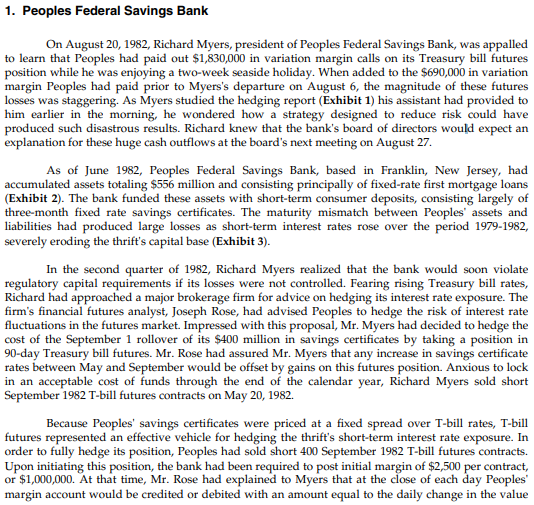

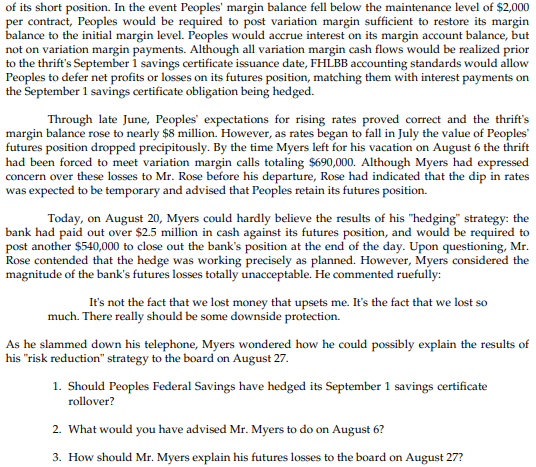

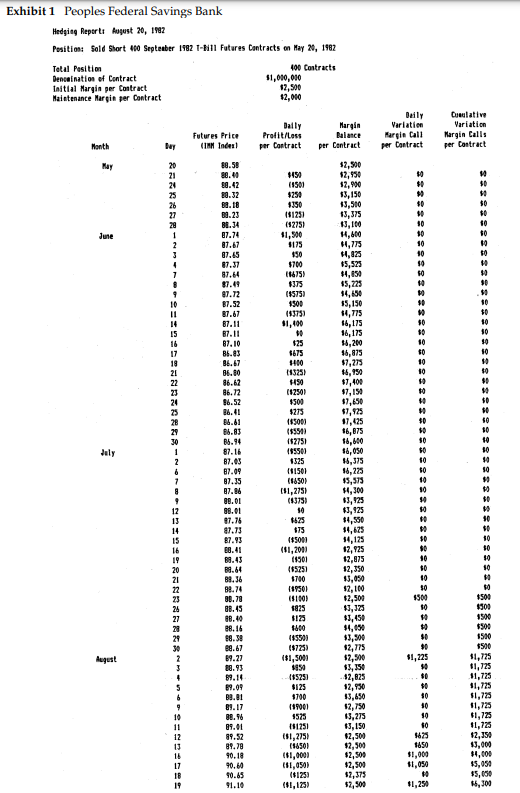

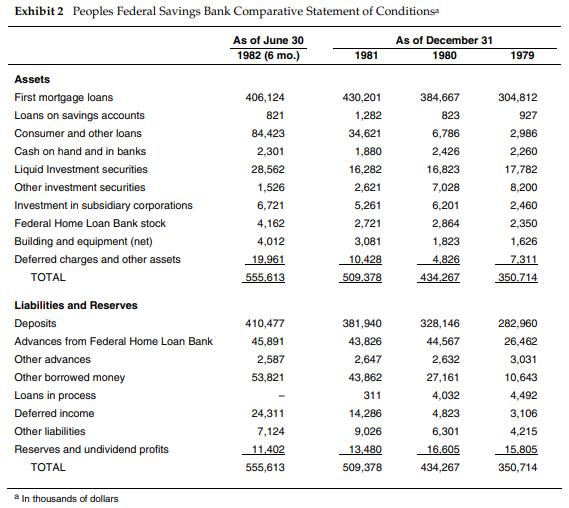

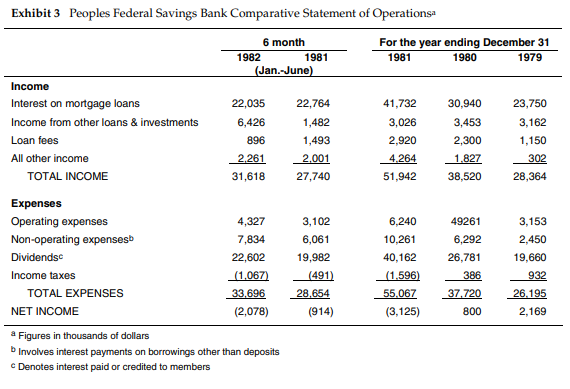

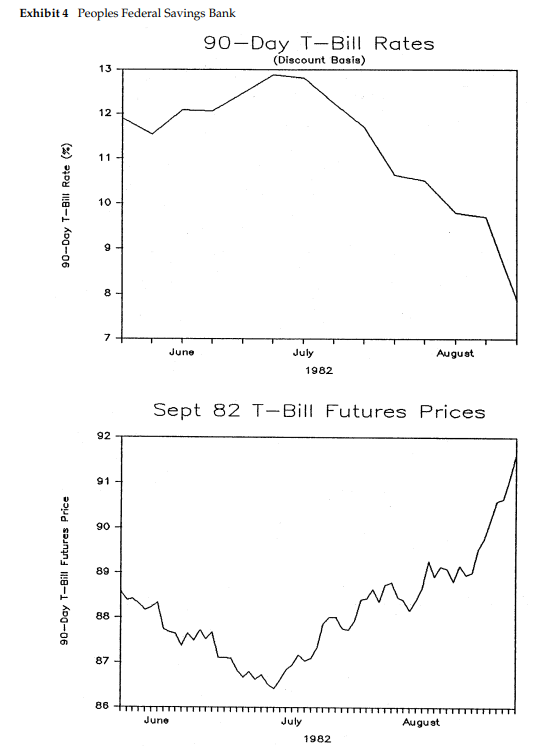

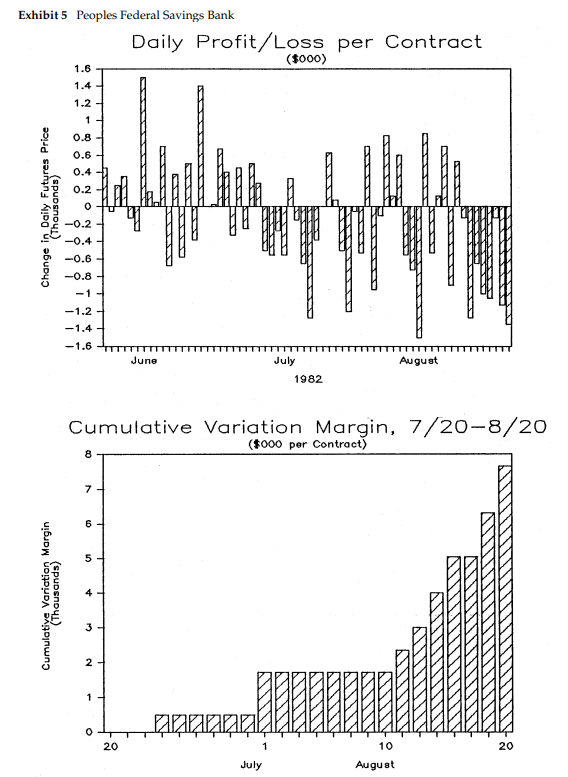

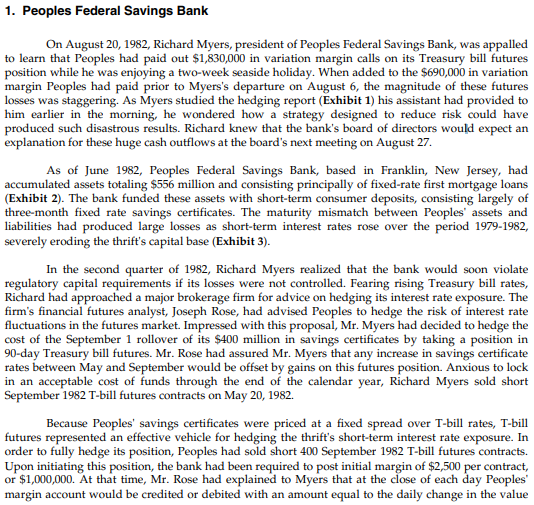

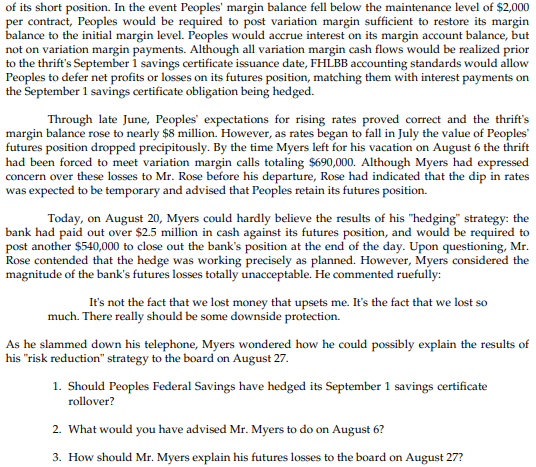

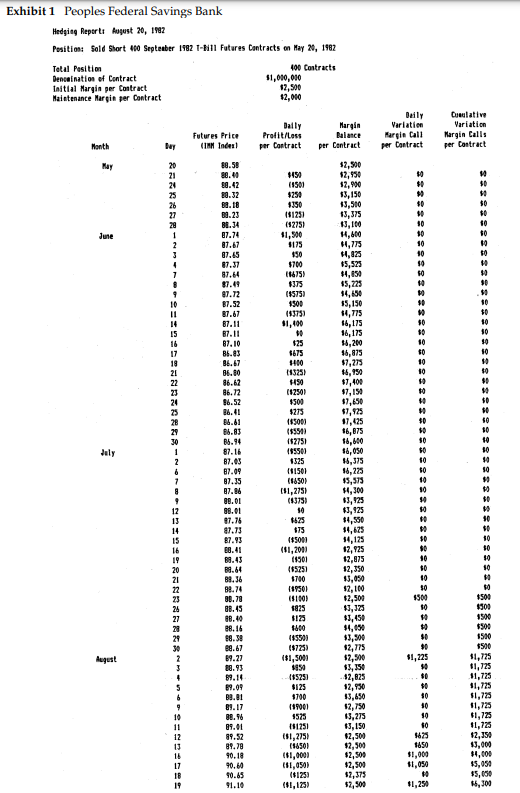

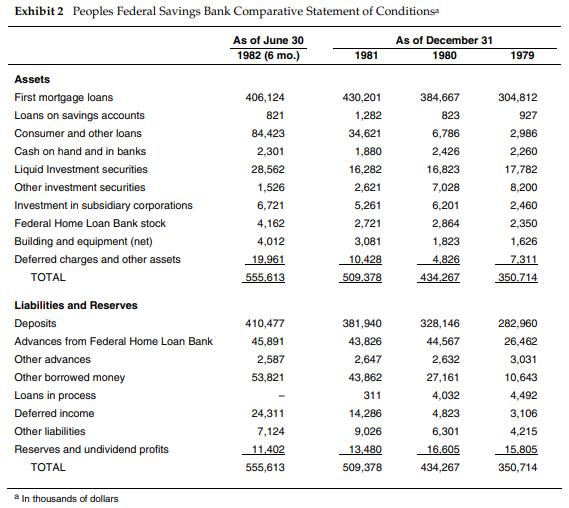

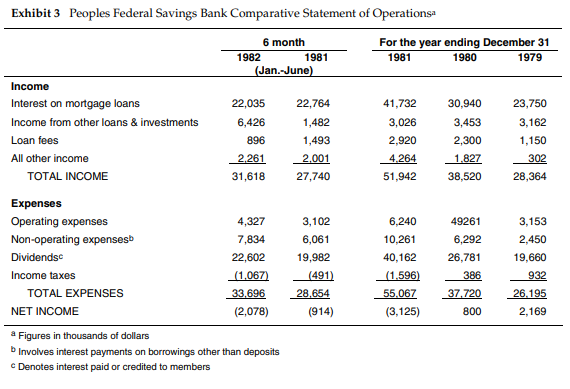

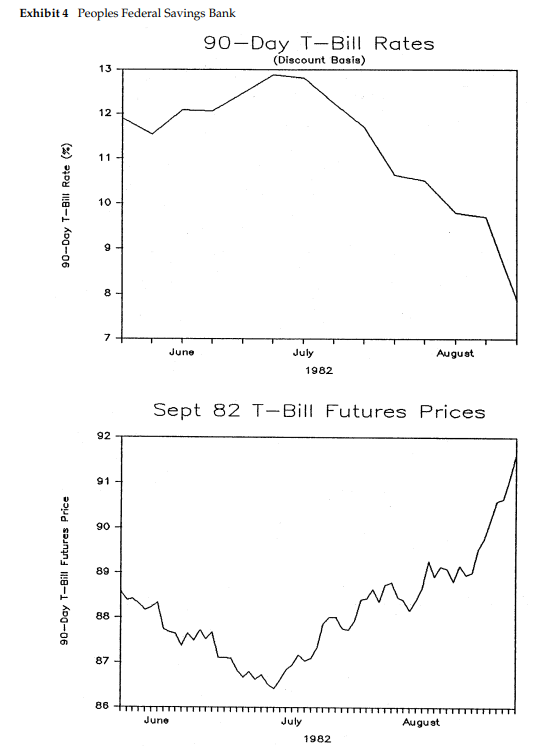

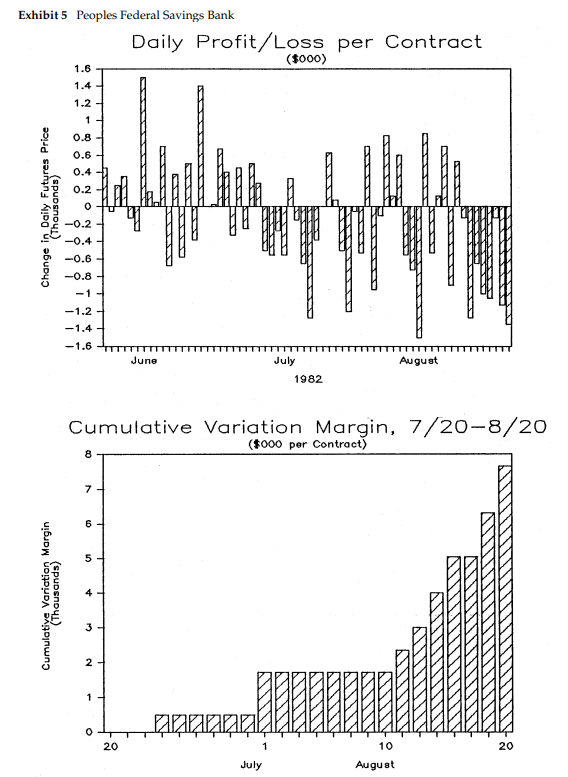

1. Peoples Federal Savings Bank On August 20, 1982, Richard Myers, president of Peoples Federal Savings Bank, was appalled to learn that Peoples had paid out $1,830,000 in variation margin calls on its Treasury bill futures position while he was enjoying a two-week seaside holiday. When added to the $690,000 in variation margin Peoples had paid prior to Myers's departure on August 6, the magnitude of these futures losses was staggering. As Myers studied the hedging report (Exhibit 1) his assistant had provided to him earlier in the morning, he wondered how a strategy designed to reduce risk could have produced such disastrous results. Richard knew that the bank's board of directors would expect an explanation for these huge cash outflows at the board's next meeting on August 27. As of June 1982, Peoples Federal Savings Bank, based in Franklin, New Jersey, had accumulated assets totaling $556 million and consisting principally of fixed-rate first mortgage loans (Exhibit 2). The bank funded these assets with short-term consumer deposits, consisting largely of three-month fixed rate savings certificates. The maturity mismatch between Peoples' assets and liabilities had produced large losses as short-term interest rates rose over the period 1979-1982, severely eroding the thrift's capital base (Exhibit 3). In the second quarter of 1982, Richard Myers realized that the bank would soon violate regulatory capital requirements if its losses were not controlled. Fearing rising Treasury bill rates, Richard had approached a major brokerage firm for advice on hedging its interest rate exposure. The firm's financial futures analyst, Joseph Rose, had advised Peoples to hedge the risk of interest rate fluctuations in the futures market. Impressed with this proposal, Mr. Myers had decided to hedge the cost of the September 1 rollover of its $400 million in savings certificates by taking a position in 90-day Treasury bill futures. Mr. Rose had assured Mr. Myers that any increase in savings certificate rates between May and September would be offset by gains on this futures position. Anxious to lock in an acceptable cost of funds through the end of the calendar year, Richard Myers sold short September 1982 T-bill futures contracts on May 20, 1982. Because Peoples' savings certificates were priced at a fixed spread over T-bill rates, T-bill futures represented an effective vehicle for hedging the thrift's short-term interest rate exposure. In order to fully hedge its position, Peoples had sold short 400 September 1982 T-bill futures contracts. Upon initiating this position, the bank had been required to post initial margin of $2,500 per contract, or $1,000,000. At that time, Mr. Rose had explained to Myers that at the close of each day Peoples' margin account would be credited or debited with an amount equal to the daily change in the value of its short position. In the event Peoples' margin balance fell below the maintenance level of $2,000 per contract, Peoples would be required to post variation margin sufficient to restore its margin balance to the initial margin level. Peoples would accrue interest on its margin account balance, but not on variation margin payments. Although all variation margin cash flows would be realized prior to the thrift's September 1 savings certificate issuance date, FHLBB accounting standards would allow Peoples to defer net profits or losses on its futures position, matching them with interest payments on the September 1 savings certificate obligation being hedged. Through late June, Peoples' expectations for rising rates proved correct and the thrift's margin balance rose to nearly $8 million. However, as rates began to fall in July the value of Peoples' futures position dropped precipitously. By the time Myers left for his vacation on August 6 the thrift had been forced to meet variation margin calls totaling $690,000. Although Myers had expressed concern over these losses to Mr. Rose before his departure, Rose had indicated that the dip in rates was expected to be temporary and advised that Peoples retain its futures position. Today, on August 20, Myers could hardly believe the results of his "hedging" strategy: the bank had paid out over $2.5 million in cash against its futures position, and would be required to post another $540,000 to close out the bank's position at the end of the day. Upon questioning, Mr. Rose contended that the hedge was working precisely as planned. However, Myers considered the magnitude of the bank's futures losses totally unacceptable. He commented ruefully: It's not the fact that we lost money that upsets me. It's the fact that we lost so much. There really should be some downside protection. As he slammed down his telephone, Myers wondered how he could possibly explain the results of his "risk reduction" strategy to the board on August 27. 1. Should Peoples Federal Savings have hedged its September 1 savings certificate rollover? 2. What would you have advised Mr. Myers to do on August 6? 3. How should Mr. Myers explain his futures losses to the board on August 27? Exhibit 1 Peoples Federal Savings Bank Hedging Reports August 20, 1982 Position: Sold Short 400 Septeuber 1982 T-kill Futures Contracts on May 26, 1982 Total Position 400 Contracts Dencination of Contract $1,000,000 Initial Margin per Contract Maintenance Margin per contract $2,000 17,500 Daily Variation Futures Price (I Indust Daily Profit/Less per Contract Hargin Balance per Contract Culative Variation Margin Calls per Contract Hargle Call per Contract Month Bay $150 05 05 20 21 24 25 26 68.50 88.41 88.42 38.32 1958) H%=Bw $0 $ 0$ 04 $2,500 $2,50 12,980 $3,150 13,510 13,375 13,160 H,400 4,775 $250 $350 ($1251 (12751 1,500 $0 0$ 05 June 1 $0 SLIS 08 $0 10 10 $0 3 $50 $700 Sze's 60 10 7 (52911 80.23 BR.34 87.74 87.67 87.65 87.37 87.44 87.49 87.72 37.52 87.67 07.11 87.11 B7.10 $5,523 $1,050 $5,723 0 0$ 0 05 06 $375 ($5751 1500 90 10 10 40 11 (526) 0 0 0$ 0$ 0$ 05 14 15 16 17 19 10 05 18-98 09 10 10 08 15,150 11.775 66,175 16,175 16,200 16,875 $7,275 16,150 $7,400 $7,150 19,650 $7,925 17,425 $6,075 $6,600 86.67 B6.10 86.62 86.72 $6.52 36.41 36.61 05 05 0$ $1,400 20 125 6675 5400 153251 H90 (12501 $500 $275 185001 ($5511 152751 ( $325 051501 186501 151,2751 (93750 M $0 $0 $ OS 1898 $0 $0 $0 $0 30 19 Joly B6.94 87.16 87.05 COSSS) oso'98 01 05 09 6028 50 50 10 7 8 87.JS 87.86 15,375 16,275 $5,573 1,300 $5,125 $3,125 08 05 10'88 90 05 $0 12 13 14 15 88.01 47.78 87.73 87.93 18.41 $ $0 4525 $75 ($5001 (11,2011 19501 (55251 $700 30 $0 10 50 91 ) 10 0 05 19 20 21 22 23 26 05 05 04 05 DOS$ 105861 (00133 SZBS $0 $500 $0 28 29 05 0$ 0$ qmumumma - us it sUmmmmmm. $1,625 14,125 12,925 12,875 12,350 13,050 12,100 $2,500 43,123 $1,450 $4,050 $3,500 12,775 $2,500 $5,350 2,825 12,950 13,650 12,750 83,150 $2,500 August 20.64 89.36 89.74 88.79 88.45 88.40 28.16 $8.50 89.67 89.21 18.93 89.14 89.09 B9.81 89.17 88.16 89.01 89.52 89.78 90.18 90.60 90.65 91.10 $1,225 $123 $800 (55301 ($725) ($1,5001 1950 $ $125 $700 (19001 ISZS) $0 5 6 $ $500 1500 $300 5580 1500 $1,725 $1,725 11,728 11,725 $1,775 11,725 61,728 $1,728 $2,50 13,000 $4,000 $5,950 $5,000 56,300 9 SESS SLZ'S 10 11 12 13 16 151251 191,2751 148501 $0 10 10 0 4628 $650 $1,000 11,050 10 $1,250 $2,500 111,0501 ($1253 (41,175 $2,500 $2,500 17,375 $2,500 Exhibit 2 Peoples Federal Savings Bank Comparative Statement of Conditions- As of June 30 As of December 31 1982 (6 mo.) 1981 1980 1979 Assets First mortgage loans 406,124 430,201 384,667 304,812 Loans on savings accounts 821 1,282 823 927 Consumer and other loans 84,423 34,621 6,786 2,986 Cash on hand and in banks 2,301 1,880 2,426 2,260 Liquid Investment securities 28,562 16,282 16,823 17,782 Other investment securities 1,526 2,621 7,028 8,200 Investment in subsidiary corporations 6,721 5,261 6,201 2,460 Federal Home Loan Bank stock 4,162 2,721 2,864 2,350 Building and equipment (net) 4,012 3,081 1,823 1,626 Deferred charges and other assets 19.961 10.428 4,826 7.311 TOTAL 555,613 509,378 434,267 350.714 410,477 45,891 2,587 53,821 381,940 43,826 2,647 328,146 44,567 2,632 43,862 Liabilities and Reserves Deposits Advances from Federal Home Loan Bank Other advances Other borrowed money Loans in process Deferred income Other liabilities Reserves and undividend profits TOTAL 311 14,286 9,026 13.480 509,378 24,311 7,124 11.402 282,960 26,462 3,031 10,643 4,492 3,106 4,215 15.805 350,714 27,161 4,032 4,823 6,301 16.605 434,267 555,613 & in thousands of dollars Exhibit 3 Peoples Federal Savings Bank Comparative Statement of Operationsa 6 month 1982 1981 (Jan-June) For the year ending December 31 1981 1980 1979 22,035 22,764 41,732 Income Interest on mortgage loans Income from other loans & investments Loan fees All other income TOTAL INCOME 6,426 896 2.261 31,618 1,482 1,493 2.001 27,740 3,026 2,920 4.264 51,942 30,940 3,453 2,300 1.827 38,520 23,750 3,162 1,150 302 28,364 3,153 3,102 6,061 19,982 (491) 28,654 (914) Expenses Operating expenses 4,327 Non-operating expenses 7.834 Dividendse 22,602 Income taxes (1,067) TOTAL EXPENSES 33,696 NET INCOME (2,078) Figures in thousands of dollars Involves interest payments on borrowings other than deposits Denotes interest paid or credited to members 6,240 10,261 40,162 (1.596) 55 067 (3,125) 49261 6,292 26,781 386 2,450 19,660 932 37.720 800 26.195 2,169 Exhibit 4 Peoples Federal Savings Bank 90-Day T-Bill Rates (Discount Basis) 13 12 11 - 90-Day T-Bill Rate) 10 -1 9 8 8 7 June July 1982 August Sept 82 T-Bill Futures Prices 92 91 90 90-Day T-Bill Futures Price 89 88 87 86 June July 1982 August Exhibit 5 Peoples Federal Savings Bank Daily Profit/Loss per Contract (4000) 1.6 1.4 - 1.2 1 0.8 - 0.6 0.4 OSU SO KO 0.2 Change in Daily Futures Price (Thousands) L SEL -0.2 -0.4 - -0.6 - NEN PE -0.8 - -1- -1.2- -1.4- -1.6 TTTTTTTT June CLONE August July 1982 Cumulative Variation Margin, 7/20-8/20 ($000 per Contract) 8 7 - 6 5 Margin (Thousands) 4 - 4 3 3 Cumulative 2 2 1 parama O 20 20 10 August July 1. Peoples Federal Savings Bank On August 20, 1982, Richard Myers, president of Peoples Federal Savings Bank, was appalled to learn that Peoples had paid out $1,830,000 in variation margin calls on its Treasury bill futures position while he was enjoying a two-week seaside holiday. When added to the $690,000 in variation margin Peoples had paid prior to Myers's departure on August 6, the magnitude of these futures losses was staggering. As Myers studied the hedging report (Exhibit 1) his assistant had provided to him earlier in the morning, he wondered how a strategy designed to reduce risk could have produced such disastrous results. Richard knew that the bank's board of directors would expect an explanation for these huge cash outflows at the board's next meeting on August 27. As of June 1982, Peoples Federal Savings Bank, based in Franklin, New Jersey, had accumulated assets totaling $556 million and consisting principally of fixed-rate first mortgage loans (Exhibit 2). The bank funded these assets with short-term consumer deposits, consisting largely of three-month fixed rate savings certificates. The maturity mismatch between Peoples' assets and liabilities had produced large losses as short-term interest rates rose over the period 1979-1982, severely eroding the thrift's capital base (Exhibit 3). In the second quarter of 1982, Richard Myers realized that the bank would soon violate regulatory capital requirements if its losses were not controlled. Fearing rising Treasury bill rates, Richard had approached a major brokerage firm for advice on hedging its interest rate exposure. The firm's financial futures analyst, Joseph Rose, had advised Peoples to hedge the risk of interest rate fluctuations in the futures market. Impressed with this proposal, Mr. Myers had decided to hedge the cost of the September 1 rollover of its $400 million in savings certificates by taking a position in 90-day Treasury bill futures. Mr. Rose had assured Mr. Myers that any increase in savings certificate rates between May and September would be offset by gains on this futures position. Anxious to lock in an acceptable cost of funds through the end of the calendar year, Richard Myers sold short September 1982 T-bill futures contracts on May 20, 1982. Because Peoples' savings certificates were priced at a fixed spread over T-bill rates, T-bill futures represented an effective vehicle for hedging the thrift's short-term interest rate exposure. In order to fully hedge its position, Peoples had sold short 400 September 1982 T-bill futures contracts. Upon initiating this position, the bank had been required to post initial margin of $2,500 per contract, or $1,000,000. At that time, Mr. Rose had explained to Myers that at the close of each day Peoples' margin account would be credited or debited with an amount equal to the daily change in the value of its short position. In the event Peoples' margin balance fell below the maintenance level of $2,000 per contract, Peoples would be required to post variation margin sufficient to restore its margin balance to the initial margin level. Peoples would accrue interest on its margin account balance, but not on variation margin payments. Although all variation margin cash flows would be realized prior to the thrift's September 1 savings certificate issuance date, FHLBB accounting standards would allow Peoples to defer net profits or losses on its futures position, matching them with interest payments on the September 1 savings certificate obligation being hedged. Through late June, Peoples' expectations for rising rates proved correct and the thrift's margin balance rose to nearly $8 million. However, as rates began to fall in July the value of Peoples' futures position dropped precipitously. By the time Myers left for his vacation on August 6 the thrift had been forced to meet variation margin calls totaling $690,000. Although Myers had expressed concern over these losses to Mr. Rose before his departure, Rose had indicated that the dip in rates was expected to be temporary and advised that Peoples retain its futures position. Today, on August 20, Myers could hardly believe the results of his "hedging" strategy: the bank had paid out over $2.5 million in cash against its futures position, and would be required to post another $540,000 to close out the bank's position at the end of the day. Upon questioning, Mr. Rose contended that the hedge was working precisely as planned. However, Myers considered the magnitude of the bank's futures losses totally unacceptable. He commented ruefully: It's not the fact that we lost money that upsets me. It's the fact that we lost so much. There really should be some downside protection. As he slammed down his telephone, Myers wondered how he could possibly explain the results of his "risk reduction" strategy to the board on August 27. 1. Should Peoples Federal Savings have hedged its September 1 savings certificate rollover? 2. What would you have advised Mr. Myers to do on August 6? 3. How should Mr. Myers explain his futures losses to the board on August 27? Exhibit 1 Peoples Federal Savings Bank Hedging Reports August 20, 1982 Position: Sold Short 400 Septeuber 1982 T-kill Futures Contracts on May 26, 1982 Total Position 400 Contracts Dencination of Contract $1,000,000 Initial Margin per Contract Maintenance Margin per contract $2,000 17,500 Daily Variation Futures Price (I Indust Daily Profit/Less per Contract Hargin Balance per Contract Culative Variation Margin Calls per Contract Hargle Call per Contract Month Bay $150 05 05 20 21 24 25 26 68.50 88.41 88.42 38.32 1958) H%=Bw $0 $ 0$ 04 $2,500 $2,50 12,980 $3,150 13,510 13,375 13,160 H,400 4,775 $250 $350 ($1251 (12751 1,500 $0 0$ 05 June 1 $0 SLIS 08 $0 10 10 $0 3 $50 $700 Sze's 60 10 7 (52911 80.23 BR.34 87.74 87.67 87.65 87.37 87.44 87.49 87.72 37.52 87.67 07.11 87.11 B7.10 $5,523 $1,050 $5,723 0 0$ 0 05 06 $375 ($5751 1500 90 10 10 40 11 (526) 0 0 0$ 0$ 0$ 05 14 15 16 17 19 10 05 18-98 09 10 10 08 15,150 11.775 66,175 16,175 16,200 16,875 $7,275 16,150 $7,400 $7,150 19,650 $7,925 17,425 $6,075 $6,600 86.67 B6.10 86.62 86.72 $6.52 36.41 36.61 05 05 0$ $1,400 20 125 6675 5400 153251 H90 (12501 $500 $275 185001 ($5511 152751 ( $325 051501 186501 151,2751 (93750 M $0 $0 $ OS 1898 $0 $0 $0 $0 30 19 Joly B6.94 87.16 87.05 COSSS) oso'98 01 05 09 6028 50 50 10 7 8 87.JS 87.86 15,375 16,275 $5,573 1,300 $5,125 $3,125 08 05 10'88 90 05 $0 12 13 14 15 88.01 47.78 87.73 87.93 18.41 $ $0 4525 $75 ($5001 (11,2011 19501 (55251 $700 30 $0 10 50 91 ) 10 0 05 19 20 21 22 23 26 05 05 04 05 DOS$ 105861 (00133 SZBS $0 $500 $0 28 29 05 0$ 0$ qmumumma - us it sUmmmmmm. $1,625 14,125 12,925 12,875 12,350 13,050 12,100 $2,500 43,123 $1,450 $4,050 $3,500 12,775 $2,500 $5,350 2,825 12,950 13,650 12,750 83,150 $2,500 August 20.64 89.36 89.74 88.79 88.45 88.40 28.16 $8.50 89.67 89.21 18.93 89.14 89.09 B9.81 89.17 88.16 89.01 89.52 89.78 90.18 90.60 90.65 91.10 $1,225 $123 $800 (55301 ($725) ($1,5001 1950 $ $125 $700 (19001 ISZS) $0 5 6 $ $500 1500 $300 5580 1500 $1,725 $1,725 11,728 11,725 $1,775 11,725 61,728 $1,728 $2,50 13,000 $4,000 $5,950 $5,000 56,300 9 SESS SLZ'S 10 11 12 13 16 151251 191,2751 148501 $0 10 10 0 4628 $650 $1,000 11,050 10 $1,250 $2,500 111,0501 ($1253 (41,175 $2,500 $2,500 17,375 $2,500 Exhibit 2 Peoples Federal Savings Bank Comparative Statement of Conditions- As of June 30 As of December 31 1982 (6 mo.) 1981 1980 1979 Assets First mortgage loans 406,124 430,201 384,667 304,812 Loans on savings accounts 821 1,282 823 927 Consumer and other loans 84,423 34,621 6,786 2,986 Cash on hand and in banks 2,301 1,880 2,426 2,260 Liquid Investment securities 28,562 16,282 16,823 17,782 Other investment securities 1,526 2,621 7,028 8,200 Investment in subsidiary corporations 6,721 5,261 6,201 2,460 Federal Home Loan Bank stock 4,162 2,721 2,864 2,350 Building and equipment (net) 4,012 3,081 1,823 1,626 Deferred charges and other assets 19.961 10.428 4,826 7.311 TOTAL 555,613 509,378 434,267 350.714 410,477 45,891 2,587 53,821 381,940 43,826 2,647 328,146 44,567 2,632 43,862 Liabilities and Reserves Deposits Advances from Federal Home Loan Bank Other advances Other borrowed money Loans in process Deferred income Other liabilities Reserves and undividend profits TOTAL 311 14,286 9,026 13.480 509,378 24,311 7,124 11.402 282,960 26,462 3,031 10,643 4,492 3,106 4,215 15.805 350,714 27,161 4,032 4,823 6,301 16.605 434,267 555,613 & in thousands of dollars Exhibit 3 Peoples Federal Savings Bank Comparative Statement of Operationsa 6 month 1982 1981 (Jan-June) For the year ending December 31 1981 1980 1979 22,035 22,764 41,732 Income Interest on mortgage loans Income from other loans & investments Loan fees All other income TOTAL INCOME 6,426 896 2.261 31,618 1,482 1,493 2.001 27,740 3,026 2,920 4.264 51,942 30,940 3,453 2,300 1.827 38,520 23,750 3,162 1,150 302 28,364 3,153 3,102 6,061 19,982 (491) 28,654 (914) Expenses Operating expenses 4,327 Non-operating expenses 7.834 Dividendse 22,602 Income taxes (1,067) TOTAL EXPENSES 33,696 NET INCOME (2,078) Figures in thousands of dollars Involves interest payments on borrowings other than deposits Denotes interest paid or credited to members 6,240 10,261 40,162 (1.596) 55 067 (3,125) 49261 6,292 26,781 386 2,450 19,660 932 37.720 800 26.195 2,169 Exhibit 4 Peoples Federal Savings Bank 90-Day T-Bill Rates (Discount Basis) 13 12 11 - 90-Day T-Bill Rate) 10 -1 9 8 8 7 June July 1982 August Sept 82 T-Bill Futures Prices 92 91 90 90-Day T-Bill Futures Price 89 88 87 86 June July 1982 August Exhibit 5 Peoples Federal Savings Bank Daily Profit/Loss per Contract (4000) 1.6 1.4 - 1.2 1 0.8 - 0.6 0.4 OSU SO KO 0.2 Change in Daily Futures Price (Thousands) L SEL -0.2 -0.4 - -0.6 - NEN PE -0.8 - -1- -1.2- -1.4- -1.6 TTTTTTTT June CLONE August July 1982 Cumulative Variation Margin, 7/20-8/20 ($000 per Contract) 8 7 - 6 5 Margin (Thousands) 4 - 4 3 3 Cumulative 2 2 1 parama O 20 20 10 August July