1. Paterson Asset Management (PAM) wishes to create a Risk Allocated portfolio to take advantage of the economic forecasts. They would like to allocate marginal contribution to risk (MCR) for the four assets as follows:

| Assets | Commodities | Hedge Funds | Private Equities | REITs |

| Proportion of MCR | 10% | 25% | 30% | 35% |

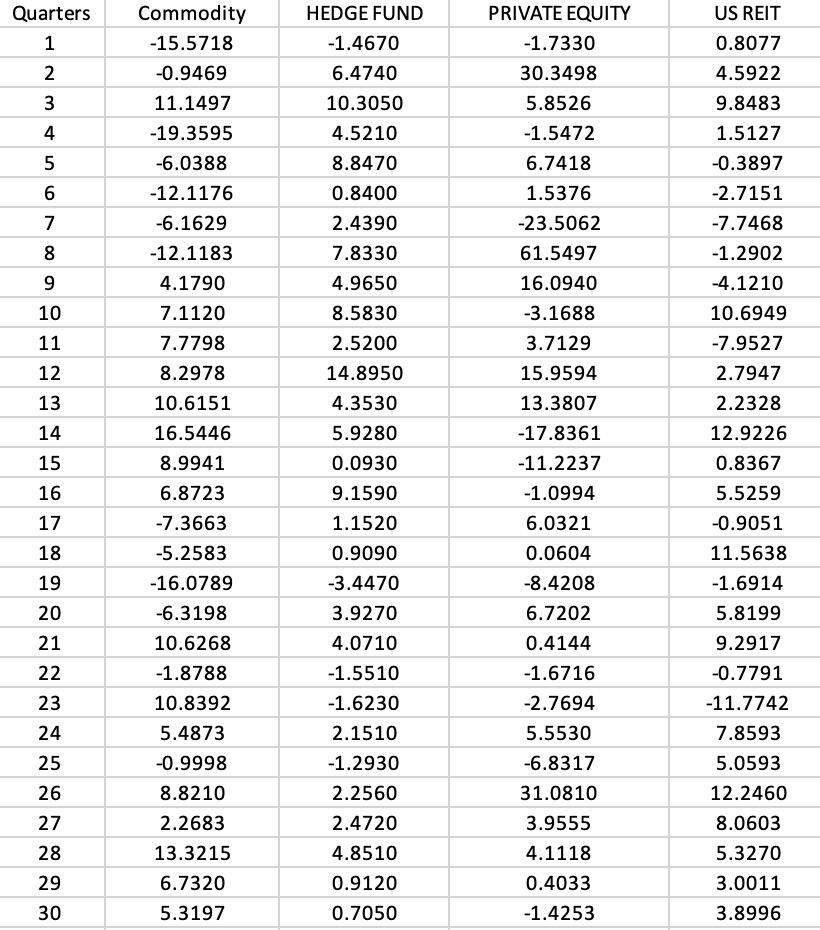

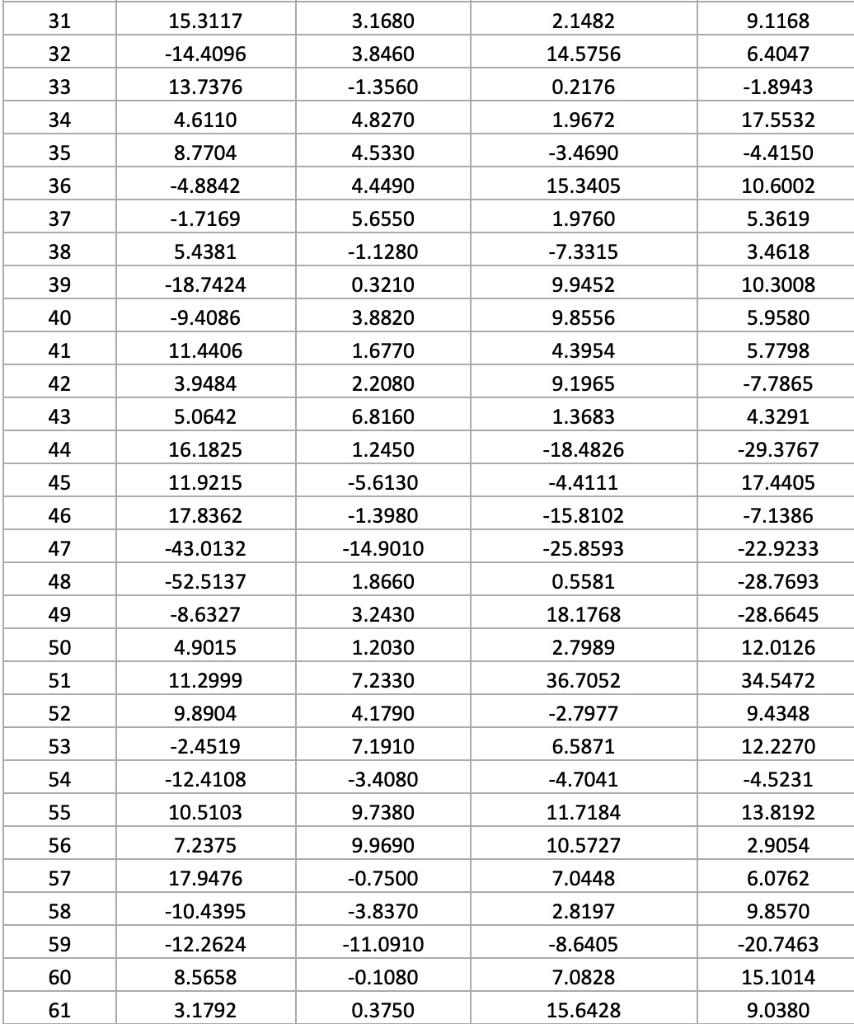

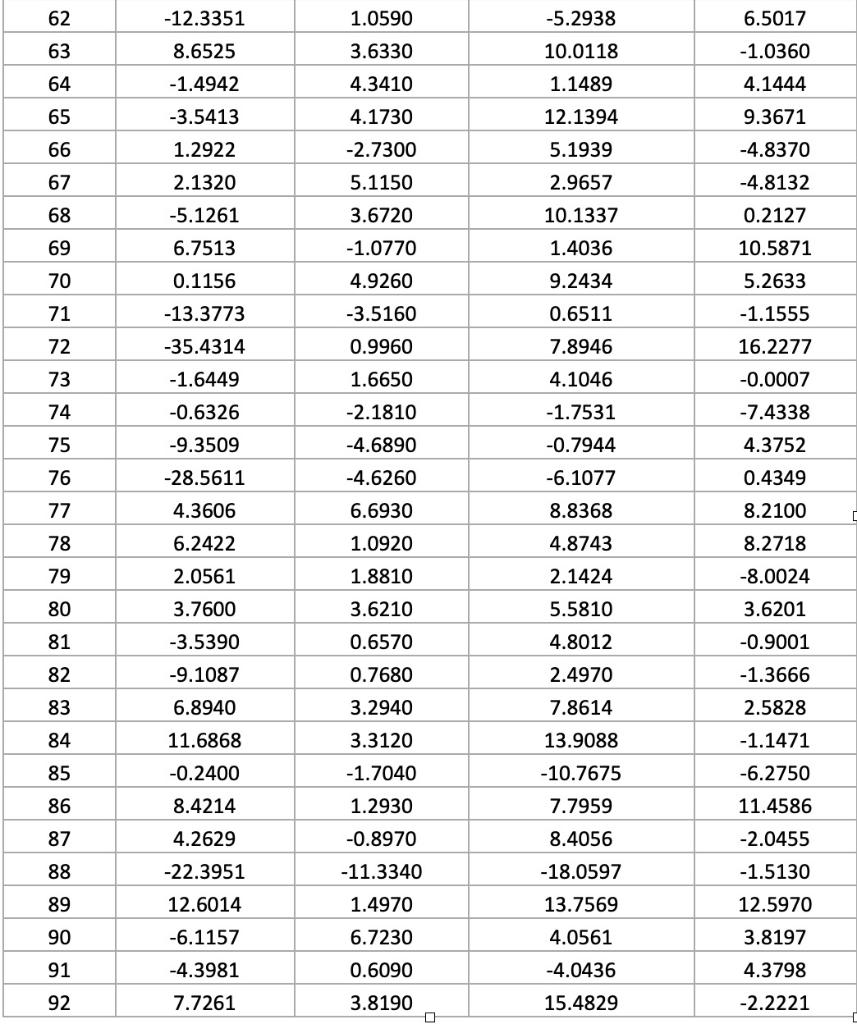

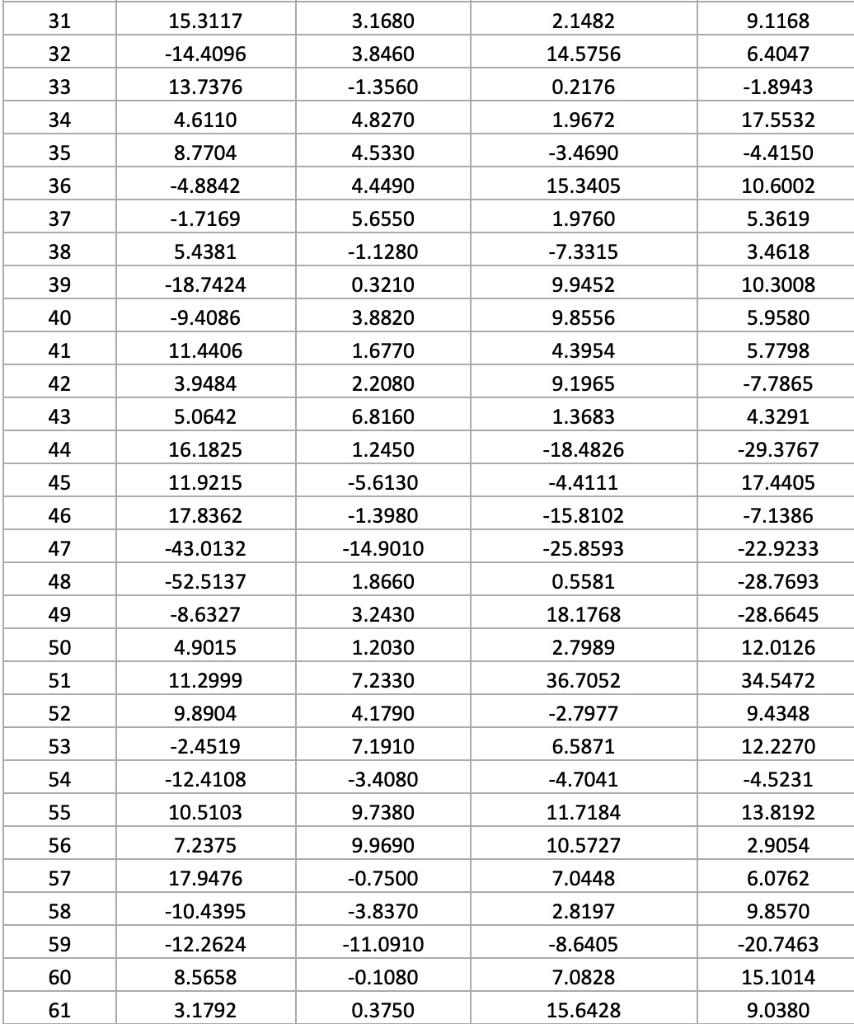

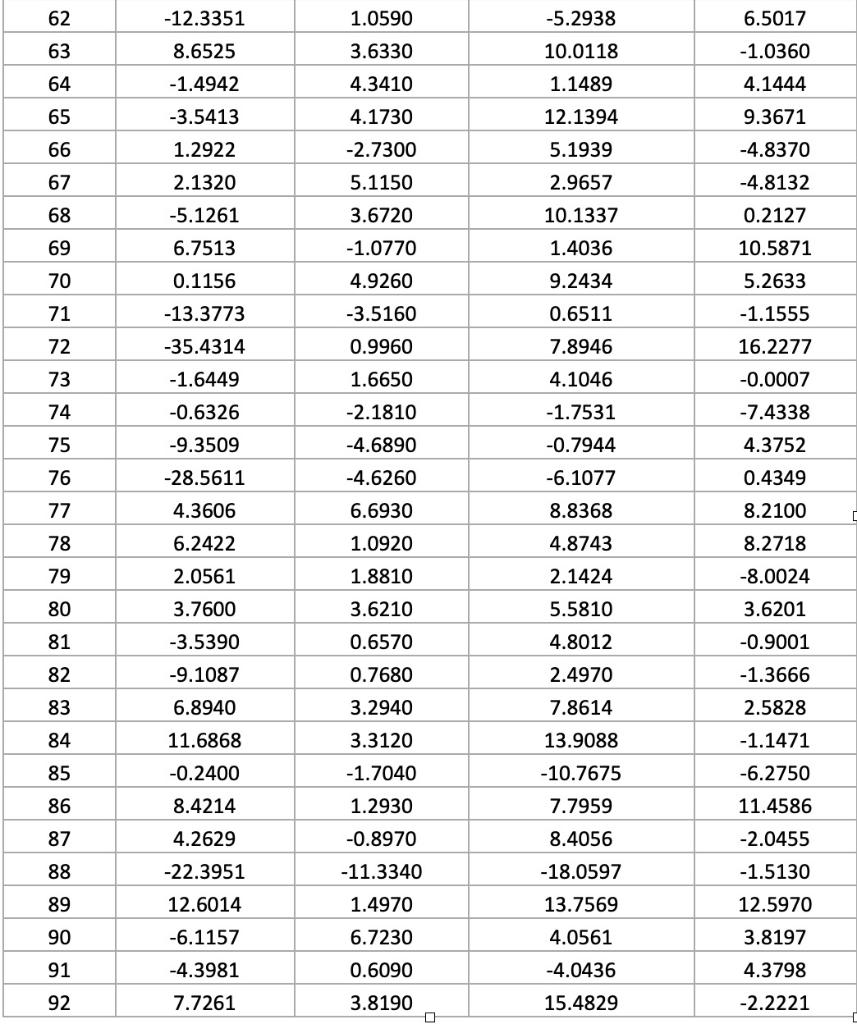

92 quarterly returns data for the four assets is provided in "Quiz 2.xlsx" in the tab "RA".

What dollar allocation (proportion) in each asset will produce the desired level of MCRs?

Commodities = 0.16; Hedge Funds =0.46; Private Equity = 0.17; REITs = 0.20

Commodities = 0.06; Hedge Funds =0.45; Private Equity = 0.2; REITs = 0.28

Commodities = 0.21; Hedge Funds =0.37; Private Equity = 0.3; REITs = 0.12

Not enough information to calculate the correct answer.

None of the three numerical answers are correct

Quarters 1 2 Nm 3 - 4 5 6 7 8 9 10 11 12 13 14 15 16 Commodity -15.5718 -0.9469 11.1497 -19.3595 -6.0388 -12.1176 -6.1629 -12.1183 4.1790 7.1120 7.7798 8.2978 10.6151 16.5446 8.9941 6.8723 -7.3663 -5.2583 -16.0789 -6.3198 10.6268 -1.8788 10.8392 5.4873 -0.9998 8.8210 2.2683 13.3215 6.7320 5.3197 HEDGE FUND -1.4670 6.4740 10.3050 4.5210 8.8470 0.8400 2.4390 7.8330 4.9650 8.5830 2.5200 14.8950 4.3530 5.9280 0.0930 9.1590 1.1520 0.9090 -3.4470 3.9270 4.0710 -1.5510 -1.6230 2.1510 -1.2930 2.2560 2.4720 4.8510 0.9120 0.7050 PRIVATE EQUITY -1.7330 30.3498 5.8526 -1.5472 6.7418 1.5376 -23.5062 61.5497 16.0940 -3.1688 3.7129 15.9594 13.3807 -17.8361 -11.2237 -1.0994 6.0321 0.0604 -8.4208 6.7202 0. -1.6716 -2.7694 5.5530 -6.8317 31.0810 3.9555 4.1118 0.4033 -1.4253 US REIT 0.8077 4.5922 9.8483 1.5127 -0.3897 -2.7151 -7.7468 -1.2902 -4.1210 10.6949 -7.9527 2.7947 2.2328 12.9226 0.8367 5.5259 -0.9051 11.5638 -1.6914 5.8199 9.2917 -0.7791 -11.7742 7.8593 5.0593 12.2460 8.0603 5.3270 3.0011 3.8996 17 18 19 20 21 22 23 24 25 26 27 28 29 30 31 3.1680 2.1482 9.1168 32 15.3117 -14.4096 13.7376 3.8460 14.5756 33 -1.3560 0.2176 6.4047 -1.8943 17.5532 34 4.8270 35 36 4.6110 8.7704 -4.8842 -1.7169 4.5330 4.4490 1.9672 -3.4690 15.3405 1.9760 -4.4150 10.6002 5.3619 37 5.6550 38 5.4381 -1.1280 -7.3315 3.4618 39 -18.7424 0.3210 9.9452 10.3008 40 -9.4086 3.8820 9.8556 5.9580 5.7798 41 1.6770 4.3954 42 2.2080 9.1965 11.4406 3.9484 5.0642 16.1825 11.9215 6.8160 43 44 1.3683 -7.7865 4.3291 -29.3767 17.4405 -18.4826 1.2450 -5.6130 45 46 17.8362 -43.0132 -4.4111 -15.8102 -25.8593 -1.3980 -14.9010 1.8660 47 -7.1386 -22.9233 -28.7693 48 -52.5137 -8.6327 0.5581 18.1768 49 3.2430 -28.6645 50 4.9015 2.7989 12.0126 1.2030 7.2330 51 11.2999 36.7052 34.5472 9.4348 52 9.8904 4.1790 -2.7977 53 -2.4519 7.1910 12.2270 54 -12.4108 -3.4080 6.5871 -4.7041 11.7184 10.5727 55 10.5103 7.2375 9.7380 9.9690 56 57 17.9476 -10.4395 58 -4.5231 13.8192 2.9054 6.0762 9.8570 -20.7463 15.1014 9.0380 59 60 -0.7500 -3.8370 -11.0910 -0.1080 0.3750 -12.2624 8.5658 3.1792 7.0448 2.8197 -8.6405 7.0828 15.6428 61 62 -12.3351 1.0590 -5.2938 6.5017 63 8.6525 3.6330 10.0118 -1.0360 64 4.1444 1.1489 12.1394 65 -1.4942 -3.5413 1.2922 2.1320 4.3410 4.1730 -2.7300 66 5.1939 2.9657 9.3671 -4.8370 -4.8132 0.2127 67 5.1150 68 3.6720 -1.0770 69 -5.1261 6.7513 0.1156 -13.3773 -35.4314 10.1337 1.4036 9.2434 0.6511 10.5871 5.2633 70 71 4.9260 -3.5160 0.9960 -1.1555 72 16.2277 7.8946 4.1046 73 -0.0007 -1.6449 -0.6326 1.6650 -2.1810 74 -7.4338 75 -9.3509 4.3752 -4.6890 -4.6260 76 -28.5611 -1.7531 -0.7944 -6.1077 8.8368 4.8743 0.4349 77 8.2100 4.3606 6.2422 6.6930 1.0920 78 || 79 2.0561 3.7600 1.8810 3.6210 80 2.1424 5.5810 4.8012 2.4970 8.2718 -8.0024 3.6201 -0.9001 -1.3666 81 -3.5390 0.6570 82 -9.1087 83 2.5828 0.7680 3.2940 3.3120 -1.7040 6.8940 11.6868 -0.2400 8.4214 84 85 7.8614 13.9088 -10.7675 7.7959 8.4056 -1.1471 -6.2750 11.4586 86 1.2930 -0.8970 87 4.2629 88 -22.3951 12.6014 -6.1157 89 -11.3340 1.4970 6.7230 -2.0455 -1.5130 12.5970 3.8197 -18.0597 13.7569 4.0561 90 91 0.6090 -4.3981 7.7261 -4.0436 15.4829 4.3798 -2.2221 92 3.8190 Quarters 1 2 Nm 3 - 4 5 6 7 8 9 10 11 12 13 14 15 16 Commodity -15.5718 -0.9469 11.1497 -19.3595 -6.0388 -12.1176 -6.1629 -12.1183 4.1790 7.1120 7.7798 8.2978 10.6151 16.5446 8.9941 6.8723 -7.3663 -5.2583 -16.0789 -6.3198 10.6268 -1.8788 10.8392 5.4873 -0.9998 8.8210 2.2683 13.3215 6.7320 5.3197 HEDGE FUND -1.4670 6.4740 10.3050 4.5210 8.8470 0.8400 2.4390 7.8330 4.9650 8.5830 2.5200 14.8950 4.3530 5.9280 0.0930 9.1590 1.1520 0.9090 -3.4470 3.9270 4.0710 -1.5510 -1.6230 2.1510 -1.2930 2.2560 2.4720 4.8510 0.9120 0.7050 PRIVATE EQUITY -1.7330 30.3498 5.8526 -1.5472 6.7418 1.5376 -23.5062 61.5497 16.0940 -3.1688 3.7129 15.9594 13.3807 -17.8361 -11.2237 -1.0994 6.0321 0.0604 -8.4208 6.7202 0. -1.6716 -2.7694 5.5530 -6.8317 31.0810 3.9555 4.1118 0.4033 -1.4253 US REIT 0.8077 4.5922 9.8483 1.5127 -0.3897 -2.7151 -7.7468 -1.2902 -4.1210 10.6949 -7.9527 2.7947 2.2328 12.9226 0.8367 5.5259 -0.9051 11.5638 -1.6914 5.8199 9.2917 -0.7791 -11.7742 7.8593 5.0593 12.2460 8.0603 5.3270 3.0011 3.8996 17 18 19 20 21 22 23 24 25 26 27 28 29 30 31 3.1680 2.1482 9.1168 32 15.3117 -14.4096 13.7376 3.8460 14.5756 33 -1.3560 0.2176 6.4047 -1.8943 17.5532 34 4.8270 35 36 4.6110 8.7704 -4.8842 -1.7169 4.5330 4.4490 1.9672 -3.4690 15.3405 1.9760 -4.4150 10.6002 5.3619 37 5.6550 38 5.4381 -1.1280 -7.3315 3.4618 39 -18.7424 0.3210 9.9452 10.3008 40 -9.4086 3.8820 9.8556 5.9580 5.7798 41 1.6770 4.3954 42 2.2080 9.1965 11.4406 3.9484 5.0642 16.1825 11.9215 6.8160 43 44 1.3683 -7.7865 4.3291 -29.3767 17.4405 -18.4826 1.2450 -5.6130 45 46 17.8362 -43.0132 -4.4111 -15.8102 -25.8593 -1.3980 -14.9010 1.8660 47 -7.1386 -22.9233 -28.7693 48 -52.5137 -8.6327 0.5581 18.1768 49 3.2430 -28.6645 50 4.9015 2.7989 12.0126 1.2030 7.2330 51 11.2999 36.7052 34.5472 9.4348 52 9.8904 4.1790 -2.7977 53 -2.4519 7.1910 12.2270 54 -12.4108 -3.4080 6.5871 -4.7041 11.7184 10.5727 55 10.5103 7.2375 9.7380 9.9690 56 57 17.9476 -10.4395 58 -4.5231 13.8192 2.9054 6.0762 9.8570 -20.7463 15.1014 9.0380 59 60 -0.7500 -3.8370 -11.0910 -0.1080 0.3750 -12.2624 8.5658 3.1792 7.0448 2.8197 -8.6405 7.0828 15.6428 61 62 -12.3351 1.0590 -5.2938 6.5017 63 8.6525 3.6330 10.0118 -1.0360 64 4.1444 1.1489 12.1394 65 -1.4942 -3.5413 1.2922 2.1320 4.3410 4.1730 -2.7300 66 5.1939 2.9657 9.3671 -4.8370 -4.8132 0.2127 67 5.1150 68 3.6720 -1.0770 69 -5.1261 6.7513 0.1156 -13.3773 -35.4314 10.1337 1.4036 9.2434 0.6511 10.5871 5.2633 70 71 4.9260 -3.5160 0.9960 -1.1555 72 16.2277 7.8946 4.1046 73 -0.0007 -1.6449 -0.6326 1.6650 -2.1810 74 -7.4338 75 -9.3509 4.3752 -4.6890 -4.6260 76 -28.5611 -1.7531 -0.7944 -6.1077 8.8368 4.8743 0.4349 77 8.2100 4.3606 6.2422 6.6930 1.0920 78 || 79 2.0561 3.7600 1.8810 3.6210 80 2.1424 5.5810 4.8012 2.4970 8.2718 -8.0024 3.6201 -0.9001 -1.3666 81 -3.5390 0.6570 82 -9.1087 83 2.5828 0.7680 3.2940 3.3120 -1.7040 6.8940 11.6868 -0.2400 8.4214 84 85 7.8614 13.9088 -10.7675 7.7959 8.4056 -1.1471 -6.2750 11.4586 86 1.2930 -0.8970 87 4.2629 88 -22.3951 12.6014 -6.1157 89 -11.3340 1.4970 6.7230 -2.0455 -1.5130 12.5970 3.8197 -18.0597 13.7569 4.0561 90 91 0.6090 -4.3981 7.7261 -4.0436 15.4829 4.3798 -2.2221 92 3.8190