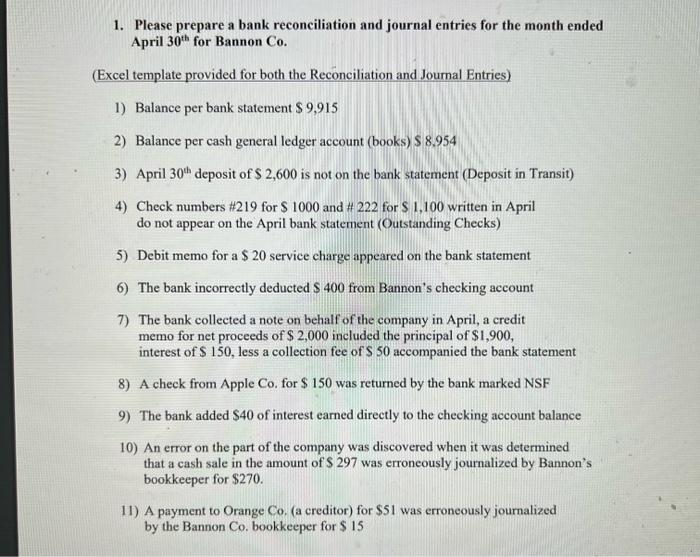

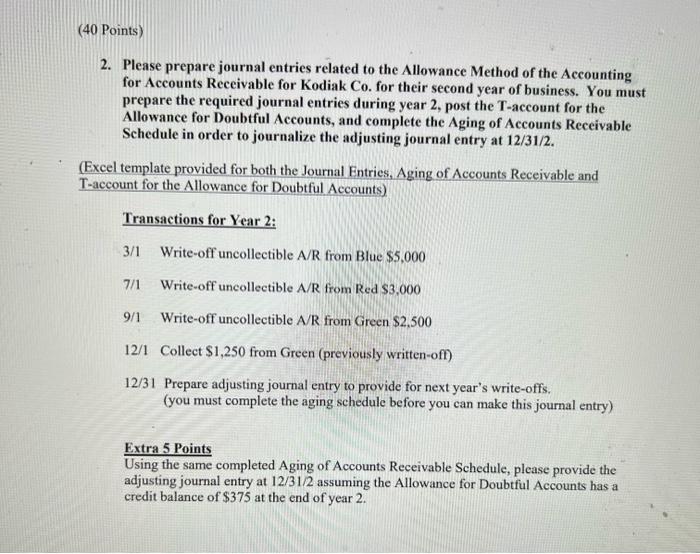

1. Please prepare a bank reconciliation and journal entries for the month ended April 30th for Bannon Co. (Excel template provided for both the Reconciliation and Journal Entries) 1) Balance per bank statement $9,915 2) Balance per cash general ledger account (books) $8.954 3) April 30th deposit of $2,600 is not on the bank statement (Deposit in Transit) 4) Check numbers #219 for $1000 and \# 222 for $1,100 written in April do not appear on the April bank statement (Outstanding Checks) 5) Debit memo for a $20 service charge appeared on the bank statement 6) The bank incorrectly deducted $400 from Bannon's checking account 7) The bank collected a note on behalf of the company in April, a credit memo for net proceeds of $2,000 included the principal of $1,900, interest of $150, less a collection fee of $50 accompanied the bank statement 8) A check from Apple Co. for $150 was returned by the bank marked NSF 9) The bank added $40 of interest earned directly to the checking account balance 10) An error on the part of the company was discovered when it was determined that a cash sale in the amount of $297 was erroneously journalized by Bannon's bookkeeper for $270. 11) A payment to Orange Co. (a creditor) for $51 was erroneously journalized by the Bannon Co. bookkeeper for $15 2. Please prepare journal entries related to the Allowance Method of the Accounting for Accounts Receivable for Kodiak Co. for their second year of business. You must prepare the required journal entries during year 2, post the T-account for the Allowance for Doubtful Accounts, and complete the Aging of Accounts Receivable Schedule in order to journalize the adjusting journal entry at 12/31/2. (Excel template provided for both the Journal Entries, Aging of Accounts Receivable and T-account for the Allowance for Doubtful Accounts) Transactions for Year 2: 3/1 Write-off uncollectible A/R from Blue $5,000 7/1 Write-off uncollectible A/R from Red $3,000 9/1 Write-off uncollectible A/R from Green $2,500 12/1 Collect $1,250 from Green (previously written-oft) 12/31 Prepare adjusting journal entry to provide for next year's write-offs. (you must complete the aging schedule before you can make this journal entry) Extra 5 Points Using the same completed Aging of Accounts Receivable Schedule, please provide the adjusting journal entry at 12/31/2 assuming the Allowance for Doubtful Accounts has a credit balance of $375 at the end of year 2