Question

1. Phone Company is deciding whether or not to accept a contract to provide Service Company with 8,000 cell phones per month in addition to

1. Phone Company is deciding whether or not to accept a contract to provide Service Company with 8,000 cell phones per month in addition to Phone Co.s existing business. The contract would require Service Co. to pay Phone Co. for all manufacturing costs plus a fixed fee of $750,000 per month. Phone Co. would incur no variable selling costs related to this contract. By what amount would Phone Co.s monthly operating income increase or decrease as a result of accepting this contract? Assume that if Phone Co. accepts this contract, then it does not change the overhead allocation rate that it set at the beginning of the year. (5 points)

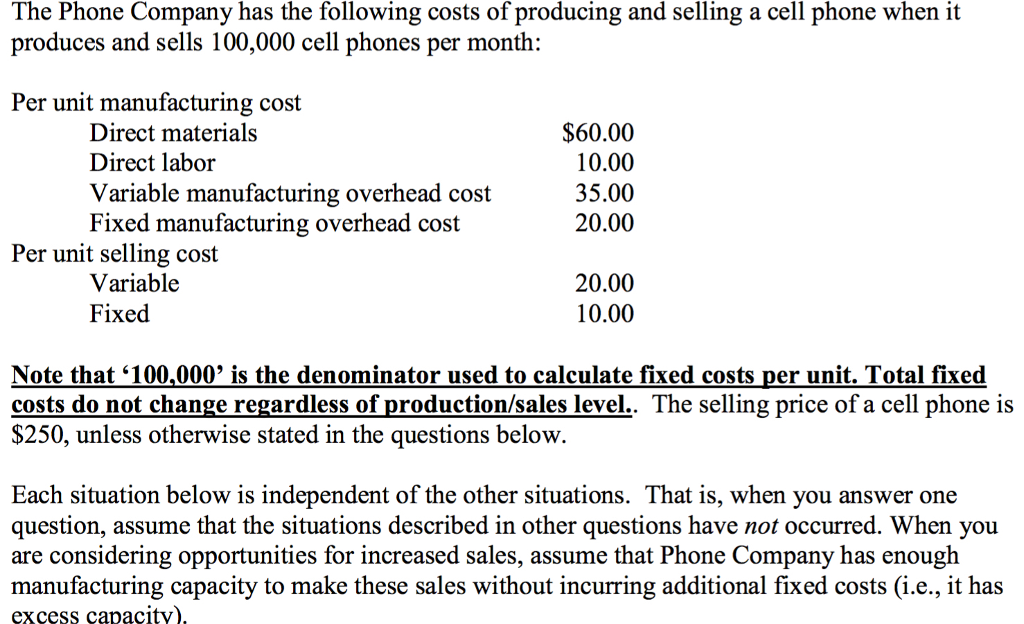

The Phone Company has the following costs of producing and selling a cell phone when it produces and sells 100,000 cell phones per month: Per unit manufacturing cost Direct materials Direct labor Variable manufacturing overhead cost Fixed manufacturing overhead cost $60.00 10.00 35.00 20.00 Per unit selling cost Variable Fixed 20.00 10.00 Note that 100.000, is the denominator used to calculate fixed costs per unit. Total fixed costs do not change regardless of production/sales level.. The selling price of a cell phone is $250, unless otherwise stated in the questions belovw Each situation below is independent of the other situations. That is, when you answer one question, assume that the situations described in other questions have not occurred. When you are considering opportunities for increased sales, assume that Phone Company has enough manufacturing capacity to make these sales without incurring additional fixed costs (i.e., it has excess capacitv)Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started