1. Part one

1. Part 2

1. Part 2

2.

2.

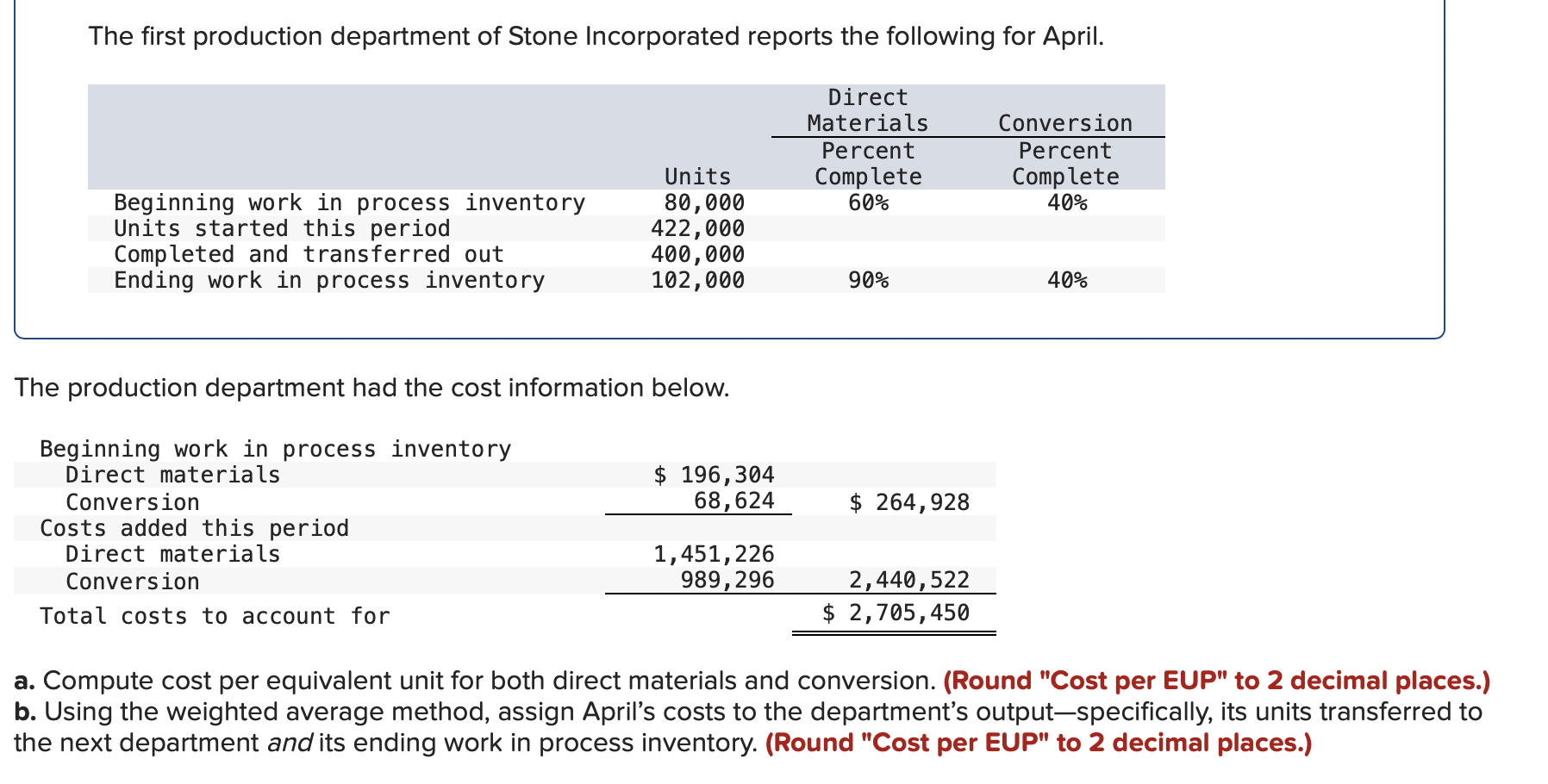

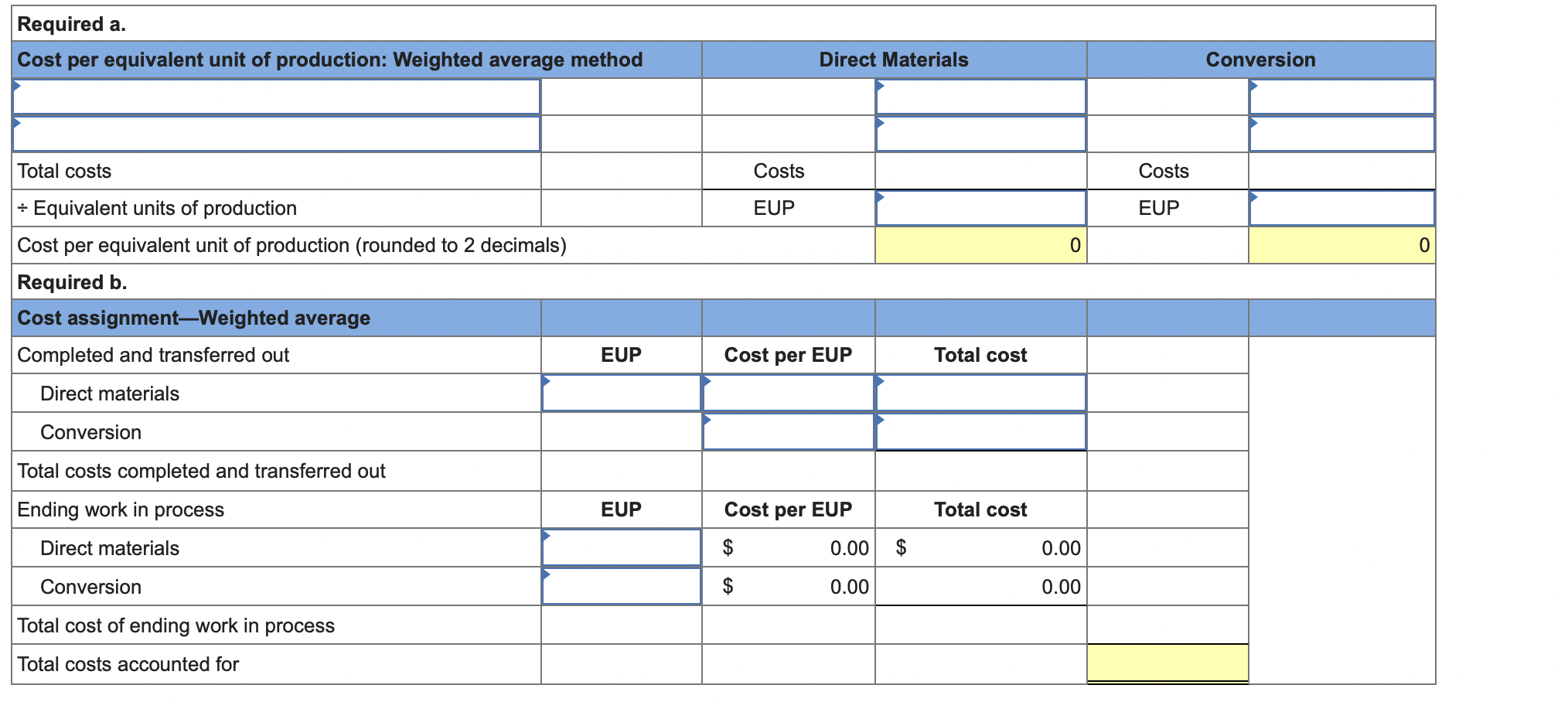

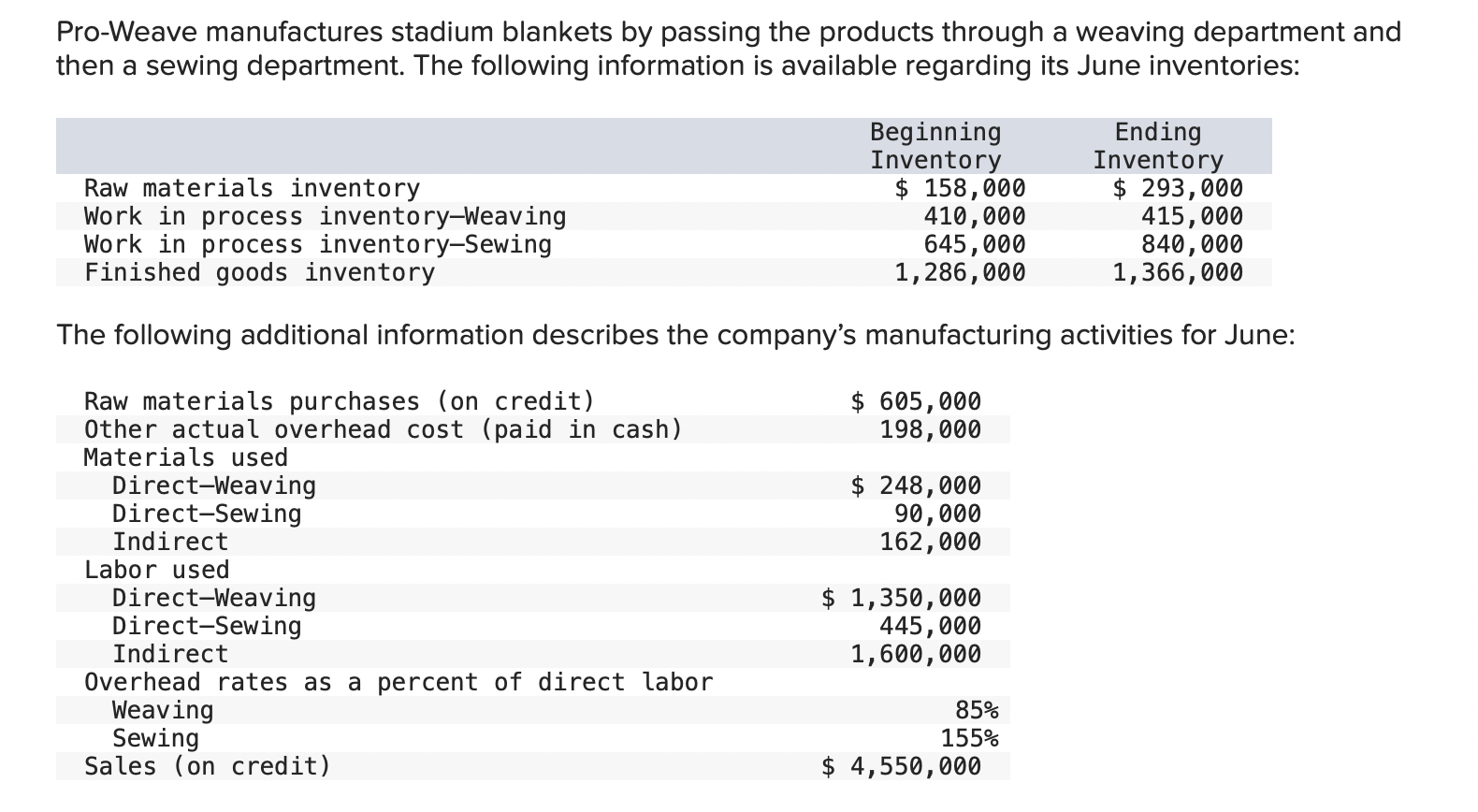

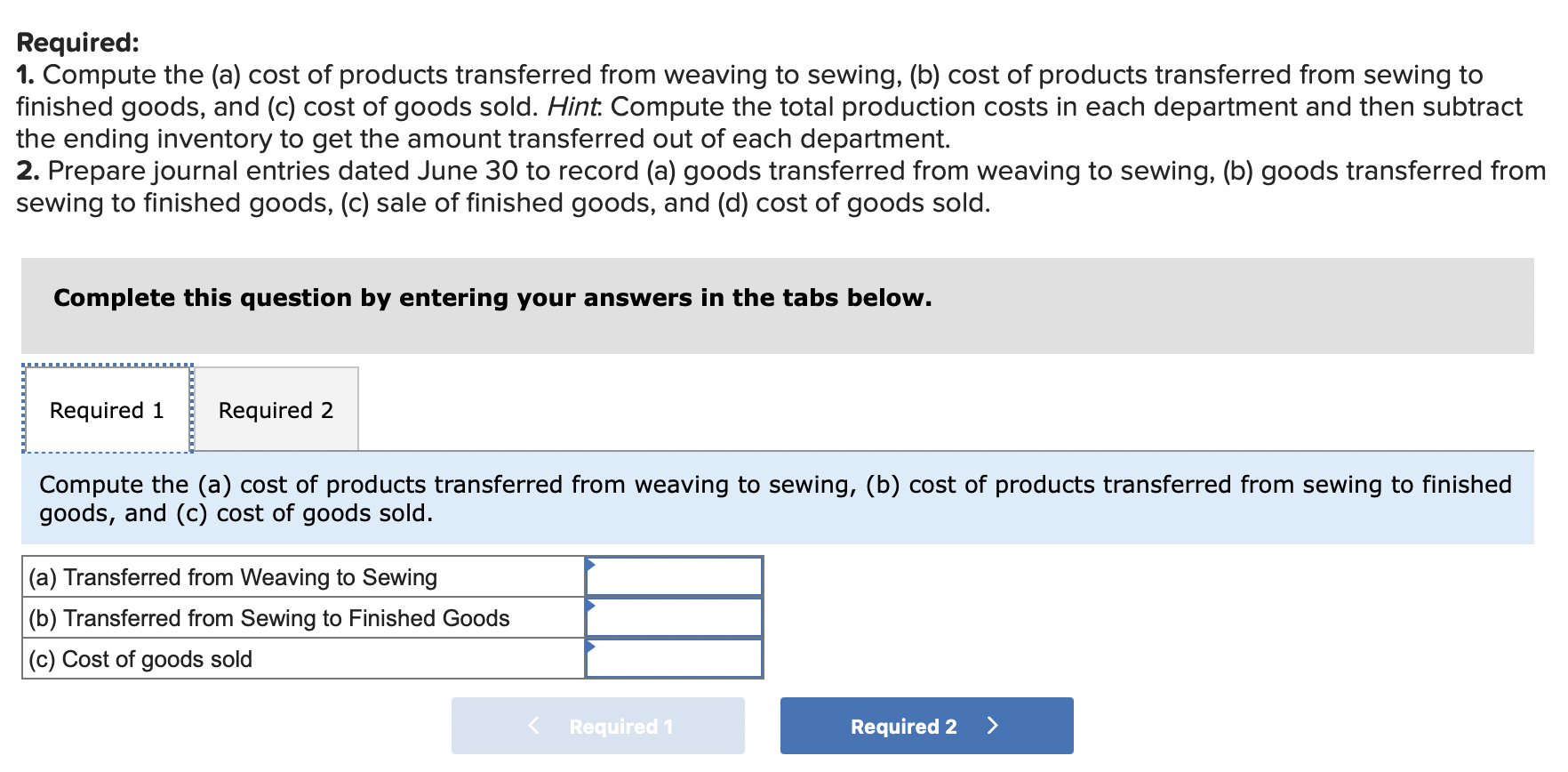

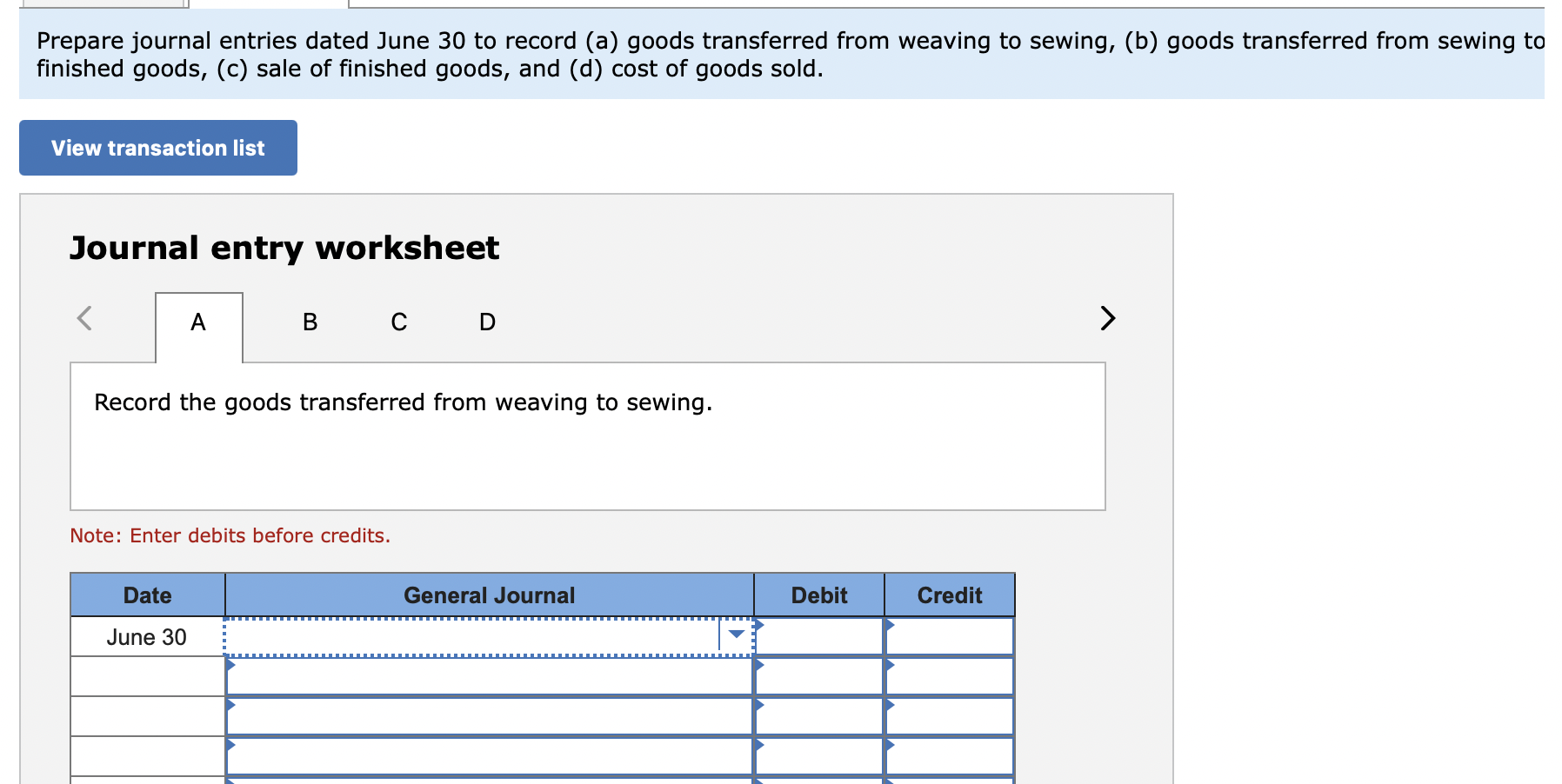

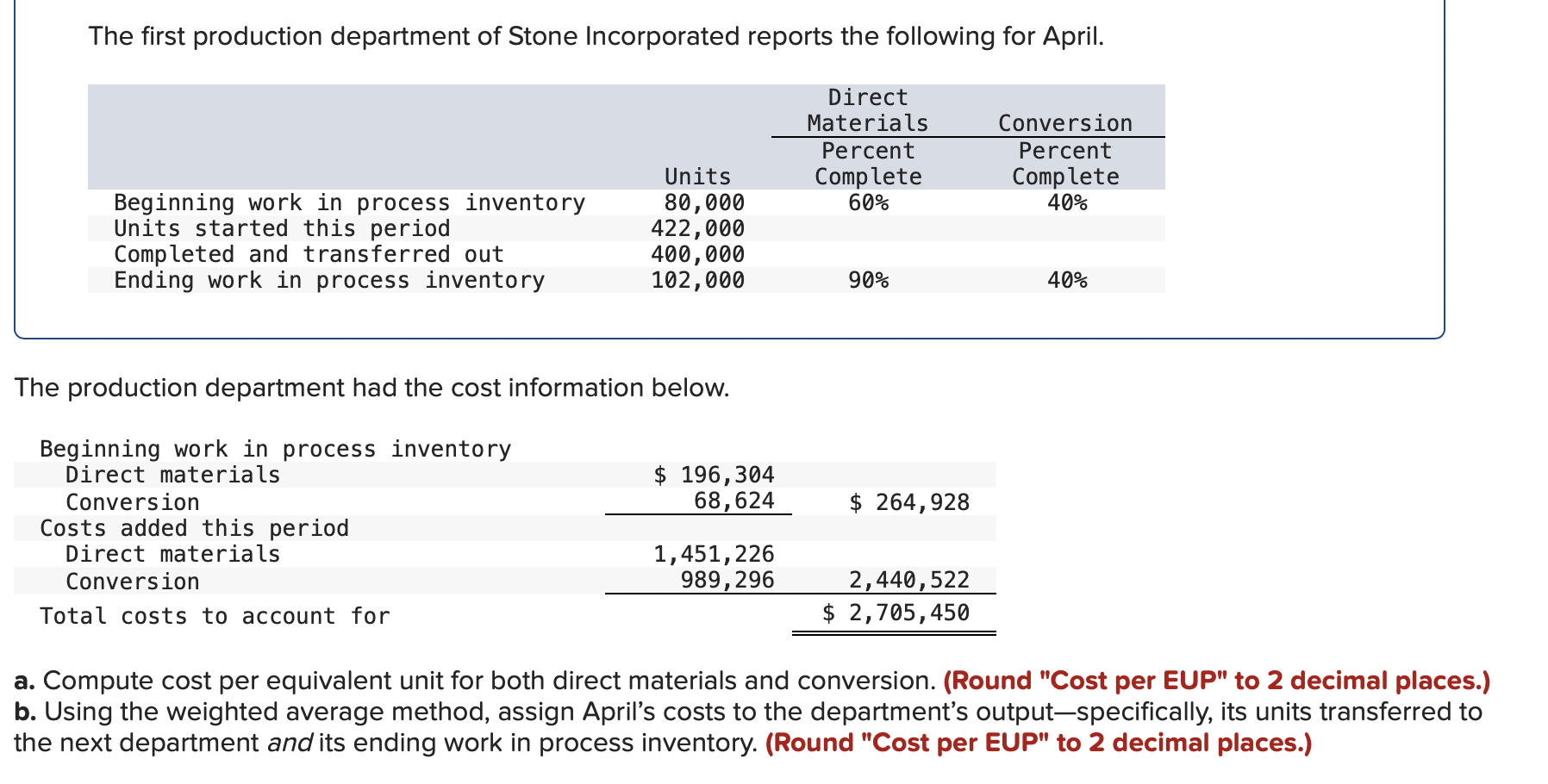

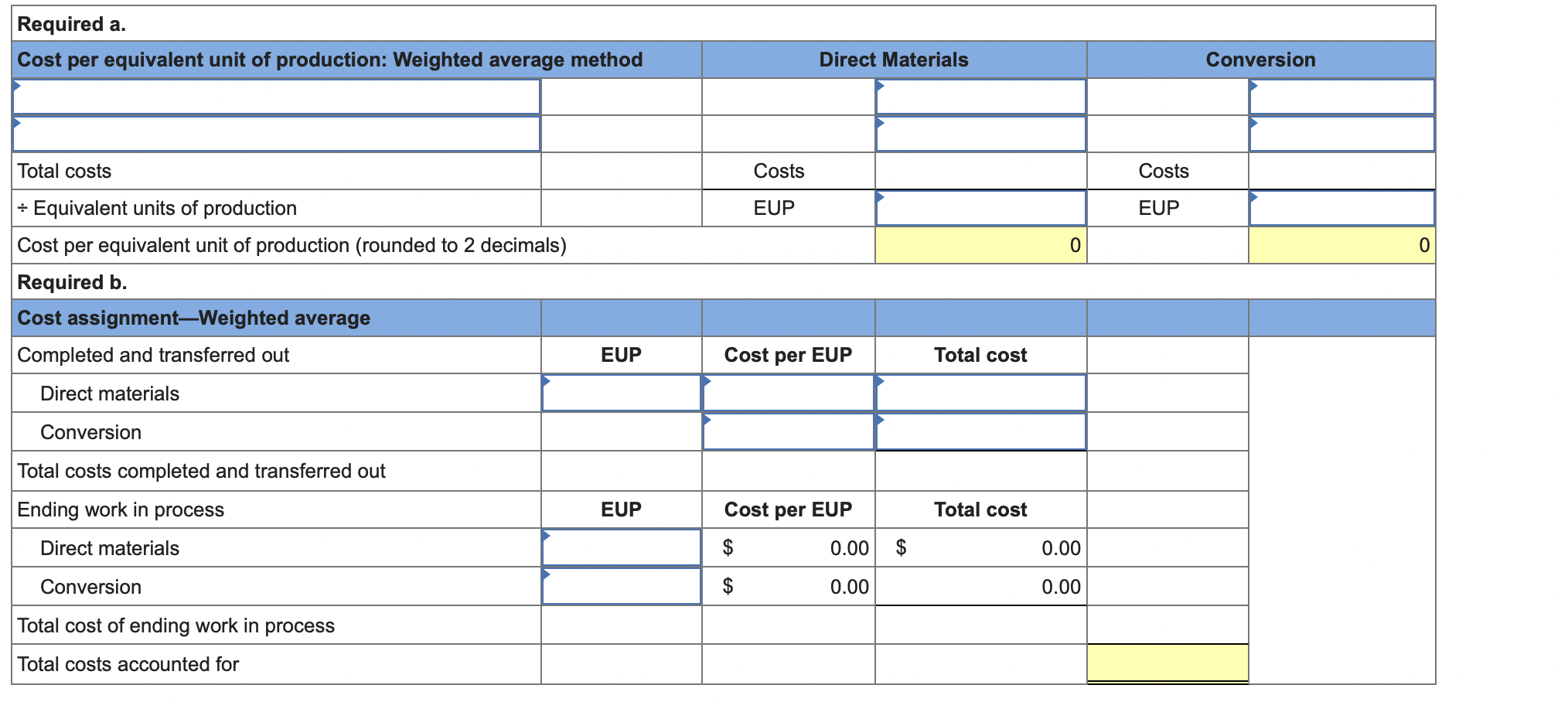

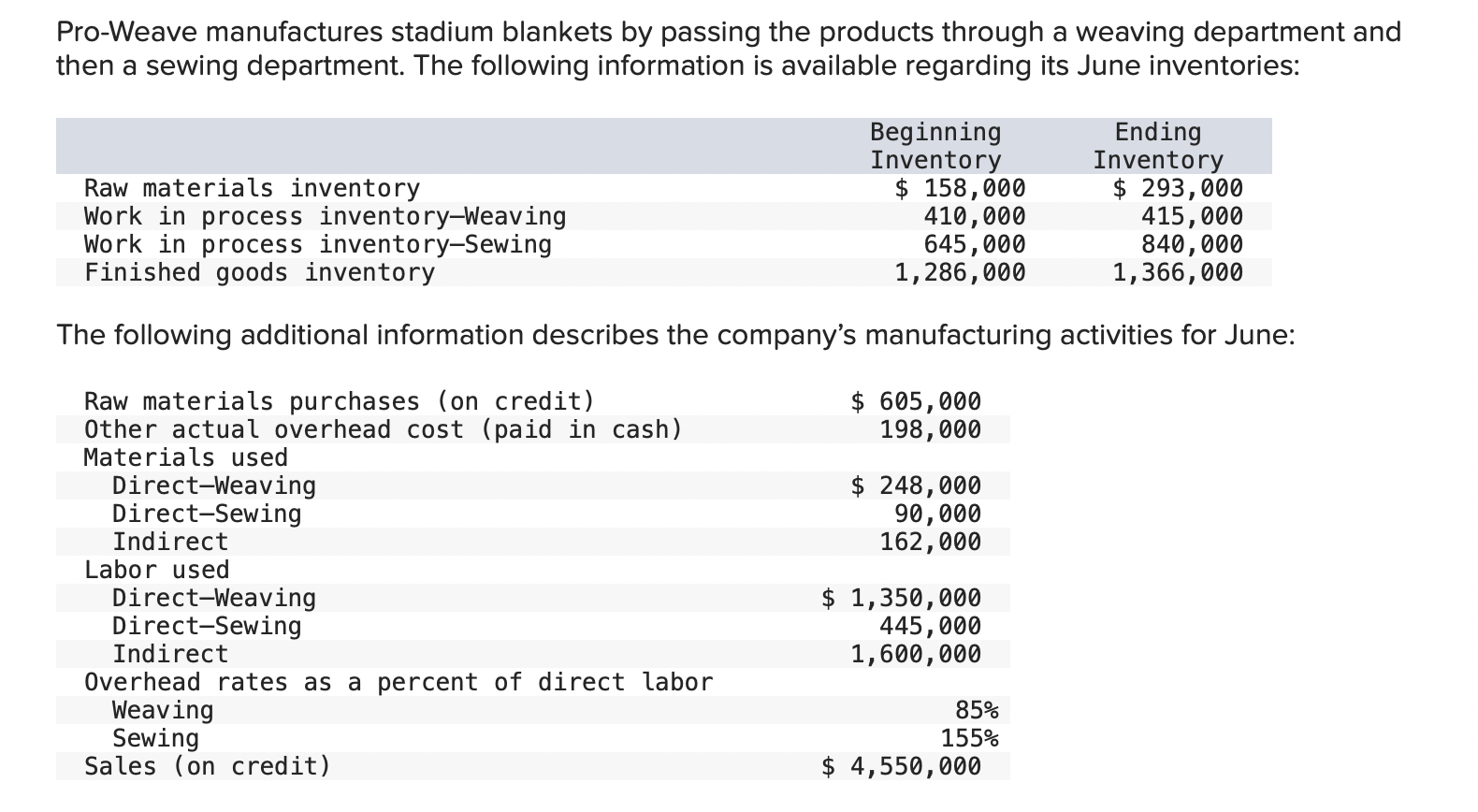

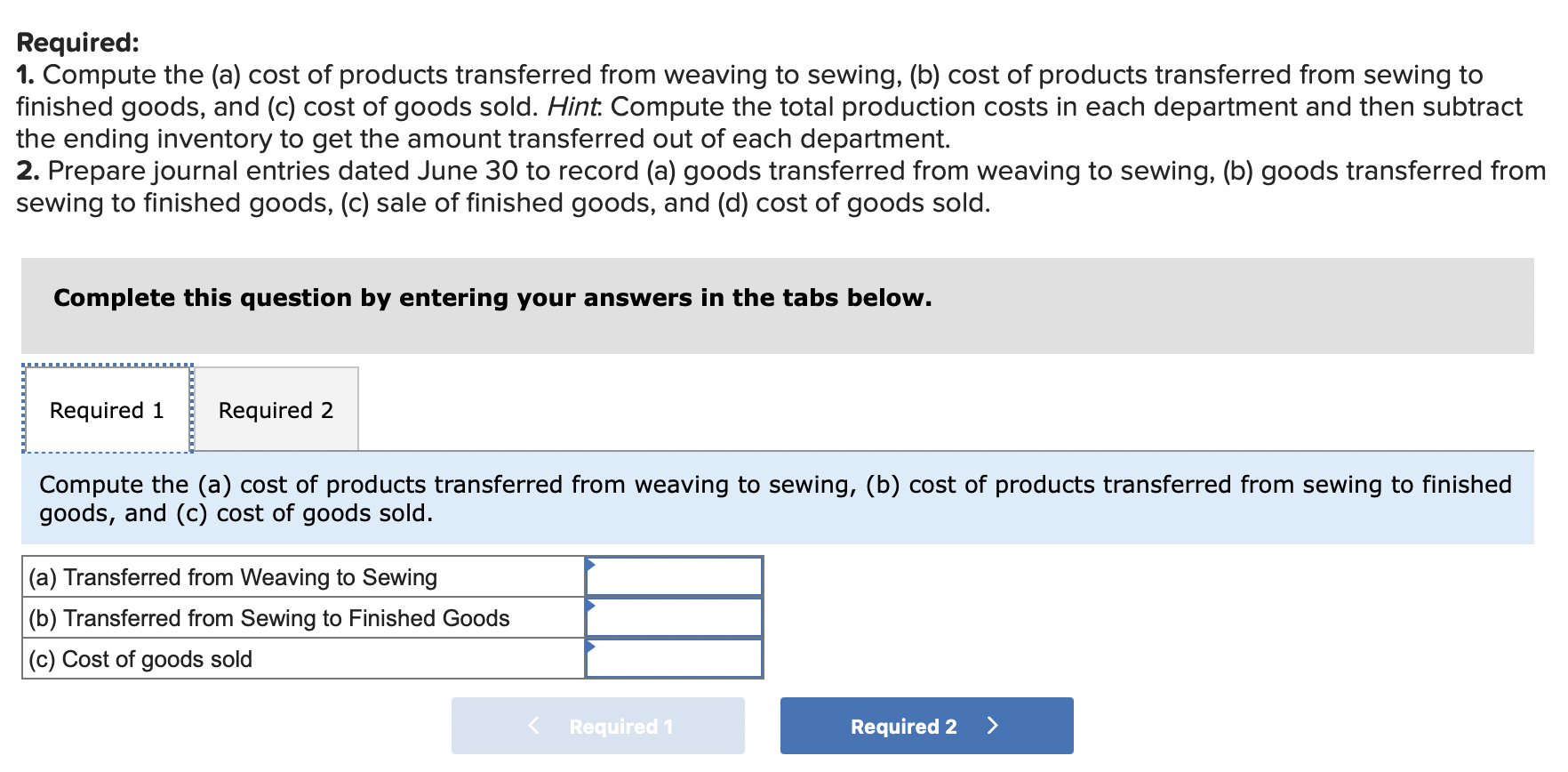

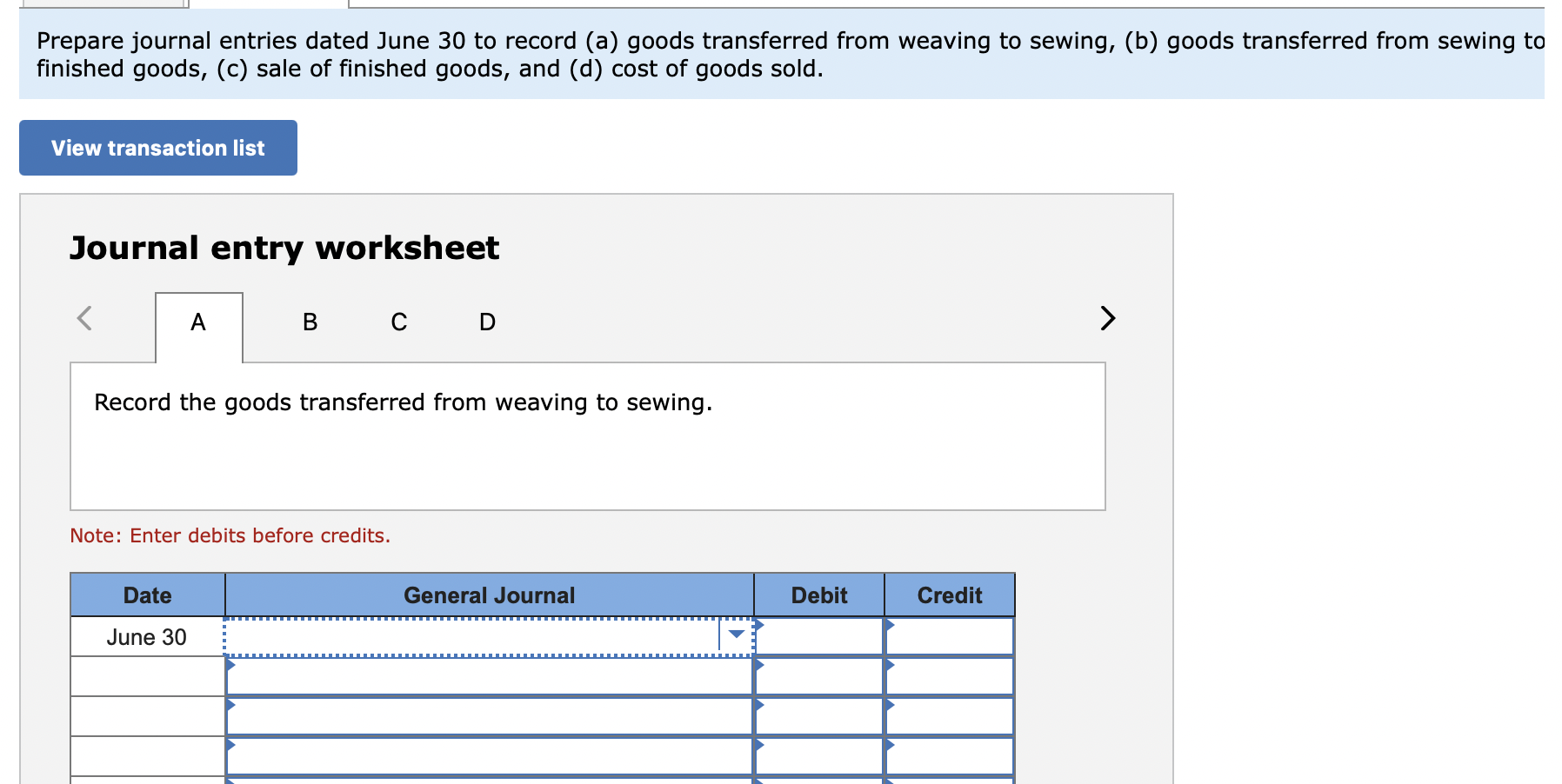

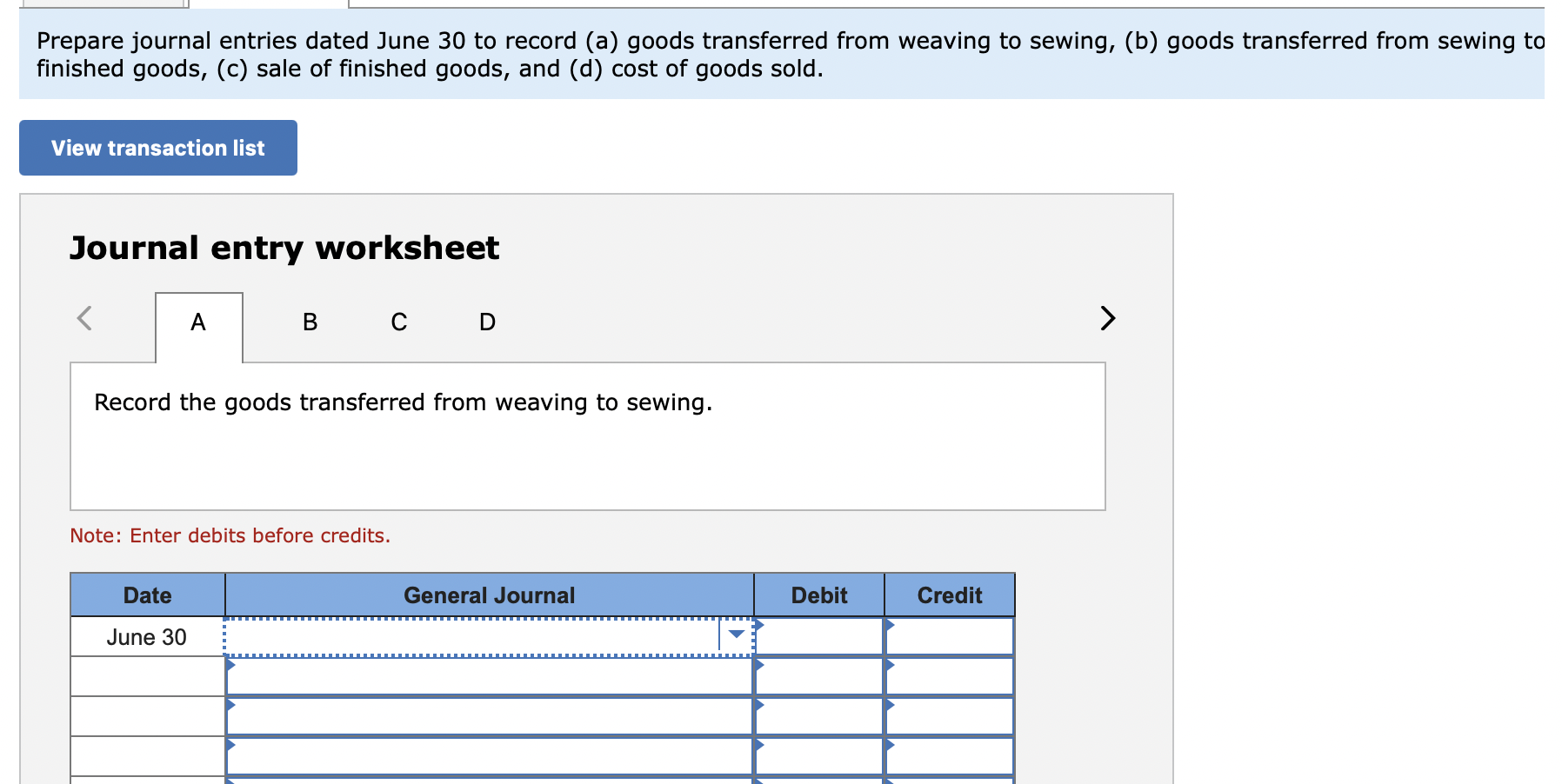

Pro-Weave manufactures stadium blankets by passing the products through a weaving department and then a sewing department. The following information is available regarding its June inventories: Raw materials inventory Work in process inventory-Weaving Work in process inventory-Sewing Finished goods inventory Beginning Inventory $ 158,000 410,000 645,000 1,286,000 Ending Inventory $ 293,000 415,000 840,000 1,366,000 The following additional information describes the company's manufacturing activities for June: $ 605,000 198,000 $ 248,000 90,000 162,000 Raw materials purchases (on credit) Other actual overhead cost (paid in cash) Materials used Direct-Weaving Direct-Sewing Indirect Labor used Direct-Weaving Direct-Sewing Indirect Overhead rates as a percent of direct labor Weaving Sewing Sales (on credit) $ 1,350,000 445,000 1,600,000 85% 155% $ 4,550,000 Required: 1. Compute the (a) cost of products transferred from weaving to sewing, (b) cost of products transferred from sewing to finished goods, and (c) cost of goods sold. Hint. Compute the total production costs in each department and then subtract the ending inventory to get the amount transferred out of each department. 2. Prepare journal entries dated June 30 to record (a) goods transferred from weaving to sewing, (b) goods transferred from sewing to finished goods, (c) sale of finished goods, and (d) cost of goods sold. Complete this question by entering your answers in the tabs below. Required 1 Required 2 Compute the (a) cost of products transferred from weaving to sewing, (b) cost of products transferred from sewing to finished goods, and (c) cost of goods sold. (a) Transferred from Weaving to Sewing (b) Transferred from Sewing to Finished Goods (c) Cost of goods sold Prepare journal entries dated June 30 to record (a) goods transferred from weaving to sewing, (b) goods transferred from sewing to finished goods, (C) sale of finished goods, and (d) cost of goods sold. View transaction list Journal entry worksheet A B C D > Record the goods transferred from weaving sewing. Note: Enter debits before credits. Date General Journal Debit Credit June 30 Prepare journal entries dated June 30 to record (a) goods transferred from weaving to sewing, (b) goods transferred from sewing to finished goods, (C) sale of finished goods, and (d) cost of goods sold. View transaction list Journal entry worksheet A B C D > Record the goods transferred from weaving sewing. Note: Enter debits before credits. Date General Journal Debit Credit June 30 The first production department of Stone Incorporated reports the following for April. Direct Materials Percent Complete 60% Conversion Percent Complete 40% Beginning work in process inventory Units started this period Completed and transferred out Ending work in process inventory Units 80,000 422,000 400,000 102,000 90% 40% The production department had the cost information below. $ 196,304 68,624 $ 264,928 Beginning work in process inventory Direct materials Conversion Costs added this period Direct materials Conversion Total costs to account for 1,451,226 989, 296 2,440,522 $ 2,705,450 a. Compute cost per equivalent unit for both direct materials and conversion. (Round "Cost per EUP" to 2 decimal places.) b. Using the weighted average method, assign April's costs to the department's output-specifically, its units transferred to the next department and its ending work in process inventory. (Round "Cost per EUP" to 2 decimal places.) Required a. Cost per equivalent unit of production: Weighted average method Direct Materials Conversion Total costs Costs Costs EUP EUP 0 0 - Equivalent units of production Cost per equivalent unit of production (rounded to 2 decimals) Required b. Cost assignmentWeighted average Completed and transferred out EUP Cost per EUP Total cost Direct materials Conversion Total costs completed and transferred out Ending work in process Direct materials EUP Cost per EUP Total cost $ 0.00 $ 0.00 Conversion 0.00 0.00 Total cost of ending work in process Total costs accounted for

1. Part 2

1. Part 2 2.

2.