Question

A Residential Purchase Agreement (RPA) Offer was submitted by Juan and Maria Buyaar and has been accepted by the sellers. The Buyaars were initially pre-qualified

A Residential Purchase Agreement (RPA) Offer was submitted by Juan and Maria Buyaar and has been accepted by the sellers. The Buyaars were initially pre-qualified prior to beginning their search for a home. Once pre-qualified, the salesperson, Michelle Gomez (CalBRE license # 568348), had a good idea of what price range homes to show the Buyaars. Now, that their offer has been accepted and escrow has been opened, they must now begin the actual loan approval process.

Purchase Terms

Address: 4862 Oliva Ave., Lakewood, CA

Purchase Price: $550,000

Initial Deposit: $10,000

Down payment: 20%

30 year fully amortized loan

4.75% interest rate

Your Position: Loan Officer 007

Your mission, if you choose to accept, is to assist the Buyaars in completing the loan application and determining if they will qualify or not. The approval must be an unconditional approval........you only have 9 days from contract acceptance date to complete your mission.

Loan Project Directions

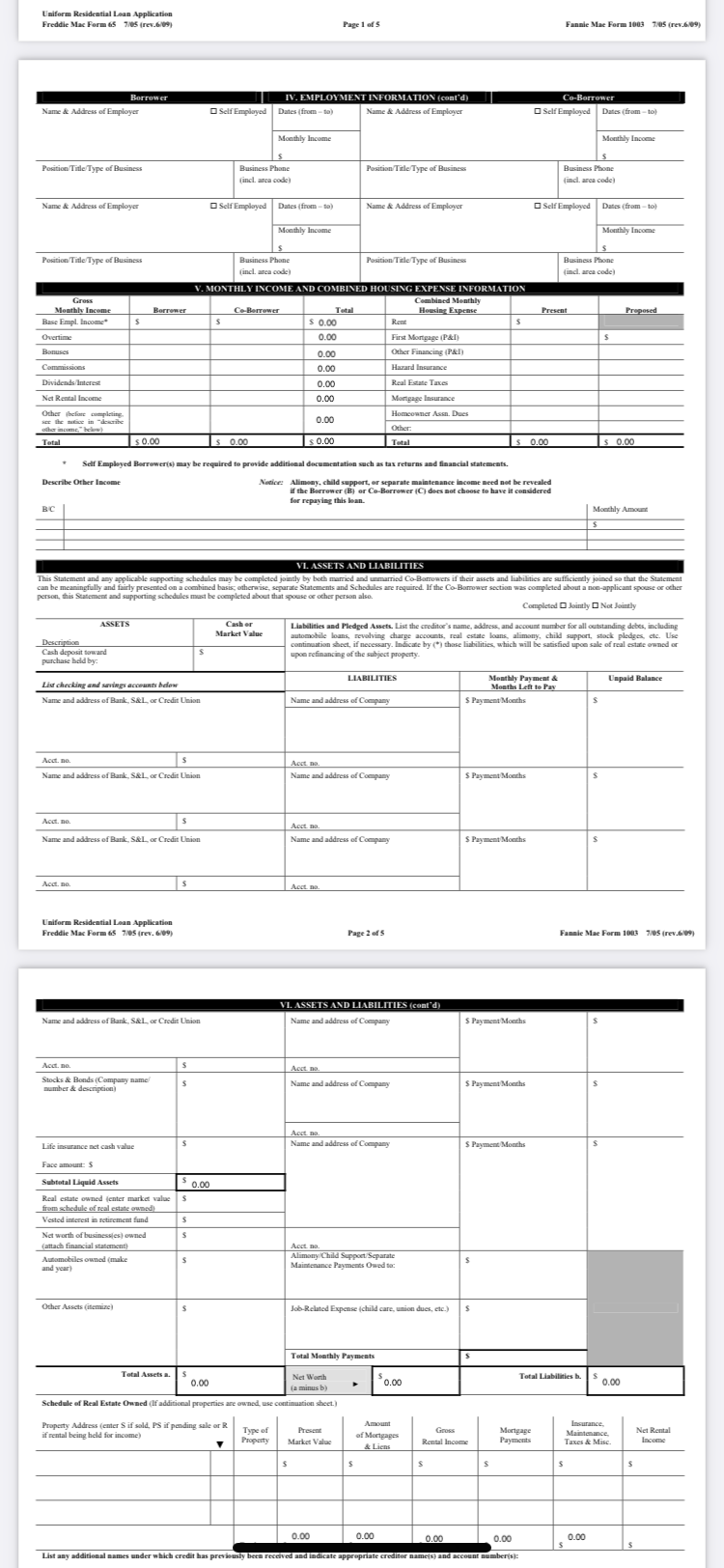

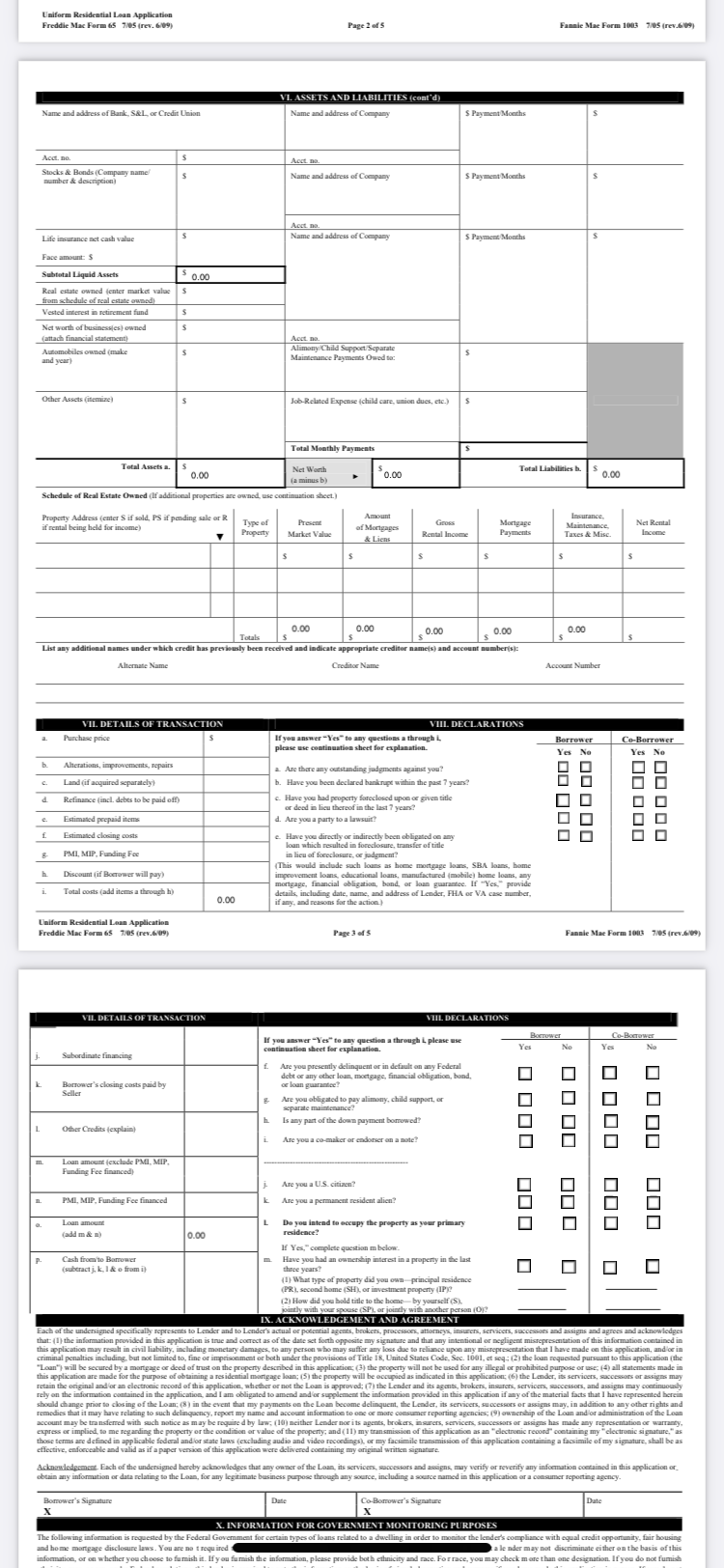

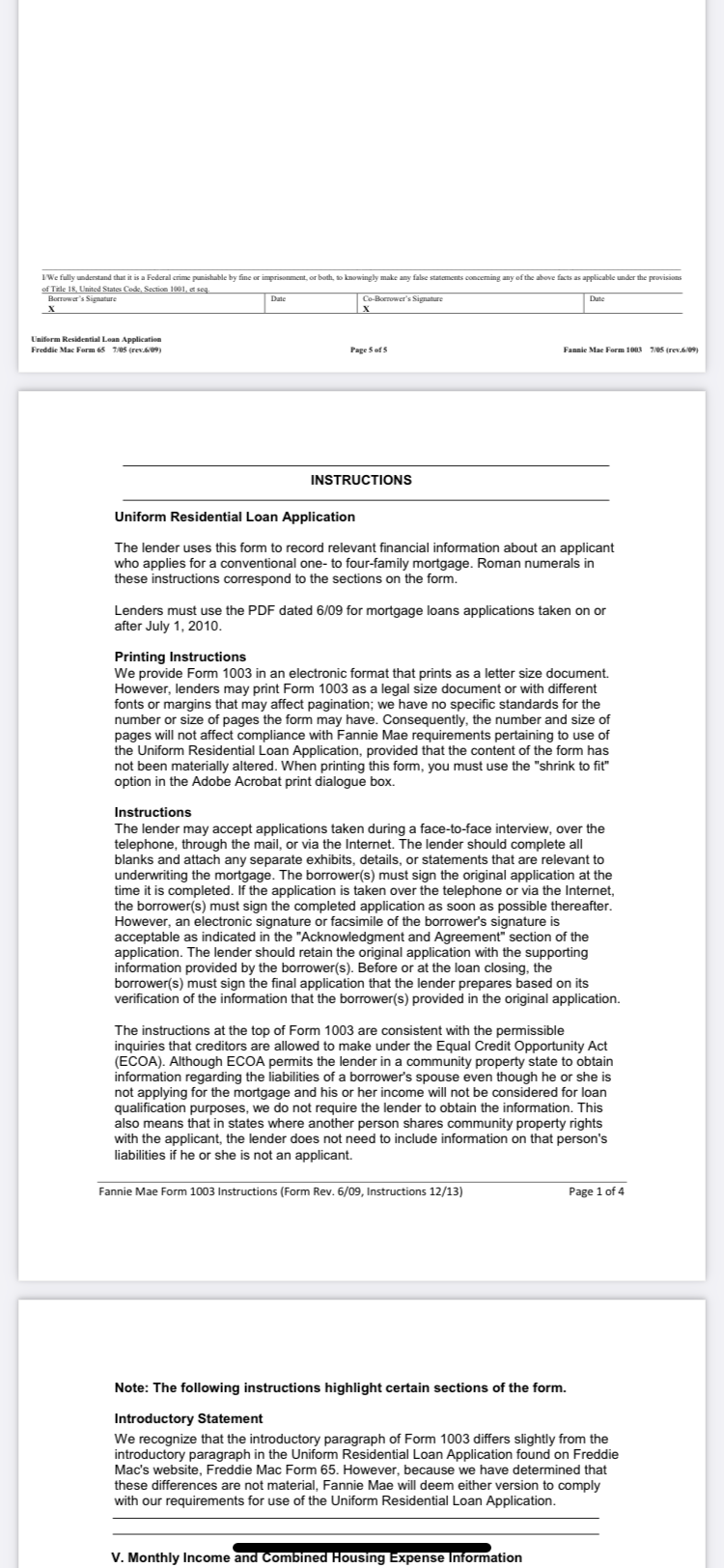

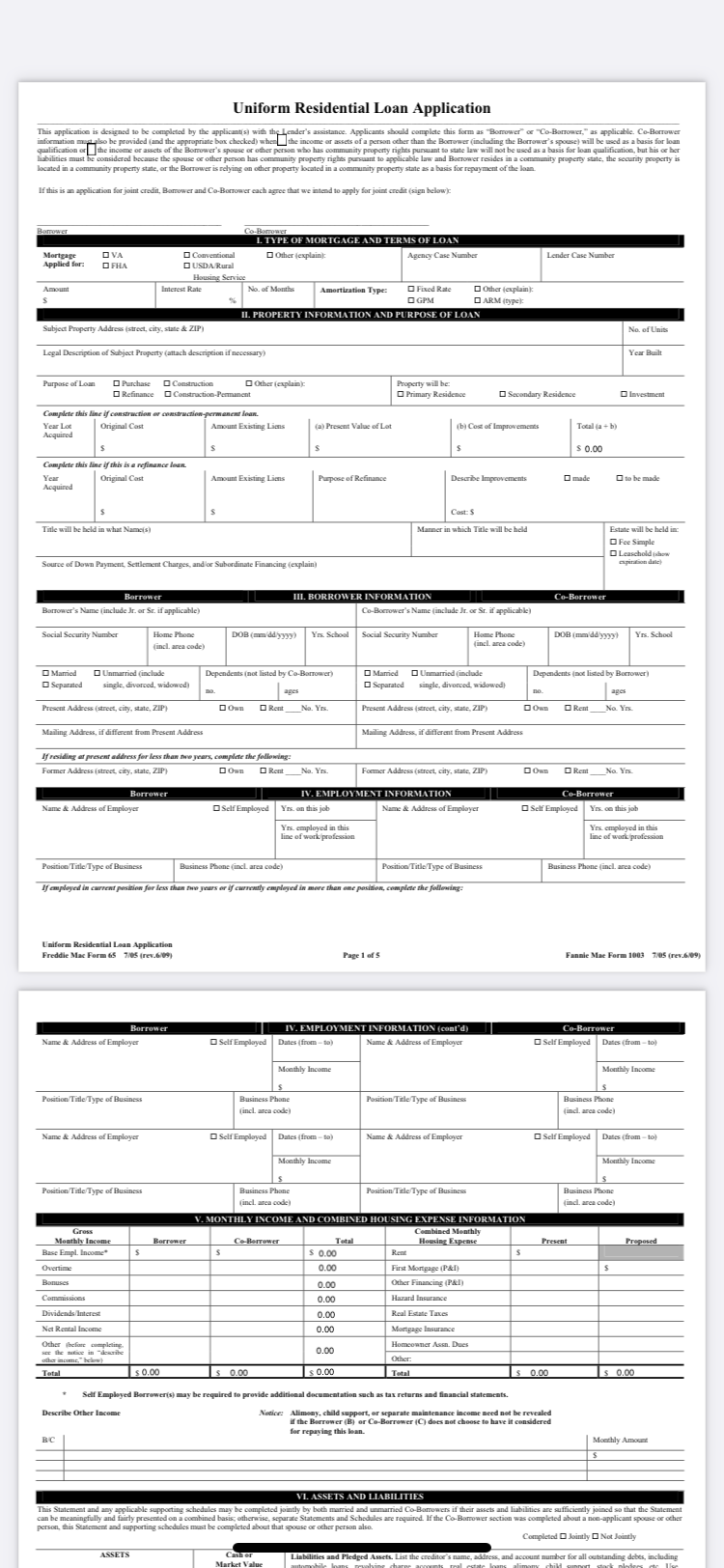

- Complete all sections of Loan Application using information provided

- Calculate total "Gross Monthly Income" and "Combined Monthly Housing Expenses" (section V)

- Calculate total "Assets" and "Liabilities" (section VI)

- Calculate "Net Worth" (section VI)

- Calculate i, o, and p (section VII)

- Complete Sections IX and X per information provided

1003 Information

Uniform Residential Loan Application Freddie Mac Form 65 7/05 (rev.6/09) Name & Address of Employer Page 1 of 5 Borrower IV. EMPLOYMENT INFORMATION (cont'd) Self Employed Dates (from-to) Name & Address of Employer Monthly Income Business Phone Position Title Type of Business Position/Title Type of Business (incl. area code) Name & Address of Employer Self Employed Dates (from-to) Name & Address of Employer Monthly Income Position/Title Type of Business Position/Title Type of Business Business Phone (incl. area code) V. MONTHLY INCOME AND COMBINED HOUSING EXPENSE INFORMATION Fannie Mae Form 1003 7/05 (609) Co-Borrower Self Employed Dates (from-to) Monthly Income Business Phone (incl. area code) Self Employed Dates (from-to) Monthly Income Business Phone (incl. area code) Gross Monthly Income Base Empl. Income Borrower Co-Borrower Total Combined Monthly Housing Expense $ $ $ 0.00 Rent Present $ Proposed Overtime 0.00 First Mortgage (P&I) Bonuses Commissions Dividends Interest Net Rental Income Other (before completing. see the notice in "de 0.00 Other Financing (P&I) 0.00 Hazard Insurance 0.00 Real Estate Taxes 0.00 Mortgage Insurance Homeowner Assn. Dues 0.00 other income, below) Other: Total $0.00 $ 0.00 $ 0.00 Total $ 0.00 S 0.00 Self Employed Borrower(s) may be required to provide additional documentation such as tax returns and financial statements. Describe Other Income Notice: Alimony, child support, or separate maintenance income need not be revealed if the Borrower (B) or Co-Borrower (C) does not choose to have it considered for repaying this loan. BC VI. ASSETS AND LIABILITIES Monthly Amount S This Statement and any applicable supporting schedules may be completed jointly by both married and unmarried Co-Borrowers if their assets and liabilities are sufficiently joined so that the Statement can be meaningfully and fairly presented on a combined basis; otherwise, separate Statements and Schedules are required. If the Co-Borrower section was completed about a non-applicant spouse or other person, this Statement and supporting schedules must be completed about that spouse or other person also. Description ASSETS Cash or Market Value Completed Jointly Not Jointly Liabilities and Pledged Assets. List the creditor's name, address, and account number for all outstanding debts, including automobile loans, revolving charge accounts, real estate loans, alimony, child support, stock pledges, etc. Use continuation sheet, if necessary. Indicate by (*) those liabilities, which will be satisfied upon sale of real estate owned or upon refinancing of the subject property. Cash deposit toward purchase held by: List checking and savings accounts below Name and address of Bank, S&I, or Credit Union Acct.no. $ Name and address of Bank, S&L, or Credit Union LIABILITIES Monthly Payment & Months Left to Pay Name and address of Company S Payment Months Acct no. Name and address of Company $ Payment Months Acct, no. $ Acct no. Name and address of Bank, S&L, or Credit Union Name and address of Company S Payment Months Acet.no. Uniform Residential Loan Application Freddie Mac Form 65 7/05 (rev. 6/09) $ Acct no. Page 2 of 5 Name and address of Bank, S&L., or Credit Union VI. ASSETS AND LIABILITIES (cont'd) Name and address of Company $ Payment Months Acct, no. $ Acct, no. Stocks & Bonds (Company name number & description) $ Name and address of Company $ Payment Months Acct no Name and address of Company $ Payment Months Life insurance net cash value Face amount: $ Subtotal Liquid Assets 0.00 Real estate owned (enter market value $ from schedule of real estate owned) Vested interest in retirement fund $ Net worth of business(es) owned $ (attach financial statement) Acct no. Automobiles owned (make and year) $ Alimony Child Support/Separate Maintenance Payments Owed to: Other Assets (itemize) Total Assets a $ 0.00 Job-Related Expense (child care, union dues, etc.) Total Monthly Payments Net Worth (a minus b) Schedule of Real Estate Owned (If additional properties are owned, use continuation sheet.) $0.00 Unpaid Balance Fannie Mae Form 1003 7/05 (rev.6/09) Total Liabilities b. $0.00 Property Address (enter S if sold, PS if pending sale or R if rental being held for income) Amount Type of Property Present Market Value Gross of Mortgages & Liens Rental Income Mortgage Payments s 0.00 0.00 0.00 Insurance, Maintenance, Taxes & Misc. 0.00 0.00 List any additional names under which credit has previously been received and indicate appropriate creditor name(s) and account number(s): Net Rental Income

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started