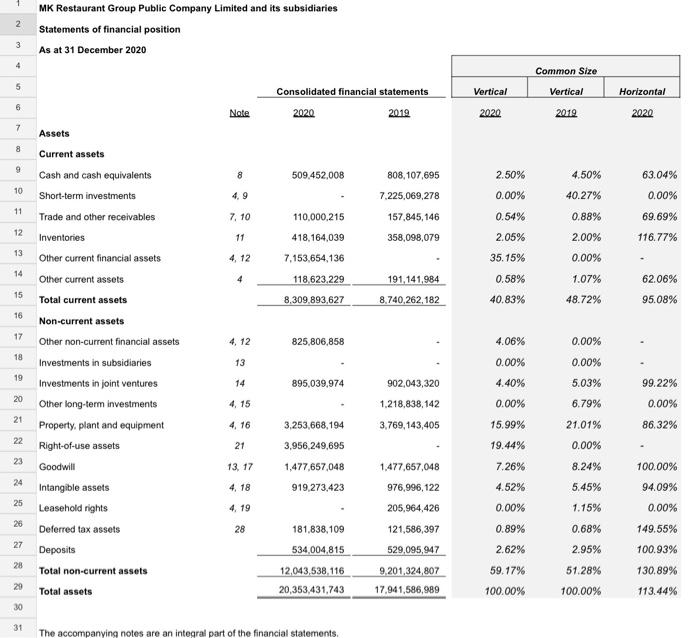

1. Please calculate ROE (Return on Equity) for MK Restaurant Group Public Company Limited and its subsidiaries for the year 2020 and 2019 and use DuPont Analysis to separate ROE into three elements in order to comment on the companys effectiveness in Operational management, Investment management, and Financing decision. To add to your analysis, you may calculate some alternative ratio that you think useful.

2. What is operating cycle? Why managing operating cycle is crucial to a company? Calculate operating cycle of MK Restaurant Group Public Company Limited and its subsidiaries and use the figure to justify your answer

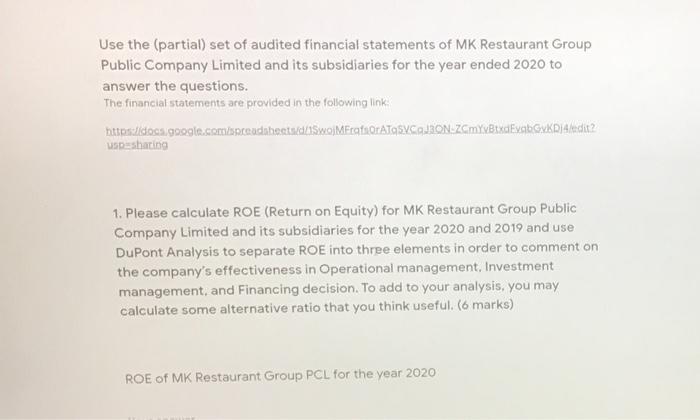

Use the (partial) set of audited financial statements of MK Restaurant Group Public Company Limited and its subsidiaries for the year ended 2020 to answer the questions. The financial statements are provided in the following link: https://docs.google.com/socauda hoatud: 15w0)MEQAQATASYSGJION:ZmywBixdExbGxKD) Aled 2 usp=sharing 1. Please calculate ROE (Return on Equity) for MK Restaurant Group Public Company Limited and its subsidiaries for the year 2020 and 2019 and use DuPont Analysis to separate ROE into three elements in order to comment on the company's effectiveness in Operational management, Investment management, and Financing decision. To add to your analysis, you may calculate some alternative ratio that you think useful. (6 marks) ROE of MK Restaurant Group PCL for the year 2020 MK Restaurant Group Public Company Limited and its subsidiaries Statements of financial position 2 3 As at 31 December 2020 4 Common Size 5 Vertical Vertical Horizontal Consolidated financial statements 2020 2019 6 Note 2020 2019 2020 7 Assets 8 9 8 509.452,008 2.50% 4.50% 63.04% 808,107,695 7.225,069,278 10 4.9 0.00% 40.27% 0.00% 11 7. 10 110.000.215 157.845, 146 0.54% 0.88% 69.69% Current assets Cash and cash equivalents Short-term investments Trade and other receivables Inventories Other current financial assets Other current assets Total current assets 12 11 418,164,039 358,098,079 2.05% 2.00% 116.77% 13 4, 12 7,153,654,136 35.15% 0.00% 14 4 118,623.229 0.58% 1.07% 62.06% 191,141,984 8,740,262,182 15 8,309,893,627 40.83% 48.72% 95.08% 16 Non-current assets 17 4, 12 825,806,858 4.06% 0.00% 18 13 0.00% 19 0.00% 5.03% 14 895,039,974 4.40% 99.22% 20 4, 15 902,043,320 1.218,838,142 3,769,143,405 0.00% 6.79% 0.00% 21 4, 16 3,253,668,194 15.99% 21.01% 86.32% 22 21 3,956,249,695 19.44% 0.00% 23 Other non-current financial assets Investments in subsidiaries Investments in joint ventures Other long-term investments Property, plant and equipment Right-of-use assets Goodwill Intangible assets Leasehold rights Deferred tax assets Deposits Total non-current assets 13, 17 1,477,657,048 7.26% 8.24% 100.00% 24 4, 18 919,273,423 4.52% 5.45% 94.09% 25 1.477,657,048 976,996,122 205,964,426 121,586,397 4. 19 26 0.00% 0.89% 1.15% 0.68% 0.00% 149.55% 28 27 529,095,947 2.62% 2.95% 100.93% 181,838,109 534,004,815 12,043,538,116 20,353,431,743 28 9,201,324,807 59.17% 51.28% 130.89% 20 Total assets 17.941,586,989 100.00% 100.00% 113.44% 30 31 The accompanying notes are an integral part of the financial statements. 2. What is operating cycle? Why managing operating cycle is crucial to a company? Calculate operating cycle of MK Restaurant Group Public Company Limited and its subsidiaries and use the figure to justify your answer. (5 marks) Use the (partial) set of audited financial statements of MK Restaurant Group Public Company Limited and its subsidiaries for the year ended 2020 to answer the questions. The financial statements are provided in the following link: https://docs.google.com/socauda hoatud: 15w0)MEQAQATASYSGJION:ZmywBixdExbGxKD) Aled 2 usp=sharing 1. Please calculate ROE (Return on Equity) for MK Restaurant Group Public Company Limited and its subsidiaries for the year 2020 and 2019 and use DuPont Analysis to separate ROE into three elements in order to comment on the company's effectiveness in Operational management, Investment management, and Financing decision. To add to your analysis, you may calculate some alternative ratio that you think useful. (6 marks) ROE of MK Restaurant Group PCL for the year 2020 MK Restaurant Group Public Company Limited and its subsidiaries Statements of financial position 2 3 As at 31 December 2020 4 Common Size 5 Vertical Vertical Horizontal Consolidated financial statements 2020 2019 6 Note 2020 2019 2020 7 Assets 8 9 8 509.452,008 2.50% 4.50% 63.04% 808,107,695 7.225,069,278 10 4.9 0.00% 40.27% 0.00% 11 7. 10 110.000.215 157.845, 146 0.54% 0.88% 69.69% Current assets Cash and cash equivalents Short-term investments Trade and other receivables Inventories Other current financial assets Other current assets Total current assets 12 11 418,164,039 358,098,079 2.05% 2.00% 116.77% 13 4, 12 7,153,654,136 35.15% 0.00% 14 4 118,623.229 0.58% 1.07% 62.06% 191,141,984 8,740,262,182 15 8,309,893,627 40.83% 48.72% 95.08% 16 Non-current assets 17 4, 12 825,806,858 4.06% 0.00% 18 13 0.00% 19 0.00% 5.03% 14 895,039,974 4.40% 99.22% 20 4, 15 902,043,320 1.218,838,142 3,769,143,405 0.00% 6.79% 0.00% 21 4, 16 3,253,668,194 15.99% 21.01% 86.32% 22 21 3,956,249,695 19.44% 0.00% 23 Other non-current financial assets Investments in subsidiaries Investments in joint ventures Other long-term investments Property, plant and equipment Right-of-use assets Goodwill Intangible assets Leasehold rights Deferred tax assets Deposits Total non-current assets 13, 17 1,477,657,048 7.26% 8.24% 100.00% 24 4, 18 919,273,423 4.52% 5.45% 94.09% 25 1.477,657,048 976,996,122 205,964,426 121,586,397 4. 19 26 0.00% 0.89% 1.15% 0.68% 0.00% 149.55% 28 27 529,095,947 2.62% 2.95% 100.93% 181,838,109 534,004,815 12,043,538,116 20,353,431,743 28 9,201,324,807 59.17% 51.28% 130.89% 20 Total assets 17.941,586,989 100.00% 100.00% 113.44% 30 31 The accompanying notes are an integral part of the financial statements. 2. What is operating cycle? Why managing operating cycle is crucial to a company? Calculate operating cycle of MK Restaurant Group Public Company Limited and its subsidiaries and use the figure to justify your