Question

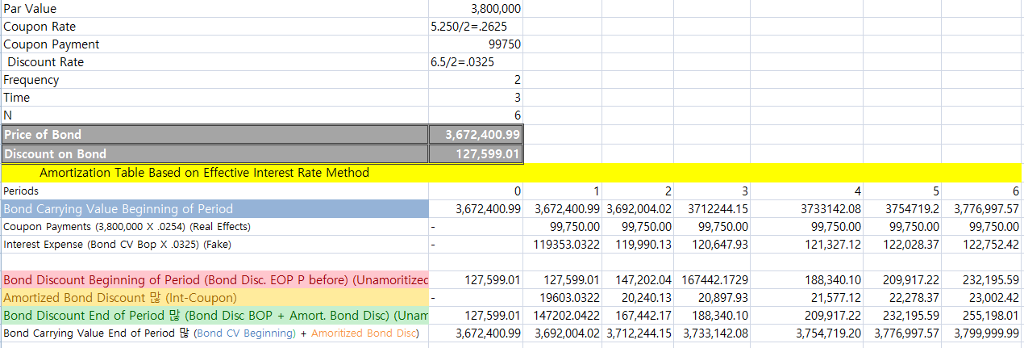

1) Paul Co. begin operations on 1/1/06 by issuing a 3.00 year term (Bullet) bond with a par value of $3,800,000. The bond pays interest

1) Paul Co. begin operations on 1/1/06 by issuing a 3.00 year term (Bullet) bond with a par value of $3,800,000. The bond pays interest semi-annually. On the date of issuance, the annual coupon rate of the bond is 5.250% while the annual required rate of return in the debt capital markets (the discount rate) is 6.5%. Paul assumes that he will earn $1,700,000 in cash revenues and incur cash operating expenses of 47.000% of revenues each 6 month period for the next 3.00 fiscal years. The corporate tax rate is assumed to be 35.00%.

1. Create an amortization table for the bond.

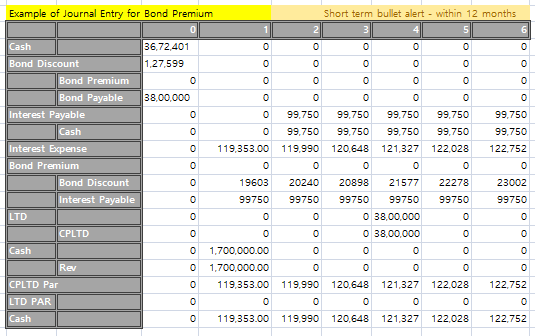

2.Provide all journal entries and T-accounts for this transaction over the next 3 years.

> I have answered both questions. The first image is the amortization, and the second one is the journal entries for the amortization. However, my question is how to fit the journal entries for the 1,700,000 revenue and 47% expense and 35% tax%. Can you please plug these to the journal entry chart provided under?

> Also in the journal entry chart, can you check whether all entries are correct? (Especially my CP LTD - third to the last line and last)

Par Value 3,800,000 5250/2 .2625 Coupon Rate 99750 Coupon Payment 65 .0325 Discount Rate 2 Frequency Price of Bond 3,672,400.99 Discount on Bond 127,599.01 Amortization Table Based on Effective Interest Rate Method 1 2 3 4 5 6 Periods Bond Carrying Value Beginning of Pe 3733142.08 3754719.2 3,776,997.57 3,672,400.99 3,672,400.99 3,692,004.02 3712244.15 Coupon payments (3,800,000 X .0254) (Real Effects) 99,750.00 99,750.00 99,750.00 99,750.00 99,750.00 99,750.00 121,327.12 122,028.37 122,752.42 Interest Expense (Bond CV Bop X .0325) (Fake) 119353.0322 119,990.13 120,647.93 127,599.01 147,202.04 188,340.10 209,917.22 232,195.59 Bond Discount Beginning of Period (Bond Disc. EOP P before) (Unamoritizec 127,599.01 167442.1729 20,897.93 21,577.12 22278.37 23,002.42 Amortized Bond Discount Bt (nt-Coupon) 19603.0322 20,240.13 147202.0422 167442.17 188, 340.10 209,917.22 232,195.59 255,198.01 Bond Discount End of Period BH (Bond Disc BOP Amort. Bond Disc) (Unam 127,599,01 Bond Carrying Value End of Period B (Bond CV Beginning) Amoritized Bond Disc) 3,672,400.99 3692,004.02 3 712,244.15 3,733,14 2.08 3,754,719.20 3,776,997.57 3,799,999.99

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started