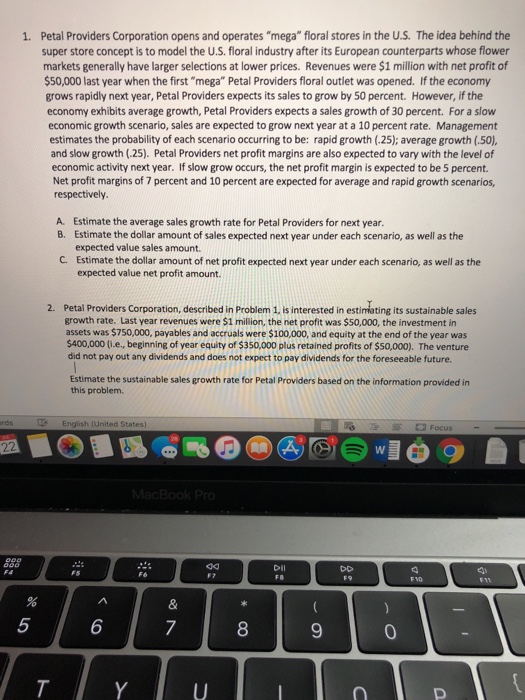

1. Petal Providers Corporation opens and operates "mega" floral stores in the U.S. The idea behind the super store concept is to model the U.S. floral industry after its European counterparts whose flower markets generally have larger selections at lower prices. Revenues were $1 million with net profit of $50,000 last year when the first "mega" Petal Providers floral outlet was opened. If the economy grows rapidly next year, Petal Providers expects its sales to grow by 50 percent. However, if the economy exhibits average growth, Petal Providers expects a sales growth of 30 percent. For a slow economic growth scenario, sales are expected to grow next year at a 10 percent rate. Management estimates the probability of each scenario occurring to be: rapid growth (.25); average growth (.50), and slow growth (25). Petal Providers net profit margins are also expected to vary with the level of economic activity next year. If slow grow occurs, the net profit margin is expected to be 5 percent. Net profit margins of 7 percent and 10 percent are expected for average and rapid growth scenarios, respectively A. Estimate the average sales growth rate for Petal Providers for next year B. Estimate the dollar amount of sales expected next year under each scenario, as well as the expected value sales amount. Estimate the dollar amount of net profit expected next year under each scenario, as well as the expected value net profit amount. C. 2. Petal Providers Corporation, described in Problem 1, is interested in estimating its sustainable sales growth rate. Last year revenues were $1 million, the net profit was $50,000, the investment in assets was $750,000, payables and accruals were $100,000, and equity at the end of the year was $400,000 (i.e., beginning of year equity of $350,000 plus retained profits of $50,000). The venture did not pay out any dividends and does not expect to pay dividends for the foreseeable future. Estimate the sustainable sales growth rate for Petal Providers based on the information provided in this problem. rds English (United States ao 5 6 8 9 0