Answered step by step

Verified Expert Solution

Question

1 Approved Answer

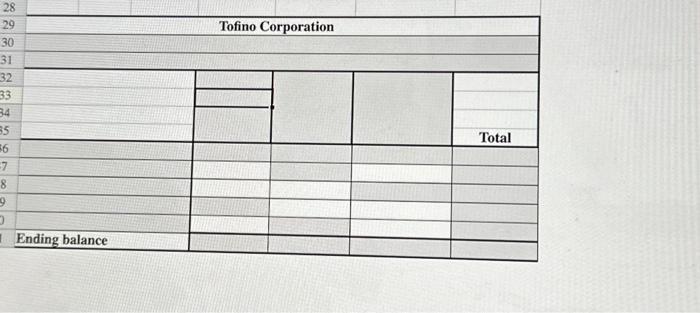

1 PART A.2-Statement of Changes in Shareholders' Equity 2 [10 marks; approx. 15 mins] 3 Tofino Corporation would like your assistance to prepare their

![1 PART A.2-Statement of Changes in Shareholders' Equity 2 [10 marks; approx. 15 mins] 3 Tofino Corporation](https://dsd5zvtm8ll6.cloudfront.net/questions/2024/01/65af84161b4c3_42965af841592946.jpg)

1 PART A.2-Statement of Changes in Shareholders' Equity 2 [10 marks; approx. 15 mins] 3 Tofino Corporation would like your assistance to prepare their Statement of 4 Shareholders' Equity: 5 They have provided the following information for their December 31, 2023 year end: 6 7 Shareholders' Equity account balances at January 1, 2023 as follows: 8 4 5 6 9 10 11 12 13 I Common Shares Accumulated Other Comprehensive income Retained Earnings Additional details relating to their Statement of Comprehensive Income for 2023: Revenue Cost of Goods Sold Other Expenses Unrealized Loss on FV-OCI Investments 7 3 They have also shared the following information relating to equity accounts: ? Issued additional Common Shares during the year Board of directors declared a dividend on December 20, 2023 Dividend is payable to Shareholders on January 31, 2024 Dividend amount REQUIRED: Prepare the Statement of Changes in Shareholders' Equity under IFRS. Ignore income tax. 500,000 300,000 800,000 1,000,000 500,000 75,000 45,000 A 200,000 90,000 28 29 30 31 32 33 34 35 56 -7 8 9 O Ending balance Tofino Corporation Total

Step by Step Solution

★★★★★

3.45 Rating (165 Votes )

There are 3 Steps involved in it

Step: 1

To prepare the Statement of Changes in Shareholders Equity for Tofino Corporation well use the provi...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started