Answered step by step

Verified Expert Solution

Question

1 Approved Answer

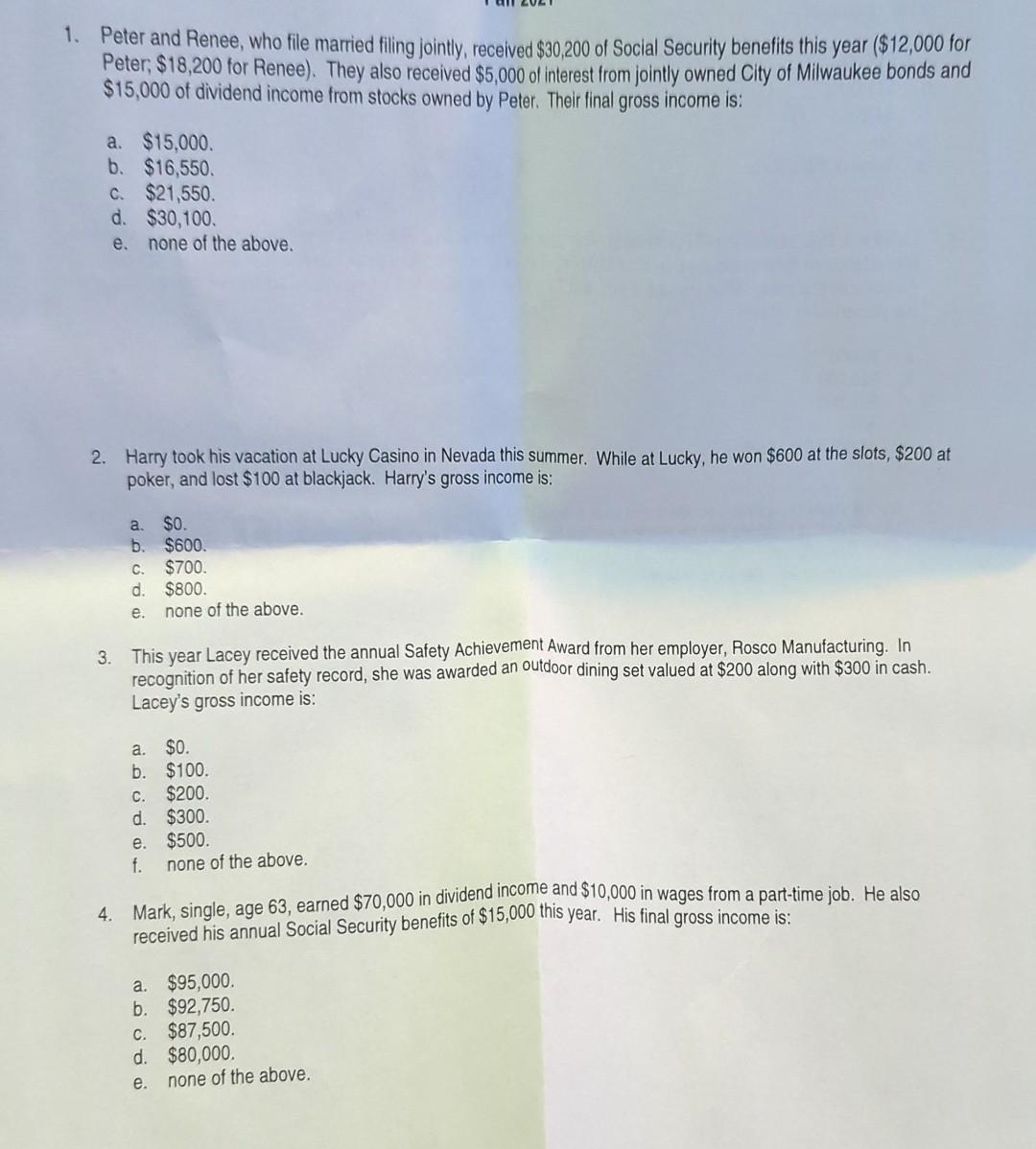

1. Peter and Renee, who file married filing jointly, received $30,200 of Social Security benefits this year ($12,000 for Peter: $18,200 for Renee). They also

1. Peter and Renee, who file married filing jointly, received $30,200 of Social Security benefits this year ($12,000 for Peter: $18,200 for Renee). They also received $5,000 of interest from jointly owned City of Milwaukee bonds and $15,000 of dividend income from stocks owned by Peter. Their final gross income is: a. $15,000 b. $16,550 C. $21,550. d. $30,100 e. none of the above. 2. Harry took his vacation at Lucky Casino in Nevada this summer. While at Lucky, he won $600 at the slots, $200 at poker, and lost $100 at blackjack. Harry's gross income is: a b. cu o da $0. $600 $700. $800. none of the above. . e. 3. This year Lacey received the annual Safety Achievement Award from her employer, Rosco Manufacturing. In recognition of her safety record, she was awarded an outdoor dining set valued at $200 along with $300 in cash. Lacey's gross income is: a. $0. b. $100. C. $200. d. $300 e. $500. f. none of the above 4. Mark, single, age 63, earned $70,000 in dividend income and $10,000 in wages from a part-time job. He also received his annual Social Security benefits of $15,000 this year. His final gross income is: a. $95,000 b. $92,750. C. $87,500. d. $80,000 e. none of the above

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started