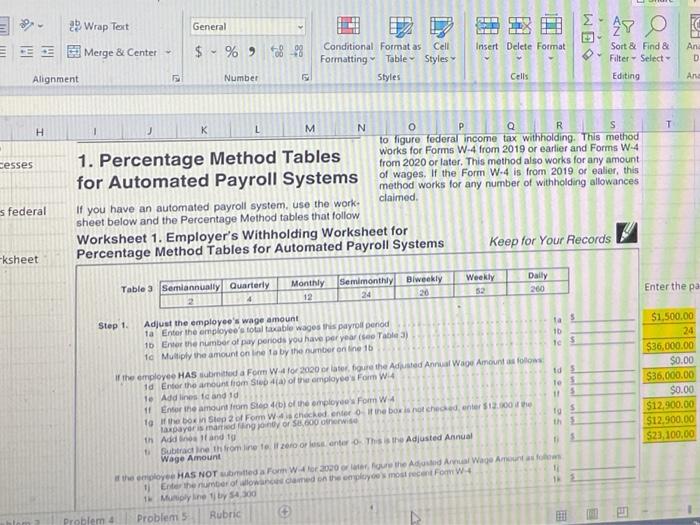

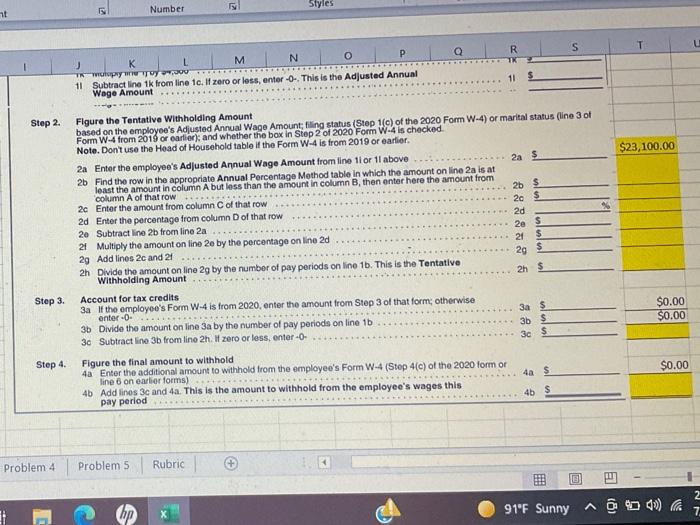

1. Pe for A If you ha sheet be Works Percer 1 Company XYZ has a new employee that submitted form W-4 from 2020 2 He is married filing jointly and box 2 is not checked. The employer processes 3 payroll automatically and he has paycheck of $1,500 and is 4 paid semi-monthly Using the percentage 5 method, the worksheet, and the correct table calculate the employee's federal 6 withholding tax for each pay check. 7 8 ***Enter the pay information into the highlighted cells next to the worksheet 9 10 11 12 13 14 15 16 17 18 19 Step 20 21 22 23 34 Instructions Problem 1 Problem 2 Problem 3 Problem 4 Ready Problem Type here to search w General 47 0 - 2 Wrap Text E B Merge & Center Insert Delete Format 8-98 $ % Conditional Format as Cell Formatting Table Styles Styles Sort & Find & Filter - Select- Editing An D Alignment Number Cells An H 1 L cesses J K M N o R to figure federal income tax withholding. This method 1. Percentage Method Tables works for Forms W-4 from 2019 or earlier and Forms W-4 from 2020 or later. This method also works for any amount for Automated Payroll Systems of wages. If the Form W-4 is from 2019 or ealier, this method works for any number of withholding allowances claimed If you have an automated payroll system, use the work. sheet below and the Percentage Method tables that follow Worksheet 1. Employer's Withholding Worksheet for Percentage Method Tables for Automated Payroll Systems Keep for Your Records s federal ksheet Weekly Tables Semiannually Quarterly Monthly 12 Semimonthly Blweekly 24 20 Daily 200 Enter the pa 16 1e5 1d5 le 5 Step 1. Adjust the employee's wage amount 1a Enter the employees total taxable wages is payroll penod 10 Enter the number of pay periods you have per year(see Table 3) 1 Multiply the amount online la by the number on line 16 of the employee HAS submitted a For W 412020 or later, gure the Adjusted Annual Wage Amount as follow 1d Enter the amount from Step 4/4) of the employees Form W:4 to Add lines and d 11 Enter the amount from Sto4(b) of the employees Form W 4 10 boxi Step 2 of For W 4 chached enter of the box is not checked, enter 512.00 the taxpayer is mariedaing joy or $4,600 erwise Add and tu 1 Subtractineth from line to 2010 or lantero This is the Adjusted Annual Wage Amount theploy HAS NOT be a Form W-4 for 2000 tour the Adjusted Ara Wage Amount Enter the number of owned on the play cos most recent Form 1. Myline by S4300 Problem Problem 5 Rubric $1,500.00 24 $36,000.00 $0.00 $36,000.00 $0.00 $12,900.00 $12,900.00 $23,100.00 to 5 th 15 ht Number Styles R T M N Topy Toy 11 Subtract line 1k from line 10. If zero or less, enter-O. This is the Adjusted Annual Wage Amount Step 2 $23,100.00 Figure the Tentative Withholding Amount based on the employee's Adjusted Annual Wage Amount:filing status (Stop 1(c) of the 2020 Form W-4) or marital status (line 3 of Form W-4 from 2019 or earlier and whether the box in Step 2 of 2020 Form W-4 is checked. Note. Don't use the Head of Household table if the Form W-4 is from 2019 or earlier. 2a Enter the employee's Adjusted Annual Wage Amount from line 11 or 11 above 2a $ 2b Find the row in the appropriate Annual Percentage Mothod table in which the amount on line 2a is at least the amount in column A but less than the amount in column B, then enter here the amount from column A of that row 2b s 20 Enter the amount from column C of that row 20$ 2d Enter the percentage from column Dol that row 2d 20 Subtract line 2b from line 2a 2e $ 21 Multiply the amount on line 2e by the percentage on line 2d 21 $ 29 Add lines 2c and 21 29 5 2h Divide the amount on line 2g by the number of pay periods on line 1b. This is the Tentative Withholding Amount Account for tax credits 3a If the employee's Form W-4 is from 2020, enter the amount from Stop 3 of that form; otherwise enter.o. 3a $ 3b Divide the amount on line 3a by the number of pay periods on line 1b 3b $ 30 Subtract line 3b from line 2h. zero or less, enter-O. Figure the final amount to withhold 4a Enter the additional amount to withhold from the employee's Form W-4 (Step 4(c) of the 2020 form or line 6 on earlier forms) 40 $ 4b Add lines 3c and 4a. This is the amount to withhold from the employee's wages this pay period 4b 2h $ Step 3. $0.00 $0.00 $ Step 4. $0.00 Problem 4 Problem 5 Rubric hp 91F Sunny ^ 400) 1. Pe for A If you ha sheet be Works Percer 1 Company XYZ has a new employee that submitted form W-4 from 2020 2 He is married filing jointly and box 2 is not checked. The employer processes 3 payroll automatically and he has paycheck of $1,500 and is 4 paid semi-monthly Using the percentage 5 method, the worksheet, and the correct table calculate the employee's federal 6 withholding tax for each pay check. 7 8 ***Enter the pay information into the highlighted cells next to the worksheet 9 10 11 12 13 14 15 16 17 18 19 Step 20 21 22 23 34 Instructions Problem 1 Problem 2 Problem 3 Problem 4 Ready Problem Type here to search w General 47 0 - 2 Wrap Text E B Merge & Center Insert Delete Format 8-98 $ % Conditional Format as Cell Formatting Table Styles Styles Sort & Find & Filter - Select- Editing An D Alignment Number Cells An H 1 L cesses J K M N o R to figure federal income tax withholding. This method 1. Percentage Method Tables works for Forms W-4 from 2019 or earlier and Forms W-4 from 2020 or later. This method also works for any amount for Automated Payroll Systems of wages. If the Form W-4 is from 2019 or ealier, this method works for any number of withholding allowances claimed If you have an automated payroll system, use the work. sheet below and the Percentage Method tables that follow Worksheet 1. Employer's Withholding Worksheet for Percentage Method Tables for Automated Payroll Systems Keep for Your Records s federal ksheet Weekly Tables Semiannually Quarterly Monthly 12 Semimonthly Blweekly 24 20 Daily 200 Enter the pa 16 1e5 1d5 le 5 Step 1. Adjust the employee's wage amount 1a Enter the employees total taxable wages is payroll penod 10 Enter the number of pay periods you have per year(see Table 3) 1 Multiply the amount online la by the number on line 16 of the employee HAS submitted a For W 412020 or later, gure the Adjusted Annual Wage Amount as follow 1d Enter the amount from Step 4/4) of the employees Form W:4 to Add lines and d 11 Enter the amount from Sto4(b) of the employees Form W 4 10 boxi Step 2 of For W 4 chached enter of the box is not checked, enter 512.00 the taxpayer is mariedaing joy or $4,600 erwise Add and tu 1 Subtractineth from line to 2010 or lantero This is the Adjusted Annual Wage Amount theploy HAS NOT be a Form W-4 for 2000 tour the Adjusted Ara Wage Amount Enter the number of owned on the play cos most recent Form 1. Myline by S4300 Problem Problem 5 Rubric $1,500.00 24 $36,000.00 $0.00 $36,000.00 $0.00 $12,900.00 $12,900.00 $23,100.00 to 5 th 15 ht Number Styles R T M N Topy Toy 11 Subtract line 1k from line 10. If zero or less, enter-O. This is the Adjusted Annual Wage Amount Step 2 $23,100.00 Figure the Tentative Withholding Amount based on the employee's Adjusted Annual Wage Amount:filing status (Stop 1(c) of the 2020 Form W-4) or marital status (line 3 of Form W-4 from 2019 or earlier and whether the box in Step 2 of 2020 Form W-4 is checked. Note. Don't use the Head of Household table if the Form W-4 is from 2019 or earlier. 2a Enter the employee's Adjusted Annual Wage Amount from line 11 or 11 above 2a $ 2b Find the row in the appropriate Annual Percentage Mothod table in which the amount on line 2a is at least the amount in column A but less than the amount in column B, then enter here the amount from column A of that row 2b s 20 Enter the amount from column C of that row 20$ 2d Enter the percentage from column Dol that row 2d 20 Subtract line 2b from line 2a 2e $ 21 Multiply the amount on line 2e by the percentage on line 2d 21 $ 29 Add lines 2c and 21 29 5 2h Divide the amount on line 2g by the number of pay periods on line 1b. This is the Tentative Withholding Amount Account for tax credits 3a If the employee's Form W-4 is from 2020, enter the amount from Stop 3 of that form; otherwise enter.o. 3a $ 3b Divide the amount on line 3a by the number of pay periods on line 1b 3b $ 30 Subtract line 3b from line 2h. zero or less, enter-O. Figure the final amount to withhold 4a Enter the additional amount to withhold from the employee's Form W-4 (Step 4(c) of the 2020 form or line 6 on earlier forms) 40 $ 4b Add lines 3c and 4a. This is the amount to withhold from the employee's wages this pay period 4b 2h $ Step 3. $0.00 $0.00 $ Step 4. $0.00 Problem 4 Problem 5 Rubric hp 91F Sunny ^ 400)