Question

1. Pickle Corp has 5,300,000 shares outstanding. If its stock is trading at $33.87, what is its market capitalization? ($) 2. Calculate the multiple of

1. Pickle Corp has 5,300,000 shares outstanding. If its stock is trading at $33.87, what is its market capitalization? ($)

2. Calculate the multiple of Pickle Corps market capitalization to its book value (balance sheet common equity). (x)

3. Calculate Pickle Corps Enterprise Value at 12/31/21. See the document in Classes, Enterprise Value in Content - Other Documents. ($)

4. Calculate Pickle Corps overall asset efficiency as we did in class per Chapter 2 Class Notes. ($)

5. Assess Pickle Corps working capital efficiency by calculating its:

a. Average accounts receivables collection period for 2021 (Days), and

b. Inventory turnover for 2021. (x)

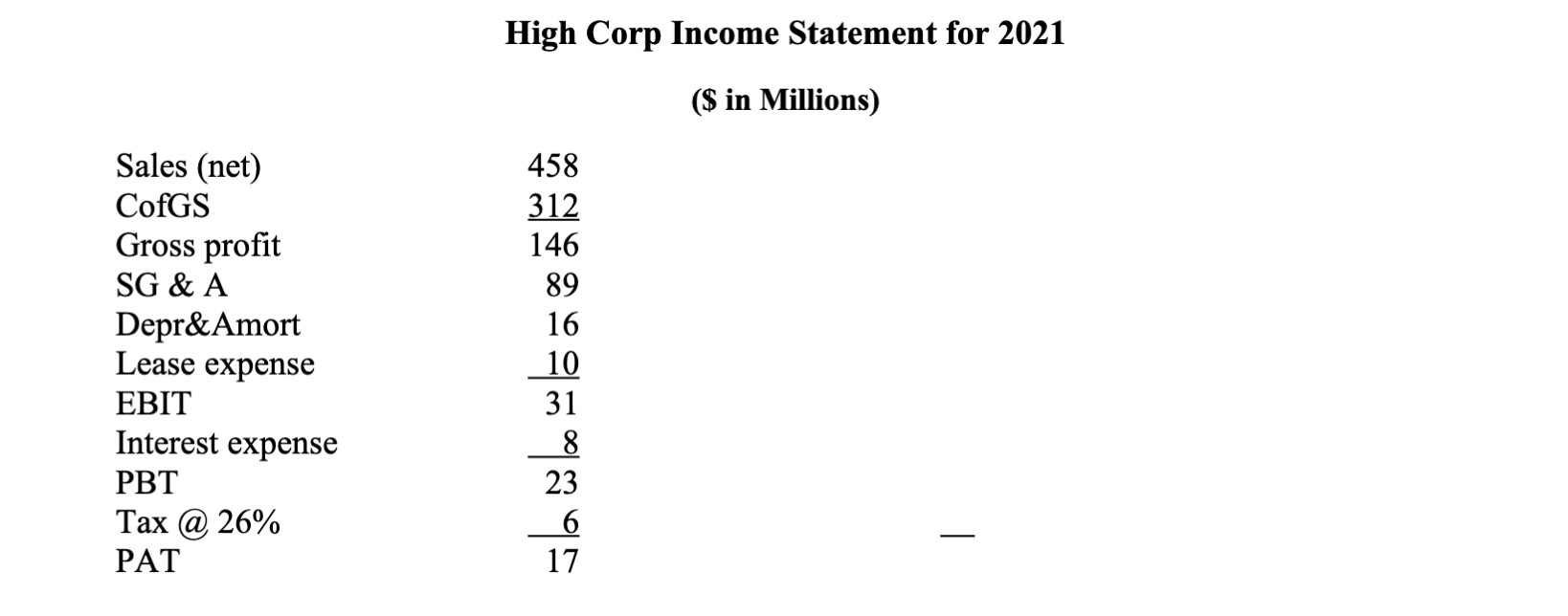

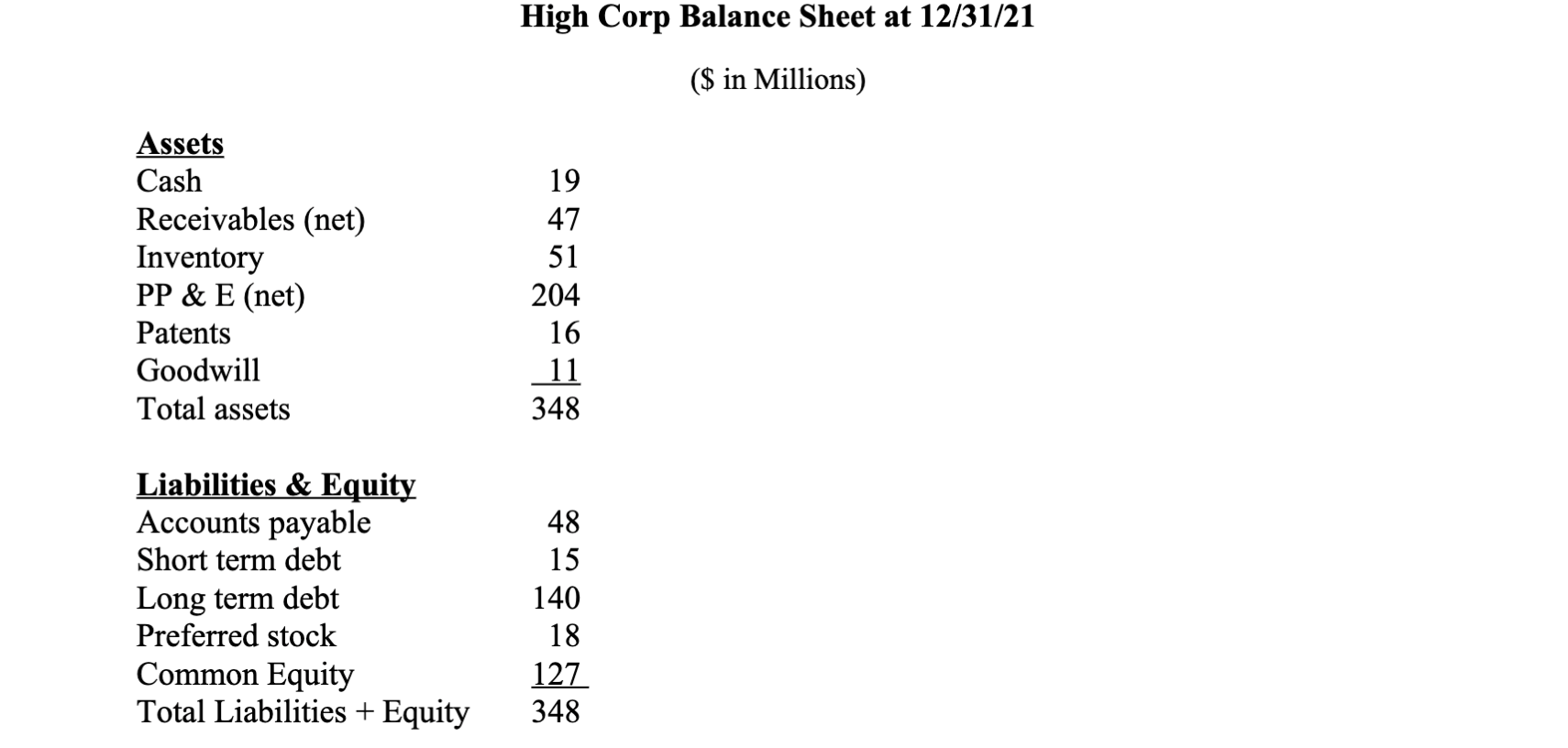

Hioh Corn Inenme Statement for 2021 High Corp Balance Sheet at 12/31/21 (\$ in Millions) AssetsCashReceivables(net)InventoryPP&E(net)PatentsGoodwillTotalassets1947512041611348 Liabilities \& Equity AccountspayableShorttermdebtLongtermdebtPreferredstockCommonEquityTotalLiabilities+Equity481514018127348 Hioh Corn Inenme Statement for 2021 High Corp Balance Sheet at 12/31/21 (\$ in Millions) AssetsCashReceivables(net)InventoryPP&E(net)PatentsGoodwillTotalassets1947512041611348 Liabilities \& Equity AccountspayableShorttermdebtLongtermdebtPreferredstockCommonEquityTotalLiabilities+Equity481514018127348

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started