Answered step by step

Verified Expert Solution

Question

1 Approved Answer

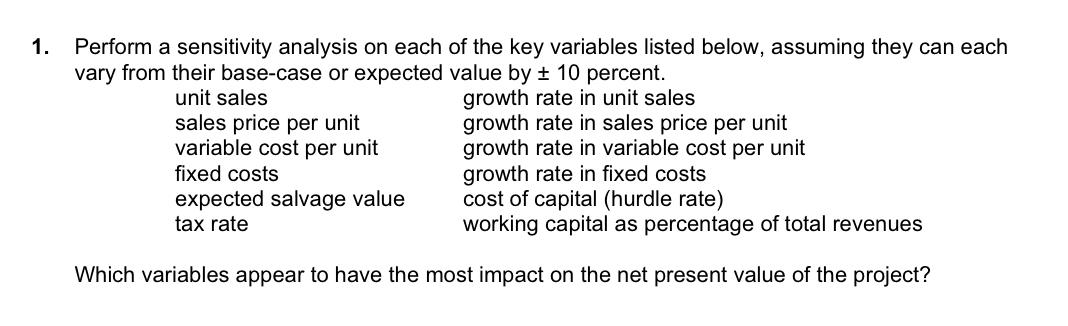

1. Perform a sensitivity analysis on each of the key variables listed below, assuming they can each vary from their base-case or expected value

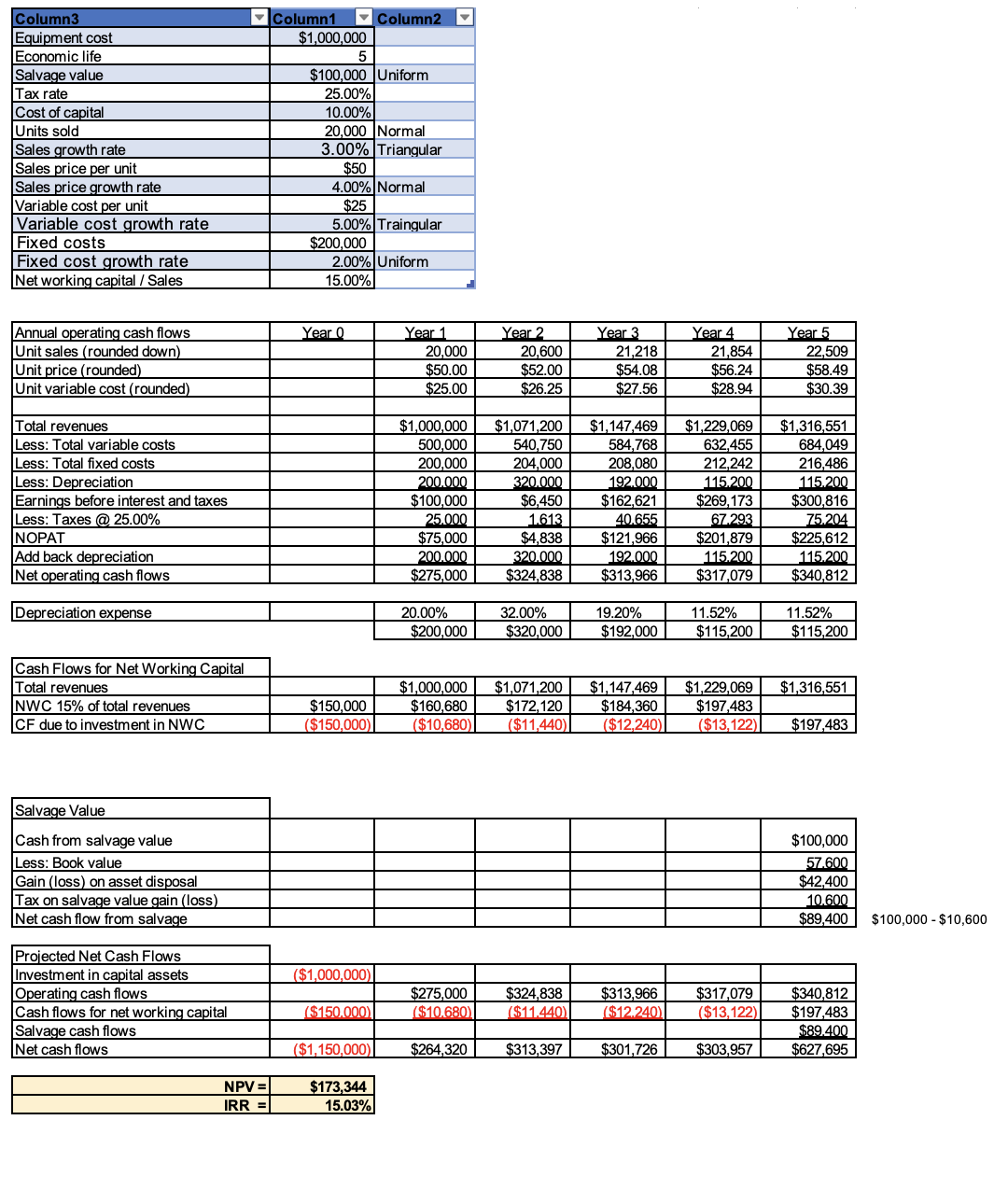

1. Perform a sensitivity analysis on each of the key variables listed below, assuming they can each vary from their base-case or expected value by 10 percent. unit sales growth rate in unit sales sales price per unit variable cost per unit fixed costs growth rate in sales price per unit growth rate in variable cost per unit growth rate in fixed costs expected salvage value tax rate cost of capital (hurdle rate) working capital as percentage of total revenues Which variables appear to have the most impact on the net present value of the project? Column3 Equipment cost Economic life Salvage value Tax rate Cost of capital Units sold Sales growth rate Sales price per unit Sales price growth rate Variable cost per unit Variable cost growth rate Fixed costs Fixed cost growth rate Net working capital / Sales Annual operating cash flows Unit sales (rounded down) Unit price (rounded) Unit variable cost (rounded) Total revenues Less: Total variable costs Less: Total fixed costs Less: Depreciation Earnings before interest and taxes Less: Taxes @ 25.00% NOPAT Add back depreciation Net operating cash flows Depreciation expense Cash Flows for Net Working Capital Total revenues NWC 15% of total revenues CF due to investment in NWC Salvage Value Cash from salvage value Less: Book value Gain (loss) on asset disposal Tax on salvage value gain (loss) Net cash flow from salvage Projected Net Cash Flows Investment in capital assets Operating cash flows Cash flows for net working capital Salvage cash flows Net cash flows NPV = IRR = Column1 $1,000,000 5 $100,000 Uniform 25.00% 10.00% 20,000 Normal 3.00% Triangular $50 4.00% Normal $25 5.00% Traingular $200,000 2.00% Uniform 15.00% Year 0 $150,000 ($150,000) ($1,000,000) Column2 ($150.000) ($1,150,000) $173,344 15.03% Year 1 20,000 $50.00 $25.00 200.000 $100,000 25.000 $75,000 200.000 $275,000 20.00% Year 2 $200,000 20,600 $52.00 $26.25 $1,000,000 $1,071,200 $1,147,469 $1,229,069 500,000 540,750 584,768 200,000 204,000 208,080 320.000 $6,450 1.613 $4,838 320.000 $324,838 32.00% $320,000 Year 3 21,218 $54.08 $27.56 $1,000,000 $160,680 $172,120 ($10,680) ($11,440) 192.000 $162,621 40.655 $121,966 192.000 $313,966 Year 4 19.20% $192,000 21,854 $56.24 $28.94 632,455 212,242 115.200 $269,173 67.293 $201,879 115.200 $317,079 11.52% $115,200 Year 5 $275,000 $324,838 $313,966 $317,079 ($10.680) ($11.440) ($12.240) ($13,122) $264,320 $313,397 $301,726 $303,957 22,509 $58.49 $30.39 $1,316,551 684,049 216,486 115.200 $300,816 75.204 $225,612 115.200 $340,812 $1,071,200 $1,147,469 $1,229,069 $1,316,551 $197,483 $184,360 ($12,240) ($13,122) $197,483 11.52% $115,200 $100,000 57.600 $42,400 10.600 $89,400 $340,812 $197,483 $89.400 $627,695 $100,000 - $10,600

Step by Step Solution

★★★★★

3.31 Rating (145 Votes )

There are 3 Steps involved in it

Step: 1

Here are the key variables that appear to have the most impact on the NPV of the project based on 10 ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started