Answered step by step

Verified Expert Solution

Question

1 Approved Answer

1. Please perform a working capital projection utilizing inflation and not growth (sustainable or otherwise). Use this information to then calculate the weighted Average Cost

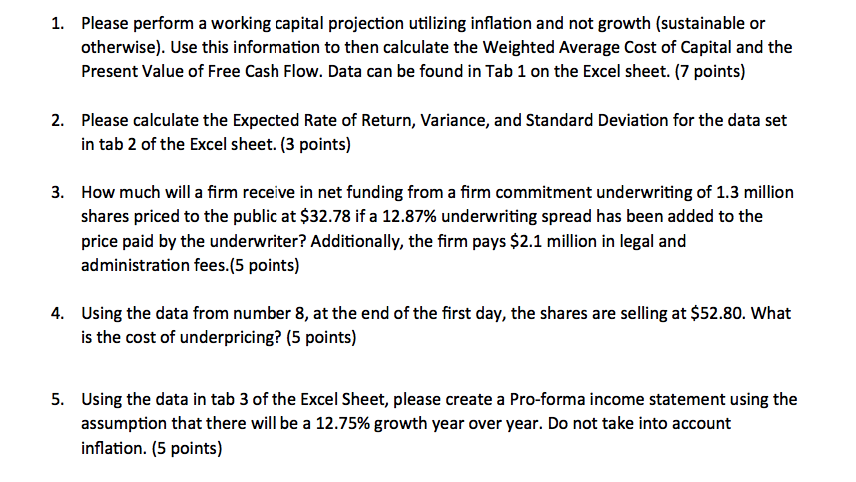

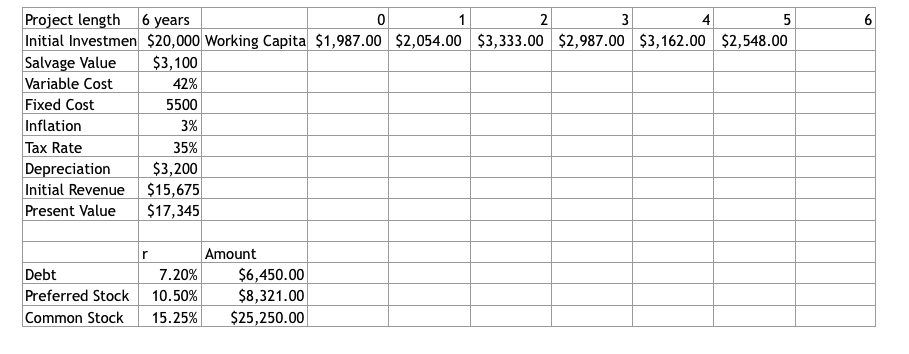

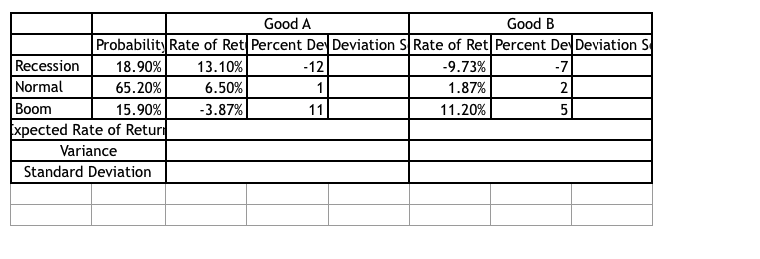

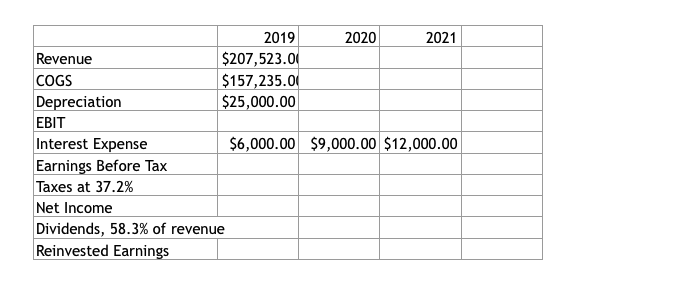

1. Please perform a working capital projection utilizing inflation and not growth (sustainable or otherwise). Use this information to then calculate the weighted Average Cost of Capital and the Present Value of Free Cash Flow. Data can be found in Tab 1 on the Excel sheet. (7 points) 2. Please calculate the Expected Rate of Return, Variance, and Standard Deviation for the data set in tab 2 of the Excel sheet. (3 points) 3. How much will a firm receive in net funding from a firm commitment underwriting of 1.3 million shares priced to the public at $32.78 if a 12.87% underwriting spread has been added to the price paid by the underwriter? Additionally, the firm pays $2.1 million in legal and administration fees.(5 points) 4. Using the data from number 8, at the end of the first day, the shares are selling at $52.80. What is the cost of underpricing? (5 points) 5. Using the data in tab 3 of the Excel Sheet, please create a Pro-forma income statement using the assumption that there will be a 12.75% growth year over year. Do not take into account inflation. (5 points) $3,333.00 $2,987.00 $3,162.00 $2,548.00 Project length 6 years Initial Investmen $20,000 Working Capita $1,987.00 $2,054.00 Salvage Value $3,100 Variable Cost 42% Fixed Cost 5500 Inflation 3% Tax Rate 35% Depreciation $3,200 Initial Revenue $15,675 Present Value $17,345 Debt Preferred Stock Common Stock 7.20% 10.50% 15.25% Amount $6,450.00 $8,321.00 $25,250.00 Good A Good B Probability Rate of Ret Percent De Deviation S Rate of Ret Percent De Deviation S Recession 18.90% 13.10% -12 -9.73% -7 Normal 65.20% 6.50% 1 1.87% 21 Boom 15.90% -3.87% 11 11.20% Expected Rate of Retur Variance Standard Deviation 2019 2020 2021 Revenue $207,523.01 COGS $157,235.00 Depreciation $25,000.00 EBIT Interest Expense $6,000.00 $9,000.00 $12,000.00 Earnings Before Tax Taxes at 37.2% Net Income Dividends, 58.3% of revenue Reinvested Earnings

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started