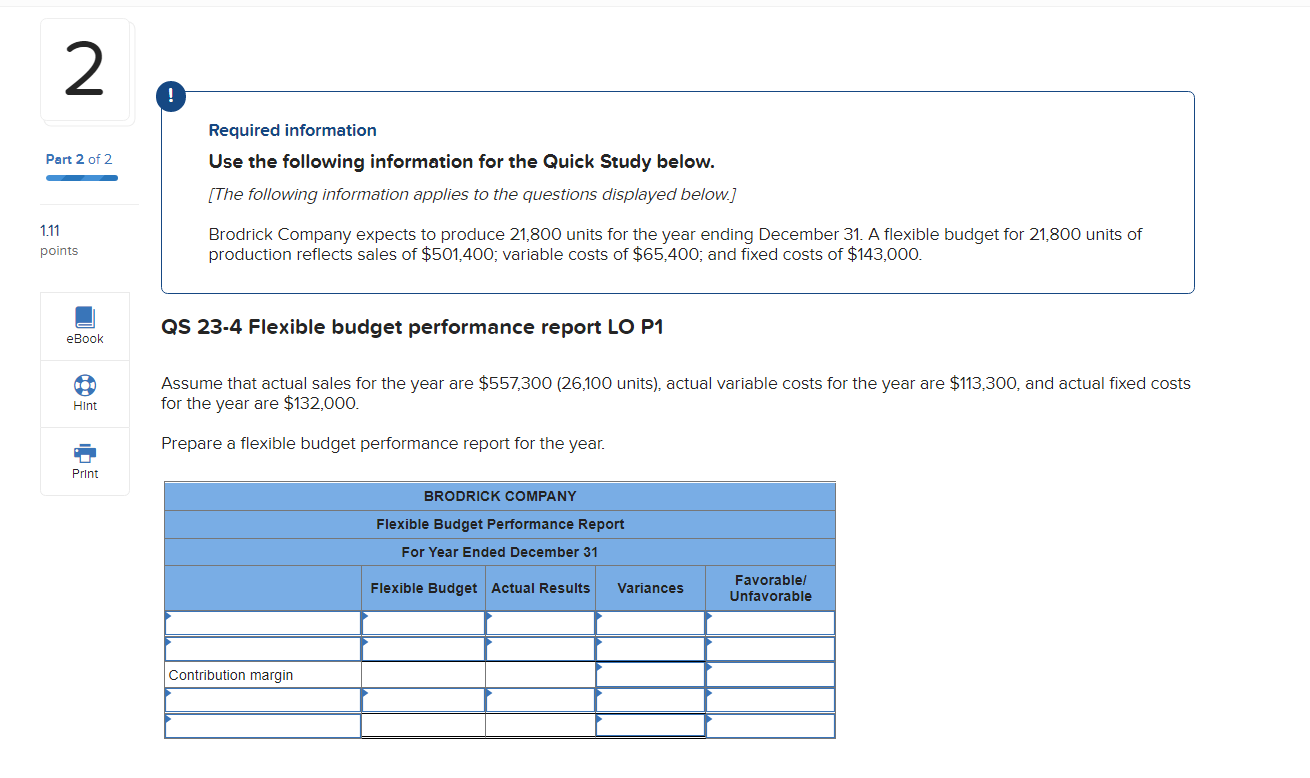

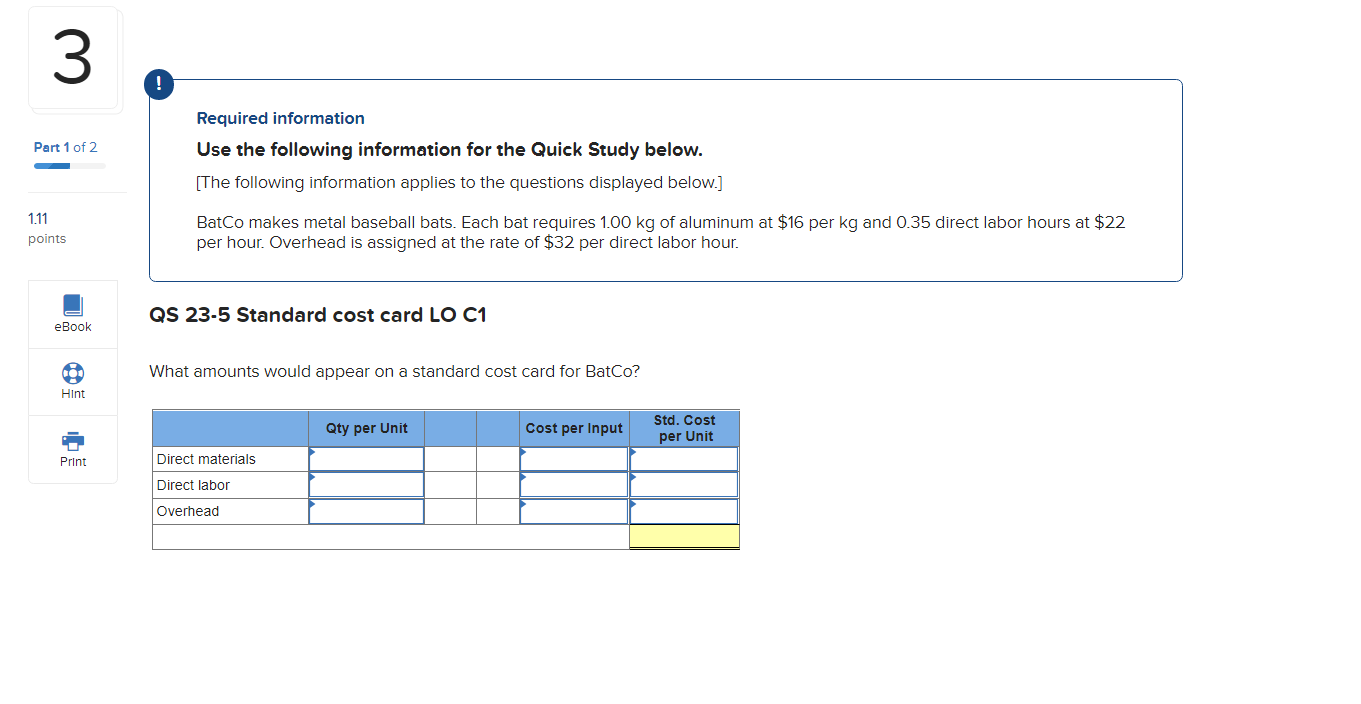

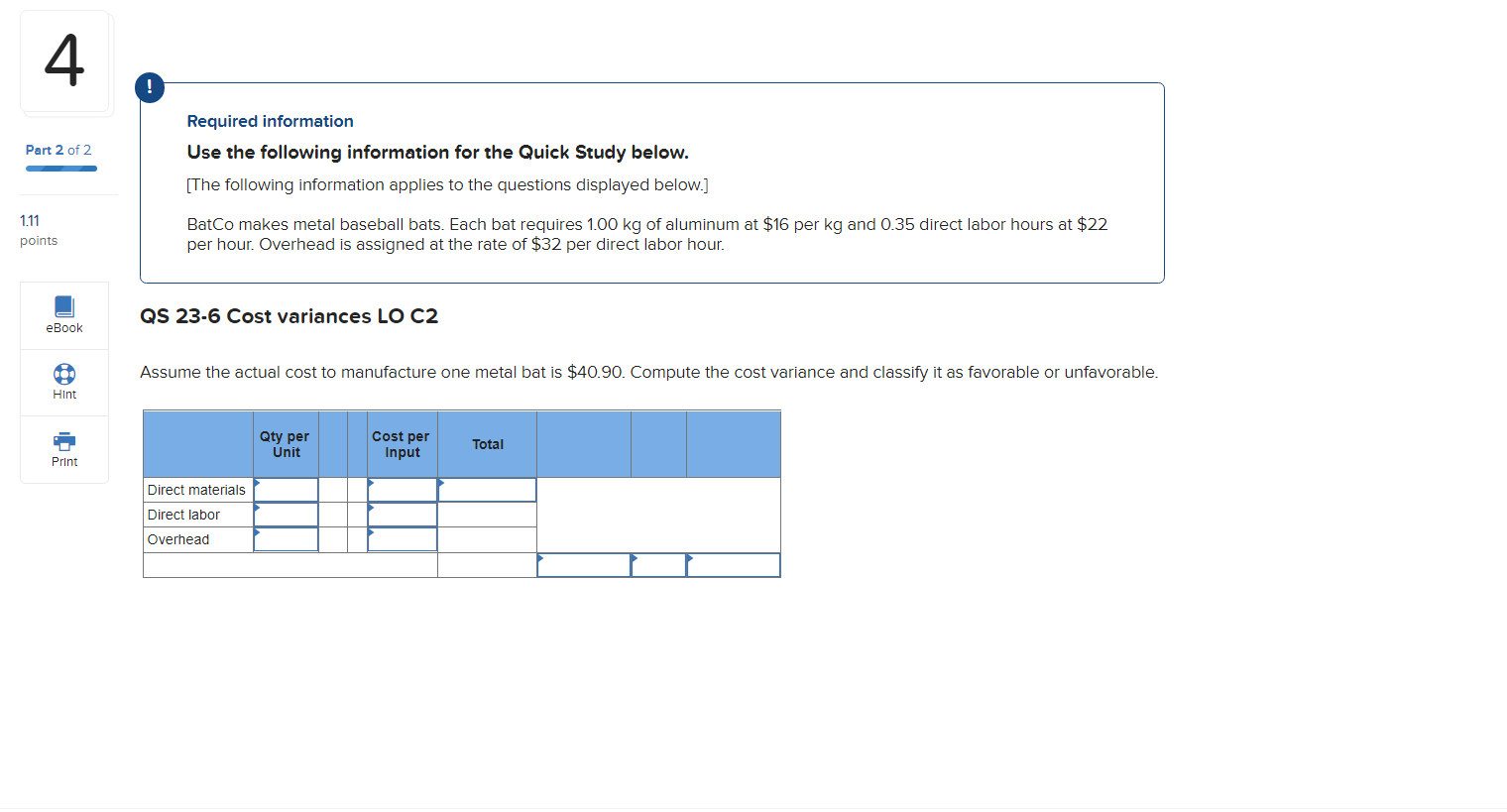

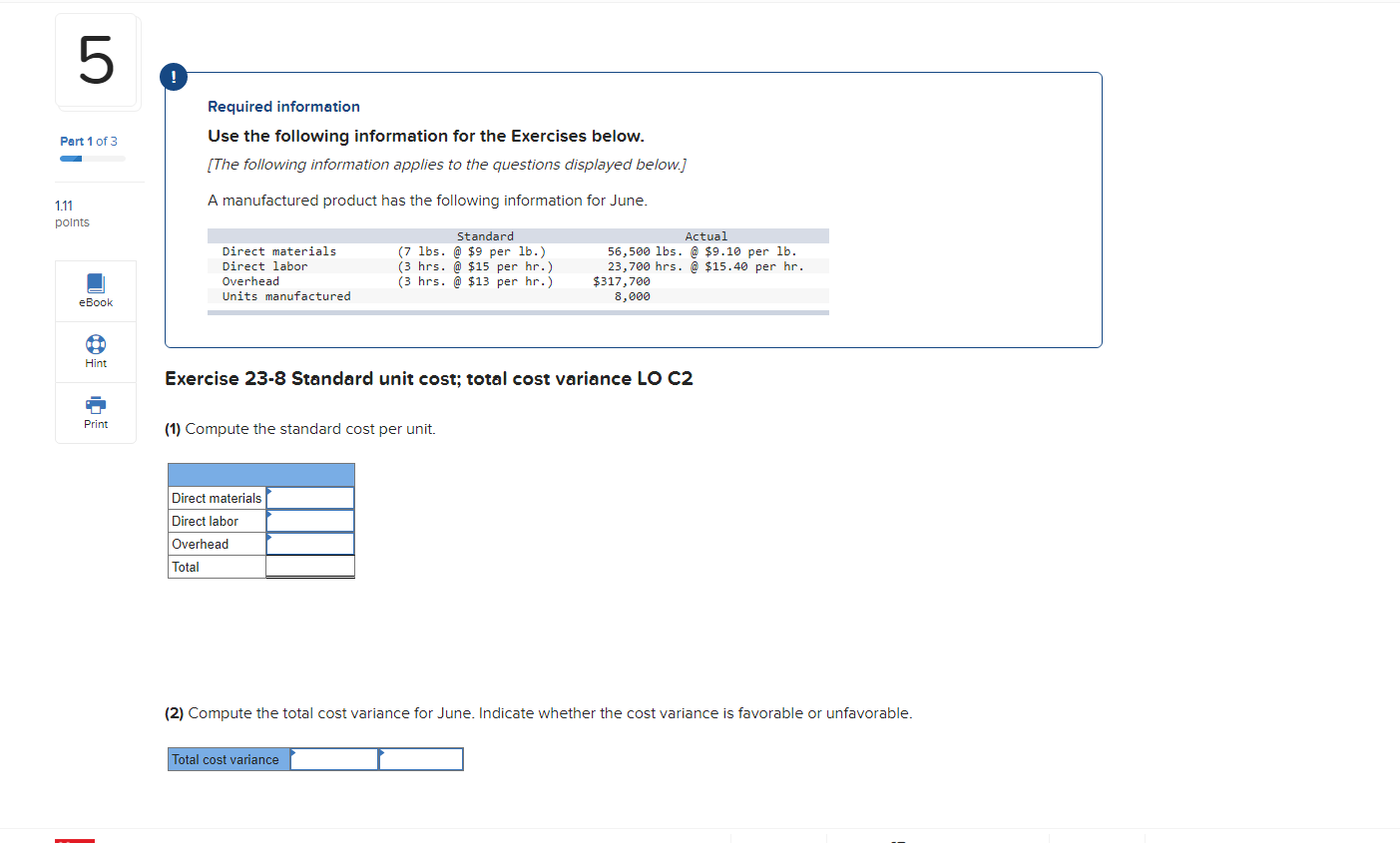

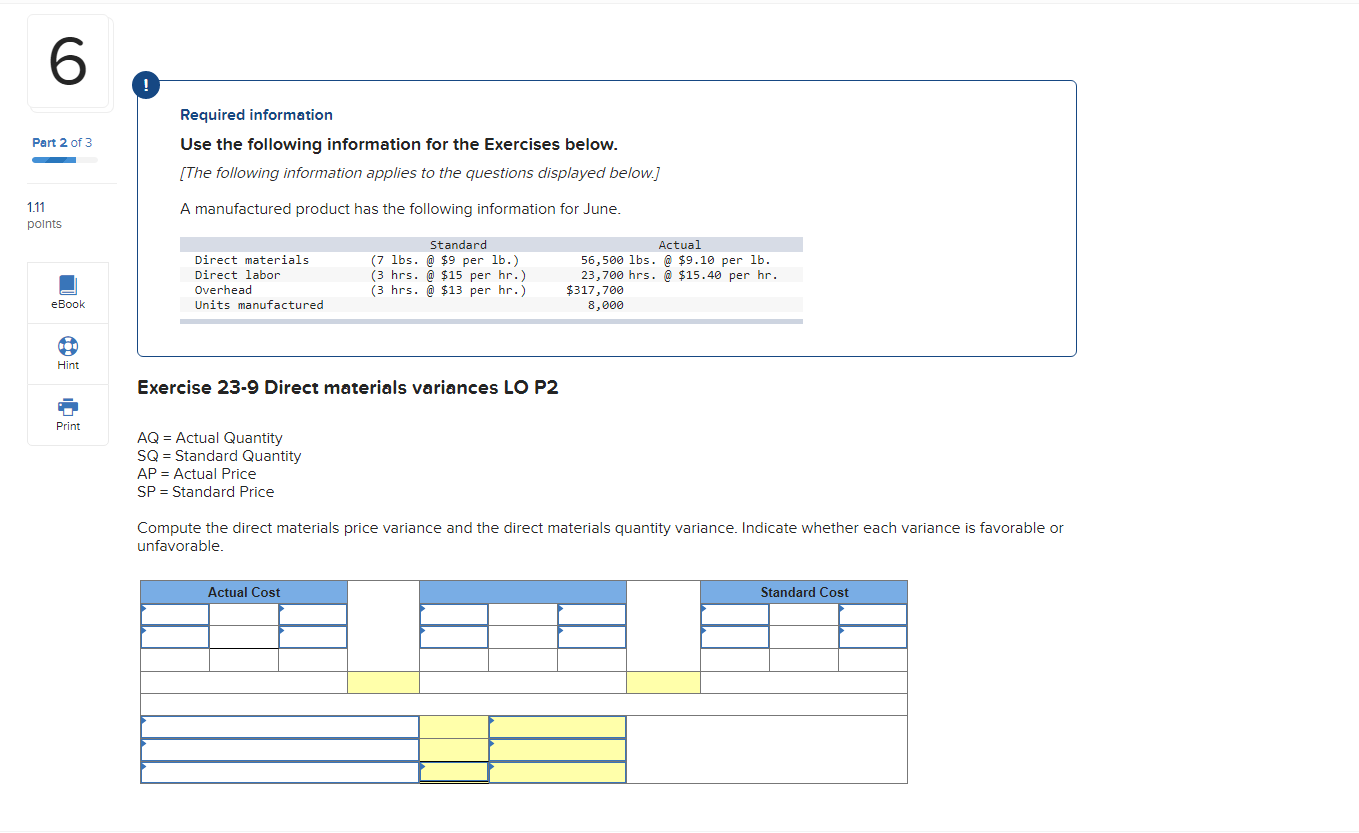

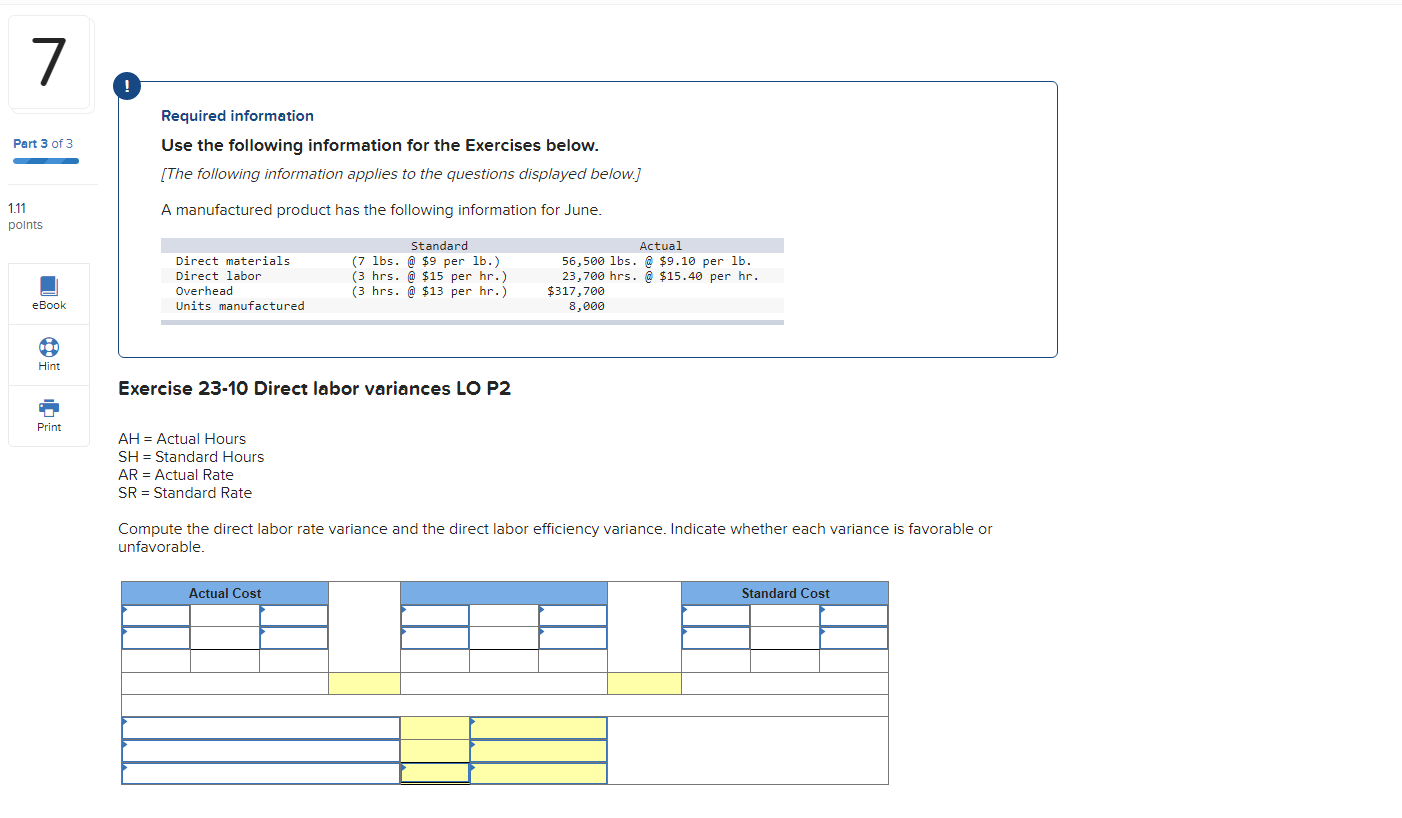

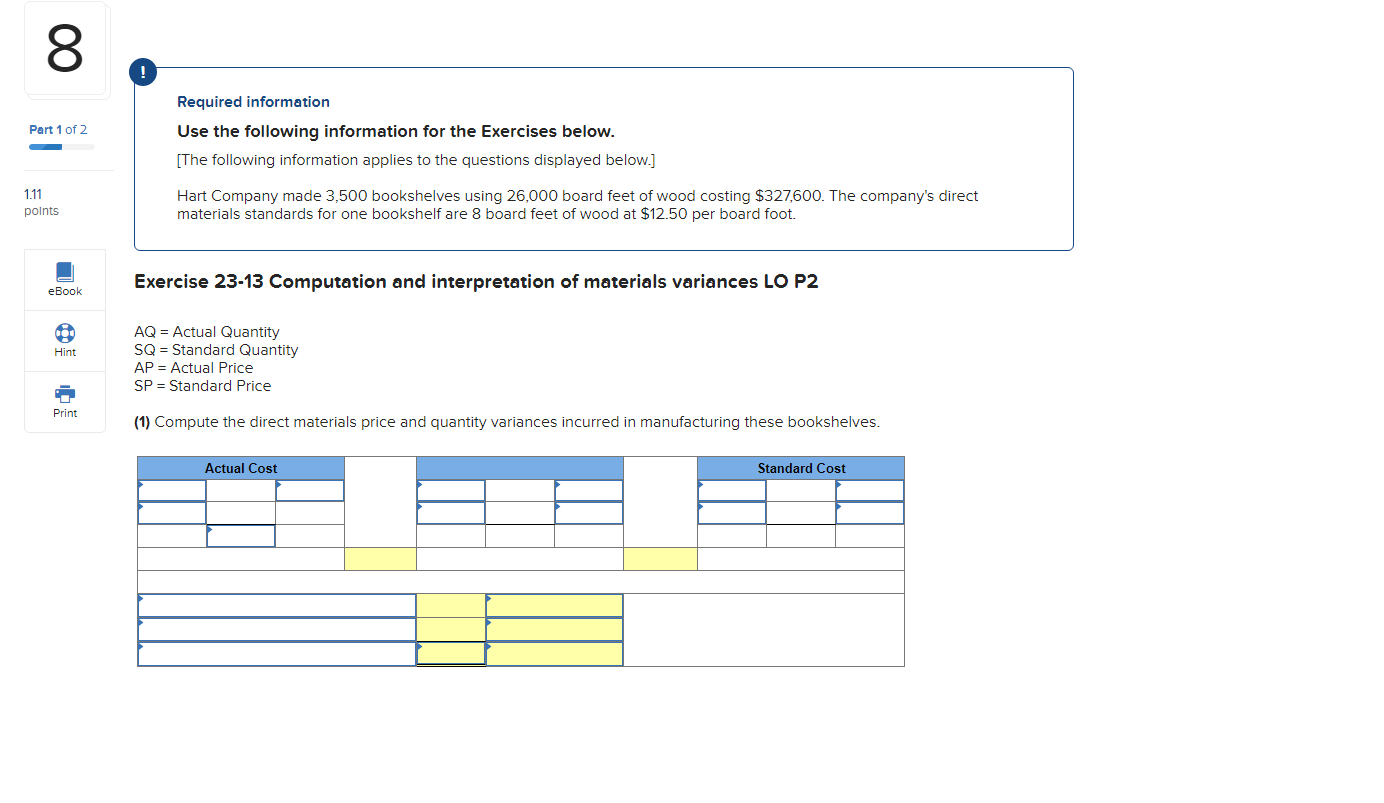

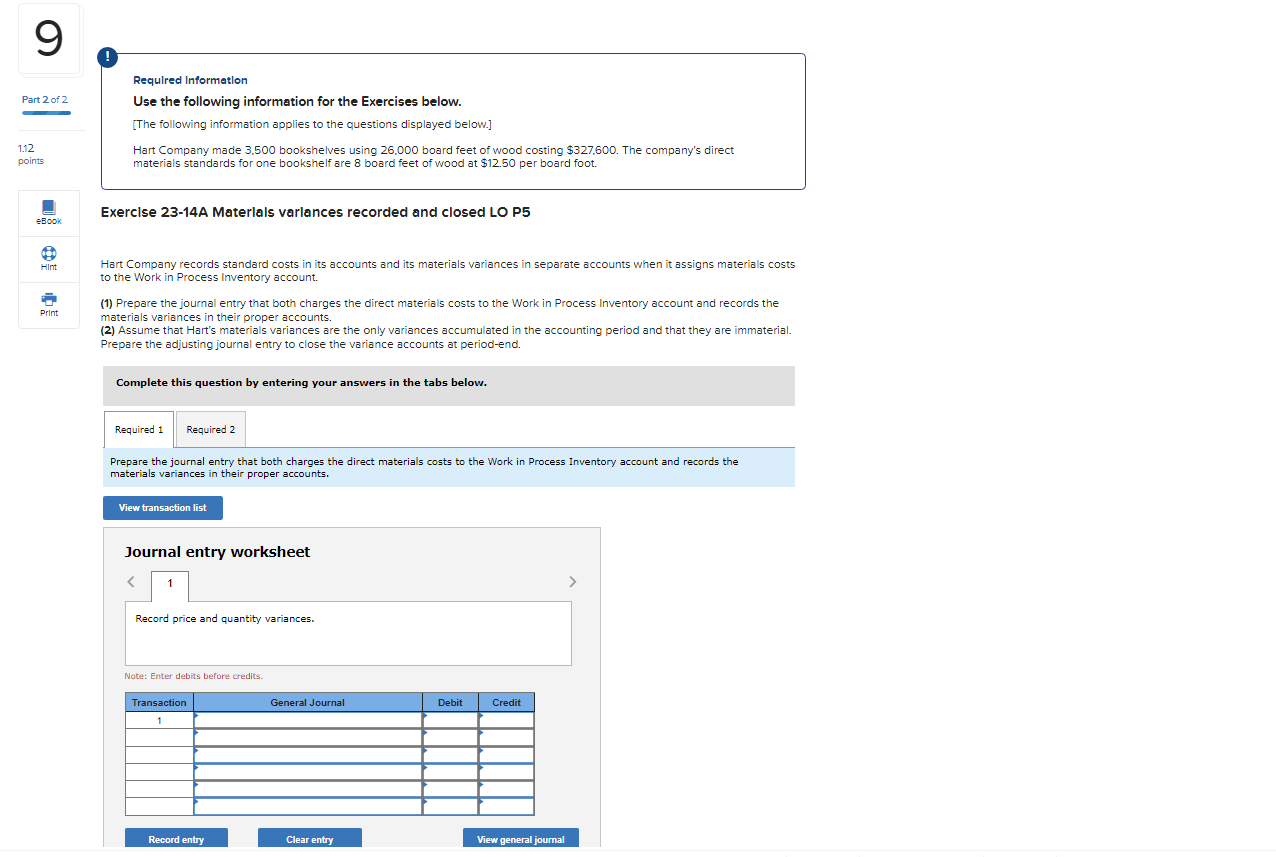

1 ! Part 1 of 2 Required information Use the following information for the Quick Study below. (The following information applies to the questions displayed below.] Brodrick Company expects to produce 21,800 units for the year ending December 31. A flexible budget for 21,800 units of production reflects sales of $501,400; variable costs of $65,400; and fixed costs of $143,000. 1.11 points QS 23-3 Flexible budget LO P1 eBook If the company instead expects to produce and sell 26,100 units for the year, calculate the expected level of income from operations. Hint ------Flexible Budget at ------ ------Flexible Budget------ Variable Amount per Total Fixed Unit Cost Print 21,800 units 26,100 units Contribution margin $ 0.00 $ 0 $ ol $ 0 $ 2 Part 2 of 2 Required information Use the following information for the Quick Study below. [The following information applies to the questions displayed below.] 1.11 points Brodrick Company expects to produce 21,800 units for the year ending December 31. flexible budget for 21,800 units of production reflects sales of $501,400; variable costs of $65,400, and fixed costs of $143,000. QS 23-4 Flexible budget performance report LO P1 eBook Assume that actual sales for the year are $557,300 (26,100 units), actual variable costs for the year are $113,300, and actual fixed costs for the year are $132,000. Hint Prepare a flexible budget performance report for the year. Print BRODRICK COMPANY Flexible Budget Performance Report For Year Ended December 31 Flexible Budget Actual Results Variances Favorable! Unfavorable Contribution margin 3 Part 1 of 2 Required information Use the following information for the Quick Study below. [The following information applies to the questions displayed below.] 1.11 BatCo makes metal baseball bats. Each bat requires 1.00 kg of aluminum at $16 per kg and 0.35 direct labor hours at $22 per hour. Overhead is assigned at the rate of $32 per direct labor hour. points QS 23-5 Standard cost card LO C1 eBook 000 Hint What amounts would appear on a standard cost card for BatCo? Qty per Unit Cost per Input Std. Cost per Unit Print Direct materials Direct labor Overhead 4 ! Part 2 of 2 Required information Use the following information for the Quick Study below. [The following information applies to the questions displayed below.] 1.11 points BatCo makes metal baseball bats. Each bat requires 1.00 kg of aluminum at $16 per kg and 0.35 direct labor hours at $22 per hour. Overhead is assigned at the rate of $32 per direct labor hour. QS 23-6 Cost variances LO C2 eBook Assume the actual cost to manufacture one metal bat is $40.90. Compute the cost variance and classify it as favorable or unfavorable. Hint Qty per Unit Cost per Input Total Print Direct materials Direct labor Overhead UT 5 Part 1 of 3 Required information Use the following information for the Exercises below. [The following information applies to the questions displayed below.] A manufactured product has the following information for June. 1.11 points Direct materials Direct labor Overhead Units manufactured Standard (7 lbs. @ $9 per lb.) (3 hrs. @ $15 per hr.) (3 hrs. @ $13 per hr.) Actual 56,500 lbs. @ $9.10 per lb. 23,700 hrs. @ $15.40 per hr. $317,700 8,000 eBook Hint Exercise 23-8 Standard unit cost; total cost variance LO C2 Print (1) Compute the standard cost per unit. Direct materials Direct labor Overhead Total (2) Compute the total cost variance for June. Indicate whether the cost variance is favorable or unfavorable. Total cost variance 6 ! Part 2 of 3 Required information Use the following information for the Exercises below. (The following information applies to the questions displayed below.) 1.11 points A manufactured product has the following information for June. Direct materials Direct labor Overhead Units manufactured Standard (7 lbs. @ $9 per lb.) (3 hrs. @ $15 per hr.) (3 hrs. @ $13 per hr.) Actual 56,500 lbs. @ $9.10 per lb. 23,700 hrs. @ $15.40 per hr. $317,700 8,000 eBook Of Hint Exercise 23-9 Direct materials variances LO P2 Print AQ = Actual Quantity SQ = Standard Quantity AP = Actual Price SP = Standard Price Compute the direct materials price variance and the direct materials quantity variance. Indicate whether each variance is favorable or unfavorable. Actual Cost Standard Cost 7 Required information Part 3 of 3 Use the following information for the Exercises below. (The following information applies to the questions displayed below.) 1.11 points A manufactured product has the following information for June. Direct materials Direct labor Overhead Units manufactured Standard (7 lbs. @ $9 per lb.) (3 hrs. @ $15 per hr.) (3 hrs. @ $13 per hr.) Actual 56,500 lbs. @ $9.10 per lb. 23,700 hrs. @ $15.40 per hr. $317,700 8,000 eBook Hint Exercise 23-10 Direct labor variances LO P2 Print AH = Actual Hours SH = Standard Hours AR = Actual Rate SR = Standard Rate Compute the direct labor rate variance and the direct labor efficiency variance. Indicate whether each variance is favorable or unfavorable. Actual Cost Standard Cost 8 Required information Part 1 of 2 Use the following information for the Exercises below. [The following information applies to the questions displayed below. 1.11 points Hart Company made 3,500 bookshelves using 26,000 board feet of wood costing $327,600. The company's direct materials standards for one bookshelf are 8 board feet of wood at $12.50 per board foot. Exercise 23-13 Computation and interpretation of materials variances LO P2 eBook Hint AQ = Actual Quantity SQ = Standard Quantity AP = Actual Price SP = Standard Price Print (1) Compute the direct materials price and quantity variances incurred in manufacturing these bookshelves. Actual Cost Standard Cost 9 Part 2 of 2 Required Information Use the following information for the Exercises below. [The following information applies to the questions displayed below.] Hart Company made 3.500 bookshelves using 26,000 board feet of wood costing $327,600. The company's direct materials standards for one bookshelf are 8 board feet of wood at $12.50 per board foot. 1.12 points Exercise 23-14A Materlals varlances recorded and closed LO P5 eBook Hint assigns materials costs Hart Company records standard costs in its accounts and its materials variances in separate accounts when to the Work in Process Inventory account. (1) Prepare the journal entry that both charges the direct materials costs to the Work in Process Inventory account and records the materials variances in their proper accounts. (2) Assume that Hart's materials variances are the only variances accumulated in the accounting period and that they are immaterial. Prepare the adjusting journal entry to close the variance accounts at period-end. Complete this question by entering your answers in the tabs below. Required 1 Required 2 Prepare the journal entry that both charges the direct materials costs to the Work in Process Inventory account and records the materials variances in their proper accounts. View transaction list Journal entry worksheet