Answered step by step

Verified Expert Solution

Question

1 Approved Answer

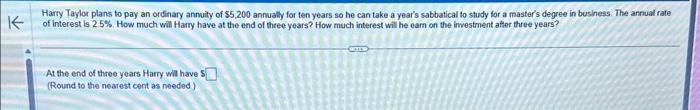

K Harry Taylor plans to pay an ordinary annuity of $5,200 annually for ten years so he can take a year's sabbatical to study

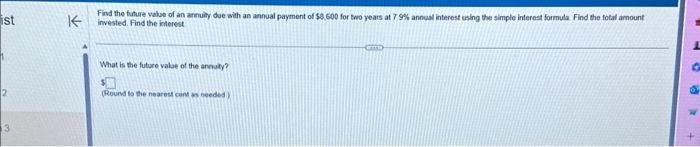

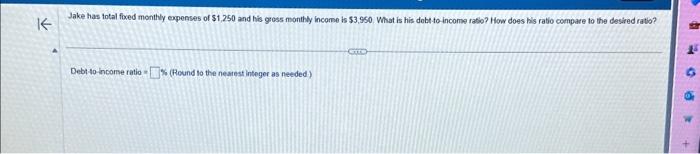

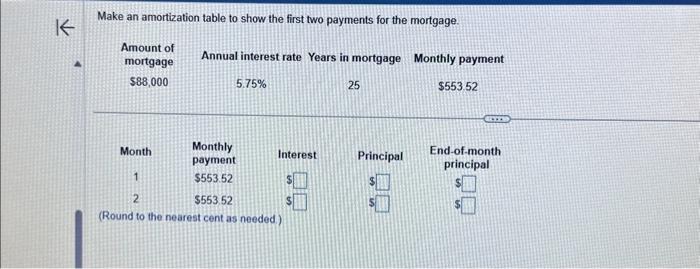

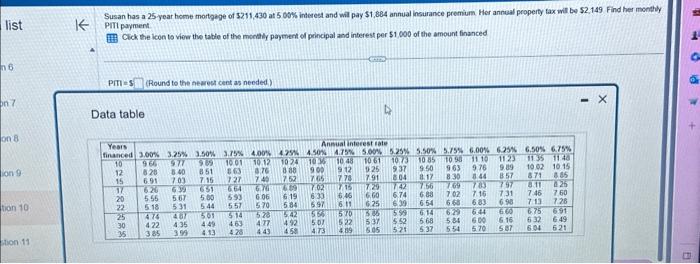

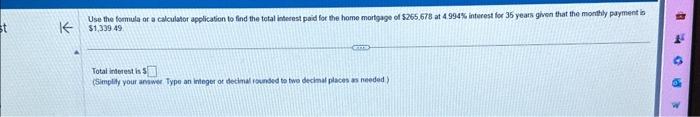

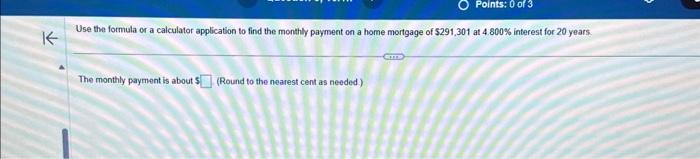

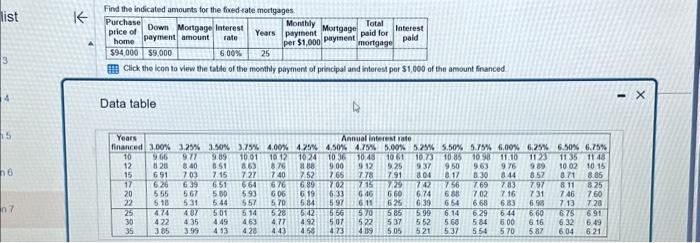

K Harry Taylor plans to pay an ordinary annuity of $5,200 annually for ten years so he can take a year's sabbatical to study for a master's degree in business. The annual rate of interest is 2.5%. How much will Harry have at the end of three years? How much interest will he eam on the investment after three years? At the end of three years Harry will have (Round to the nearest cent as needed) CHE ist 3 Find the future value of an annuity due with an annual payment of $3,600 for two years at 7.9% annual interest using the simple interest formula Find the total amount invested. Find the interest K What is the future value of the annuity? (Round to the nearest cent as needed) Jake has total fixed monthly expenses of $1,250 and his gross monthly income is $3,950. What is his debt-to-income ratio? How does his ratio compare to the desired ratio? K Debt-to-Income ratio-% (Round to the nearest integer as needed) S 4 K Make an amortization table to show the first two payments for the mortgage. Amount of mortgage $88,000 Annual interest rate Years in mortgage Monthly payment 5.75% Monthly payment $553.52 Month 1 2 $553.52 (Round to the nearest cent as needed.) Interest 25 Principal $553.52 RETER End-of-month principal list n6 on 7 on 8 on 9- tion 10 stion 11 Susan has a 25-year home mortgage of $211,430 at 5.00% interest and will pay $1,884 annual insurance premium. Her annual property tax will be $2,149 Find her monthly K Click the icon to view the table of the monthly payment of principal and interest per $1,000 of the amount financed PITI payment PITI S (Round to the nearest cent as needed.) Data table Years financed 3.00% 3.25% 3.50% 3.75% 4.00% 4.25% 1024 10.01 10.12 10 966 977 828 8.63 8.76 888 6.91 727 7.40 7.52 6.26 6.64 6.09 5.56 6:19 5:18 5.31 584 mWNEWNZ505 12 15 37 20 22 25 30 35 8.40 851 7.03 7.15 609 5.67 50.5 4:35 3.99 651 5.00 5:44 4.74 481 5.01 422 4:49 3.85 4.13 6.76 6.06 593 557 5.70 514 4.63 4.28 5.23 5,42 477 4.92 443 Annual interest rate 4.50% 4.75% 5.00% 10 36 10 48 10 61 9.00 912 925 7.65 7.78 7.91 7:02 7.15 7.29 6.46 6.60 6.11 6.25 6:33 6.97 999 501 4.73 570 522 4.09 D 5.85 5:37 6.05 5.25% 5.50% 5.75% 6.00 % 10 85 10 98 10.73 9.37 804 742 6.74 6:39 5.99 552 521 9.50 8.17 7.56 6.88 654 6.14 6.68 5:37 9.63 8.30 1.69 7.02 6.68 11.10 9.76 8:44 7.83 7.16 6.83 629 6.44 5.84 6.00 554 5.70 6.25 % 6.50% 6.75% 11.35 11:48 10.02 10.15 11:23 9.89 857 797 7.31 6.98 871 8.11 7.46 7:13 6.60 6.75 6.16 6:32 587 604 8.85 92.0 7.60 7.28 6.91 649 621 st K Use the formula or a calculator application to find the total interest paid for the home mortgage of $265.678 at 4.994% interest for 35 years given that the monthly payment is $1,339 49 Com Total interest is $ (Simplity your answer Type an integer or decimal rounded to two decimal places as needed) 044 Points: 0 of 3 Use the formula or a calculator application to find the monthly payment on a home mortgage of $291,301 at 4.800% interest for 20 years. K The monthly payment is about $ (Round to the nearest cent as needed.) CITTS list 3 4 15 6 n7 K Find the indicated amounts for the fixed-rate mortgages Purchase price of Monthly Down Mortgage Interest Years payment home payment amount rate $94,000 $9,000 6.00% 25 Click the icon to view the table of the monthly payment of principal and interest por $1,000 of the amount financed Data table FERNKRA Years Annual interest rate 10 9.66 12 820 6.50% 6.75% 11.35 11 48 10 02 10 15 8.71 8.85 811 7.46 6.91 7.03 financed 3.00% 3.25% 3.50% 3.75% 4.00% 4.25% 4.50% 4.75% 5.00% 5.25% 5.50% 5.75% 6.00% 6.25 % 9.77 9.09 10.01 10.12 1024 10.36 10.48 1061 10.73 10.85 10 98 11.10 1123 8:40 5.61 8.63 8.76 8.88 9.00 9.12 9.25 9.37 9.50 9.63 9.76 9.89 7.15 7.27 7.40 7.52 7.65 7.78 7.91 8.04 817 8.30 8.44 8.57 651 6.64 676 6.89 7.02 7.15 7.29 7.42 7.56 7.69 7.83 7.97 5.67 5.00 5.93 6.06 6.19 6.33 6.46 6.60 6,74 6.88 7.02 7.16 7.31 5.18 531 5.44 5.57 5.70 5.84 5:97 6.11 6.25 6.39 6.54 6.68 6.83 6.98 713 4.74 4.87 501 5.14 6.28 5:42 5.66 5.70 5.85 5.99 6.14 6.29 6.44 6.60 6.75 422 4.35 4.49 463 4.77 4.92 507 5.22 5:37 5.52 5.68 5.84 6.00 6.16 6.32 6.49 385 3.99 413 428 4:43 4:58 473 4 119 5.05 521 5.37 554 5.70 6.26 6.39 555 691 5.87 6:04 6.21 15 17 20 22 Total Mortgage Interest paid for per $1,000 payment mortgage paid 25 30 35 A 8.25 7.60 7:28

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Here are the stepbystep calculations for the questions 1 Harry plans to pay an ordinary annuity of 5200 annually for ten years so he can take a years ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started