1- Please Don't copy and paste from your work colleague on chegg, because he didn't answer this question.

2- Build the model

3- Advise Ahmad what would change in your model if you start continuous production rather than on order production as the policy is now.

4- what would change in your model if the company issued preferred shares

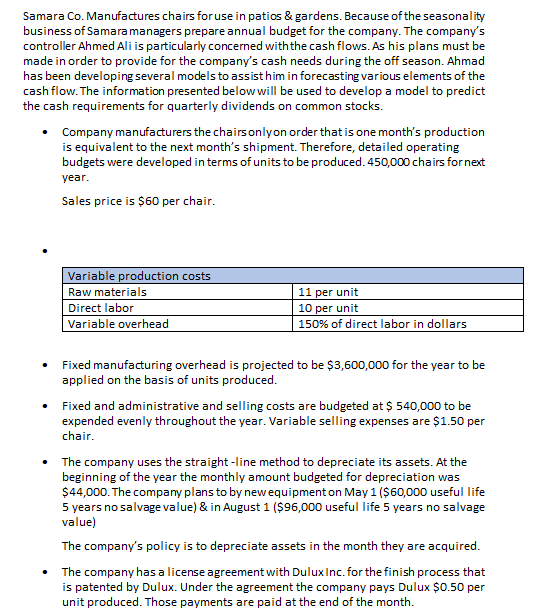

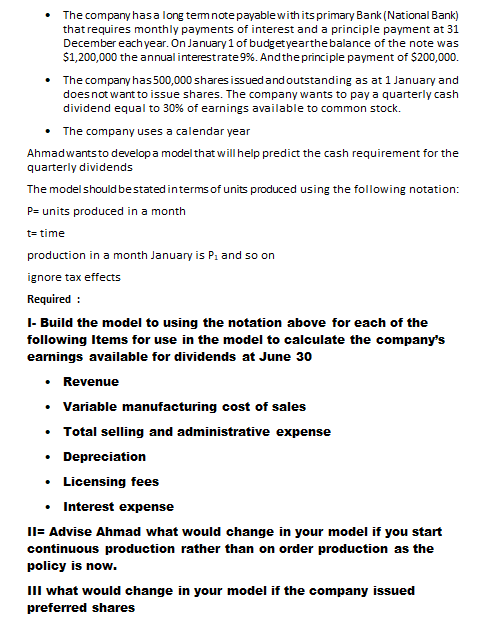

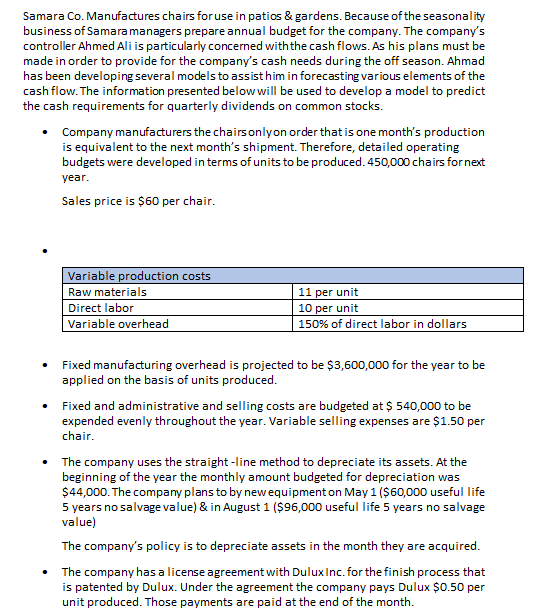

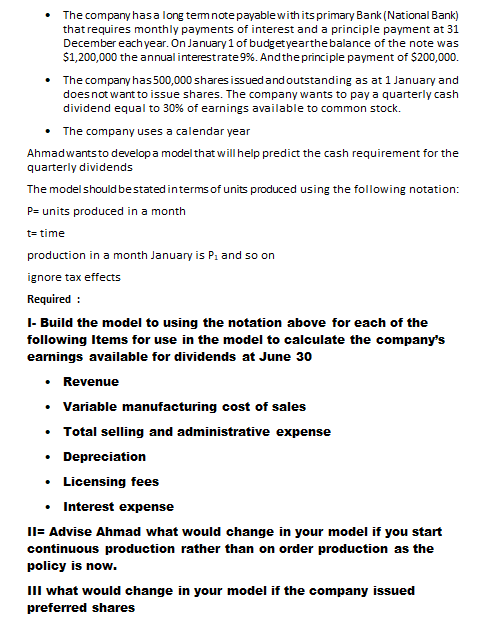

Samara Co. Manufactures chairs for use in patios & gardens. Because of the seasonality business of Samara managers prepare annual budget for the company. The company's controller Ahmed Ali is particularly concerned with the cash flows. As his plans must be made in order to provide for the company's cash needs during the off season. Ahmad has been developing several models to assist him in forecasting various elements of the cash flow. The information presented below will be used to develop a model to predict the cash requirements for quarterly dividends on common stocks. Company manufacturers the chairs onlyon order that is one month's production is equivalent to the next month's shipment. Therefore, detailed operating budgets were developed in terms of units to be produced. 450,000 chairs for next year. Sales price is $ 60 per chair. Variable production costs Raw materials Direct labor Variable overhead 11 per unit 10 per unit 150% of direct labor in dollars Fixed manufacturing overhead is projected to be $3,600,000 for the year to be applied on the basis of units produced. Fixed and administrative and selling costs are budgeted at $ 540,000 to be expended evenly throughout the year. Variable selling expenses are $1.50 per chair. The company uses the straight-line method to depreciate its assets. At the beginning of the year the monthly amount budgeted for depreciation was $44,000. The company plans to by new equipment on May 1 ($60,000 useful life 5 years no salvage value) & in August 1 ($96,000 useful life 5 years no salvage value) The company's policy is to depreciate assets in the month they are acquired. The company has a license agreement with Dulux Inc. for the finish process that is patented by Dulux. Under the agreement the company pays Dulux $0.50 per unit produced. Those payments are paid at the end of the month. The company has a long temnote payable with its primary Bank (National Bank) that requires monthly payments of interest and a principle payment at 31 December each year. On January 1 of budgetyearthe balance of the note was $1,200,000 the annual interestrate 9%. And the principle payment of $200,000. The company has 500,000 shares issued and outstanding as at 1 January and does not want to issue shares. The company wants to pay a quarterly cash dividend equal to 30% of earnings available to common stock. The company uses a calendar year Ahmadwants to develop a model that will help predict the cash requirement for the quarterly dividends The model should be stated interms of units produced using the following notation: P= units produced in a month t=time production in a month January is P. and so on ignore tax effects Required: 1- Build the model to using the notation above for each of the following Items for use in the model to calculate the company's earnings available for dividends at June 30 Revenue Variable manufacturing cost of sales Total selling and administrative expense Depreciation Licensing fees Interest expense II= Advise Ahmad what would change in your model if you start continuous production rather than on order production as the policy is now. III what would change in your model if the company issued preferred shares Samara Co. Manufactures chairs for use in patios & gardens. Because of the seasonality business of Samara managers prepare annual budget for the company. The company's controller Ahmed Ali is particularly concerned with the cash flows. As his plans must be made in order to provide for the company's cash needs during the off season. Ahmad has been developing several models to assist him in forecasting various elements of the cash flow. The information presented below will be used to develop a model to predict the cash requirements for quarterly dividends on common stocks. Company manufacturers the chairs onlyon order that is one month's production is equivalent to the next month's shipment. Therefore, detailed operating budgets were developed in terms of units to be produced. 450,000 chairs for next year. Sales price is $ 60 per chair. Variable production costs Raw materials Direct labor Variable overhead 11 per unit 10 per unit 150% of direct labor in dollars Fixed manufacturing overhead is projected to be $3,600,000 for the year to be applied on the basis of units produced. Fixed and administrative and selling costs are budgeted at $ 540,000 to be expended evenly throughout the year. Variable selling expenses are $1.50 per chair. The company uses the straight-line method to depreciate its assets. At the beginning of the year the monthly amount budgeted for depreciation was $44,000. The company plans to by new equipment on May 1 ($60,000 useful life 5 years no salvage value) & in August 1 ($96,000 useful life 5 years no salvage value) The company's policy is to depreciate assets in the month they are acquired. The company has a license agreement with Dulux Inc. for the finish process that is patented by Dulux. Under the agreement the company pays Dulux $0.50 per unit produced. Those payments are paid at the end of the month. The company has a long temnote payable with its primary Bank (National Bank) that requires monthly payments of interest and a principle payment at 31 December each year. On January 1 of budgetyearthe balance of the note was $1,200,000 the annual interestrate 9%. And the principle payment of $200,000. The company has 500,000 shares issued and outstanding as at 1 January and does not want to issue shares. The company wants to pay a quarterly cash dividend equal to 30% of earnings available to common stock. The company uses a calendar year Ahmadwants to develop a model that will help predict the cash requirement for the quarterly dividends The model should be stated interms of units produced using the following notation: P= units produced in a month t=time production in a month January is P. and so on ignore tax effects Required: 1- Build the model to using the notation above for each of the following Items for use in the model to calculate the company's earnings available for dividends at June 30 Revenue Variable manufacturing cost of sales Total selling and administrative expense Depreciation Licensing fees Interest expense II= Advise Ahmad what would change in your model if you start continuous production rather than on order production as the policy is now. III what would change in your model if the company issued preferred shares