Answered step by step

Verified Expert Solution

Question

1 Approved Answer

1. Please prepare the consolidation entries (basis consolidation entry, differential reclassification entry, other) needed as of December 31, 2012. 2. Please prepare a three-part consolidation

1. Please prepare the consolidation entries (basis consolidation entry, differential reclassification entry, other) needed as of December 31, 2012.

2. Please prepare a three-part consolidation worksheet as of December 31, 2012

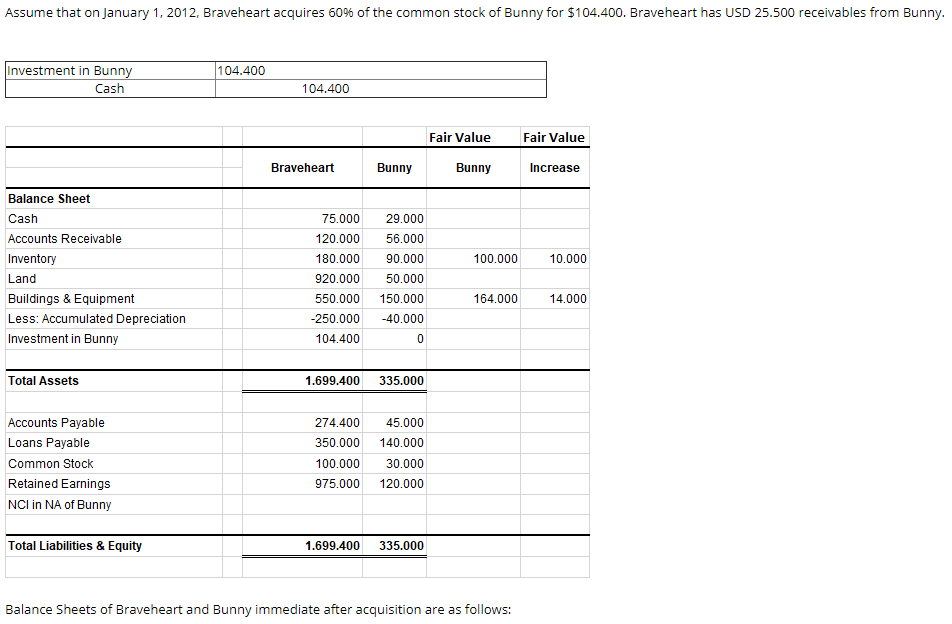

Assume that on January 1, 2012, Braveheart acquires 60% of the common stock of Bunny for $104.400. Braveheart has USD 25.500 receivables from Bunny. 104.400 Investment in Bunny Cash 104.400 Fair Value Fair Value Braveheart Bunny Bunny Increase 75.000 100.000 10.000 Balance Sheet Cash Accounts Receivable Inventory Land Buildings & Equipment Less: Accumulated Depreciation Investment in Bunny 120.000 180.000 920.000 550.000 -250.000 104.400 29.000 56.000 90.000 50.000 150.000 -40.000 0 164.000 14.000 Total Assets 1.699.400 335.000 274.400 350.000 Accounts Payable Loans Payable Common Stock Retained Earnings NCI IN NA of Bunny 45.000 140.000 30.000 120.000 100.000 975.000 Total Liabilities & Equity 1.699.400 335.000 Balance Sheets of Braveheart and Bunny immediate after acquisition are as followsStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started