Question

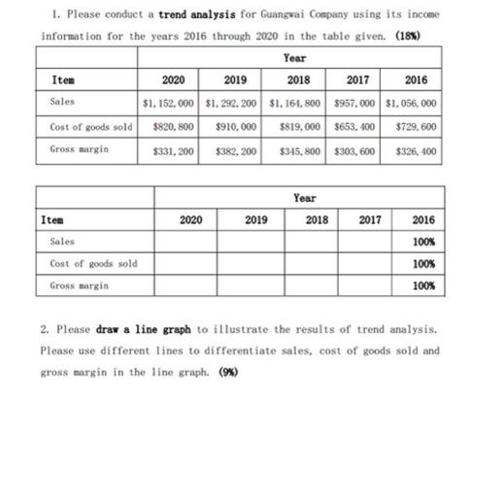

1. Please conduct a trend analysis for Guangwai Company using its income information for the years 2016 through 2020 in the table given. (18%)

1. Please conduct a trend analysis for Guangwai Company using its income information for the years 2016 through 2020 in the table given. (18%) Year 2019 2018 2017 $1.292, 200 $1. 164,800 $957,000 $910,000 $819,000 $653, 400 $345,800 $303,600 Item Sales Cost of goods sold Gross margin Item Sales Cost of goods sold Gross margin 2020 $1, 152,000 $820, 800 $331, 200 2020 $382, 200 2019 Year 2018 2017 2016 $1,056, 000 $729,600 $326, 400 2016 100% 100% 100% 2. Please draw a line graph to illustrate the results of trend analysis. Please use different lines to differentiate sales, cost of goods sold and gross margin in the line graph. (9%)

Step by Step Solution

3.34 Rating (160 Votes )

There are 3 Steps involved in it

Step: 1

To conduct a trend analysis for Guangwai Company using its income information for the years 2016 thr...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Fundamental Accounting Principles Volume II

Authors: Kermit Larson, Tilly Jensen, Heidi Dieckmann

16th Canadian edition

1259261433, 978-1260305838

Students also viewed these Finance questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App